Justin Sullivan

In this analysis of PayPal Holdings, Inc. (NASDAQ:PYPL), we analyzed the company following the announcement of Venmo’s acceptance as a payment method on Amazon.

On the Amazon (AMZN) partnership, we analyzed the top digital wallets based on the share of users which we used to estimate the share of payments on Amazon. Moreover, we then determined the payment volume opportunity for Venmo based on Amazon’s GMV. Lastly, we estimated the revenue opportunity for PayPal from the Venmo partnership based on Venmo’s merchant fees.

Venmo To be a Popular Payment Choice on Amazon

According to Amazon, PayPal and Amazon will enable its 90 mln users with the ability to pay with Venmo on Amazon.

We understand our customers want options and flexibility in how they make purchases on Amazon, – Ben Volk, Amazon’s director of global payment acceptance

Compared to PayPal, Venmo was more focused on personal transactions (P2P) but has increased its focus on business transactions too. Moreover, both Venmo and PayPal are similar, but PayPal has a more complex fee structure with higher fees than Venmo.

|

Comparison |

Fees |

Availability |

Global Users (‘mln’) |

US Users (‘mln’) |

|

PayPal |

1.9% to 3.49%+ $0.49 |

More than 200 countries |

426 |

146 |

|

Venmo |

1.9%+$0.10 |

Only in the US |

90 |

90 |

Source: The Balance Money, PayPal, Statista, Venmo, Amazon, Khaveen Investments

We then compared PayPal and Venmo fees, availability and number of users to determine the competitive advantage of each of them. As shown, Venmo has an advantage in terms of transaction fees as it has a base transaction fee of 1.9% whereas PayPal fees are from 1.9% to 3.49% which depends on the PayPal products used. However, PayPal is better in terms of availability as it is available in more than 200 countries whereas the usage of Venmo is only limited in the US. As shown in the table above, PayPal has 426 mln users globally and 197 mln users in the US. According to Forbes, PayPal is a more versatile platform compared to Venmo as it is used for both P2P payments and business transactions whereas Venmo is more focused on P2P payments.

Following this announcement with Amazon, we analyzed the share of payment methods online and calculated the share of digital wallets to determine whether Venmo could become a top payment choice on Amazon.

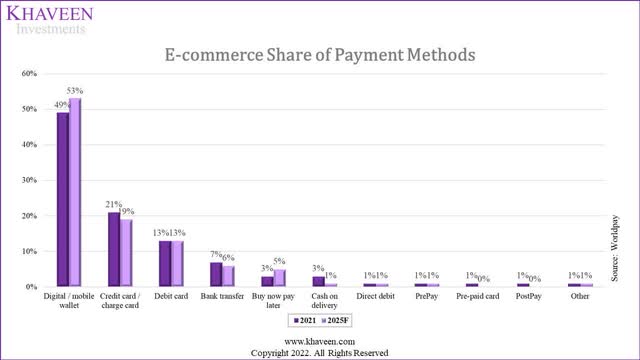

According to World Pay, digital wallets are the most common payment method for e-commerce purchases in 2021. Amazon accepts various payment methods such as pre-paid cards, credit cards, debit cards and digital wallets.

As shown, based on Worldpay, the digital wallet share of online purchases is expected to increase from 49% in 2021 to 53% in 2025 driven by factors such as the growth of e-commerce and the emergence of super-apps.

|

Company |

Global Users (‘mln’) |

Share of Total Users % |

|

PayPal |

426 |

12.53% |

|

Venmo |

90 |

2.65% |

|

Cash App (SQ) |

44 |

1.29% |

|

Apple Pay (AAPL) |

507 |

14.91% |

|

Google Pay (GOOG) |

150 |

4.41% |

|

Wise (OTCPK:WPLCF) |

13 |

0.38% |

|

WeChat Pay (OTCPK:TCEHY) |

800 |

23.53% |

|

AliPay (BABA) |

1,300 |

38.24% |

|

GrabPay (GRAB) |

25 |

0.74% |

|

Orange Money |

45 |

1.32% |

|

MTN Mobile Money |

46 |

1.35% |

|

Total Digital Wallet Users |

3,400 |

Source: Telemedia Online, Business of Apps, Statista, Earth Web, Wise, Startup Bonsai, Merchant Machine, The Fintech Times, Remitly, Khaveen Investments

Based on Telemedia Online, there are 3,400 mln digital wallet users in 2022. We then calculated the share of digital wallets for each company. Based on the table, the digital wallet with the highest number of users is AliPay with a share of 38.24% followed by WeChat Pay with a 23.53% share. Venmo has the 6th largest % with a share of 2.65%.

