Abstract Aerial Art/DigitalVision via Getty Images

Gilead’s (NASDAQ:GILD) Q3, 2022 earnings came in hot after years of tepid reports. Having followed Gilead closely over the last many years, I was shocked and excited to see its vigorous post-earnings uptick of ~13%. Following its Q3, 2022 earnings on 10/27/2022’s market close, it jumped to $79.27 at the end of 10/28/2022 from its previous close of $70.20.

After digesting its Q3, 2022 earnings call (the “Call“), I was pleased to learn that its increase was not just piggybacking on the market’s overall 10/28/2022 strength. Rather Gilead was showing strength across its increasingly diverse portfolio.

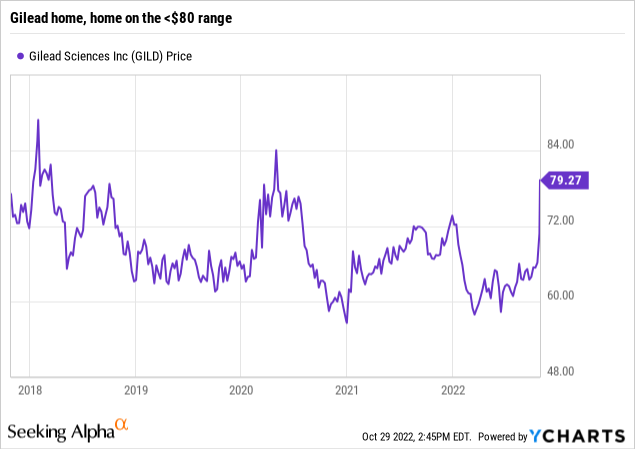

Such is a solid bull thesis. Yet the bear is always lurking. As I will discuss, the $80 peak has proven nearly impossible to crest over the last five years. This article discusses how investors ought to consider 10/28/2022’s run-up to close at $79.27.

Gilead has struggled to get its act together after long disappointments.

For way too long Gilead”s next big thing has turned out to be a fiasco. Its long struggles to build up a cancer franchise and its torturous Galapagos (GLPG) collaboration have kept its share price hovering around $70 for the last five years with few exceptions.

It has made several forays into the >$80 range as shown by its 5-year price chart below:

Gilead’s after-market 10/27/2022 Q3 earnings report showed product sales, excluding VEKLURY’S pandemic focused sales, of $6.1 billion, an 11% gain compared to Q3, 2021. The increase was widely based across its product line. It characterized its R&D and SG&A expenses as relatively flat with Q3, 2021.

It raised its full year guidance. It raised total annual product sales guidance to between $25.9 billion and $26.2 billion, compared to $24.5 billion and $25.0 billion previously. This translated to non-GAAP earnings per share of between $6.95 and $7.15, compared to $6.35 and $6.75 previously and GAAP earnings per share between $3.35 and $3.55, compared to $2.90 and $3.30 previously.

The market cheered the earnings report vigorously as noted above. Piper Sandler came out with an immediate upgrade of its rating from neutral to overweight. It raised its share target price from $79 to $96.

The question now that Gilead has had its big upswing is whether it can maintain this trajectory. Judging by its price performance in its most recent five year past, the answer is clear and it is negative. Sell Gilead first thing this 2022 Halloween morning when the market opens.

No doubt there will be some pressure towards that end over the next few days. As a longstanding and ongoing Gilead bull, I am more sanguine as I will discuss.

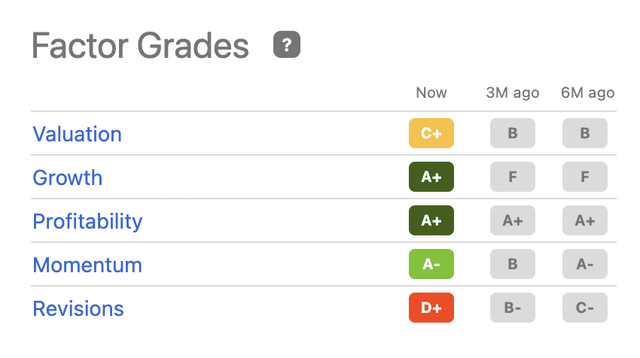

In terms of Seeking Alpha’s quant factor ratings grades on 10/30/2022 as I write, it comes out rather well:

It gets A+ for its important growth and profitability grades. Its C+ for valuation properly reflects its recent uptick. I do not get its revisions grade.

