Justin Sullivan/Getty Images News

PayPal’s (NASDAQ:PYPL) shares are down almost 60% in the last 6 months alone and investors are wondering if this is a good time to buy. While many believe its shares are undervalued at current levels after their recent correction, others feel the stock is poised for a major rally in light of the company’s continued growth. In this article, I’ll attempt to discuss PayPal’s strengths and eventually explain why its shares may not have bottomed out yet. Let’s take a look.

History of Rapid Growth

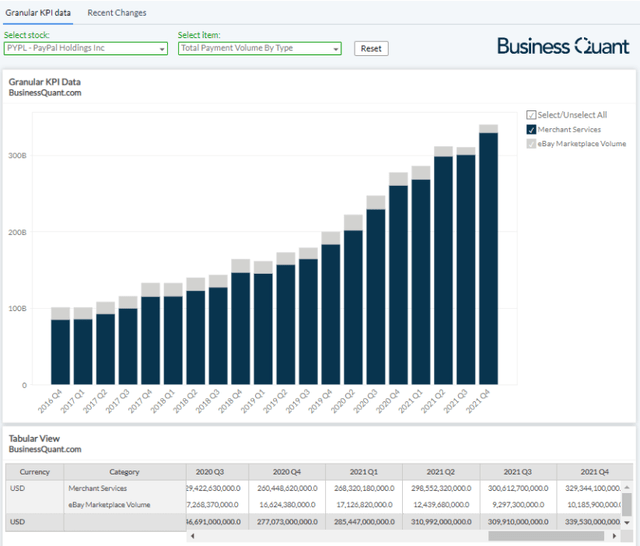

Let me start by giving credit where it’s due. PayPal has been a global force that has disrupted payment processing for more than a decade. It has weathered economic downturns and also the 2008-crash, and still continued on with its growth trajectory. To put things in perspective, PayPal’s total payment volume (or TPV) has created new record highs in 18 of its last 23 quarters. This is a commendable feat and I believe it’s an enviable position to be in.

BusinessQuant.com

For the uninitiated, TPV is the dollar-value of all the transactions that were processed through PayPal’s payment networks, on which the company is likely to generate revenue. It essentially highlights PayPal’s global footprint and how much its payment network is being used.

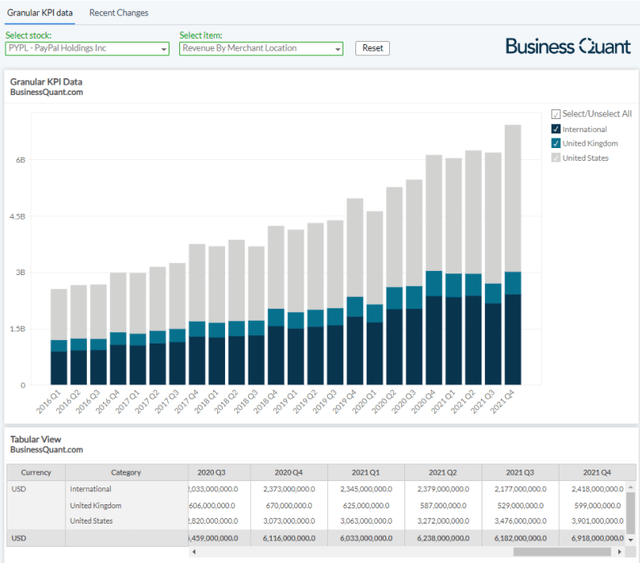

This rapidly growing TPV figure has, in turn, bolstered PayPal’s revenue both, domestically and internationally. This goes to show that PayPal is a commercial hit and an arguably indispensable payment processor across the globe. Considering how consistently the company continues to grow, in and around the US, it’s understandable why many investors want to invest in this growth stock.

BusinessQuant.com

But PayPal isn’t exactly a flawless investment opportunity. It has broadly two issues that are stymying its stock price, which should encourage its investors to rethink their investment thesis in the FinTech firm.

Growth Deceleration

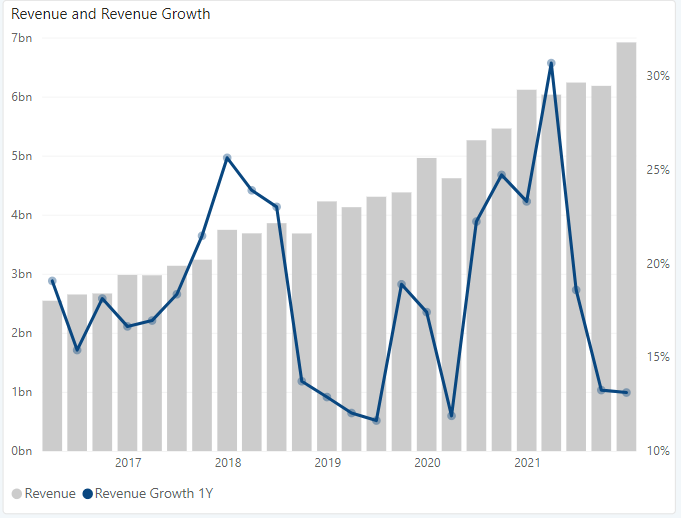

The first concern surrounding PayPal, is that its revenue growth is slowing down. This isn’t necessarily due to misdoings on the company’s part, but rather due to a mix of macroeconomic and competitive pressures.

For starters, digital payments companies benefited immensely with the onset of COVID-19 pandemic in 2020. There were travel restrictions and curfews imposed across major markets, and consumers like ourselves took precautionary measures by ordering things online, often times making use of PayPal’s payments network.

