Povozniuk

JOANN Inc. (NASDAQ:JOAN) appears to be receiving a lot of attention after making significant efforts to transform itself into a digital shop. Analysts are expecting an increase in free cash flow. Under my own assumptions that include correct assessment of the database and more suppliers from Asia, I think the fair price is significantly higher than the stock price. I see risks from tariffs to Asian products in the United States and lack of innovation. However, from here, the downside risk in the stock price does seem very limited.

JOANN: From A Traditional Retailer Into A Digital Shop

After 75 years in business, JOANN bills itself as the nation’s best seller of sewing and fabrics. The recent increase in customers is the first thing that seems worth mentioning. Since February 1, 2020, the company got close to 10 million new customers.

Source: Company’s Website

In my view, after the transformation of the company that started in 2016, the numbers are getting better and better. I believe that management successfully changed the business from a traditional retailer into a digital shop. The acceleration of the free cash flow that many analysts out there are expecting is a great reason to review the new business model.

Balance Sheet

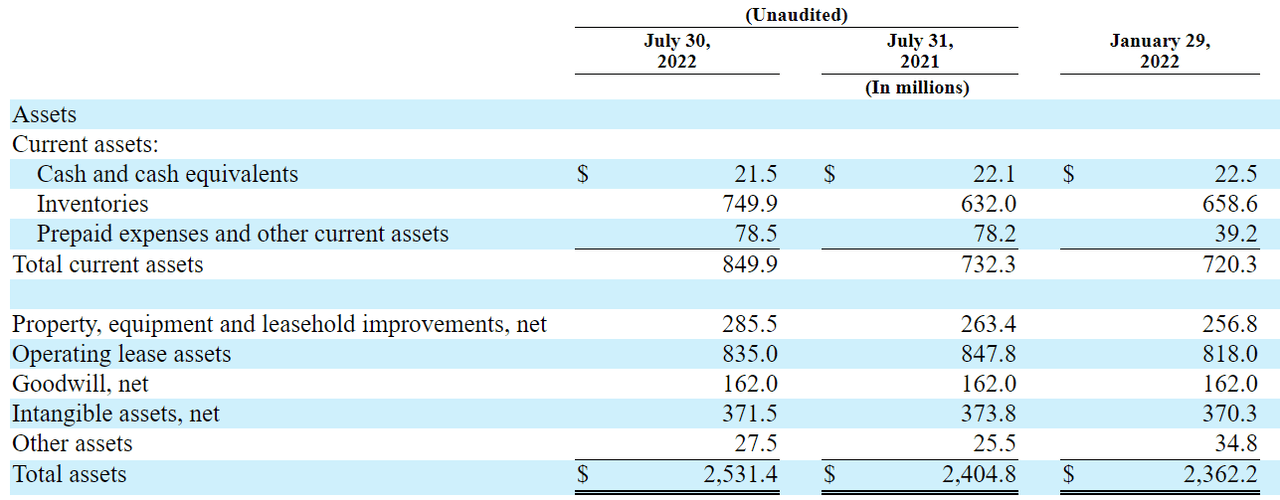

As of July 30, 2022, a total of cash and cash equivalents of $21.5 million was reported, with inventories of $749.9 million, other current assets of $78.5 million, and total current assets of $849.9 million. The property, equipment and leasehold improvements were worth $285.5 million in addition to goodwill worth $162 million and intangible assets of $371.5 million. Total assets stand at $2.53 billion. I believe that the company’s numbers in 2022 are a bit better than that in 2021.