Gilead has several revenue drivers that support continued outperformance.

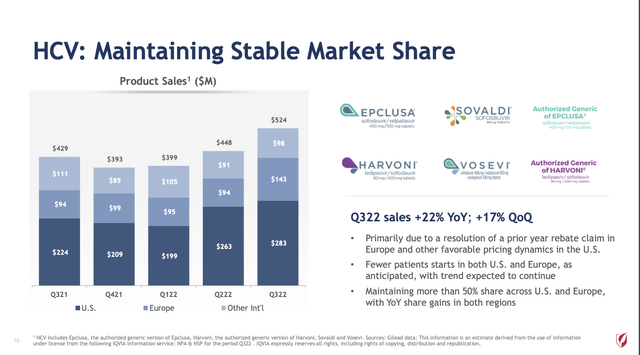

HCV

Over the years Gilead has had some phenomenal flashes in the pan that have given it the financial muscle to support its miscues. Think of its Sovaldi, Harvoni, Epclusa, and Vosevi HCV cures pulling in untold billions in its heyday from 2015 to 2019.

The problem with its HCV therapies was that the revenues they generated were unsustainable; during 2016 Gilead pulled in ~$15 billion (slide 9) in HCV revenues. As announced during the Call, Gilead has retained >50% of the HCV market which provided ~$524 million for the quarter. While this is a big difference, it is not bad for a franchise that has been dwindling for years. The slide below from its Q3, 2022 earnings presentation describes its current situation:

Its HCV Product Sales for its most recent 4 quarters aggregate to $1,764 million. The Q3 was an outlier unlikely to repeat. CEO O’Day noted as follows during the Call:

HCV sales for the third quarter were $524 million, up 22% year‐over‐year and 17% sequentially, primarily due to the favorable resolution of a prior year rebate claim in Europe and other favorable pricing dynamics in the U.S. Offsetting these benefits, there were fewer patient starts in both the U.S. and Europe, consistent with our expectations for both the quarter and the general trend that you should expect in HCV going forward.

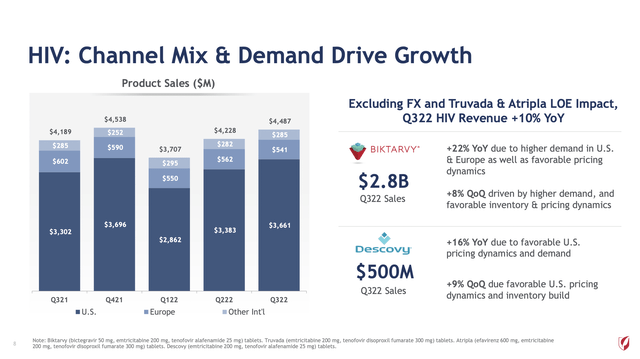

HIV

HIV on the other hand has been a nice steady builder for Gilead over the years. Gilead’s Q3, 2022 earnings slide 8 shows its impressive recent HIV portfolio revenue:

During the Call CEO O’Day commented on this slide and Biktarvy’s performance as follows:

… Once again, Biktarvy continues to command a leading position in the treatment of HIV, with another record quarter growing to 45% market share in the U.S., up 4 percentage points year‐over‐year. Moreover, Biktarvy remains the leading medicine for those seeking to switch to a new regimen in the U.S. as well as those starting treatment in both the U.S. and Europe, most notably, capturing 10 new starts for every 1…

He went on to temper future expectations noting that Biktarvy’s growth was driven somewhat by inventory channel mix dynamics which were likely to be more stable during Q4.

