CreativaStudio/E+ via Getty Images

In the luxury retail home furnishings market, one company that stands out as an interesting prospect is RH (NYSE:RH). Over the years, management has done well to grow the company’s top line. They have also taken the company from struggling to generate a profit to generating strong and growing profits. The same holds true from a cash flow perspective. Growth during its 2021 fiscal year has been particularly robust, implying that there might be some nice amount of upside for investors moving forward. But as we near the firm’s financial release covering the final quarter of its 2021 fiscal year, investors should pay attention to how shares are priced versus how shares might be priced if we should see some sort of pullback moving forward. In all, I do believe that this prospect makes for an attractive opportunity, with the risk to reward ratio clearly favoring value-oriented investors.

A play on the luxury home furnishings market

As I mentioned previously, RH is centered in large part on the luxury retail home furnishings market. Operationally, the company has 66 RH Galleries opened that consists of 26 Design Galleries, 36 Legacy Galleries, one RH Modern Galleries location, and three RH Baby & Child Galleries. These locations are spread across the US, as well as some parts of Canada. On top of this, the company also has 14 Waterworks Showrooms split between the US and UK. And in addition to that, the company operates 38 outlet stores between the US and Canada. Some of these locations can be rather small, coming in at just 3,900 square feet on average. Meanwhile, its larger outlets have an average size of 33,000 square feet. In terms of segment composition, the bulk of the company’s revenue, about 95.6% in all, is attributable to its RH segment. That unit is also responsible for 96.1% of the company’s profits. The other segment, called Waterworks, is responsible for 4.4% of sales and 3.9% of overall profits.

Through these locations and through its online channels, the company sells a wide variety of products. Examples include interior and exterior products such as tables and chairs, couches, textiles, planters, fountains, lighting, fire and heat solutions, umbrellas, and more. The business also has a number of other offerings, such as custom interior design services, nursery products, bedding, storage units, and other related offerings. Beginning in 2015, the company also began expanding into the foodservice space with the launch of its own restaurants and wine bars. These are upscale locations that provide a luxury experience for their visitors.

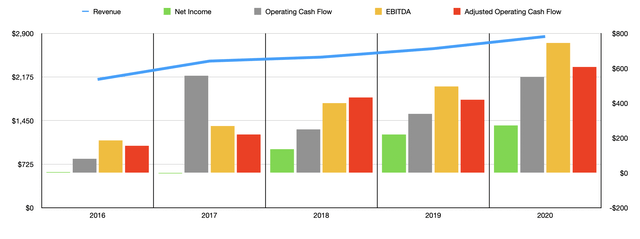

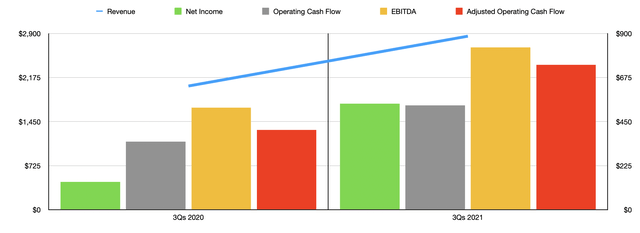

As a result of management’s ingenuity, the company has done well to grow its top line over the years. Revenue expanded from $2.14 billion in 2016 to $2.85 billion in 2020. Fortunately for investors, growth has been particularly strong since the end of 2020, with revenue in the first nine months of 2021 coming in at $2.86 billion. That represents a year-over-year increase of 40.3% compared to the $2.04 billion generated the same time one year earlier. According to management, the sales growth for the company experienced for the first nine months of its 2021 fiscal year with driven in large part by strong demand for its products, combined with parts of its supply chain catching up with customer demand. For the Waterworks segment, demand increased because of resumed construction activity and large residential investments by high-end homeowners, all following the dying down of the COVID-19 pandemic.

Just as revenue has risen, the same can be said of profitability. The worst of the past five completed fiscal years for the firm was in 2017 when the business generated a net loss of $2.6 million. Fast forward four years, and the company’s net loss had turned to a profit of $271.8 million. Net income was not the only area of improvement. Operating cash flow has been rather volatile from year to year, rising from $80.5 million in 2016 to $556.8 million one year earlier. But between 2018 and 2020, cash flow was on a steady incline, increasing from $249.6 million to $550.8 million. Over that same window of time, operating cash flow is generally growing, hitting a high point of $607.6 million in 2020. That compares favorably to the $156.2 million generated one year earlier. Also, on a positive trend in recent years has been EBITDA. From 2016 to 2020, it expanded from $186.2 million to $745.6 million.

