Alberto Masnovo

This is my first hold rating for eXp World Holdings, Inc. (NASDAQ:EXPI) since I started covering the company. This is also the lowest the stock has been since I started covering it so I haven’t done a good job. But this hold rating is mainly due to the current state of the residential real estate market, and not due to any change of heart I’ve had about the company. In fact, I’ve been extremely impressed with eXp given the circumstances of the housing market.

I’m also still long-term bullish on the stock. It’s difficult to think this way during a bear market as everyone, myself included, is so focused on what the stock will do next quarter, next week, or even tomorrow. But it’s the only way I know how to think about investing. I could try to put on my portfolio manager hat and figure out which stocks will have upwards revisions of earnings expectations over the course of the next year and/or stocks that will benefit from factor and trend flows, but this is not how I think. I will always look to own high-quality businesses for long periods of time and even though the real estate industry is a highly competitive and difficult industry, I still believe eXp is high quality.

I went back and forth between a buy or hold rating but ultimately decided on hold because I see no reason why the stock will perform well over the course of the next 6-12 months. Call it capitulation but it’s just how I see it based on the horrible housing market data. The only way out is if the Fed changes course, which they most certainly will not do anytime soon in my opinion. There could be short squeezes and relief rallies along the way as most investors are positioned very negatively on anything related to the housing market, but I’m speaking strictly about housing market fundamentals.

Below I’ll go over why I say this and what I’m looking at in the housing market, and I’ll explain why I’m impressed with eXp’s business performance despite the housing market data, and how this bodes well for eXp over the long run.

Frozen Housing Market

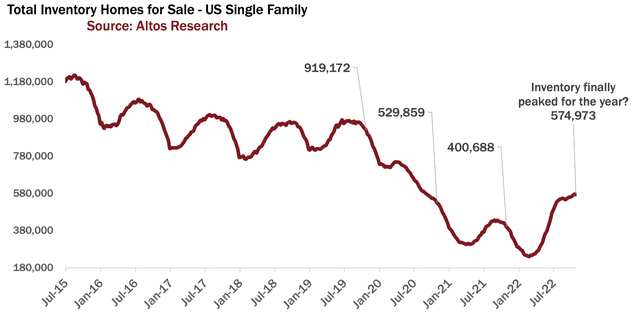

If you told me in 2021 that the 30-year fixed mortgage rate would rise above 7%, I would not have believed you. But here we are. There was some buyer demand when mortgage rates were hovering around 5% but once they skyrocketed to 7%+, buyer demand dried up. Going from 5% to 7% is a massive, unprecedented move and the reaction on the supply side was equally as unprecedented: housing inventory actually went up in September and October, a time of year it always drops.

Total Inventory of Homes for Sale (Altos Research)

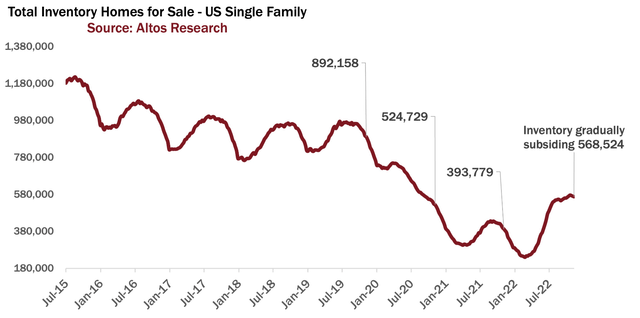

That was back in October. The current 30-year fixed rate is closer to 6% which has helped increase demand to the point that the usual seasonal inventory pattern is back.

Total Inventory of Homes for Sale (Altos Research)

This is already old data, however, and what’s important is what will happen going forward. While it is difficult to know, it depends almost entirely on the path of inflation and how Jerome Powell and the Fed respond to it. If there is a dovish pivot, mortgage rates will drop and home demand will go up. If they hold rates higher for longer and maintain a hawkish stance, mortgage rates will stay elevated and there will continue to be no buyers. The unemployment rate will also play a role but mortgage rates are the main factor.

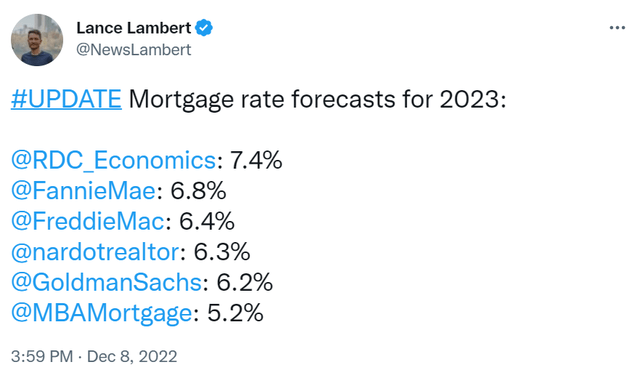

I could give you my opinion but most banks have forecasted 2023 mortgage rates to be in the 5-7% range.

