dabldy

Summary

Gol Linhas Aéreas Inteligentes S.A. (NYSE:GOL) could see EBITDA more than double in 2023 as its traffic revenue (RPK) fully recuperated from pandemic on the return of corporate travel. This should lead to higher aircraft utilization, positive cash generation and an upgrade in its debt rating that would start a virtuoso cycle to positive earnings and valuation. Gol is still a long shot with plenty of risks but with key triggers in 2023 that provide substantial upside into 2024.

Back from the pandemic

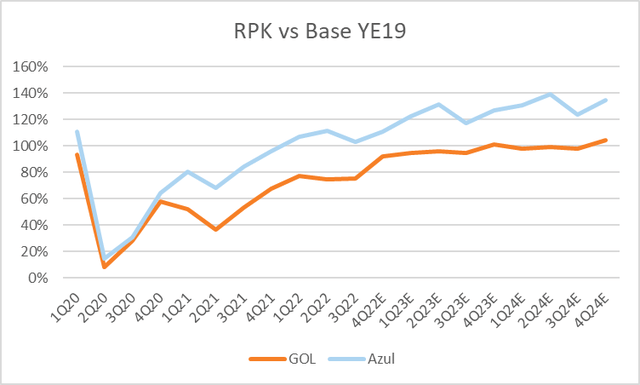

Brazil has a 60%/40% corporate /leisure passenger mix, with business far less price sensitive than tourist. While both were hurt by the pandemic, leisure recuperated faster, as has been seen in the rest of the world. Thus GOL’s RPK is still climbing to pre pandemic levels and should grow by 20% in 2023.

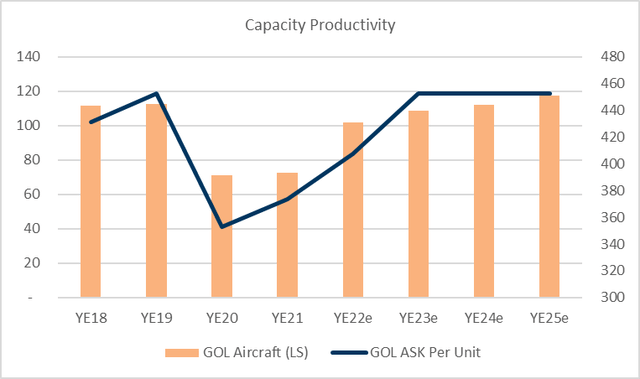

This has clear scale, productivity and margin gains as highlighted in the 3Q22 earnings call. The company expects to reach full aircraft utilization (12hrs a day) by 4Q22 which reduces fixed costs and generates healthy EBITDA margin which could reach the 20% level.

During the next few years Gol will transition from the BA 737 Neo to the 737 Max that are 15% more fuel efficient and should boost structural margins on lower operating costs. This fleet upgrade will be financed via leases at somewhat lower rates.

RPK recuperating to base 2019 (Created by author with data from Gol and Azul) Aircraft Capacity vs Feet Recuperation (Created by author with data from GOL)

Fuel and BRL are key variables

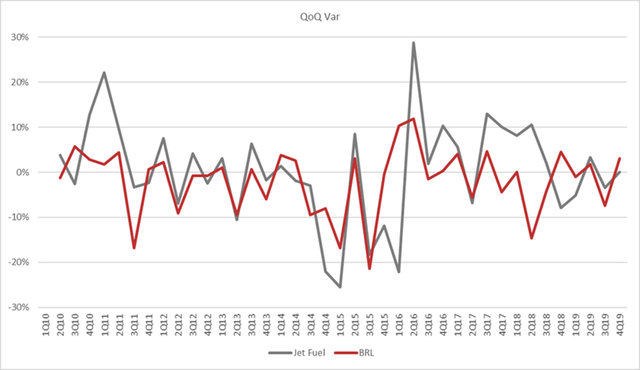

Jet fuel volatility is not always easy to pass on to airfare (yields) and can be exasperated by the volatility of the Brazilian Real since jet fuel is priced in USD. Gol has hedged about 25% of its fuel needs 12 months out that provided some cushion but any oil and or BRL spike will cut into margins. The opposite is also very true.

Brazil Real and Jet Fuel Volatility (Created by author with data from Capital IQ)

Debt and leverage

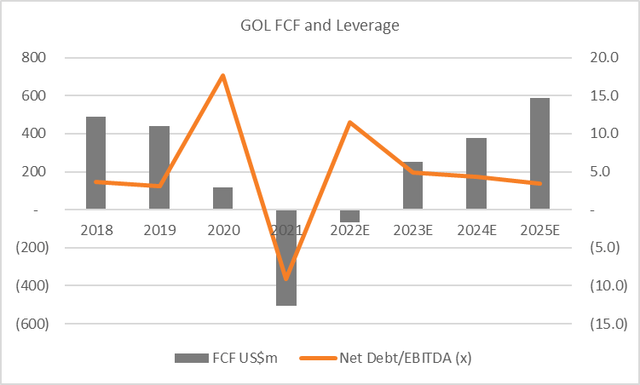

GOL, has a junk debt rating from Moody’s, S&P and Fitch, which impacts the cost of debt and leases. If the operating scenario evolves as expected, GOL should improve cash flow and liquidity that would lead to an upgrade in its debt rating and help reduce financials cost that in turn drives valuation.

