Editor’s note: Seeking Alpha is proud to welcome Jonathan Searcy as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

GOLDRAGONFLY/iStock via Getty Images

It is likely that fundamental changes in the demographics of virtually every major economy in the world are making the present round of inflation both more severe and more persistent than central bankers would have us believe. Classic economic thought reasons that if there is too little money in the economy, economic activity is constrained because it is difficult for the participants to raise the money needed to accomplish transactions. And if there is too much money, the surplus has a dilutive effect and causes inflation, but the truth is much more complicated.

Certainly, there is ample evidence that the former is true. The Great Depression is an oft-cited example. But the notion of the dilutive effect of overly loose monetary policy is part of the story, but far from the whole story. From the beginning of 2008 until the middle of 2020, the U.S. Fed increased the money supply (M2) from 51.6% to 90.6% of GDP, and it had very little inflationary effect. Then, all of a sudden starting at around the beginning of 2021, inflation kicked in with a vengeance.

It is likely that the reasons for this lie as much in demographics and changes in human behavior as they do in contemporary economic reasoning. As generations age and enter new phases of their lives they behave differently, and this has an economic consequence. If this is true, the present round of inflation will be much harder to bring under control than a lot of people are thinking, and the implications for effective investing will be much more profound.

Inflation Anchoring and Wage-Price Spirals

In a speech delivered in 2007, Ben Bernanke said that “undoubtedly, the state of inflation expectations greatly influences actual inflation.” Writers during this period seemed to have embraced the notion that inflation, as much as having fundamental causes, was also a self-fulfilling prophecy and that if one could control inflationary expectations, one could control inflation itself. They promulgated the notion that the wage-price spiral of the Great Inflation of the 1970s and 1980s was perpetuated by the expectation that prices would rise and that wages would have to rise to compensate workers for the loss of buying power, and that consequently costs of production would rise and thus prices would rise – and so the vicious circle would perpetuate itself.

In effect, a failure to anchor inflationary expectations could be a source of a self-perpetuating spiral that needed to be nipped in the bud before it took hold. The problem is that when econometric modelers endeavored to wrap all this up in mathematical equations, specifically using vector autoregression (VAR), there were unexplained differences between what was explained by the mathematics and the historical observations. Indeed, when studying a peculiar phenomenon known as the “price puzzle,” in which the tightening of monetary policy transiently provokes inflation, Bishop and Tulip wrote that:

Under a wide range of specifications, higher interest rates are estimated to lead to higher inflation. These results are difficult to explain. We think this raises important questions about the reliability of VARs for the analysis of monetary policy.

No, that’s not a typo. They actually wrote and actually meant that “under a wide range of specifications, higher interest rates are estimated to lead to higher inflation.” Now, it seems to me that the obvious reason is that higher interest rates propagate into prices as a factor of production more quickly than money is redirected from consumption to savings by the attraction of increased interest rates (or the avoidance of them if you’re a borrower). Quite simply, businessmen can incorporate interest cost changes into their prices much more quickly than the wider population can change its spending habits and move from consumption to saving.

The reason I’m raising all this is not so much to discuss the price puzzle, but rather to show that the vector autoregression models widely used by central bankers are simply not up to the task of robustly forecasting future inflation.

The Role of Demographics

In my estimation, the vector autoregression models omit a critical parameter – that human attitudes and behaviors change over time. A youth may spend all his income on entertainment and holidays, a family man on saving for his children’s education and paying off his house, and a middle-aged man on saving for his retirement, whereas a retiree may legitimately spend his savings on consumption and lifestyle, much as in his youth.

In 2021, Juselius and Takáts reported the following:

Demography accounts for a large share of low frequency inflation variation in 22 countries from 1870 to 2016. The dependent population (young and old) is associated with higher, and the working age population with lower inflation.

This might well be the key to understanding the reason why the enormous quantities of money injected into the economies of the world between 2008 and the end of 2020 were not inflationary. Yet somewhere in the middle of the COVID-19 epidemic, something changed and inflation took off.

The Boomers Are Retiring

Between 2008 and 2020 the baby boomers were saving for their retirements. If they received more money, they didn’t spend it – instead, they put it into their retirement savings. This caused significant increases in asset prices, which are observed in the progressive increases in the price of real estate and the price-to-sales ratio of the S&P 500, as shown below. But the effects on consumer price inflation were insignificant.