Mortgage Rate Forecasts for 2023 (Lance Lambert – Fortune Magazine)

Even if we see the low end of these forecasts, around 5.5-6%, the housing market will likely remain slow through 2023 and the build-up of inventory we are currently seeing will probably continue.

What Happened to Prop Tech?

While mortgage rates and Fed intervention are hurting prop tech companies, there is another reason for the underperformance of this cohort.

Over the past few years, investors piled into companies that operated in industries with the largest “TAM”. The prop tech “TAM” was considered one of the largest due to the size of the residential real estate market. This led to careless capital allocation as these businesses eviscerated investor capital. It’s easy to bash this behavior in hindsight, but the market rewarded them simply for growth and capturing more of this massive “TAM”. Now that the money has stopped flowing and because growth is hard to come by, these businesses have had to change their tones and aggressively cut costs in order to become cash flow positive.

The market has spotted the difference between the companies that will struggle during this period and the ones that will struggle to survive this downturn. For example, Redfin Corporation (RDFN) and Opendoor Technologies Inc. (OPEN), both highly unprofitable and highly leveraged, are down 80%-90% year to date while eXp is down 65% and Zillow Group, Inc. (ZG) is down 40%. I think this “outperformance” is because eXp and Zillow have almost no liquidity risks. All of these companies will struggle during this period, but first and foremost they must survive it.

This downturn is forcing all companies in this industry, especially the ones that are burning cash, to be more rational with their capital allocation. I hope this is a trend that continues into the future.

Back to My Original Thesis

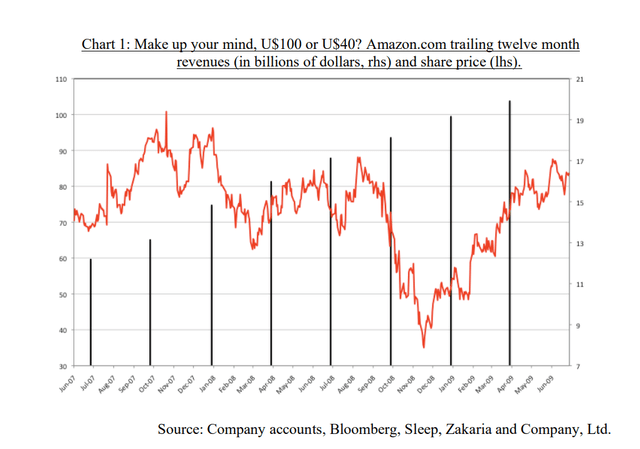

Why did I invest in eXp in the first place? It’s been some time since I’ve revisited this, but I invested in eXp because they practice a scaled economics shared business model. This model consists of returning the majority of excess cash generated by the business to customers versus shareholders. This leads to customer loyalty and growth even during times of economic weakness. For example, Amazon (AMZN), another business that provides value to customers via its scaled economies, grew revenue and gained market share consistently during the great financial crisis.

Amazon TTM Revenue and Stock Price 2007-2009 (Nomad Investment Partnership Letters to Partners)

I invested in eXp because I believed it would grow and gain market share if there were a housing market recession, just as Amazon grew in 2008/2009. I’ve been right so far even if, in hindsight, I should have been more patient on its valuation. In Q3 2022, the thick of this housing recession, eXp’s revenue increased 11% year over year and agent count increased 30% from an already large base. Look at all of the other large prop tech companies and you will see declining year-over-year revenue. Zillow’s main IMT segment saw revenue decline 13% year over year in Q3 2022. Redfin’s main real estate services segment saw revenue decline 17% year over year in Q3 2022. Compass, Inc. (COMP) saw revenue decline 14% in Q3 2022. They did report an increase in principal agents in the quarter but they have separate definitions of principal agents and regular agents. I would not be surprised if the total agent count declined in the quarter. Anywhere Real Estate Inc. (HOUS) saw a 17% decline in revenue and RE/MAX Holdings, Inc. (RMAX) saw a 2.3% decline in revenue.

eXp is one of the only large brokerages that grew during this period. I can’t stress how remarkable this is given the severity of the housing market downturn. If they continue to do this while the market declines, it necessarily means that they are gaining market share.