Source: 10-Q

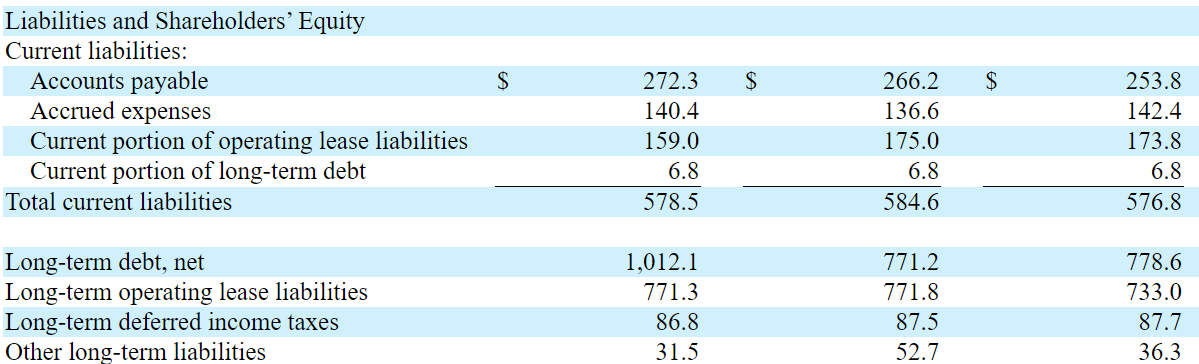

With regards to the list of liabilities, JOANN reported a total of accounts payable of $272.3 million, accrued expenses of $140.4 million, and current portion of operating lease liabilities of $159 million. The current portion of long term debt was equal to only $6.8 million in addition to total current liabilities of $587.5 million. With long term debt worth $1.012 billion and long term operating lease liability of $771.3 million, I believe that the company’s contractual obligations don’t seem that significant. Keep in mind that market estimates include 2025 FCF close to $306 million.

Source: 10-Q

Free Cash Flow Is Expected To Trend North In The Next Three Years

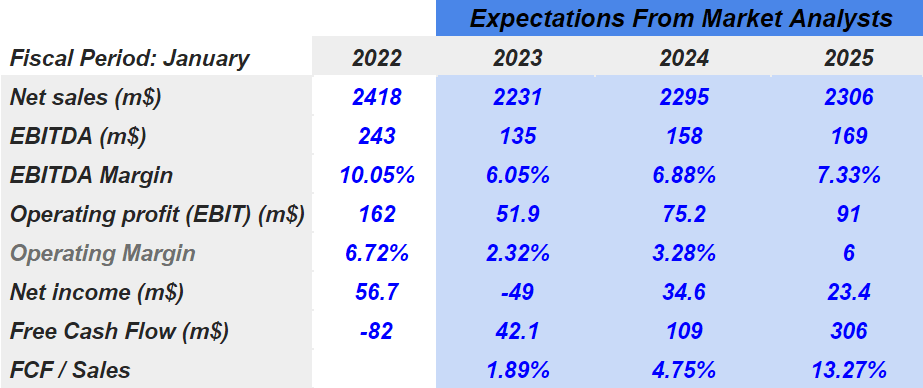

Investment analysts expect that JOANN will, by 2025, likely report a total net sales of $2.3 billion as compared to $2.2 billion in 2023. Besides, EBITDA is expected to increase from $135 million in 2023 to $243 million in 2025. The EBITDA margin is also expected to stand at around 6.05%-7.33%.

Source: seekingalpha.com/symbol/JOAN/earnings/estimates

In 2025, in addition to an operating profit of $91 million and an operating margin of 6%, the net income is expected to be $23.4 million. Finally, the free cash flow will likely stand at around $306 million with FCF/sales of 13.27%. In sum, in my view, the investment community expects to see better numbers in the coming years.

With Correct Assessment Of The Company’s Database And Correct Purchase Of Inventory From Asia, I Obtained A Fair Price Of $10.27 Per Share

Under normal conditions, I expect a lot from the company’s digital interactions through online communities and social media platforms. Let’s keep in mind that JOANN owns a massive database with many customers, and offers very different purchasing channels. With correct marketing efforts, JOANN will likely see sales growth:

As of the end of fiscal 2022, we had approximately 77 million addressable customers in our vast database.

Customers have the ability to shop their local store location online, with convenient omni-channel services available like BOPIS or curbside pickup. Customers can also choose to order direct to home, with extended aisle offerings across all major product categories. For customers seeking to purchase in greater quantities, we offer low pricing for bulk purchases through our JOANN+ service on joann.com. Source: 10-k

I also believe that the company’s EBITDA margins will remain solid because JOANN buys cheap supply materials in cheap jurisdictions. In my view, if management buys even more from sources in Pakistan, India, Vietnam, Taiwan, Turkey, China, and South Korea, we could see an increase in the EBITDA margin. The fact that the company recently opened a foreign sourcing office in Shanghai indicates that management is willing to go abroad:

During fiscal 2022, we sourced approximately 64% of our purchases from domestic suppliers with the remaining approximately 36% of our products coming directly from manufacturers located in foreign countries, of which over one-third is sourced from China. To further support our direct sourcing strategic initiative, we opened our foreign sourcing office in Shanghai, China in 2018. We continue to diversify our internationally sourced products by expanding in several other countries, including Pakistan, India, Vietnam, Taiwan, Turkey and South Korea. Source: 10-k

