LordHenriVoton/E+ via Getty Images

Co-produced with Treading Softly

When it comes to retirement planning, there is a plethora of routes and ideas.

Historically, retirees had two major funding sources for their retirement – pensions and social security. Two dependable, stable, and recurring sources of income to lean on.

Over time, the pension was replaced with the 401k – reducing an employer’s responsibility for their employees who no longer worked for them after decades of dedication. Many companies were struggling under the heavy weight of longer lifespans and the costly structures of pensions, making them unable to sustain growth while taking care of their former employees.

The ownership and responsibility of a retiree’s outcome were shifted by 401k’s, from the company to the retiree. Now the retiree had to set aside their own money, often matched by the company to a certain level, to pay for retirement. From this monumental shift arose new routes to pay for retirement.

Annuities, insurance products offering stable payouts of income by insurance companies, tried to supplant pensions as reliable sources of income. Furthermore, retirees started to plan on selling their investments and depleting their savings over their lifespans to afford the retirement lifestyle.

This orderly dismantling of assets had a massive change in how wealth was passed down from one generation to the next. There is less to pass forward if you’re forced to liquidate it all to pay for your bananas!

I want to suggest something many have written off as crazy. Using the market to pay for your retirement instead of letting the market pay for your retirement. That means not relying on what the market thinks your investments are worth, but getting great income from your retirement holdings without having to sell a single share.

One route to maximize income from the market is via closed-end funds. These funds are managed by expert portfolio managers who often place emphasis on regular and recurring income to their shareholders.

Now you can FUND your retirement through funds.

Let’s dive in on two excellent funds to add to your stable income generators.

Pick #1: BTO – Yield 7.5%

Banks opened earnings season with a roar. Huntington Bancshares (HBAN), Goldman Sachs (GS), JPMorgan Chase (JPM), and Bank of America (BAC) all beat on earnings, with Net Interest Income coming in stronger than expected while default rates remain low.

Fear continues to persist in the banking sector. Many in the market believe that a recession is coming, which will mean rising default rates which can create a headwind to bank earnings. They fear a repeat of the Great Financial Crisis, which was a tough period for banks.

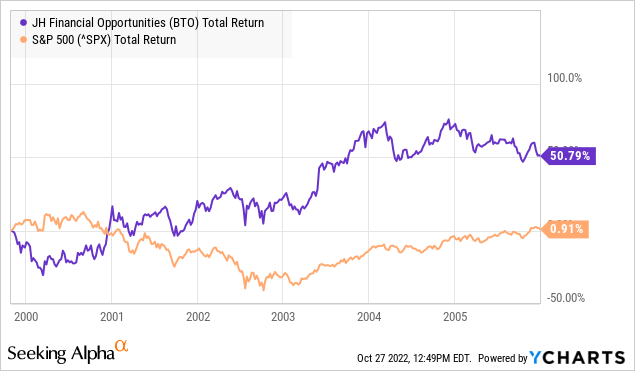

Yet a recession does not automatically spell bad news for banks, and specifically, our preferred method to invest in them is through John Hancock Financial Opportunities Fund (BTO). Take a look at what happened during the Dot Com recession.

Note that BTO sold off and bottomed before the S&P 500 peaked. Then surged upwards as the market indexes crashed. Credit defaults are a headwind to earnings, but they are not the only factor in bank profitability.

Today, banks are in a great situation.

- Liquidity is still high. Banks are sitting on plenty of cash, corporations that borrow are sitting on cash levels well above historical averages, and even the consumer is still in relatively strong financial shape despite inflation. Problematic times for banks usually come on the heels of long periods of excessive borrowing. COVID stopped that in its tracks and led to above-average saving rates. As a result, borrowers are quite healthy relative to historical comparisons.

- Banks collect interest. Banks lend money, and a good bit of that lending is floating-rate loans. Rising interest rates are going straight to their bottom line, and that is why banks are beating expectations for Q3. This will certainly continue going into next year. Higher interest rates are great for banks, especially when default rates remain low.

- Borrowing will increase. As inflation remains above average and outpaces wage increases, it is only a matter of time before consumers become more reliant on debt. The U.S. consumer does not have a history of letting little things like a lack of money crimp their lifestyle. That’s what credit cards are for. There is little reason to believe this time will be different. As consumers spend their savings, they will turn to debt. This will set up future default problems, but we’ve seen this story before, and it is a story that takes years to run. Years that are very profitable for banks.

The bottom line is that the financial sector and its customers are in a very good position to absorb a recession. Any recession is much more likely to look like the Dot Com bust than the GFC. This means that banks are likely to remain strong investments throughout.

BTO is currently trading close to NAV and is yielding 7.5%, this is a great time to be buying.

Pick #2: RNP – Yield 12.7%

It’s beginning to feel a lot like Christmas! I know some folks hate seeing Christmas decorations appearing in the stores before we even get to Halloween, while others love to do their Christmas shopping in July. I won’t take sides in that controversial debate. I learned long ago to stay clear of such contentious political issues in my writings, but whatever your views are on the proper timing of getting Christmas decorations out, one thing we can all agree on is that special dividends make for a wonderful Christmas present and it is never too early to declare them!