We believe that Venmo could benefit from the partnership with Amazon to allow it as a payment method based on Venmo’s share of digital wallets which is 2.65% and the expectations that the use of digital wallets will increase in the year 2025.

Amazon Partnership to Contribute to Venmo Payment Volumes

We expect the partnership to benefit Venmo in terms of increased payment volumes as customers on Amazon pay with Venmo.

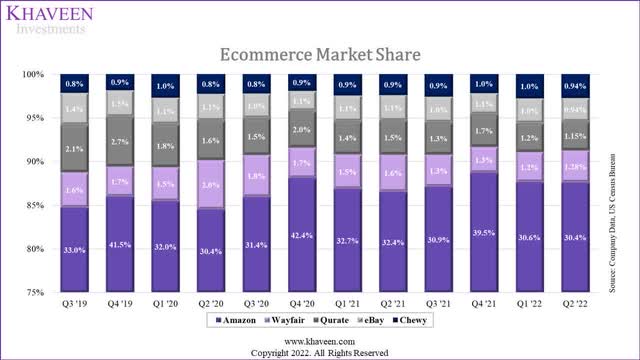

US Census Bureau, Company Data, Khaveen Investments

Based on our previous analysis of eBay (EBAY), we updated our market share of US e-commerce companies where Amazon is the market leader with a 30.4% share as of Q2 2022, highlighting the significance of Amazon.

We estimated the potential payment volume contribution from the Amazon partnership to Venmo based on our estimated share of payments on Amazon and Amazon’s GMV in 2021. Previously, we forecasted Amazon’s GMV growth (1P and 3P) through 2025 in the table below. To estimate the payment volume contribution of Amazon to Venmo, we multiplied our Amazon total GMV forecast by the share of Venmo users as discussed above.

|

Estimated Venmo Payment Volume Contribution from Amazon |

2021 |

2022F |

2023F |

2024F |

2025F |

|

Amazon 1P GMV |

222.08 |

203.97 |

225.75 |

246.88 |

270.60 |

|

Amazon 3P GMV |

390.00 |

489.00 |

596.00 |

717.00 |

865.00 |

|

Total Amazon GMV ($ bln) (‘a’) |

612.08 |

692.97 |

821.75 |

963.88 |

1,135.60 |

|

Venmo Share of Amazon Users (‘b’) |

0.00% |

0.66% |

1.32% |

1.99% |

2.65% |

|

Payment Volume Contribution ($ mln) (‘c’) |

0.00 |

4,586 |

10,876 |

19,136 |

30,060 |

*c = a x b

Source: Khaveen Investments

Based on the table, we forecasted Venmo’s payment volume contribution from Amazon to increase by $4,586 mln in 2022 and increase to $30,060 mln by 2025.

Revenue Opportunity from Amazon Partnership

According to CNET, “no additional fees are calculated for using Venmo at checkout”. However, Venmo charges merchants who accept Venmo payments a seller transaction fee. Based on Venmo’s website, “the seller transaction fee is a standard rate of 1.9%+$0.10 of the payment”.

We estimated the revenue opportunity for PayPal based on our estimated Venmo payment volume contribution from Amazon with Venmo’s merchant fees.

|

Estimated Venmo Revenue from Amazon |

2021 |

2022F |

2023F |

2024F |

2025F |

|

Venmo Payment Volume ($ mln) (‘a’) |

0 |

4,586 |

10,876 |

19,136 |

30,060 |

|

Venmo Merchant Fees % (‘b’) |

1.90% |

1.90% |

1.90% |

1.90% |

1.90% |

|

Venmo Revenue from Amazon ($ mln) (‘c’) |

0 |

87.13 |

206.65 |

363.58 |

571.14 |

|

Growth % |

137.2% |

75.9% |

57.1% |

*c = a x b

Source: Khaveen Investments

Based on the table, we estimated the Venmo revenue opportunity from Amazon to be $87.13 mln in 2022 and to reach $571.14 mln by 2025.