VEKLURY

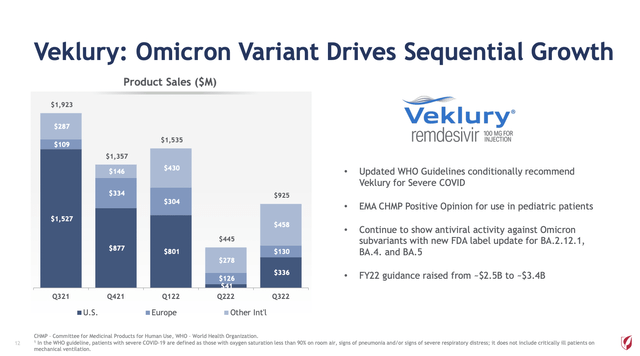

VEKLURY (remdesivir) has been the flash of all flashes. It has been the pandemic’s gift to Gilead generating revenues of ~$2.8 billion in 2020 and ~$5.5 billion in 2021 (2022 10-K p. 36). As shown by its earnings slide below, its 2022 revenues so far have throttled back to aggregate ~$2.9 billion:

During the Call O’Day noted the difficulty of predicting its forward revenue path. It is still a significant player during the pandemic. In the US it is used in ~60% of hospitalized COVID patients. Outside the US it is also a factor recognized by WHO and the European Medicines Agency.

Other areas with Q3, earnings presentation slides included:

- Slide 11, HBV/HDV with Q3 revenues of $264 million, +7% Y/Y; +13% Q/Q, again driven by favorable inventory dynamics;

- Slide 12, TRODELVY (sacituzumab govitecan-hziy) with Q3 revenues of $180 million, +78% Y/Y and 13% Q/Q;

- Slide 13, cell therapy with Q3 combined YESCARTA and TECARTUS product sales of $398 million.

Gilead has significant upcoming catalysts.

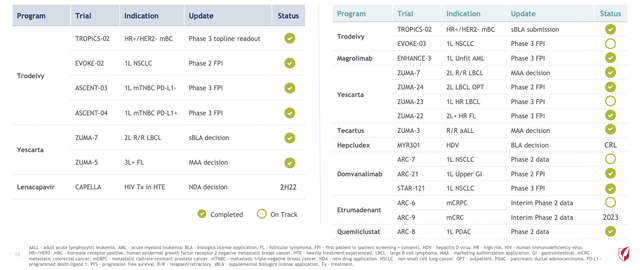

Gilead’s Q3 slide below lists its upcoming catalysts. The balance of the year promises a continuing interesting news flow for Gilead investors:

TRODELVY, lenacapavir and magrolimab, three molecules highlighted as Gilead’s future in my most recent Gilead article, feature prominently among these catalysts. TRODELVY will be coming up to bat on its sNDA for the treatment of certain adult patients with unresectable locally advanced or metastatic hormone receptor (HR) positive breast cancer in 02/2023.

Additionally on TRODELVY, during the Call CMO Parsey noted:

…following the acquisition of Trodelvy’s Asian commercialization and development rights from Everest Medicines, we expect data from our Phase 3 metastatic TNBC China bridging trial in the next few months and our Phase 3 Asian HR-positive/HER2-negative metastatic breast cancer study in mid‐2023.

As for Gilead’s long acting subcutaneous HIV treatment lenacapavir. it has been approved as Sunlenca in the EU. Per slide 17 it is the only twice-yearly subcutaneous HIV treatment option for people living with multi-drug resistant HIV in the EU.

The FDA has accepted a resubmission of lenacapavir for the treatment of HIV-1 infection in heavily treatment-experienced people with multi-drug resistant HIV-1 infection after resolution of its vial issue, with a 12/27/2022 PDUFA.

Conclusion

After careful consideration of Gilead’s Q3 report I am holding on to my current Gilead shares. I am not going to play the market selling in hopes of buying back cheaper although there is certainly a case that can be made for that course. My expectations for Gilead as we move ahead is for it to tend towards a range of $70-$80 up from its current range of $60-$70.

If the overall market trends upward and Gilead scores on some of its regulatory applications it may well find a path to build a higher ridge. In closing let me note that O’Day closed his presentation by stating that Gilead is holding to its existing capital allocation priorities which included return of:

…over $1.1 billion to shareholders, including $928 million in dividend payments and $180 million in share repurchases. As we announced previously, we repaid $1 billion of debt early in the third quarter and have returned to the same debt level we were at prior to the Immunomedics acquisition.

With its HCV and VEKLURY cash cows still producing nicely Gilead can well afford to pay a nice dividend and keep it debt in check.

Be the first to comment