John M Lund Photography Inc

Vanguard Information Technology ETF (NYSEARCA:VGT) appears attractive on the charts with shares down 34% so far in 2022 and valuations easing to around their five to ten-year average. However, dip buyers who want to take full advantage of the price collapse should wait longer since tech stocks haven’t hit their bottom yet. In the days ahead, I believe third-quarter earnings, upcoming rate hikes, and the possibility of a recession could negatively impact tech stocks’ performance. The dip buyers might, however, keep high-growth ETFs like VGT on their radar and buy them once the market bottoms out, which could happen around year-end or early in 2023.

Technology-focused ETFs Carry High Risk In the Short-term

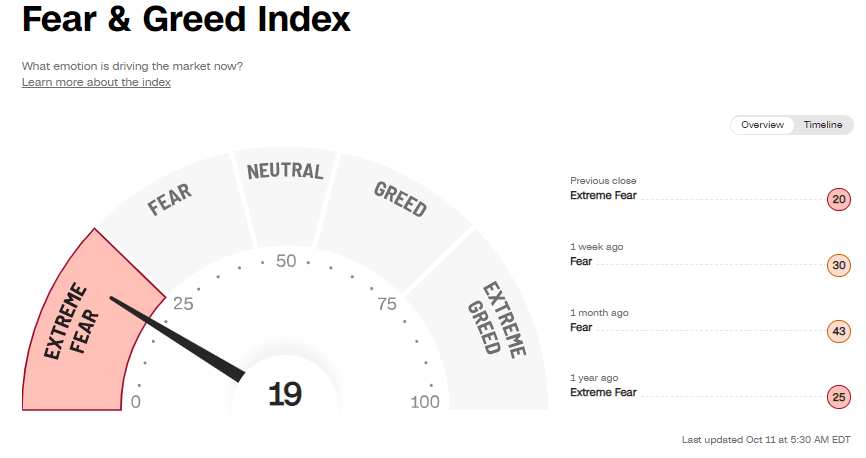

Fear & Greed index (CNN.com)

CNN’s Fear & Greed index, a compilation of seven different indicators, shows extreme fear among investors due to a lack of clarity about the future fundamentals. In addition to another Fed rate hike of 75 basis points, investors are also concerned about a looming recession in 2023. Projections from last month’s Fed meeting and Powell’s comments indicate the Fed expects to raise rates by at least 1.25 percentage points by the end of this year and reach a terminal level by next year. The drop in the unemployment rate to 3.5% in September boosted prospects for the extension of an aggressive rate hike policy in the next two months.

So far this year, tightening monetary policy has led to the destruction of trillions of dollars of stock market value, but legendary investors envision a massive price crash if the Fed raises rates to around 4.50%. Ray Dalio, the founder of Bridgewater Associates, last month predicted that the Fed’s plan to raise interest rates to 4.5% could erase another 20% of the value from the US stock market and push the economy into recession in 2023. Recession and high rates in the United States are not the only risk for growth stocks. The increasing risk of global recession and trade restrictions with China could also negatively affect information technology stocks and ETFs. Overall, it appears that growth ETFs like VGT, which are significantly sensitive to interest rates and economic conditions, have yet to factor-in upcoming rate hikes and recession, which could cause further volatility in their price from the current level.

Earnings Could Be Another Headwind Tech Growth Stocks

The crucial earnings season is just around the corner, and tech stocks may reverse their losses if earnings exceed expectations. However, the chances for the NASDAQ and S&P 500 falling deeper into a bear market are higher than those of a rebound. This is because many analysts have revised their earnings estimates for the S&P 500 index in the past few months. According to FactSet data, the S&P 500 is expected to report year-over-year earnings growth of 2.4% for the third quarter, the lowest since Q3 2020 and down considerably from the estimated Q3 earnings growth of 9.9% in June.

