tongpatong

High quality companies can go through periods of undervaluation when their businesses underperform during the near term. This creates great buying opportunities so long as the long-term growth thesis is intact. This can otherwise be described as “time arbitrage” as investors who are more nimble and are not beholden to managing a portfolio for others can take advantage of a sell-off by short-term focused mutual funds and hedge funds.

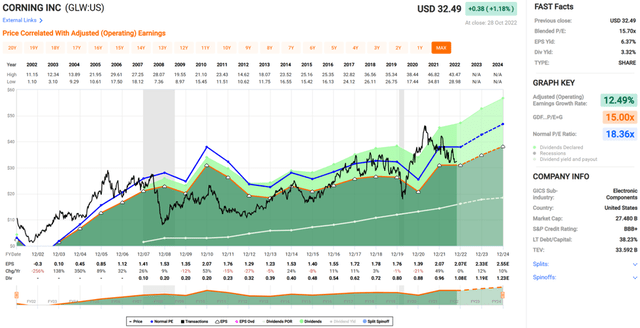

This brings me to Corning (NYSE:GLW), which remains cheap due to short-term headwinds, while being well-positioned for the long run. In this article, I highlight why GLW is an appealing choice for dividend growth investors.

Why GLW?

Corning is a global leading innovator of materials science. It’s been in business for over 170 years and specializes in the production of glass, ceramics, and optical fiber, the latter of which makes GLW a crucial partner to telecom players. Corning has a leading market share in many end markets, with products that include flat-panel monitor displays, Gorilla Glass, gasoline particulate filters in cars, and very importantly, optical fiber for broadband communications.

What makes Corning stand out is the robust demand for its optical fiber products that serve as the plumbing for telecoms and the emerging 5G category. Furthermore, Corning is also becoming an important player to the semiconductor industry through its 80% ownership stake in Hemlock Semiconductor, which manufactures ultrapure polysilicon for the semiconductor and solar industries.

GLW recently reported respectable results for the current economic climate, with core sales of $3.7 billion during the third quarter, up slightly from sales in the prior year period. This was largely driven by strong showings from optical communications, environmental technologies, life sciences, and Hemlock and emerging growth businesses, offset by a decline in display technologies (22% decline sequentially and 28% decline YoY).

The weakness in display technologies and the automotive segment are the likely reasons behind why GLW didn’t participate as much in the recent market rally, with the share price rising by just 0.8% over the past week compared to a 3.1% rise in the S&P 500 (SPY). Moreover, management guided for lower than expected Q4 core EPS in the $0.41 to $0.47 range compared to the $0.55 consensus estimate, and Q4 sales in the $3.45 to $3.65 billion range versus consensus estimate of $3.74 billion.

While display technologies may be pressured in the near term, I believe it’s important to keep in mind that it had a tough comparable, as sales of consumer display devices soared last year when many people were working and spending more time at home. In addition, the weakness in automotive was driven by supply chain constraints, which should eventually correct itself.

Meanwhile, I see GLW’s long-term growth thesis as being intact, driven by 5G acceleration and the Infrastructure Act that was recently passed. These tailwinds were highlighted by management during the recent conference call:

Let’s move to Optical Communications, which was the largest contributor to third quarter sales. The industry continues to experience a large multiyear wave of growth for passive optical networks, and we continue to increase our capacity to support this growth.

In August, U.S. Secretary of Commerce, Gina Raimondo, joined AT&T CEO, John Stankey, and me to announce a new manufacturing facility in Arizona. You may recall Secretary Raimondo’s leadership helped pass infrastructure legislation dedicated to the idea of Internet for all. Our new plant will boost optical cable capacity to meet record demand.

In September, we opened a new optical fiber manufacturing plant in Poland to serve committed demand. And we’re innovating to support every phase of broadband deployment as network access is increasingly viewed as a fundamental human right.

In the quarter, we announced additions to our Evolv connectivity portfolio which helps operators streamline permitting, accelerate field installation and optimize network testing. Optical sales have grown 22% and for the first 3 quarters of the year, setting us up for another strong year of growth. However, we expect fourth quarter sales to be down sequentially due to the timing of customer projects.

Meanwhile, Corning maintains a strong BBB+ rated balance sheet and yields a respectable 3.3% at the current price of $32.49. The dividend is well-protected by a 48.6% payout ratio and comes with a high 5-year CAGR of 12%.

Lastly, I find Corning to be attractive at the current forward PE of 15.7, sitting well below its long-term normal PE of 18.4. Analysts project strong 9 – 15% annual EPS growth over the next 2 years, and S&P Capital IQ has an average price target of $37.48, translating to potential double-digit annual returns.

Investor Takeaway

While Corning’s display business and automotive businesses may be pressured in the near term, I believe these segments should normalize over time. Plus, the long-term growth story around optical communications is intact, as the company is well-positioned to benefit from 5G acceleration and the recent Infrastructure Act. Meanwhile, GLW’s share price remains value priced, offering dividend growth investors a solid starting yield. As such, I find GLW to be an attractive buy at present before the market wakes up.

Be the first to comment