Initiatives for Greater Profitability

While market share gains are important, the market is currently focused first and foremost on profitability. This year has not been eXp’s most profitable year as the original SG&A spending plan did not account for this type of housing recession, but they’ve has been solidly profitable in the past with a 22% EBITDA margin (using gross profit as revenue) in 2020. And that wasn’t any sort of adjusted EBITDA, that was GAAP operating income plus D&A. 2020 was an outlier year as the uncertainty of the pandemic caused them to cut expenses drastically and abruptly but it showcases the profitability of the core business.

Because profits have been very low this year there’s not much of a valuation floor for the stock at the moment. In Q3 2022 operating profit was $26,000 so there’s no use in trying to use an earnings multiple to predict the stock price. This is another reason for my short-term trepidation. But Glenn Sanford and Jeff Whiteside spoke to investors at the D.A. Davidson Big Sky Summit back in August and provided ideas on how they plan on improving profitability. While they didn’t go into too much detail there were a few things I took away from the event.

First, the new Chief Strategy Officer, Leo Pareja, is working on adding new relationships to the business over the next few years that could bring in $1 million in net income each. This will not necessarily make a massive difference in the bottom line of the business but it gives them more wiggle room to make important investments during the downturn.

Second, they are continuing to find ways to expand affiliated services. They will do this primarily by making these services more accessible in ZooCasa and on their KVCore platform. Additionally, Success Lending is growing. They are hoping to break affiliated services out in the income statement by 2024 but the general long-term goal is a 10% attachment rate for affiliated services. For Success Lending, Glenn provided a long-term goal of a 10% attach rate on buyer transactions. So if there are eventually 500,000 buyer transactions, then 25,000 of those transactions would have a mortgage via Success Lending. Assuming $1000 of gross profit per mortgage, Success Lending could eventually bring in $25,000,000 of gross profit dollars. The title and escrow could have similar economics with an even higher attach rate.

And finally, their global reach provides them with an opportunity to create real estate portals internationally. This is an especially ripe area because there is no international MLS. As they grow their agent count and number of listings in new countries, eXp could have the largest real estate portal in many new markets.

None of this is really new, and the main driver of the business remains the organic growth model. But the more eXp grows and gains market share, the more these initiatives will have a positive impact on the income statement in the future.

Besides these initiatives, I’m always impressed when Glenn talks about the business. It’s clear he lives and breathes eXp and is always thinking about how to create the most value for customers so that eXp can drive maximal long-term shareholder value. This is the key part of the scaled economies shared model. I think this quote from Nick Sleep summarizes it well and is important to keep in mind during bear markets as short-term thinking prevails:

But in the center of the model is a paradox: the company grows through giving more back. We often ask companies what they would do with windfall profits, and most spend it on something or other, or return the cash to shareholders. Almost no one replies give it back to customers – how would that go down with Wall Street? … The firm is not interested in today’s static assessment of performance. It is managing the business as if to raise the probability of long-term success.

I recently watched a video from Glenn Sanford’s personal YouTube channel where he talks about the origin of the eXp model. In it he mentions what he thinks it truly means to be agent-centric. He says, “I think everybody thinks they’re agent-centric but then the question is are they agent-centric? What I think about is, can an agent make more and live a better life, and have a better opportunity in our model than anywhere else? And so that’s where I continually look.” This type of thinking is the essence of what Nick Sleep talked about with the scaled economies shared model. Glenn is using excess profits to create a product that provides value to his customers and partners, the agents. This is the best way to ensure long-term growth.

Final Thoughts

I invested in eXp because I believed it would grow and gain market share regardless of the housing market conditions. So far during this housing recession, they are doing just that. Just as Amazon grew revenue during the 2008 financial crisis when all other retailers saw declines, eXp is growing revenue, gross profit, and agent count during a severe housing market recession because it shares value with customers via its scaled economies. I know most people will roll their eyes at the Amazon comparison because it seems like every company was compared to Amazon during the bull market in 2021, but the main point of the comparison isn’t Amazon. The main point is the power of the scaled economies shared business model which shows that the surest way for a business to grow, especially during an economic downturn, is to provide customers with the most value relative to peers.

However, at the moment, I don’t see much reason for optimism. eXp makes money when eXp agents assist in real estate transactions and right now, there are very few transactions happening. It’s difficult to emphasize just how frozen things are. Along with the labor market, the housing market is out of balance in terms of supply and demand and the Fed is using higher interest rates to bring it back into balance. I believe rates will stay elevated over the next 6-12 months which, coupled with higher unemployment and a recession, will keep real estate transactions low. This does not bode well for eXp, or any other brokerage.

But thinking longer term, there will be a point when the housing market turns around. It could take years for it to happen, but it will. And when it does eXp will have gained significantly more market share and will be a much more valuable business.

Be the first to comment