So far, the Q3 earnings season is looking disastrous for tech stocks, with Advanced Micro Devices (AMD) forecasting a revenue shortfall of $1 billion compared to its previous estimate of $6.7 billion. The chip maker also warned that PC demand is waning significantly, a negative sign for the entire sector. In recent months, other chip makers such as Intel (INTC) and Nvidia (NVDA) also hinted at slowing demand and lower revenues. On top, the restrictions by the US government on chip shipments to China could have a noteworthy impact on the revenues of the semiconductor industry. According to Citi analyst Arya, the new rules could have a 5% to 10% impact on sales of Intel, Advanced Micro Devices, Nvidia, and Lam Research (LRCX).

VGT’s Portfolio Is Vulnerable to Headwinds

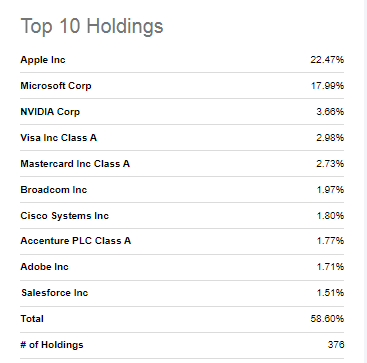

VGT’s Top 10 Stock Holdings (Seeking Alpha)

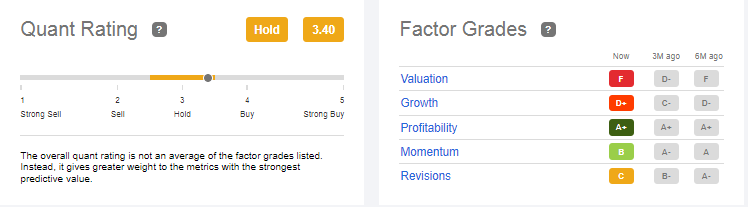

While VGT’s portfolio is diversified across 376 tech stocks, its top two holdings account for 40% of the overall portfolio and the top ten stocks represent 59%. Its two largest stock holdings, Apple (AAPL) and Microsoft (MSFT) are in the bear market territory with a share price drop of 23% so far in 2022. The Seeking Alpha Quant grading system, which is based on five factors, assigned both tech giants a hold rating with a quant score of approximately 3.4. They were rated poorly on valuations, growth, and revisions.

Seeking Alpha (Quant Ratings)

Apple, for example, earned an F on valuations despite a steep drop in its share price. Its stock is currently trading around 23 times forward earnings, which is in line with the five-year average but higher than the sector median of 19.64 times. The low grade on the growth factor is also concerning because growth investors react negatively to slowing growth trends, particularly when it comes to high-growth companies like Apple with stellar revenue, earnings, and cash flow growth histories. According to the Wall Street forecast, Apple is expected to grow revenue and earnings in the mid to low single-digit range over the next few years.

In addition to Apple and Microsoft, 18% of VGT’s portfolio is devoted to semiconductor stocks. Economic slowdown, high rates, and chip shipment restrictions to China affected the fundamentals of chip stocks harder than the rest of the technology sector. VGT’s semi-stock holdings, such as NVIDIA, Broadcom (AVGO), Cisco Systems (CSCO), Advanced Micro Devices, Qualcomm (QCOM), and many others, may experience higher volatility due to lower revenue and earnings growth estimates. Additionally, VGT’s portfolio holdings in software application stocks, which includes Adobe (ADBE), Salesforce (CRM), and Intuit (INTU) also earned low quant scores with a hold rating.

In Conclusion

Currently, the US stock market indices are at their lowest level in two years, but I believe the worst is yet to come, especially for growth stocks. Markets have yet to factor in significant economic contraction and upcoming interest rate hikes. The downbeat third-quarter earnings and waning earnings forecast would add to the bearish trend. According to one of the Morgan Stanley analysts, the S&P 500 is expected to bottom around the low 3,000s, and if that happens, I expect NASDAQ to retreat to the 9000 range by year-end or early in 2023. Consequently, dip buyers might be better off waiting a little longer rather than attempting to time the market now.

Be the first to comment