AndreyPopov/iStock via Getty Images

Introduction

After battling the severe Covid-19 inspired downturn during 2020 and early 2021, it appeared that the recovery had finally arrived for PBF Energy (NYSE:PBF) during the third quarter, as my previous article highlighted. Thankfully as we now traverse 2022, they appear to be out of the fire, proverbially speaking, although there are still years of deleveraging ahead before investors should expect any meaningful shareholder returns.

Executive Summary And Ratings

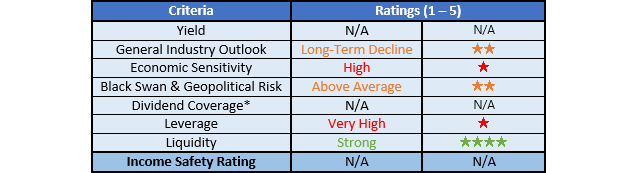

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

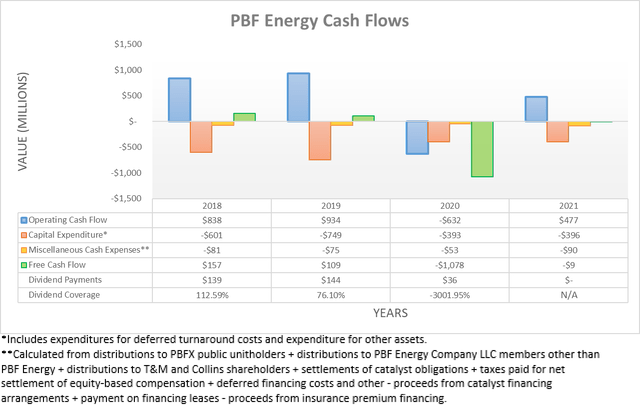

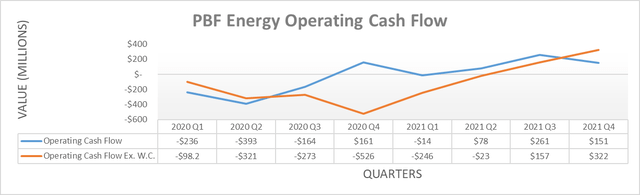

After seeing their cash flow performance beginning to recover during the third quarter of 2021, it was very positive to see this continue into the fourth quarter with their operating cash flow ending the year with a result of $477m. Whilst this marks an improvement in absolute terms, it only increased $151m versus their results during the first nine months of 2021, whereas the earlier third quarter was relatively stronger with an improvement of $261m versus the preceding first half. Thankfully this slowdown was only due to temporary working capital movements during the fourth quarter of 2021 with their underlying results actually strengthening relative to earlier quarters, as the graph included below displays.

It can be seen that their operating cash flow excluding the impacts of working capital movements was a very strong $322m during the fourth quarter of 2021, which if annualized would equal $1.288b and thus actually best the high point from their recent history since at least 2018, which was $934m during 2019. Whether this continues remains to be seen given their inherently volatile industry but thankfully it appears likely given the recent very strong oil prices and their outlook for higher refinery utilization during 2022 that sees their throughput increasing 8.45% year-on-year to 905,000b/d at the midpoint versus their level of 834,500b/d during 2021, as per their fourth quarter of 2021 results announcement. Whilst this often signals the prospect for dividends to be reinstated, this seems unlikely during 2022 and likely beyond given their combined outlook for higher capital expenditure and deleveraging target, as per the commentary from management included below.

“While our planned refining capital expenditures in 2022 are increased over 2021, we continue to focus on capital disciple.”

“So, our view has not changed. This is an insurance policy and over time, what we have outlined to investors to rating agencies and to the market is our long-term goal is to get back inside of that 40% net debt to cap number.”

– PBF Energy Q4 2021 Conference Call.

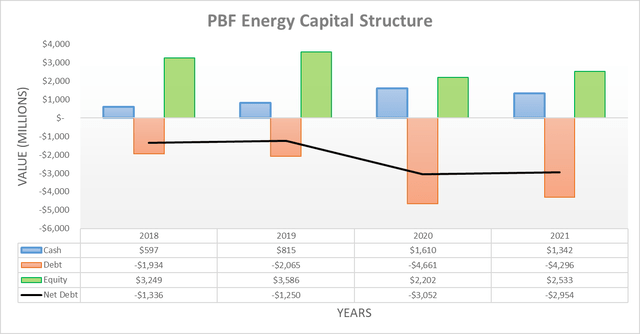

Following the fourth quarter of 2021, their net debt was essentially unchanged at $2.954b and whilst down slightly versus its previous level of $3.052b at the end of 2020, it remains more than double its earlier level of $1.25b at the end of 2019 before the severe downturn began. When their net debt is combined with their equity of $2.533b, it sees their net debt-to-capital ratio at 53.84%, also known as their gearing ratio and whilst noticeably above the 40% target of management, thankfully the difference is not too large.

