hapabapa/iStock Editorial via Getty Images

Amazon (NASDAQ:AMZN) is a behemoth by nearly any standard. The company has a market capitalization of more than $1.5 trillion and is roughly 20% below its 52-week highs. As we’ll see throughout this article, despite the company’s impressive core assets, increasing competition, a lack of new opportunities, and a lack of competitive compensation mean the company is at several times its fair valuation.

Amazon’s Financial Performance

Amazon had a weak financial performance for 2021 versus 2020, however, there are several discrepancies worth noting.

Amazon Financial Performance – Amazon Investor Presentation

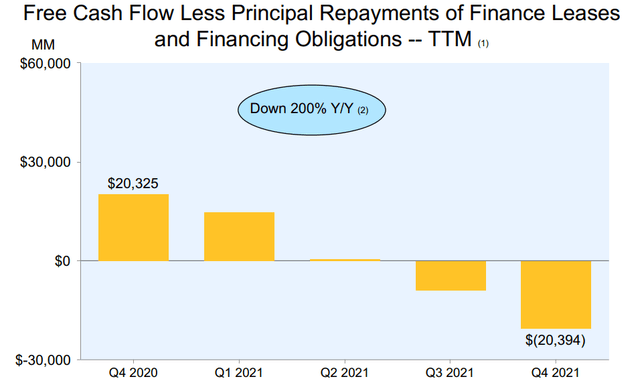

Amazon saw FCF take a turn to -$20 billion in 2021, however, in the interest of full disclosure, the company had numerous one-time costs. For example, the company built up almost $10 billion in inventory to accelerate rapid delivery, and we expect higher inventory levels to continue going forward without expanding the company’s costs.

The company has rapidly expanded its capital spending as well. That YoY increase could be seen as a permanent factor of the company’s expanding business, but there’s no indication that the company won’t need to maintain high spending to continue growing. This is especially concerning when the company’s quarterly sales for 4Q 2021 slowed down to 9% YoY.

Amazon’s Outstanding Shares

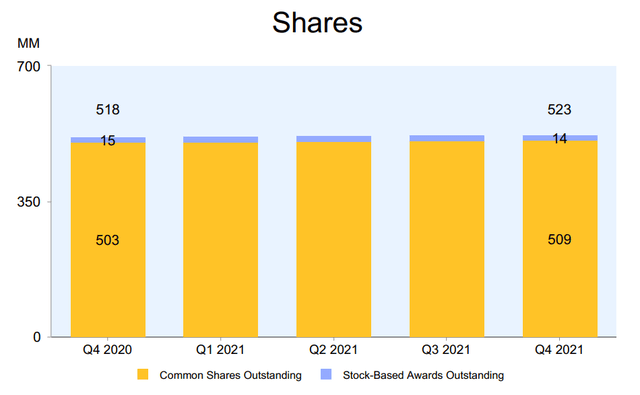

Amazon continues to argue it’s efficiently managing dilution.

Amazon Outstanding Shares – Amazon Investor Presentation

Amazon has expanded its common shares outstanding by 5 million shares over the last year. The company has seen a 1 million share decline in its stock-based awards outstanding. The company has recently announced a $10 billion share buyback, however, it’s worth noting that that’s roughly 7-8 months of share awards while using a non-negligible part of the company’s cash.

With continued massive investment and negative FCF, the company needs to spend roughly $15 billion in annual share buybacks to generate even neutral shares outstanding. That’s a significant cost worth noting. With a $1.5 trillion market capitalization, you need significant FCF after expenses to justify that valuation.

Amazon’s Sales and Competition

Amazon operates a massive business with almost $470 billion in net sales over the TTM. AWS makes up 13% of this, but the lion’s share of profits, while the company’s International and North America sales are 87% (of which North America sales are 60%), there are several important concerns to pay attention to here.

First, the company’s business is still very concentrated in North America, especially the U.S. The company has been unable to significantly expand its business outside the country, which means, if suitable replacements appear in the U.S., the company’s overall business will decrease substantially. Walmart and other companies are entering the market.

Amazon has continued to see revenue growth, however, its market share has remained roughly constant. Microsoft (MSFT) and Google (GOOG) (GOOGL) are investing heavily in their cloud businesses, and we expect competition to increase from here, especially now that Amazon has proven out the market and the opportunity that’s contained within it.

Unfortunately, for Amazon, its competitors are larger and wealthier than those in many other industries. Google, Microsoft, Walmart (WMT), and Costco (COST) are some of the company’s largest competitors and also some of the largest and most profitable companies in the world. That competition is worth paying a close attention to.

Amazon’s Fair Value

It’s tough to gauge Amazon’s fair value. Even removing the company’s one-time inventory building, the company is still at roughly $0 cash flow. Capital spending is growing, but there’s no sign that that’s temporary. We expect the company’s margins to shrink as competition increases. The company’s more than doubling of tech employee salary caps also shows struggles.

The company assumes 15% annualized stock growth in RSUs it pays to employees and we don’t expect that assumption to hold up. Compensation expenses, where dilution already costs the company >$15 billion annualized, can only be expected to grow from this point outwards. That’ll put strong negative pressure on the company.

We think that the company is currently priced at 2-3x its true fair value. The basis of this is threefold.

(1) Geographic Risk and Competition Risk

The company is heavily concentrated in North America, and as discussed above, competition in North America is increasing. New competition could hurt continued growth in this region which is a major driver of the company’s results.

(2) AWS

AWS has, historically, provided an outsized share of the company’s earnings versus its revenue. However, the company has stopped gaining market share over the past few years, and revenue growth has been due to overall market growth. With wealthy and growing competition, we expect revenue growth to slow down and margins to compress.

(3) FCF

At the end of the day, the company’s valuation is based on its current or potential future shareholder rewards. Even for a $500 billion market capitalization, Amazon would need roughly $40 billion in annualized FCF at some point, a level we expect the company to struggle to reach given competition growth.

For these factors, we think that Amazon’s fair value is significantly below its current value.

Thesis Risk

The largest risks to our thesis are two-fold.

(1) Amazon is continuing to invest massively in growth versus shareholder rewards. This has long been the thesis behind the company’s valuation. The company could roll back capital spending without giving up growth, enabling growth in shareholder returns. Its buybacks might be a sign of that, but the company’s true cash flow generation remains to be seen.

(2) Amazon has a unique ability to identify and grow in new industries. Prime has continued to outperform along with AWS. The company could continue to see reliable low-cost cash flow growth from subscription services such as the above which could enable increased future shareholder returns.

Conclusion

Amazon had tough earnings with its FCF dropping significantly. The company was partially punished due to temporary effects, however, there’s also a significant need for growing capital expenditures in a competitive environment. That competitive environment could hurt the company’s ability to continue growing its overall business.

More so that competition isn’t just in selling. The company is struggling to hire talent, recently increasing its pay significantly. That’s a bad sign when the company is already diluting shareholders to the tune of $15 billion annually. We expect these combined effects to compress margins, hurting the company’s ability to continue rewarding shareholders.

Be the first to comment