Joe Raedle

One of the greatest investment success stories in the fitness space in recent years has been Peloton Interactive (NASDAQ:PTON). The interactive fitness platform stormed onto the global fitness stage a few years ago, rapidly expanding as a result of its innovative strategy of merging technology with the concept of getting physically fit. Prior to the current fiscal year, the company had demonstrated tremendous upside in revenue. But profitability has been an issue. Today, however, the company is facing even more significant problems. With a meaningful decline in the sale of its exercise equipment and concerns over its subscriber numbers, shares of the business have plummeted in recent months. Management is working to reduce expenses moving forward and that could well turn the ship around. But making an investment on that fact is being truly speculative in nature. Truly, the company is a rather risky prospect at this point in time. But given how little cash flow is needed to justify the company’s current valuation, it could make for a good opportunity for those who don’t mind accepting the risk and uncertainty that comes with it.

Peloton Interactive – A stellar growth story that has ended

Most people have probably heard of Peloton in some way, shape, or form. But for those who haven’t, the best way to describe the company is as an interactive fitness platform that pairs technology with physical fitness. The company’s business model is really centered around two different revenue-generating activities. The largest, by far, involves the sale of what management calls Connected Fitness Products. Examples here include its Bike, which is produced using a carbon steel frame and other high-end equipment.

The device has on it a 22-inch high-definition touchscreen with built-in stereo speakers that are capable of streaming live and on-demand classes to those riding it. The company has other products that fall under this category. One example is called Bike+. This is a newer version of the Bike that provides a more immersive cardio experience and to transition to floor-based exercises with a 24-inch 360-degree rotating display. According to management, those using it can easily pivot and tilt the screen in order to add strength, yoga, and stretching to their routine. They can also take a Bike Bootcamp class series. Another benefit to this is the ability to control their resistance from the touch screen display. There are obviously other perks to this as well. The company also has other smart products like its Tread and Tread+, which are basically the smart version of the treadmill.

While selling exercise equipment is a major source of revenue for the company, the more interesting one to me is the second major revenue-generating activity the company has. This would be its subscription products. First, you have the Connected Fitness Subscriptions. These are month-to-month subscriptions that allow members to access classes through their Connected Fitness Products. It also allows customers to track their progress, see a leaderboard, and to connect with and interact with the Peloton community. The company also has a companion app called Peloton Digital that gives users access to the same classes when they are away from their device. According to management, 69% of the members on its Connected Fitness Subscriptions used this app to supplement their workout regimen in 2021. The reason why I find this to be the more interesting aspect of the company is because, while it does account for just 21.7% of the company’s revenue, it is an opportunity for the business to generate recurring sales. And with a monthly charge of $39 for the Connected Fitness Subscriptions or $12.99 for Peloton Digital as a standalone offering, there is plenty of opportunity for the company moving forward.

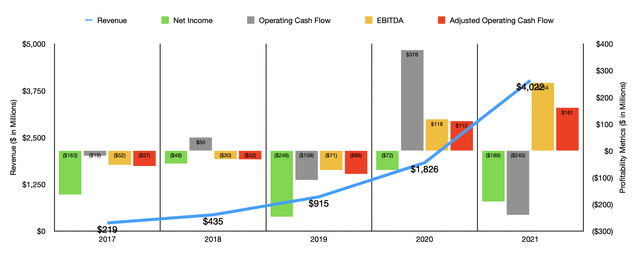

Author – SEC EDGAR Data

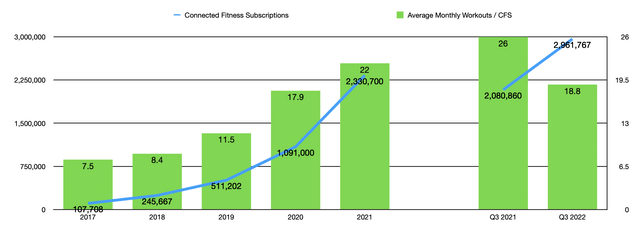

Over the past few years, the management team at Peloton has done a fantastic job growing the company’s top line. Revenue surged from $218.6 million in 2017 to $4.02 billion in 2021. The driving source of the company’s revenue has always been the sale of its exercise equipment. However, this has led to additional subscriptions that are being paid for by members each year. For instance, in 2017, the company had only 107,708 paid subscribers. This number jumped to 2.33 million by the end of 2021. In addition to seeing the number of subscribers increase, the company also saw the average number of workouts per month from its subscribers rise materially, jumping from 7.5 to 22 over this same timeframe.

Author – SEC EDGAR Data

Unfortunately, profitability has been rather elusive. At no point in the past five years did the company generate a net profit in any given fiscal year. Even operating cash flow has been all over the place, ranging from a low point of negative $239.7 million to a high point of $376.4 million, with no clear trend from year to year. If we adjust for changes in working capital, the picture does look slightly better. After bottoming out at negative $85.8 million in 2019, cash flow went up to a positive $111.6 million in 2020 to $160.8 million in 2021. A similar trend can be seen when looking at EBITDA, with the metric climbing from negative $71.3 million to $117.7 million before ultimately hitting $253.7 million last year.

