AleksandarNakic

Overview

XPEL Technology (NASDAQ:XPEL) is currently undervalued by ~35%. I believe XPEL’s true value will continuously be realized and inflect higher as it continues to execute well and print strong financial numbers. The growth potential is immense for XPEL given the large TAM and its leading position. The high valuation might be a concern in the short-term, but I believe XPEL has what it takes to support this valuation.

Business description

Originally founded as a provider of proprietary software for the automotive industry, XPEL has expanded into the aftermarket industry with a wide range of products, including surface and paint protection, headlight protection, automotive window films, and more. Automotive ceramic coatings, window films, architectural films, and paint protection films (PPF) are just some of the aftermarket items that XPEL sources, distributes, and installs. Sixty-five percent of XPEL’s sales in FY21 came from sales of paint protection film, 15% from sales of window film, and the remaining sales came from sales of ceramic coating products, software, installation labor, and training classes. 51.5% of XPEL’s revenue came from the United States in FY21, followed by 18% from China, 12% from Canada, 8% from Europe, and the rest from Asia, the United Kingdom, and Latin America.

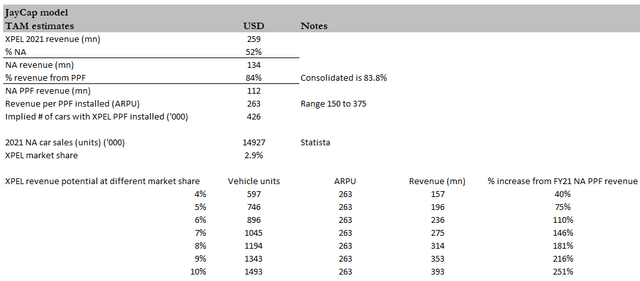

Market leader in a large TAM with a long runway to continue growing

The sheer number of automobiles in North America creates a massive total addressable market (TAM) for PPF. There is a lot of room for XPEL to expand its market share, as I believe it only has a low-single digit market share as of FY21, and that number could easily go up to 5% or more, implying at least double the revenue size of FY21 North America’s PPF revenue.

I believe that the fact that it saves car owners money over time will contribute significantly to its growing popularity. Clear adhesive film, or PPF, is applied to a car’s paint job to protect it from the elements. This helps the car guard against scratches and chips in the paint. PPF not only makes car cleaning easier, but it also prevents dirt and dust from adhering to the film. The truth is that there is always the possibility of damaging your car’s paint job while driving, and the paint on your car can be shielded with a film designed to protect a car’s paint from road debris and other road hazards. Paint protection film has the obvious advantage of extending the life of the car’s paint job, making it look like new for a much longer period of time. Paint protection film also has the advantage of self-repairing after being damaged. In this way, XPEL’s custom-cut PPF acts as an invisible shield for a car’s paintwork, protecting it from hazards like road debris, gravel, minor scratches, and UV radiation.

A well-established brand is a strong moat

XPEL’s brand moat is one of the reasons why the company is so appealing to investors. By providing installers with training, accompanying them on sales pitches, and funneling leads to them, XPEL has shaped itself into a lead funnel, making installers extremely reliant on XPEL’s patented software. Installers, in particular, appear to gain a competitive advantage and incur a switching cost as a result of lead generation. The XPEL website includes a “Find An Authorized XPEL Installer” locator, and the site could be a major source of new business for XPEL’s authorized installers, given that car owners who search for XPEL film are more likely to land on the XPEL website, as most film installers do not have a strong web presence. Film installers that rely on XPEL have higher switching costs; for example, is an installer going to switch film providers to try to save a couple of percentage points on film purchases when, say, more than 30% of their revenues are generated by leads that XPEL provides them for free? If an installer in this situation tried to switch film suppliers, their business would plummet.

I believe this is a strategic move by XPEL to educate and expand its installer base. XPEL’s revenue increases as these independent installers succeed and strengthen their relationships with nearby new car dealerships and customers. As XPEL establishes more OEM relationships and expands into more new car dealerships, its installed base of repeat customers grows. So, underneath it all, the goal is to maintain high service quality. Before doing my research on XPEL, I assumed that service quality wouldn’t matter much because it’s “just pasting stickers,” but there are differences in the quality of the films and installers. There are many things to think about, such as the film being too thin or too thick, not being self-healing, not having a warranty for more than one year, the installation being bad, with bumps or creases in the film if it isn’t stretched enough, less accurate cuts around the exterior lights and indents, and so on.