Strong performance on the bottom line continued into the 2021 fiscal year. For the first nine months of that timeframe, net profits of $541.5 million dwarfed the $141.6 million generated one year earlier. Operating cash flow grew from $347.3 million to $533.7 million, while the adjusted figure for this expanded from $521.2 million to $829.3 million. Meanwhile, EBITDA for the company increased from $407.9 million to $739.7 million. As for how the rest of the 2021 fiscal year ended up, investors should know soon. This is because, on March 29th, after the market closes, the management team at RH is due to report financial results for the final quarter of the company’s 2021 fiscal year.

At present, analysts anticipate sales of $931.5 million. This would imply a year-over-year increase of 14.7% compared to the $812.4 million generated the same time one year earlier. If this does come to fruition, it would translate to a 32.9% rise in revenue for the year as a whole. That carefully matches the 32% to 33% increase in sales management has been forecasting. As for profitability, the company has not provided any guidance. But analysts are anticipating earnings per share of $5.67. Interestingly, this would actually imply net profits of $121.7 million. That would be down slightly from the $130.2 million reported one year earlier. Even so, it would still translate to net profits of $663.2 million for the year. That’s nearly triple the $271.8 million reported for 2020.

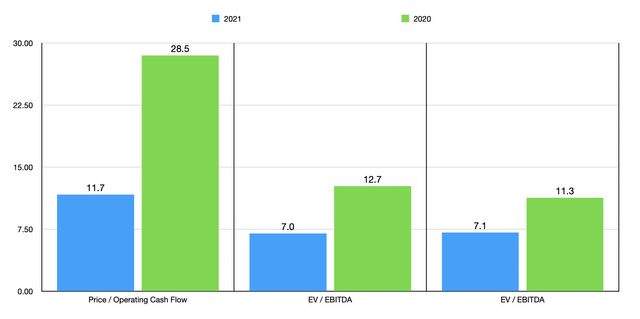

Irrespective of what the company ends up achieving, shares of the business look rather cheap. If analysts are accurate about earnings guidance, the company would be trading at a price-to-earnings multiple of 11.7. This compares to the 28.5 the company would be trading at if we relied on 2020 results. The price to adjusted operating cash flow multiple of the company would be 7, while the EV to EBITDA multiple would be 7.1. These are based on my decision to annualize results experienced so far for the 2021 fiscal year. Even if these metrics come in at levels experienced in 2020, the company would still be trading at a fairly reasonable level of 12.7 and 11.3, respectively.

To put the pricing of the company into perspective, I did compare it to five similar firms. On a price-to-earnings basis, these companies range from a low of 5.8 to a high of 38.4. Using our 2021 estimates, as well as our 2020 results, we can find that, on a price-to-earnings basis, four of the five firms were cheaper than RH. Using the price to operating cash flow approach, the range should be 4.8 to 13.6. Our 2021 estimates would result in three of the companies being cheaper than our prospect, while the 2020 results would translate to four of them being cheaper. And finally, using the EV to EBITDA approach, the range would be from 0.9 to 103.9. In this scenario, irrespective of whether we use the 2021 estimates or the 2022 results, four of the five companies are cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| RH | 11.7 | 7.0 | 7.1 |

| Haverty Furniture (HVT) | 5.8 | 5.5 | 2.3 |

| Williams-Sonoma (WSM) | 10.9 | 8.5 | 6.6 |

| Bed Bath & Beyond (BBBY) | 38.4 | 13.6 | 103.9 |

| The Aaron’s Company (AAN) | 6.8 | 5.4 | 0.9 |

| Sleep Number (SNBR) | 9.4 | 4.8 | 6.8 |

Takeaway

At present, RH is experiencing a nice bit of upside in terms of revenue and profitability. If this continues, in particular, if this implies a new normal for the business, then shares of the firm could be trading at fairly cheap levels even though they probably would be closer to fairly valued compared to the competition. But even if financial performance were to revert back to what the company achieved in 2020, shares don’t look all that bad in the grand scheme of things. To me, this points to a favorable risk to reward prospect for the business at this time.

Be the first to comment