I am also quite optimistic about the company’s logistics and quality control. Let’s keep in mind that JOANN owns distribution centers. A significant portion of its products is stored in-house. It means that management can really detect issues in supply chain or a decrease in quality:

As of January 29, 2022, approximately 89% of the products in our store locations were shipped through our distribution center network, with the remaining 11% of our purchases shipped directly from our suppliers to our store locations. Source: 10-k

Finally, I believe that JOANN has accumulated a lot of expertise in shop location. If management continues to select and run profitable shops, I would be expecting free cash flow to trend north. In the annual report, JOANN gave a few hints on some criteria used to select new shops:

Site-specific criteria we consider important include, but are not limited to, size of the store location, rental terms, size of the shopping center, co-tenants, traffic patterns, availability of convenient parking and ease of entry from the major roadways framing the store location. Source: 10-k

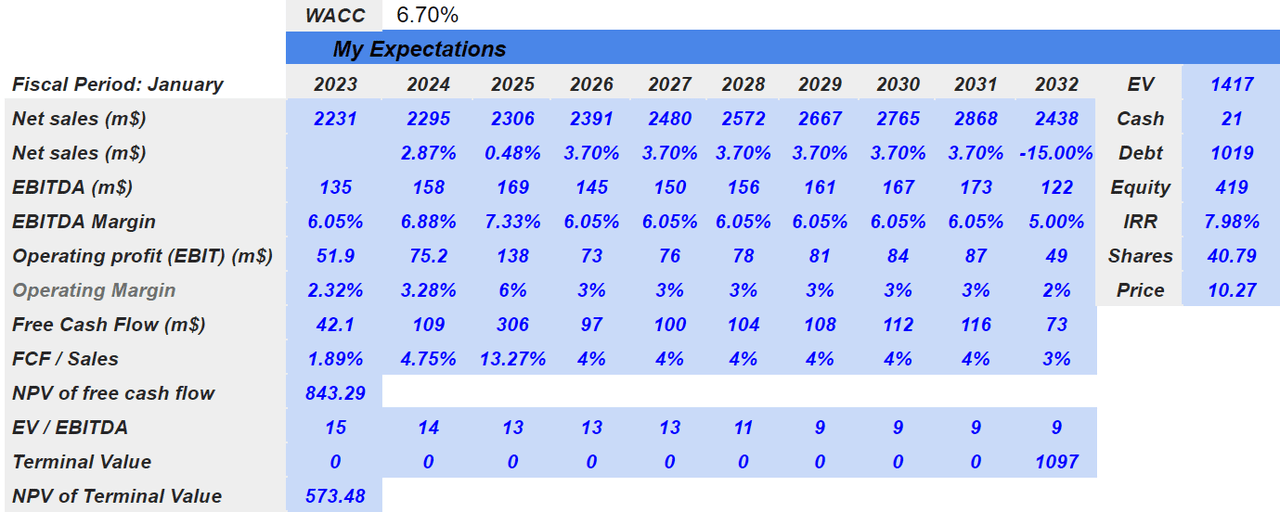

By 2032, under this scenario, I expect that JOANN will likely present a total net sales of $2.438 billion, with EBITDA worth $122 million and an EBITDA margin of 5.0%. In terms of operating profit, JOANN will likely report $49 million with an operating margin of 2%. I also anticipate 2032 FCF of $73 million, FCF/sales of 3%, plus NPV of free cash flow of $843 million.

Source: Author’s Materials

With an EV/EBITDA multiple of 9x, the terminal value would be $1.097 billion, with a net present value of $573.48 million. Finally, the results would include an internal rate of return of 7.98% and a fair price of $10.27 per share.