United States Single Family Home Prices (tradingeconomics.com)![United States Single Family Home Prices [5]](https://static.seekingalpha.com/uploads/2022/9/30/57271156-16645955215328605.png)

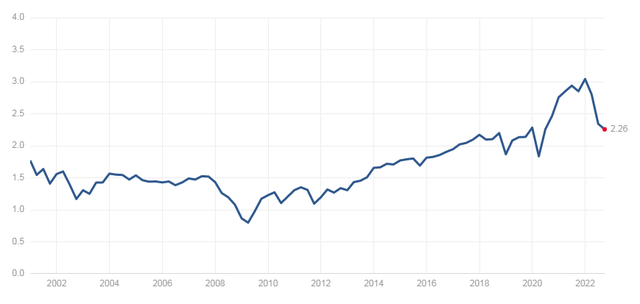

S&P 500 Price to Sales Ratio (www.multpl.com)

In the middle of the COVID-19 epidemic, somewhere between 2020 and 2021, various writers started referring to a phenomenon that would become known as the Great Resignation. The labor force participation rate dropped off dramatically, as shown below. I imagine a lot of boomers – when faced with the implications of restrictions, lockdowns, and potential exposure to a disease that was more deadly to them than to younger people – simply took the opportunity to retire.

United States Labor Force Participation Rate (tradingeconomics.com)

The Effect of Mass Retirement

The effect of the mass retirement was to shift a good proportion of the working age population into the dependent population. As observed by Juselius and Takáts, this was likely to be inflationary.

The mechanism is easy enough to imagine in terms that even the father of economics, Adam Smith, would understand. When the working-age population shrinks, productivity is constrained, the entire supply curve moves to the left, volumes decrease, prices increase – et voilà, inflation. And that’s accompanied, quite likely, by a decrease in gross domestic product, generally known as a recession.

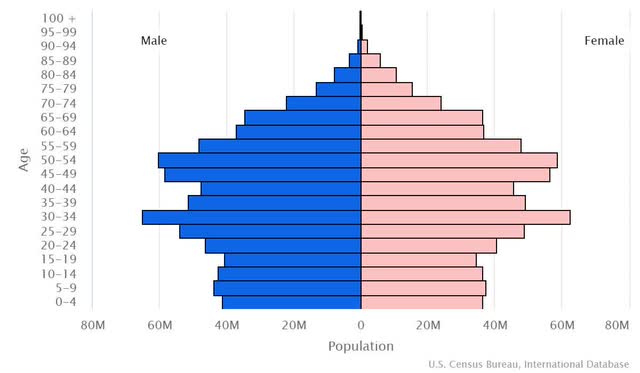

In the present case, the restrictions in supply are compounded by restrictions caused by the war in Ukraine and China’s “zero-COVID” policy – hence the perfect storm. While you might think the U.S. statistics are keeping Jerome Powell up at night, spare a thought for the Chinese. They have to contend with this population profile:

China Age Structure 2020 (United States Census Bureau)

In China, the retirement age is 60, so the 55-59 group is dropping out of the working age segment and the 15-19 group is joining it. That means that between 2020 and 2025, approximately 96 million Chinese are dropping out of the segment and at the same time only 75 million are joining it. That’s a decrease of approximately 26 million people, and as time goes on the problem gets much worse. But just before you walk away with a comfortable feeling that the Chinese situation is someone else’s problem, think again because, as highlighted by Forbes, inflation can be contagious.

The demographic effect is more problematic than the impulses from the Ukraine war and the Chinese zero-COVID policy because it is structural and uncontrollable. The decisions that are causing the demographically induced inflation now were made by mothers and fathers 60-something years ago, and are completely impossible to change.

The Prognosis for Investors

If the fundamental cause of the current round of inflation is a generational shift from saving for retirement to spending in retirement, then it might well take another generational shift before the inflation is brought under control – let’s say a decade, maybe two. Even if the short-term effectiveness of using interest rates to control inflation is questionable, undoubtedly interest rates will rise in order to provide inflation compensation to lenders. As to the magnitude of the rise in interest rates, if the late 70s and early 80s are any guide, we can expect double digits.

Equities will then be faced with having to compete with borrowers for the available capital, and consequently, valuation discount rates will have to increase. The effect of increasing valuation discount rates is diminishing equity valuations. But, at the same time, the generation that retired is liquidating their investments in order to realize the comfortable retirement they saved for. The selling pressure will surely cause the inflated equity prices so repeatedly highlighted by Hussman to deflate back to their new lower values quite rapidly. Regrettably, many retirees will not enjoy as comfortable a retirement as they had hoped for.

Be the first to comment