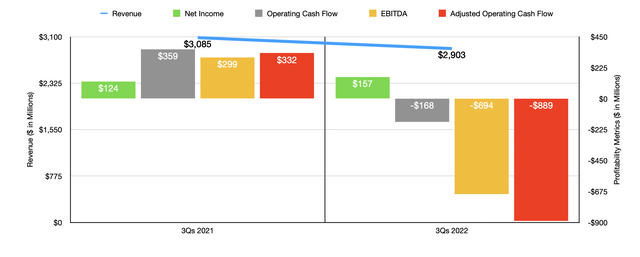

Author – SEC EDGAR Data

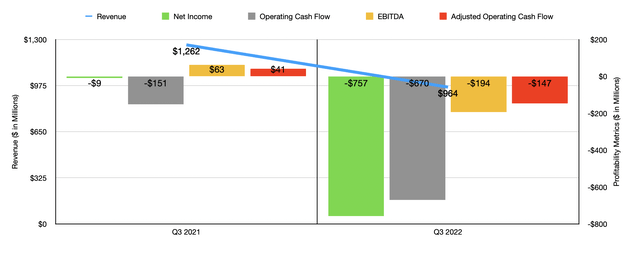

Although growth through the 2021 fiscal year was robust, the same cannot be said of results so far in 2022. In the first three quarters of the company’s 2022 fiscal year, revenue came in at $2.90 billion. That’s down modestly from $3.09 billion one year earlier. But this seems to obscure the real pain the company saw in the latest quarter alone. Revenue of $964.3 million represented a drop of 23.6% compared to the $1.26 billion we reported in the third quarter of 2021. This came even as the number of subscribers for the company increased, rising from 2.08 million at the end of the third quarter of 2021 to 2.77 million by the end of the second quarter of this year before ultimately rising further to 2.96 million at the end of the latest quarter.

Author – SEC EDGAR Data

In fact, revenue for the subscribers in the latest quarter came in 54.5% higher than it was the same time one year earlier. The pain, then, was attributable to fewer shipments of the company’s fitness equipment as demand for their products declines. This makes sense from two perspectives. First, as the global economy has reopened, there would be more people willing and interested in going to a physical gym than when times were tough. And second, the market for physical exercise devices can only be so large. At some point, the low-hanging fruit will be captured and the pandemic likely front-loaded a lot of that potential. Another worrisome data point, however, is that while the number of total workouts in the latest quarter increased from 149.5 million in the third quarter of last year to 164.6 million this year, the average workouts per month for its subscribers plummeted from 26 to 18.8, while the churn rate on its subscriptions more than doubled from 0.31% to 0.75%.

To make matters worse, analysts are not particularly bullish on the outlook for the company’s subscription service. In June of this year, UBS Group (UBS) said that the company’s share of downloads for fitness apps dropped to 1.9%, down from the 2.8% experienced the same time one year earlier. By comparison, the share of downloads for Planet Fitness (PLNT) increased from 23% in April of this year to 54% in June. In a separate news item, Morgan Stanley (MS) warned about weak subscriber numbers heading into the company’s final quarter release. They also said that they think management will guide toward weaker expected numbers for the 2023 fiscal year because of the economic situation and because of a new CFO wanting to start the year with a degree of conservatism. Long term, however, the bank did say that Peloton should remain the leader in connected fitness.

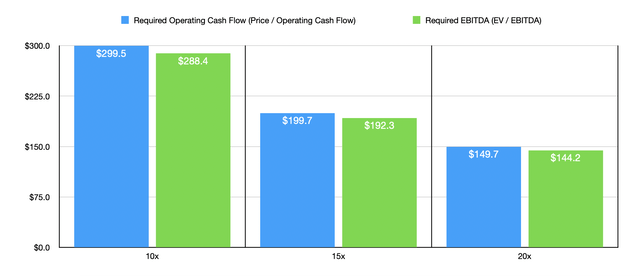

Valuing a company is volatile as this can be problematic. Instead of doing that, I like to ask myself what kind of cash flow the business in question would need to generate in order to be worth a certain trading multiple. In the chart below, you can see this based on the assumption of trading for either 10 times, 15 times, or 20 times, the price to operating cash flow and the EV to EBITDA multiples. Even if we take the 15 multiple, those numbers are not terribly far off from what the company achieved in 2021. Certainly, we could see more downside before we see upside. But it’s not unthinkable that the market is overreacting to current conditions and that, if this is going to be a long-term survivor, the price being paid at this moment could leave some nice upside on the table. Management’s current plan at addressing weakness this year is expected to generate annual cost-savings of $800 million once implemented (at a cost of $210 million). This is in addition to $150 million in reduced capital expenditures planned for the year. In all, the company will reduce its headcount by 2,800, with 20% of corporate positions being eliminated. This all could help to achieve the aforementioned numbers.

Author – SEC EDGAR Data

Takeaway

Based on the data provided, I will say that I am not particularly bullish on Peloton. I think the company is interesting and its business model has potential. Recent weakness has been significant and, when coupled with broader economic concerns, it makes sense why shares are down as much as they are. Having said that, if we assume that management can eventually turn the ship around and achieve some degree of stability, shares are not priced at levels that are unrealistic. I personally prefer more conservative opportunities than this. And because of that, I have decided to rate the business a ‘hold’. But for those who don’t mind taking some additional risk, I definitely could see some upside potential down the road since a lot of the pain seems priced in. All it will take is some patience and success from management in weathering the current storm.

Be the first to comment