JacobH

Energy Fuels Inc. (NYSE:UUUU) is a US-based producer and processor of uranium as well as vanadium and a variety of rare earth elements (“REE”). The company currently doesn’t produce uranium at any of its properties, but up until a few years ago the miner was one of the top two producers of the actinide in the US. The prolonged bear market in the sector forced the company into making significant production cuts; moving several properties out of production and into care and maintenance in an effort to ride out the storm.

But, as most readers are probably well aware, geopolitical and economic developments are breathing new life into the nuclear industry, and these changes are almost certain to eventually impact that industry’s main input: uranium. That’s where a company that has a broad portfolio of production-ready, permitted properties becomes truly advantaged. And all of that is before even mentioning that Energy Fuels owns the only uranium and vanadium mill in the country.

Like most of the industry, Energy Fuels was dormant in the last few years, but in recent months the company has begun making moves in preparation of the next up-cycle in the uranium market. In this article, we’ll discuss the measures being taken by Energy Fuels and their longer-term impact on both the company and the stock price.

Backgrounder

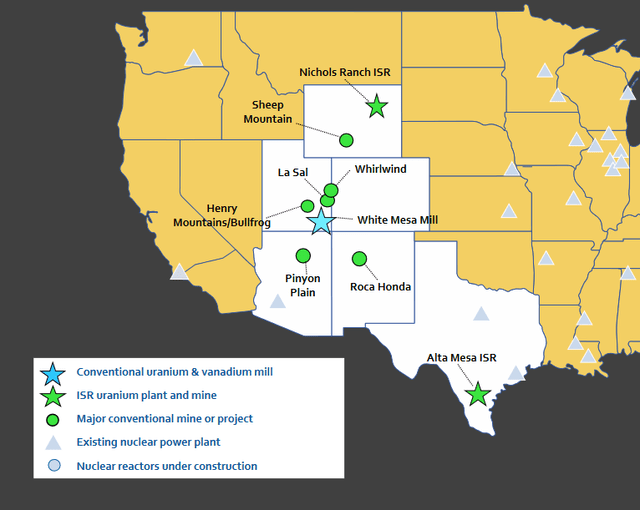

Energy Fuels has about a dozen properties scattered throughout the southwestern United States, the more prominent of which are indicated on the map below. All of these are currently either in development or in care and maintenance, and they are a mix between sites on which either in situ recovery (“ISR”) or conventional mining methods will eventually be used. The total resource size of all of these properties sums to an impressive 81 million pounds (M&I) of U3O8 and 31 million lbs. (M&I) of vanadium.

But the jewel in the crown has to be the White Mesa Mill, located in southeastern Utah. It is the only fully-licensed and operating conventional uranium mill in the country, and has a licensed capacity of over 8 million lbs of uranium per year. It can also process vanadium, REE and the company is exploring the potential for it to recover radioisotopes from its existing process streams for use in the treatment of cancer.

As alluded to in the intro, the mill has been underutilized in recent years, but that may be changing. Energy Fuels has an agreement with The Chemours Company (CC), which runs a nearby mine, to provide it with monazite from which it extracts rare-earth oxides (“REO”). That agreement has been underwhelming as shipment delays have resulted in Energy Fuels receiving only small quantities so far; leading to the production of only 95 tons of REO so far this year. But management expects shipments to increase and anticipates ramping production to between 2,500 to 5,000 metric tons in 12 to 18 months.

All of the material for the company’s sales has come from either inventory or from processing ore bought from third parties, but management is laying the groundwork to change that.

Bahia and Utility Contract

To secure more feedstock for the mill, Energy Fuels purchased mineral sand concessions in the State of Bahia, Brazil totaling approximately 37,300 acres or 58.3 square miles this past May. The company paid $27.5 million and the deal is expected to close at the end of this year or in early 2023. Energy Fuels believes that the Bahia site holds significant quantities of monazite, and could supply the mill for decades. The monazite contains both rare earth elements and uranium which will also be recovered when the ore is processed at the White Mesa Mill.

The Company will eventually need this feedstock as it has entered into contracts to supply three US nuclear facilities beginning in 2023 and lasting until 2030. The minimum delivery amount will be 3 million lbs, but that amount could eventually be expanded to a total of 4.2 million pounds.

Energy Fuels intends to use its inventories to fulfill the contracts in the short term. Mark Chalmers, Energy Fuels’ CEO, said during the company’s Q3 call that, “We have significant inventories of uranium already to be able to fill some of these contracts. If you add up all this — the various sources of feed we have, it’s north of 1 million pounds.” This indicates that the company doesn’t have to restart production immediately, but the fact that the contract is triple the company’s inventory level does puts pressure on Energy Fuels to restart production in the not-too-distant future. Luckily for shareholders, management has signaled that it intends to do just that.

Production Restart and The Alta Mesa Deal

During the Q3 call, Chalmers said that the company was, “hiring people to resume large-scale uranium production as soon as next year.” He also discussed how production could be restarted at an existing property where it had previously been suspended in, “Around 12 months or less.”

However, these preparations are part of the reason why the company posted a net loss of $9.3 million in Q3. The balance sheet remains strong with over $88 million in cash and marketable securities as well as $27 million in inventory, but clearly the purchase of Bahia combined with the cost of reopening mines will be a cash drain.

That’s why the sale of Alta Mesa for $120 million earlier this month was a wise move. Selling the property, which Energy Fuels had purchased for about $13.6 million in 2016, will provide funds for all of the various projects without having to dilute existing shareholders by issuing more stock.

Investor Presentation

Downside Risk

The primary risks to this thesis come from two sources with the first being the price of uranium. No one can predict with certainty where prices are going, and if a sharp fall in uranium prices were to occur UUUU’s stock could plummet. The other source of risk comes from the timeline. Long delays in the restart of mothballed properties could result in additional costs and negatively impact the stock.

Takeaway

If Energy Fuels can stick to these timelines, the renewed uranium production that’s secured by these long-term contracts and supported by higher uranium prices could be a big boost for the stock. After being dormant for years, the uranium market is finally beginning to wake up and Energy Fuels appears to be ready to take advantage of this opportunity.

Be the first to comment