Since there are two components to this equation, they either need to increase their equity or reduce their net debt or more practically, a combination of both because as their net debt reduces it increases their equity comparably, as the latter is derived from assets minus liabilities. Their equity is also influenced by changes to the value of other assets and liabilities on their balance sheet, although these are not practical to predict and thus will be assumed to broadly equalize each other for the purpose of this analysis. Based upon my calculations, if they were to reduce their net debt by circa $750m and thus increase their equity comparably, it would see their net debt-to-capital ratio decrease to approximately 40%.

Whilst this would see their deleveraging target achieved, I suspect they would refrain from reinstating meaningful shareholder returns until they are at least slightly below this target since it remains rather high and thus, I would personally expect circa $1b of deleveraging. The timeframe to reach this point will depend heavily upon their future cash flow performance, which even at the best of times is volatile due to the inherent characteristics of their industry.

Considering their guidance for higher capital expenditure during 2022 and possibly beyond, it seems likely to take a number of years. If utilizing their highest ever annual free cash flow in recent history since 2018 as the basis, its result of $157m would take around five to six-plus years to reduce their net debt between $750m to $1b. Alternatively, if their strong underlying operating cash flow during the fourth quarter of 2021 translates into tangible performance and lasts well into the future, this timeline would easily be reduced and thus possibly be as low as two to three years, although only time will tell due to the inherent volatility of their industry but one way or another, a multiyear wait appears guaranteed.

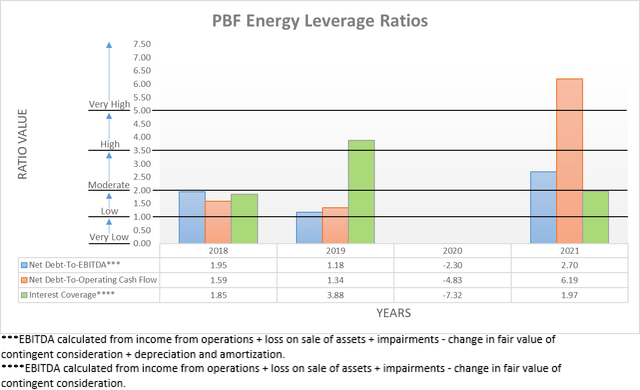

Now that 2021 has ended, their leverage ratios have started to normalize versus their results when conducting the previous analysis following the third quarter and earlier during 2020 when they were rendered useless due to their negative earnings. Although due to the $669.6m boost that their EBITDA enjoyed thanks to inventory market valuation adjustments, it still leaves their net debt-to-EBITDA of only 2.70 rather impractical. Meanwhile, their net debt-to-operating cash flow remains well into the very high territory with a result of 6.19 well above the applicable threshold of 5.01.

Even though very high leverage is certainly not ideal, it should improve as their operating conditions and thus financial performance recovers throughout 2022. If they reduce their net debt by the circa $750m to $1b as previously discussed, their net debt-to-operating cash flow would be pushed down to a much more reasonable circa 2.50 based upon their average operating cash flow during 2018-2019, which would sit within the moderate territory of between 2.01 and 3.50, thereby providing scope to safely reinstate their shareholder returns.

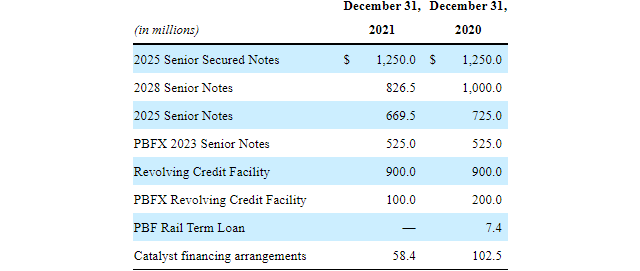

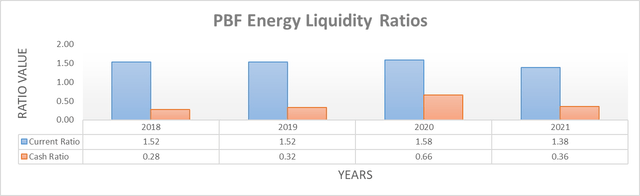

Now that operating conditions appear to be well on their way to recovering, thankfully the pressure is now off their liquidity that ultimately saved the day, as was discussed with my earlier article. Despite suffering immensely during this severe downturn, their liquidity still ended 2021 on strong footings with a current ratio of 1.38 and a cash ratio of 0.36, both of which should be broadly sustained going forwards as their cash flow performance recovers. Meanwhile, their credit facility also retains a further $2.22b available but thankfully this should not be required because its maturity date of May 2023 is beginning to approach with essentially only one year remaining, thereby making refinancing an important task since they obviously cannot repay its balance. Thankfully, the remainder of their debt does not mature until 2025 at the earliest and thus they have breathing room, as the table included below displays.

PBF Energy 2021 10-K

Conclusion

Ultimately only time will tell how quickly they are able to reach their deleveraging target but given their outlook for higher capital expenditure, it seems reasonable for investors to brace for years ahead that will likely see scant shareholder returns. Whilst their improving cash flow performance is very positive, as their share price has now rallied back towards its level during early 2020 before the worst of the severe downturn wreaked havoc, I now believe that downgrading my rating to hold from buy is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from PBF Energy’s SEC Filings, all calculated figures were performed by the author.

Be the first to comment