Risk: Cannibalization

With the introduction of Venmo as a payment option on Amazon, we expect PayPal users could switch to Venmo to pay, which would cannibalize PayPal’s usage. Therefore, we estimated the % of total PayPal users to be cannibalized based on Venmo’s share of Amazon users which we forecasted and PayPal’s share of total Amazon users. We expect that in 2022, 10.95 mln of PayPal Users on Amazon would be cannibalized and increase to 13.48 mln users in 2025. Then, we obtained the payment volume cannibalized based on Amazon’s GMV and PayPal’s share of users that would be cannibalized. We then calculated the PayPal revenue from Amazon that would be cannibalized by multiplying the PayPal merchant fees and the cannibalized payment volume.

|

Cannibalization |

2021 |

2022F |

2023F |

2024F |

2025F |

|

Venmo Share of Amazon Users (‘a’) |

0.00% |

0.66% |

1.32% |

1.99% |

2.65% |

|

Venmo Number of Users (‘mln’) |

0 |

87.4 |

95.3 |

101.8 |

107.6 |

|

PayPal Share of Total Users (‘b’) |

13% |

13% |

13% |

13% |

13% |

|

% of Total PayPal Users Cannibalized (‘c’) |

0% |

0.1% |

0.2% |

0.2% |

0.3% |

|

Cannibalization of PayPal Users (‘mln’) |

0.00 |

10.95 |

11.94 |

12.75 |

13.48 |

|

Amazon GMV ($ bln) (‘d’) |

612.08 |

692.97 |

821.75 |

963.88 |

1,135.60 |

|

Cannibalization PayPal Payment Volume ($ mln) (‘e’) |

0 |

575 |

1,363 |

2,398 |

3,766 |

|

PayPal Merchant Fees % (‘f’) |

2.70% |

2.70% |

2.70% |

2.70% |

2.70% |

|

PayPal Revenue Cannibalized ($ mln) (‘g’) |

0.00 |

15.48 |

36.73 |

64.62 |

101.50 |

*c = a x b

*e = d x c

*g = f x e

Source: Khaveen Investments

Based on the table, we forecasted that $15.48 mln of PayPal revenue from Amazon would be cannibalized in 2022 and increase to $101.50 mln in 2025.

Verdict

To conclude, we expect Venmo to be a popular payment choice on Amazon. We forecasted the Venmo payment volume contribution to Amazon to increase by $4,586 mln in 2022 and increase to $30,060 mln by 2025. Whereas, we estimated the Venmo revenue opportunity from Amazon to be $87.13 mln in 2022 and reach $571.14 mln by 2025.

|

Revenue Projections |

2021 |

2022F |

2023F |

2024F |

2025F |

|

Venmo Revenue Contribution from Amazon ($ mln) (‘a’) |

0.00 |

87.13 |

206.65 |

363.58 |

571.14 |

|

Cannibalized PayPal Revenue ($ mln) (‘b’) |

0.00 |

15.48 |

36.73 |

64.62 |

101.50 |

|

Net Revenue Gain ($ mln) (‘c’) |

0.00 |

71.65 |

169.92 |

298.97 |

469.64 |

*c = a – b

Source: Khaveen Investments

We expect that after accounting for the potential cannibalization of PayPal revenue, Venmo would provide a net revenue gain of $71.65 mln in 2022 and reach $469.64 mln in 2025.

|

Revenue Projections |

2021 |

2022F |

2023F |

2024F |

2025F |

|

Initial Revenue Forecast ($ bln) |

25.13 |

27.91 |

30.95 |

34.28 |

37.94 |

|

Including Net Revenue Gain from Venmo ($ bln) |

25.13 |

27.98 |

31.12 |

34.58 |

38.41 |

|

Revenue Growth |

11.36% |

11.20% |

11.12% |

11.08% |

Source: Khaveen Investments

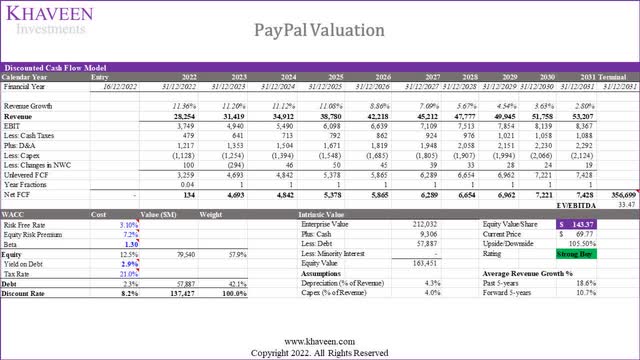

We then valued the company based on a DCF analysis by adding our estimated net revenue gain from the Venmo-Amazon partnership to our previous revenue forecast and with other assumptions from our previous analysis. Overall, we continue to rate the company as a Strong Buy with a price target of $143.37 with an upside of 105.5%.

Be the first to comment