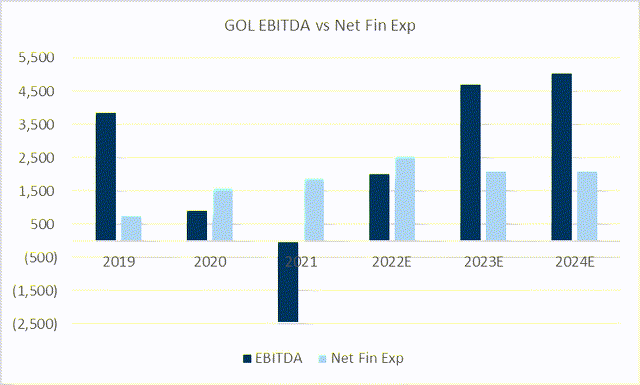

Free Cash Flow and ND/EBITDA (Created by author with data from GOL) EBITDA vs Net Fin Exp (Created by author with data from GOL)

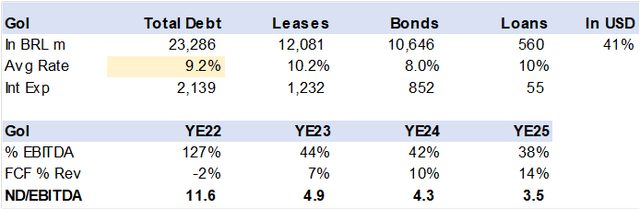

Gol has nearly R$24bn in debt of which half are aircraft leases with an average 10.2% annual cost. The next debt maturity is in July 2024 that the company will need to roll over. This is a US$350m convertible bond with a strike price of around R$37 deep out of the money.

GOL Debt Structure (Created by author with data from Capital IQ)

Smiles

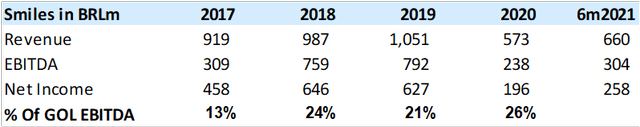

Gol bought back the minority stake in its fidelity program, called Smiles, in 2021 that is highly profitable and should provide annual savings of R$400m on synergies and lower taxes. The fidelity programs at most major airlines are solid cash generators as banks buy frequent flyer miles to then reward credit card customers. These pre-paid RPKs are priced to earn over 50% while expired miles (breakage) are 100% margin.

Smile Summary Financials (Created by author with data from Capital IQ)

ABRA Wild Card

ABRA is a holding company set up by the controlling shareholders of Gol and Avianca that are in the process of getting regulatory approval to form a JV alliance while maintaining brands and management separately, much as in the case with IAG, British & Iberia alliance or the Air France/KLM alliance. Designed to better manage capacity and avoid price wars, i.e, “excessive competition”. This event could improve Gol’s financing structure given certain cash injection commitments by ABRA shareholder. The risk is that this comes in the form of a capital increase which can dilute valuation short term.

Valuation

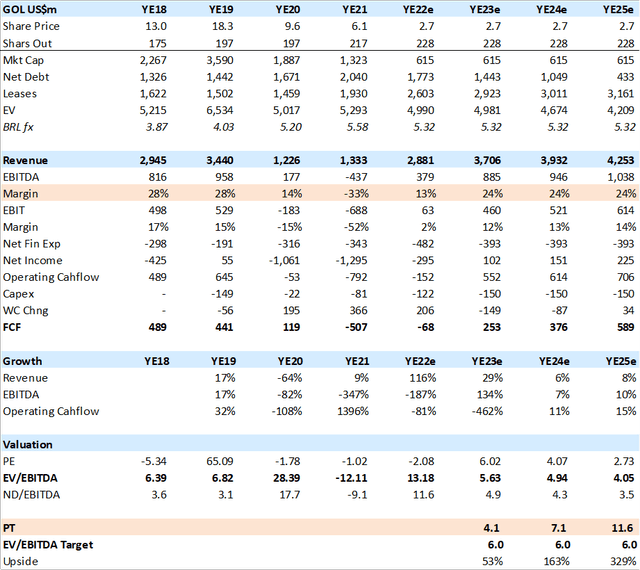

I value GOL at 6x EV/EBITDA, in line with historical range that factors in emerging market risks. A combination of higher EBITDA and the beginning of deleveraging drives a very substantial share price recuperation.

GOL Valuation and Financial Estimates (Created by author with data from GOL)

Conclusion

Gol Airlines could fully recuperate from the pandemic in 2023 with EBITDA more than doubling that in turn starts a virtuoso cycle of positive cash flow and de-leveraging that further feeds into valuations.

Be the first to comment