Huge pricing power

When a company has a sizable “brand moat,” a high switching cost for customers, and a large number of “resellers,” they have tremendous bargaining power in the market. If XPEL raises prices by 5%, is that installer really going to switch film suppliers, losing a portion of their business that comes from XPEL’s leads? Almost never. I still think XPEL has a lot of unrealized pricing power due to its importance in the value chain for installers. The fact that XPEL has not increased film prices for many years because it has prioritized rapid expansion and market dominance is likely news to most investors. I expect them to use that pricing power one day, which could have a big effect on their bottom line.

Proprietary technology advantage

The Direct Access Program (DAP) is XPEL’s unique offering in the market. The DAP is a web-based application that stores information about the exterior and interior shapes of more than 80,000 different vehicle models and year ranges. In turn, this helps XPEL and its clients get the best possible results from their paint protection and window film tinting panel orders. Film is automatically cut to the correct sizes and pattern shapes via communication between the XPEL DAP software and electronic plotters. The automatic cutting plotter saves installers from having to cut out the shapes by hand, which takes a lot of time and effort. It also makes sure that the bumper and the area around the headlights fit more precisely and evenly.

Forecast

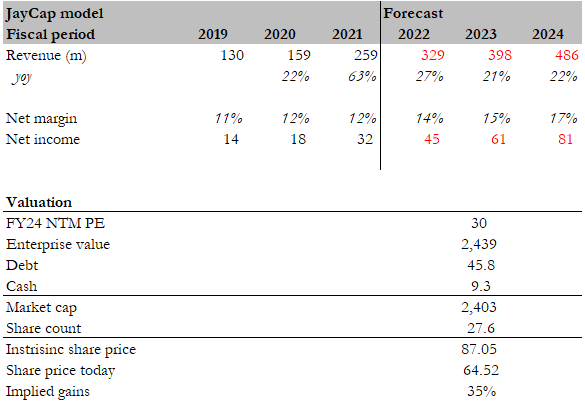

Based on my investment thesis, I expect XPEL to continue to sustain its leadership position due to its brand and proprietary technology. The beauty of investing in a company with a strong moat and market leadership with strong growth is that you do not need exceptional variant perception. For my model, I used the same numbers as consensus to derive my expected value of XPEL. I expect revenue to hit the mid-point of management’s FY22 guidance of 25% to 28%. I believe this is definitely possible given the strong growth momentum it has demonstrated and the large TAM. Profit margins will gradually increase over time due to rising prices and incremental margins from a fixed cost base.

I calculated an intrinsic value of $87.05 based on the aforementioned assumptions and a 30x NTM PE (which is where it is trading today), which is 35% higher than the current share price of $64.52.

Author’s estimates

Red Flags

Supply constraint situations may impact growth

Since XPEL deals in product sourcing and distribution, it is especially vulnerable to the current supply shock. Even though these problems in the supply chain haven’t slowed down product delivery, a sudden drop in demand and sales could happen if there isn’t enough stock.

High valuation

XPEL is trading at a high valuation (30x forward PE), implying that multiples have plenty of room to fall, as we have seen in many high-growth software companies. While it is true that XPEL’s earnings are not yet mature, and thus the 30x multiple is much lower on a matured basis, it also means that a significant amount of earnings growth is embedded. Any change in the company’s growth trajectory could cause the stock to plummet.

Conclusion

XPEL is undervalued at its current share price as of the date of this writing. XPEL is a leading player with an extremely long runway of growth, stemmed by the vast number of cars that XPEL can continue to capture and also its well-built ecosystem that enhances the entire value chain. In my honest opinion, we are still in the early innings of XPEL’s growth, but that is something that nobody can verify today. As such, the catalyst for XPEL’s financials and stock price to inflect higher is for it to continue executing and printing strong numbers.

Be the first to comment