Cohen & Steers REIT and Preferred and Income Fund (RNP) has declared a large special dividend of $1.0714/share. Typically, when we see a special dividend declared, the price runs up. RNP’s price is still trading below NAV.

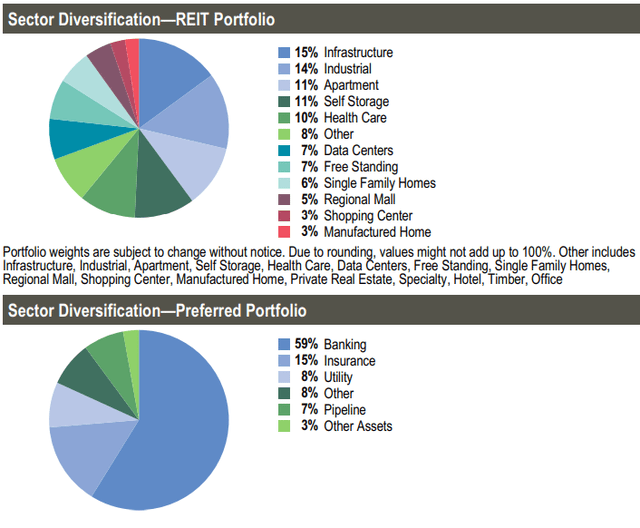

RNP invests in a combination of real estate investment trusts (“REITs”) and preferred shares. Keeping the balance approximately 50/50. The preferred portfolio is in banking, insurance, utilities, and pipelines. So RNP provides diversification by type of investment as well as by sector. Source.

This combination ensures that RNP has stable cash flow while also providing upside potential through its exposure to quality REITs.

It is clear that sentiment is strongly against REITs. Prologis (PLD), RNP’s second largest position, reported effective rent increases at a staggering 60% and cash rent increasing by nearly 40% on new leases. These numbers are staggering, and this is money in PLD’s pocket. It will take several years for all of the leases in PLD’s portfolio to renew, but as they do, they will be reset at substantially higher rents than they are expiring at. In other words, PLD has enormous built-in organic growth just from lease renewal.

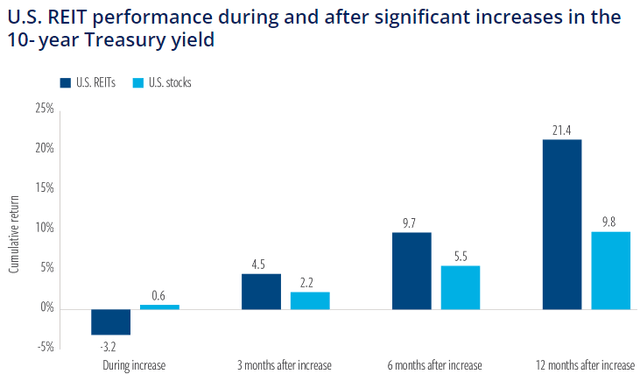

Yet the market remains obsessed with rising interest rates. Rates go up, Wall Street sells REITs. It does this despite ample evidence that rising rates have not historically negatively affected REIT earnings. In fact, REITs have outperformed in the months following significant increases in the 10-year Treasury. (Source: Cohen & Steers)

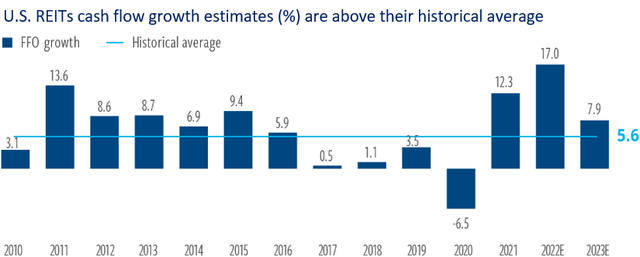

Rent growth is what drives funds from operations (“FFO”), not interest rates. The outlook for cash flow growth for REITs remains well above historical averages.

The bottom line, REITs are making more money. Being REITs, that growing cash flow will be passed along to shareholders as dividend increases. RNP is one option to invest in the sector before the market realizes the cash it is leaving on the table. You can buy at a discount and catch the large special dividend as well!

Shutterstock

Conclusion

There’s an adage that there are two guaranteed things in life: death and taxes.

Perhaps we should say there are two investments that will likely be with us for decades to come – banks and real estate. Investing via BTO and RNP, we can continue to collect excellent income from a curated group of holdings in these two long-lived sectors.

I don’t want to have to worry about where my income comes from. I want to be able to rest assured that my income will keep on flowing and growing over long periods of time. Holding a diverse array of banks and REITs, I can enjoy the income while doing whatever I want to do.

I can get paid by the major and minor U.S. banks, while I go golfing with my friends. I get paid by vast real estate empires, while I visit my county fair and enjoy funnel cake. I get paid when I flip on the TV and watch the latest episode of A Handmaid’s Tale.

My retirement is covered by a relentless shower of income, which overwhelms the fires of my expenses and nourishes the garden on my hobbies. That’s the beauty of income investing.

It’s a revolutionary way to fund your retirement.

Be the first to comment