Scott Olson

Summary

Last year, I wrote an article on Krispy Kreme (NASDAQ:DNUT), outlining some risks I believed did not justify its $4.3 billion valuation at the time. Since then, shares have fallen more than 20% as slowing revenue growth and softer than expected earnings guidance have plagued the well-known doughnut maker. The company recently reported its Q2 earnings on August 17th, missing analyst expectations on both the top and bottom line while also cutting guidance for the rest of 2022. Shares fell considerably after the news, and many investors may now feel uncertain about the company’s future growth prospects.

Despite the nearly 30% decline since its IPO in July 2021, I believe Krispy Kreme still has more room to fall due to its high enterprise value of $3.4 billion. Since the company remains unprofitable on a GAAP basis, analysts use other financial metrics such as EBITDA to try and estimate a fair valuation. My target price of $10/share is based on a few factors, including average EV/EBITDA multiples of other restaurant stocks in the industry, revenue growth rates, and future P/E. When using an average EV/EBITDA multiple for the restaurant industry of 15x and the 2022 EBITDA high-end guidance of ~$195 million, Krispy Kreme’s stock price would trade closer to $10/share. Also, when considering the fully diluted ~170 million shares outstanding (167.4 million as of June 2022 and growing), Krispy Kreme’s net income will need to improve its roughly flat/negative GAAP earnings to nearly $85 million in order hit $0.50 of earnings per share. This means at 20x earnings, which is in line with historical S&P 500 averages, the company could be fairly valued at $10/share.

Q2 Earnings Update

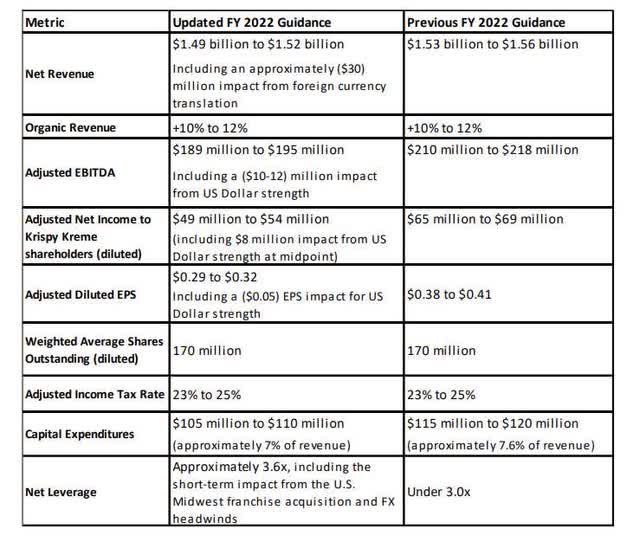

Krispy Kreme missed Q2 revenue estimates, reporting $375 million vs. $385 million consensus. It also missed on its EBITDA margins, which was attributed to a few reasons, including foreign exchange headwinds and higher costs. Additionally, the latest investor presentation found here provides a detailed update on Krispy Kreme’s guidance for the remainder of 2022 (Slide 9).

Figure 1: Krispy Kreme Guidance August vs. May

As you can see, management reduced its net income guidance by $15 million, or a 23% decline. This caused a significant reduction in its adjusted fully diluted EPS estimates, declining from $0.38-$0.41 to $0.29-$0.32, or a 28% decline. While organic revenue growth is still expected to be in the +10% to 12% range, foreign currency translation poses a threat. And although these adjusted EPS estimates appear positive on paper, I believe there are real costs that should be taken into consideration now. Figure 2 shows a more detailed overview of how Krispy Kreme reconciles its net income to achieve its adjusted EPS:

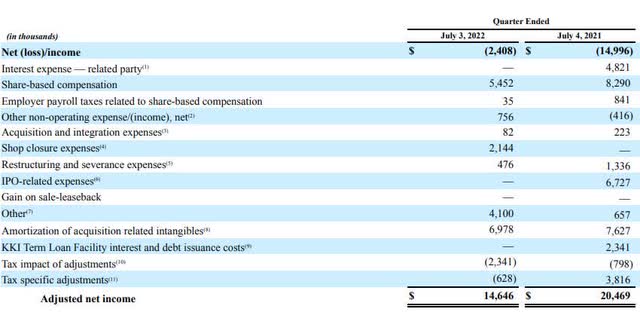

Figure 2: Krispy Kreme Adjusted Quarterly Earnings

On a GAAP basis, Krispy Kreme’s profitability is still negative. Costs related to shop closures (since the company is moving away from a point of sale system), share-based compensation, and amortization of intangibles have a meaningful impact on the profitability of a company, and I don’t think it’s necessarily best to exclude it when valuing a company today. The “other” line item consists of what is described as “legal expenses incurred outside the ordinary course of business on matters”. Regardless, Krispy Kreme is still forecasting using this adjusted EPS metric, which was reduced to $0.29-$0.32 for the remainder of the year.

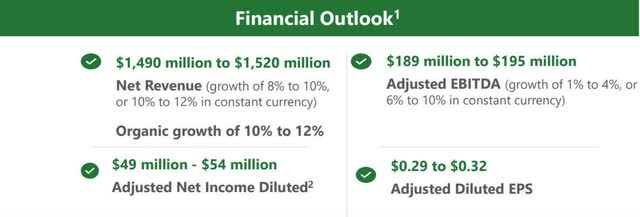

Figure 3: Krispy Kreme 2022 Outlook As Of August

Even when using this adjusted metric and applying historical S&P 500 multiples, it doesn’t justify a $12/share price at its current growth rate. When Krispy Kreme was generating 15-20% growth, an argument could be made that EPS didn’t matter since the company was prioritizing growth over profits for the near term. However, now that it appears net revenue growth may be in the single digits (for now), investors may not be willing to pay the premium to own shares of Krispy Kreme’s stock. In my opinion, this is becoming more of a “show me” story for management, and they need to prove that organic revenue growth can get back to that 15-20% area.

