kontrast-fotodesign/iStock via Getty Images

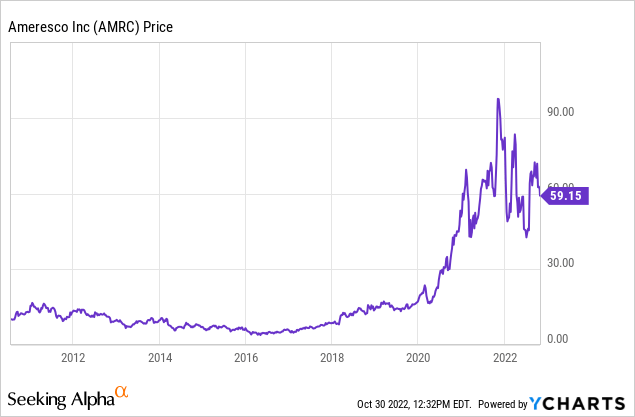

Ameresco’s (NYSE:AMRC) common shares for much of the decade after it went public in 2010 were for all purposes flat. The company’s vision to energize a sustainable world fell on deaf ears and so too did its efforts across its core markets from energy efficiency to infrastructure upgrades, asset sustainability and renewable energy solutions.

The cleantech integrator works with a diverse range of institutions and has clients from federal and local governments to educational institutions and commercial and industrial customers. For example, Ameresco was selected to construct, own and operate an 18.6 MW renewable energy solar facility for the US Army Fort Detrick military installation. The partnership supports the Army’s goal of deploying 1 GW of renewable energy by 2025 and sees Ameresco sell electricity generated back to the Army through a 25-year power purchase agreement.

This forms the core bull case for Ameresco. ESG commitments by both public and private firms will over the next decade create a material level of revenue opportunities for the company. The company has the breadth, scale, and experience across a number of sustainability solutions that will appeal to the growing climate economy wave that is only set to be accelerated by the Inflation Reduction Act.

The IRA represents a step change with at least $370 billion being allocated towards decarbonization initiatives across all parts of the US economy over the next decade. Ameresco’s shares were set alight when the initial signing of the IRA was announced and ran up from lows of just over $40 to $76. It has since pulled back. The company by virtue of operating across a number of secular growth markets is fully exposed to the full benefits of the IRA.

The IRA might spend twice as much as the currently earmarked $370 billion figure because many of its important provisions including subsidies for solar and battery storage systems are uncapped tax credits. The US government has essentially written a blank check to the low-emissions industries. The government will award credits as long as a project meets the terms. There is no upper ceiling, no budget, and no restrictions. Hence, the IRA’s total spending is likely to be more than $800 billion, 2x more than the frequently cited figure.

The IRA’s provisions now form part of the foundations of Ameresco’s short, medium and long-term investment story. It represents a significant effort by the US government to induce a radical transition away from the current fossil fuel-dominated energy orthodoxy and will fast become the change that will help Ameresco realize its vision to energise a sustainable world.

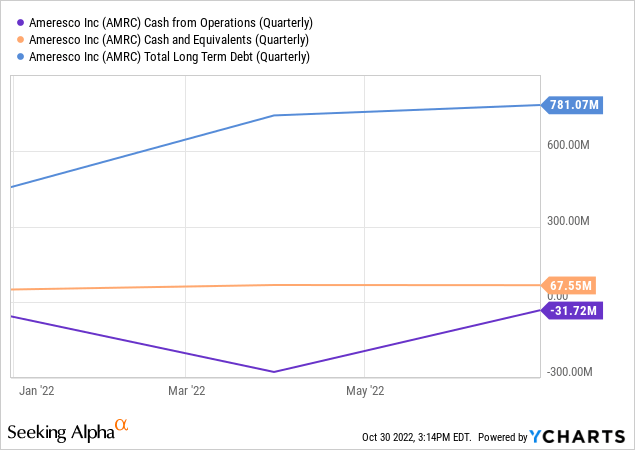

Revenue Is Ramping But Positive Cash Flows Remain Elusive As Long-Term Debt Rises

