Justin Sullivan

PayPal Holdings, Inc. (NASDAQ:PYPL) is doomed to fall back into a down channel, in my opinion, due to a slew of factors such as growing bearish sentiment, a break of an important technical support level, increased guidance risk for 4Q-22, and slowing net new active account growth.

PayPal has also increased the risk associated with its sales growth in the face of a broader economic slowdown and high inflation, which will be a headwind to transaction growth in 2022 and 2023.

Since PayPal set new lows in July and business conditions aren’t improving, I believe the stock is about to test those levels.

In my opinion, the risk/reward relationship here is not appealing, and I believe PayPal could fall to $50, which is in line with my fair value estimate.

Net New Active Account Growth

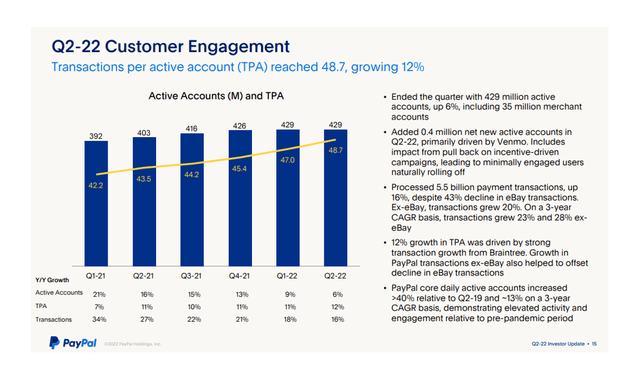

The most fundamental issue that PayPal is dealing with is the slowing of net new active account growth in 2022. Part of the reason for the slowdown in account growth is that PayPal has cleaned up its books and deleted a large number of ghost accounts.

Furthermore, due to economic headwinds, PayPal’s net new active account growth is slowing, with inflation cited as a top concern for financial companies, including Fintechs.

PayPal increased its total accounts to 429 million in 2Q-22, but the company abandoned its original account growth target due to industry headwinds. PayPal now expects to add only 10 million accounts, down from a previous forecast of 15-20 million.

Q2-22 Customer Engagement (PayPal Holdings)

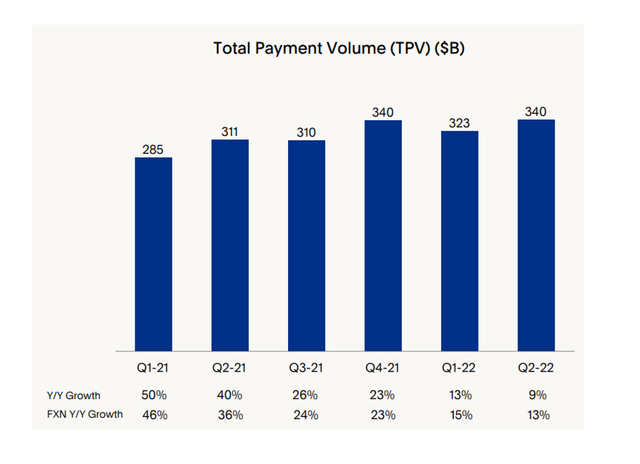

PayPal’s weak net new active account guidance corresponds to a slowdown in total payment volume (TPV). PayPal’s total payment volumes were $340 billion in 2Q-22, but growth slowed from 40% in 2Q-21 to 9% in 2Q-22 due to the Covid-19 pandemic. It is not unreasonable to assume that PayPal’s total payment volume slowed further in 3Q-22, implying increased guidance risks.

Total Payment Volume (PayPal Holdings)

Will PayPal Lower Its Guidance Again?

This is, of course, a speculative call, but I believe the odds favor a third-quarter guidance revision, especially if PayPal’s total payment volume continued to decline in 3Q-22.

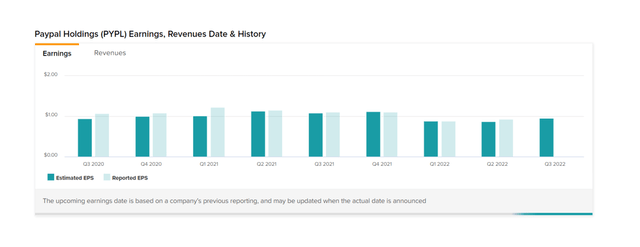

PayPal anticipates earnings of $3.87-$3.97 per share in 2022, up from $3.81-$3.93 per share previously. However, PayPal’s growth driver is largely outside of the company’s control, and deteriorating GDP resilience may result in lower net new active account and earnings guidance for 2022.

Earnings are expected to be $0.96 per share in 3Q-22, a 14% decrease from the previous year. A significant earnings miss, in my opinion, would be a negative stock event for PayPal.

Earnings And Revenues (PayPal Holdings)

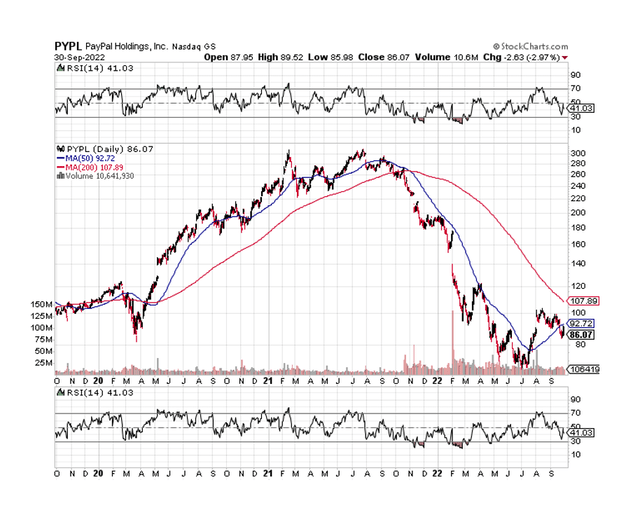

No Hope Of A Technical Relief Rallye: Technical Analysis

PayPal dropped to a 52-week and multi-year low of $67.58 in June before rebounding in line with the broader market in July and August. The recent stock market downturn has weighed on PayPal’s stock, which is now down approximately 54% in 2022.

Based on the Relative Strength Index the Fintech’s stock is not oversold. However, PYPL has recently fallen below the 50-day moving average, indicating a short-term sell signal and further decline in the stock price of PayPal. Even though the stock is not oversold, a drop below the 50-day moving average creates a negative chart picture for PYPL.

Given the weak economic backdrop and exorbitant inflation, I believe PayPal stock will at the very least test its June lows and expand its short-term down channel.

PayPal’s Valuation

In terms of valuation, I believe PayPal is worth around $50, and my estimate has not changed since my last update.

Why PayPal Might See A Higher Valuation

PayPal does have one thing going for it that could change the sentiment going forward. The Fintech company announced in August that Elliot Management made an investment in PayPal during the third quarter, which caused some excitement at the time. The investor is advocating for stock buybacks, cost savings, and other measures to boost profitability and stock price.

Elliot Management is an activist hedge fund run by Paul Singer that is known for its no-holds-barred approach to investing. PayPal’s successful turnaround could boost the stock price.

My Conclusion

Despite the fact that PayPal has an investor on board who is pushing for measures to boost the stock price, the company is in an extremely vulnerable position.

PayPal’s guidance for the third quarter may have to be revised down again if economic risks, particularly inflation, continue to weigh on the company’s ability to generate strong transaction and account growth.

Furthermore, I believe PayPal’s technical situation, particularly the recent drop below the 50-day moving average, is cause for concern.

Because PayPal’s guidance contains higher-than-acknowledged risks, I believe the Fintech’s stock will test new lows and fall towards a $50 price target in the near term.

Be the first to comment