Fundamentals Don’t Justify This Share Price

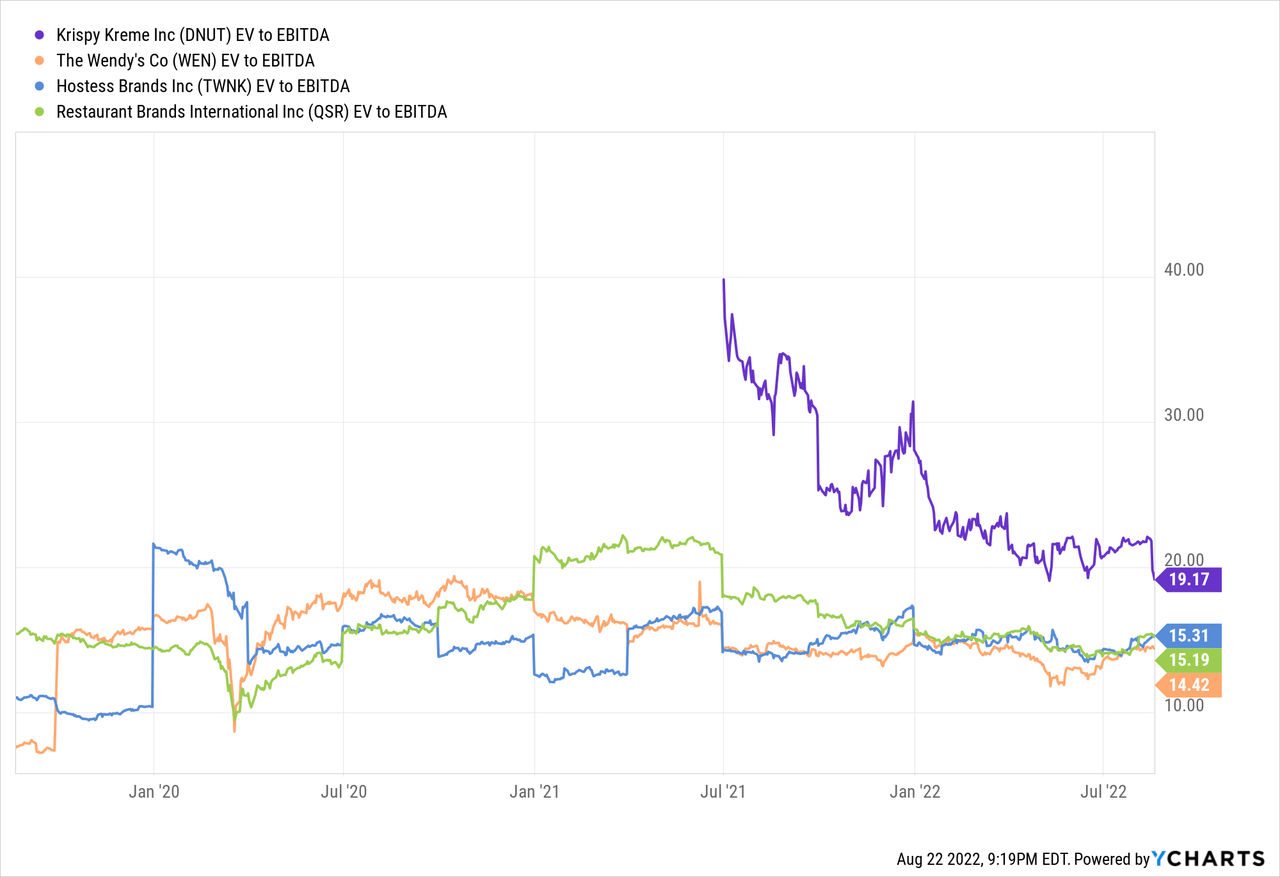

Krispy Kreme falls under the restaurant industry umbrella, where many well-established companies such as Wendy’s (WEN), Hostess Brands (TWNK), and Restaurant Brands (QSR) can be used as reasonable comparables. Figure 4 outlines some EV/EBITDA comparables.

Figure 4: Krispy Kreme EV/EBITDA Comparables

While Krispy Kreme trades closer to 17x post Q2 earnings, it’s still well above other companies that have higher growth rates and better profit margins. Average EV/EBITDA multiples in the restaurant industry typically hover between 10-20x, depending on the company’s profitability and future growth prospects.

Risks To Consider And Conclusion

There are notable risks with betting against a company, especially when it is a crowded trade already. The latest short interest data shows that 13.5% of the public equity float for Krispy Kreme is currently sold short. This is pretty high compared to other companies in the industry such as Wendy’s (3.5%), Restaurant Brands (2.5%), and Hostess Brands (4%). While a “short squeeze” is unlikely at 13.5% short interest, it’s still important to be aware of the potential higher borrowing costs and it being a crowded trade already.

I believe Krispy Kreme still has a lot to prove in order to justify its $3.4 billion valuation currently. Although the company obviously has a strong brand, profit margins are not where they need to be for the long-term, and with growth currently slowing to high single digits now, Wall Street may run out of patience. Management was able to secure a high valuation when they decided to go public in July 2021 as growth was substantially higher in the 15-20% range. Since the company is still not yet consistently profitable, Wall Street analysts continue to use EBITDA valuation metrics, which when looking at industry comps, you can see how Krispy Kreme appears overvalued. Companies like Restaurant Brands and Hostess are cheaper, more profitable, and offer similar growth estimates compared to Krispy Kreme and could be a more suitable investment.

Be the first to comment