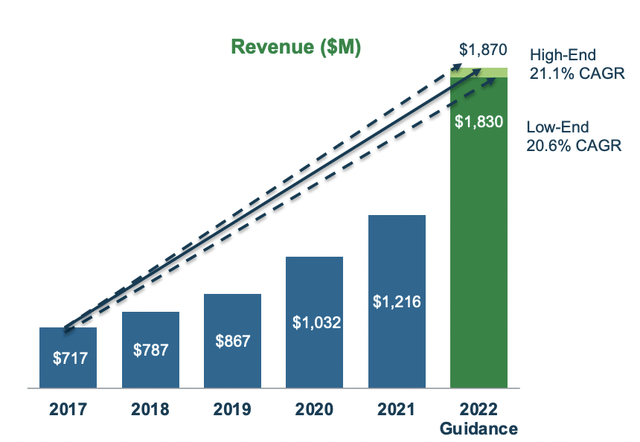

Ameresco last reported earnings for its fiscal 2022 second quarter saw revenue come in at $577.4 million, a 110.8% increase from the year-ago quarter and a beat of $56.32 million on consensus estimates. The company generated gross profits of $81.3 million on the back of a gross margin of 14%, a 43 basis point sequential decline.

Revenue growth has been on a strong upward ramp over the last five years as more institutions take concrete steps to reduce their carbon emissions on the back of the rising visibility of the ESG phenomenon. The company stands to record at least a 20.6% compound annual growth rate at the low end of its full-year 2022 revenue guidance.

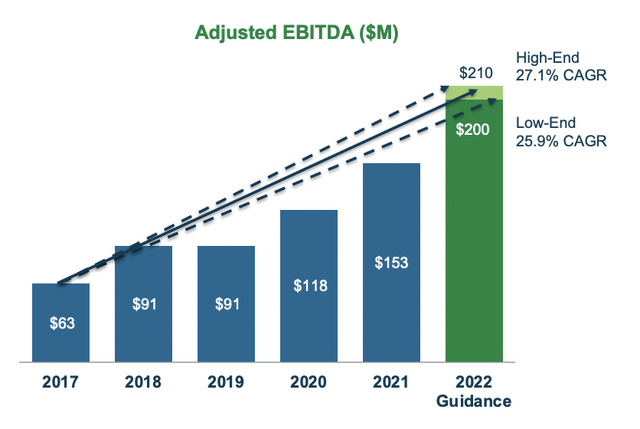

Ameresco also generated a positive adjusted EBITDA of $58.4 million during the quarter, up from $35 million in the year-ago quarter.

The company is guiding for adjusted EBITDA to reach at least $200 million exiting fiscal 2022 which would be a growth of 30.7% over the previous year and see its 5-year compound annual growth rate come in at nearly 26%.

However, the company’s cash generation profile is inverted.

The company’s cash flow from operations during the quarter was negative at $31.72 million, albeit an improvement from a loss of $57.8 million in the year-ago quarter. This meant a deterioration of its balance sheet which held cash and equivalents of just $67.55 million against long-term debt of at least $781 million. The divergence of adjusted EBITDA from actual cash flows came from non-cash changes to account receivables. Further, capital expenditure of $74.6 million during the quarter meant total free cash outflow was $106.3 million. This deficit was financed by the issuance of around $122 million in debt.

Energizing A Sustainable World

Ameresco’s triple-digit growth rate as of its last reported quarter is a strong vote of confidence that its go-to-market strategy is working after nearly a decade of largely being ignored by the market. By helping its clients pursue net zero, Ameresco has set itself up to ride the IRA accelerated decarbonization wave set to take transpire over the next decade.

The company is set up to drive the next chapter of its investment story through strong revenue growth and focused execution. This will be in contrast to the late pandemic era animal spirits that drove shares in the Framingham, Massachusetts-based company to 52-week highs of just over $100 per share. But I’m not a buyer here as I expect more short-term weakness with common shares likely retracing back to recent lows on the back of broader economic headwinds.

Be the first to comment