But as we move past the aftereffects of COVID-19 and return to normalcy, we’re looking at a drop in online ordering, possibly down to pre-pandemic levels. This means that payment processing companies such as PayPal, that benefited from disruptions caused by the pandemic, are likely to see a de-growth in their total payment volume in coming quarters.

PayPal’s management actually disclosed this very risk factor in their last 10K filing (emphasis is mine):

The spread of COVID-19 has also accelerated the shift from in-store shopping and traditional in-store payment methods (e.g., cash) towards e-commerce and digital payments and resulted in increased customer demand for safer payment and delivery solutions (e.g., contactless payment methods, buy online and pick up in store) and significant increases in online spending in certain verticals that have historically had a strong in-store presence. On balance, our business has benefited from these behavioral shifts. To the extent that consumers revert to pre-COVID-19 behaviors as the pandemic-related restrictions lessen, our business, financial condition, and results of operations would be adversely impacted.

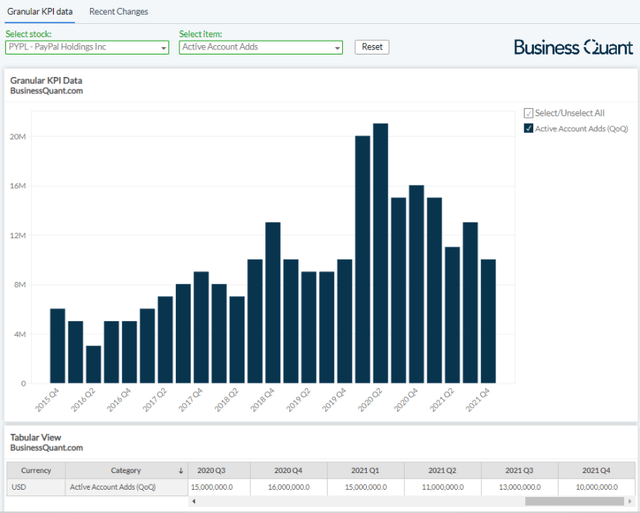

Hopeful bulls might think that the company’s rapidly growing accounts will make up for the macroeconomic headwinds. However, the issue here is that PayPal’s account additions have been decelerating continuously for the past many quarters.

BusinessQuant.com

This is a concerning development for PayPal and its shareholders, as it suggests that the company:

- Is unable to attract new customers with relative ease, which could be due to intensifying competitive pressures,

- Will be relegated to growing its average revenue per user in order to make up for slowing down account adds,

- Is unlikely to offset the headwinds caused by easing of COVID-19 restrictions across the globe

The aftereffects of these developments are manifesting in the form of deteriorating revenue outlook for the company. PayPal’s management has lowered its initial FY22 revenue guidance of 18%, down to as low as 15%. For a company that’s termed as a growth stock, the prospect of decelerating revenue growth can be punishing on the Street.

BusinessQuant.com

Unfortunately, nobody knows for sure if and when the company will come out of its growth slump. Maybe these subdued levels of growth are the new normal for PayPal, in light of stifling competition from companies like SoFi Technologies. Or maybe PayPal engages in strategic M&A activity, releases more payment products and/or ramps up its marketing spend in order to bolster its growth in subsequent quarters. Besides, the company’s CFO resigned this week, so that further puts a question mark on the timeline and pace of the company’s recovery. The point that I’m trying to make here is that PayPal’s growth prospects are mired with uncertainty at the current juncture and yet, as we’ll see in the next section of this article, its shares continue to trade at a steep premium compared to industry peers.

Lofty Valuation

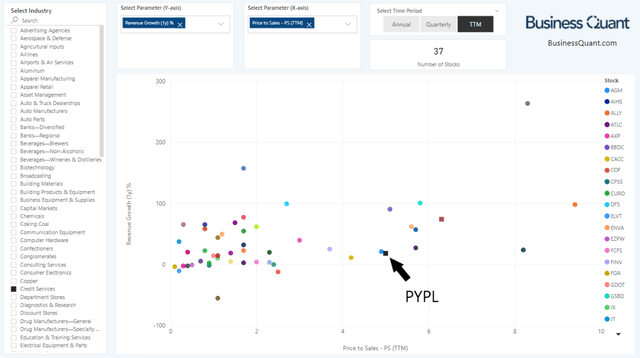

Let’s look at the chart below to better understand how PayPal is valued amongst its peers. The Y-axis highlights the revenue growth rates of over 35 US-listed stocks that are classified in the credit services industry. Note how PayPal is vertically positioned right around the middle which indicates that its revenue growth rate is more or less at par with a broad swath of its peers.

BusinessQuant.com

Now, let’s shift attention to the X-axis which plots the Price-to-Sales (or P/S) multiples for the same set of stocks. Note how PayPal is positioned towards the right-side of the plot. Most of its peers are horizontally positioned towards its left. This indicates that PayPal is trading at a significantly higher P/S multiple even though its revenue growth rate is, at best, mediocre. There are at least 12 other stocks within the credit services industry, that are growing faster than PayPal but trading at much lower P/S multiples.

This should encourage readers and investors to ask – why invest in PayPal over other rapidly growing companies that are also relatively undervalued?

Final Thoughts

PayPal has been a fantastic payments facilitator over the past decade. It’s functional, international and intuitive. However, that doesn’t necessarily make PayPal, as a company, a great investment in today’s time.

The company is experiencing a deceleration in growth and its shares are trading at a steep premium compared to its peers. This suggests that PayPal’s shares have limited upside potential and ample downside potential from current levels. Therefore, I believe that risk-averse investors should avoid the stock for the time being at least. Contrarian investors, on the other hand, may want to wait a little longer for PayPal’s shares to decline further, before initiating any new long positions. The stock may seem undervalued at the first glance but it really isn’t. Good Luck!

Be the first to comment