New Tariffs To Products From Asia, Demand Failures, And Lack Of Technological Innovation Would Lead To A Valuation Of $1.5 Per Share

JOANN receives products from China and many other countries in Asia. If the United States changes taxes on products brought from overseas, or increases tariffs on China for instance, JOANN may suffer a decrease in profitability. I also believe that the list of products offered to clients may not be that long. As a result, revenue growth may not be as large as expected:

Our products are sourced from a wide variety of suppliers, including from suppliers overseas, particularly in China and other Asian countries. In addition, changes in U.S. trade regulations and policies could have an adverse impact on trade relations between the United States and certain foreign countries, which could materially and adversely affect our relationships with our international suppliers and reduce the supply of goods available to us. Source: 10-k

JOANN has to make a significant number of assumptions about future demand. If JOANN fails to meet the demand from clients, the company’s reputation may be affected. Management may also suffer from shortages related to suppliers, which affect the company’s ability to respond to demand. In sum, I believe that these effects could push revenue growth down:

Conversely, if we underestimate consumer demand, we may experience shortages of key items and may not be able to provide products to our customers to meet their demand. Given the project and component nature of our business, these shortages could materially and adversely affect sales of other related products and even conversion of traffic to sales within our store locations and on our mobile application and website. Source: 10-k

Management also has to identify and respond correctly to changing consumer tastes, and design its platform to respond to client needs. If JOANN fails to offer great products and sell them using the best technology, revenue may grow less than expected. Management discussed these risks in the last annual report:

There are various risks associated with omni-channel retailing, including the need to keep pace with frequent technology changes, internet security risks and an increased level of competition. Failure to identify and effectively respond to changing consumer tastes, preferences and spending patterns on a timely basis could materially and adversely affect our relationship with our customers and the demand for our products. Source: 10-k

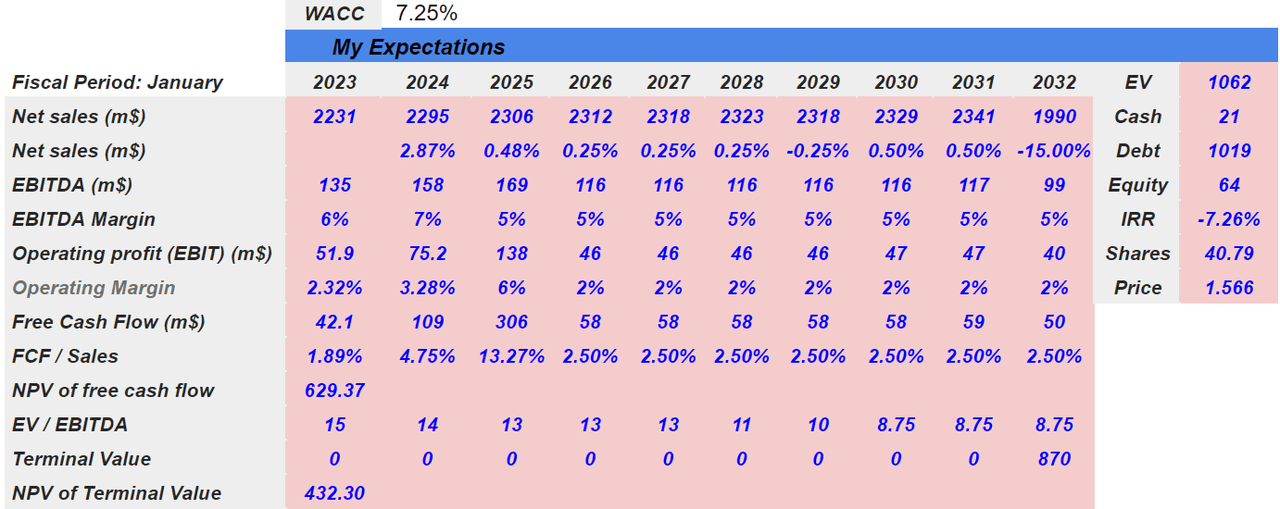

Under these conditions, my DCF model is shown in the image below. In January 2032, I expect total net sales to be $1.99 billion, EBITDA close to $100 million, and EBITDA margin at 5%. I also assumed an operating profit of $40 million, with an operating margin of 2%. Regarding the free cash flow, it will likely be $50 million with FCF/sales around 2.50%. I forecast a NPV of free cash flow of $629 million, in addition to an EV/EBITDA of 8.7x million and a fair price of $1.5 per share.

Author’s Materials

Conclusion

I believe that JOANN made a lot of efforts to transform its business model from a traditional company to a digital platform. Many analysts out there believe that investors will likely receive, in the coming years, a significant amount of free cash flow growth. Under my own discounted cash flow model, with correct assessment of the database and more suppliers from Asia, I believe that the fair price could reach $10.27 per share. Even considering risks from an increase in tariffs to products from China and lack of technological innovation, the downside potential in the share price appears limited.

Be the first to comment