Dzmitry Dzemidovich

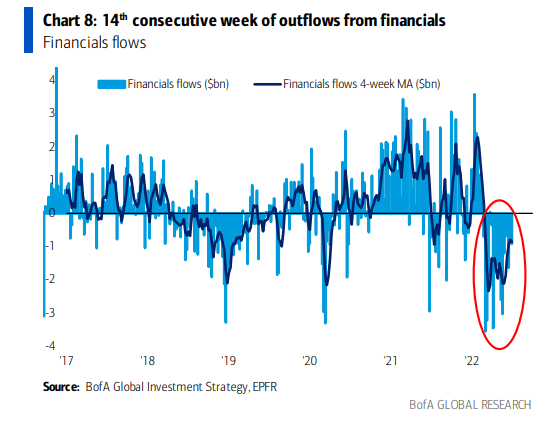

Investors continue to flee Financials. The sector has struggled amid a flat to inverted yield curve this year despite some benefits from higher deposit rates. EPFR data show a staggering 14 straight weeks of outflows from the value-oriented group. One small REIT within the sector has seen its share of struggles lately, but it also pays an extremely high dividend yield.

Investors Jump Ship From Financials

BofA Global Research

According to Bank of America Global Research, New York Mortgage Trust (NASDAQ:NYMT) is an internally managed REIT that invests in residential mortgage loans, Agency RMBS, and multi-family commercial mortgage-backed securities, as well as mezzanine loans and preferred equity investments. NYMT’s objective is to deliver long-term stable distributions to stockholders over a range of economic conditions through a combination of net interest margin and capital gains. The portfolio is actively managed to maintain dividend and book value stability.

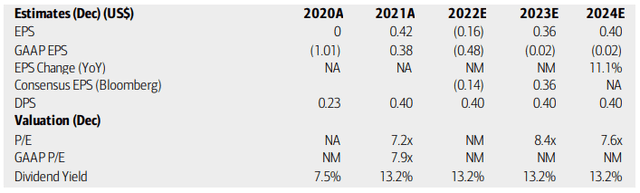

The New York City-based and Nasdaq-listed $1.1 billion market cap Mortgage REIT industry company within the Financials sector has negative earnings over the past 12 months and negative profits are seen in 2022. Its trailing 12-month price-to-book ratio is low at just 0.72. The stock pays a whopping 13.5% dividend yield, according to The Wall Street Journal.

BofA analysts see operating earnings turning positive by 2023 and growing further in 2024. GAAP EPS should still be in the red, though. BofA believes NYMT’s beefy dividend will remain intact over the coming quarters and years. Of course, REITs are required to pay out 90% of profits as dividends.

NYMT Earnings, Dividend, Valuation Forecasts

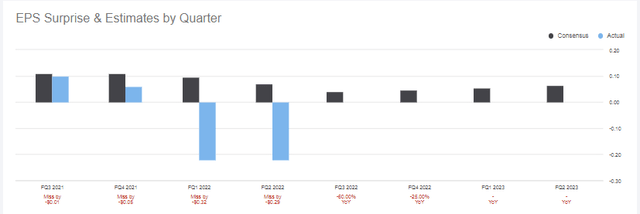

Unfortunately, the company has badly missed on earnings in the previous two quarters. Not surprisingly, NYMT got sliced in half from its mid-2021 peak near $5 to the low this past June at $2.24. The stock managed to recover in the last two months despite the massive earnings miss reported back on August 3.

NYMT Earnings History: Two Big Misses Follow A Pair Of Smaller Misses

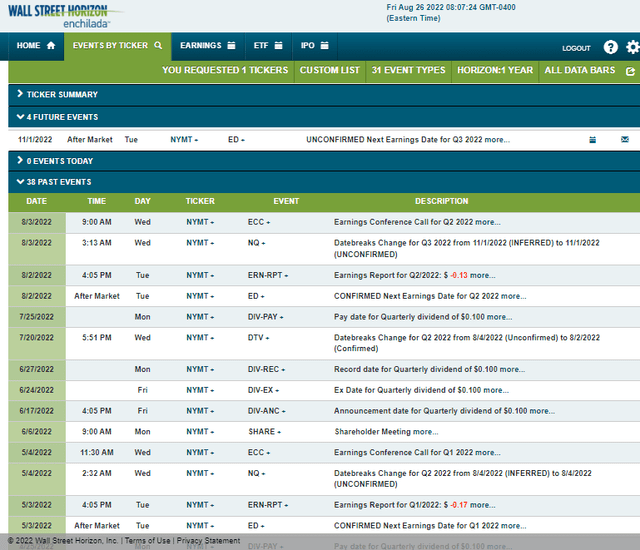

Looking ahead, NYMT’s corporate event calendar is light until the next quarterly report unconfirmed to cross the wires on Tuesday, November 1, AMC, according to Wall Street Horizon.

NYMT Corporate Event Calendar

The Technical Take

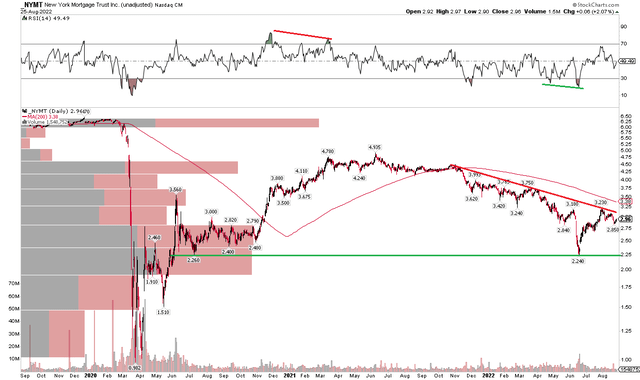

It doesn’t take a CMT to spot the big downtrend off the 2021 zenith. The high of $4.935 notched last year came on a bearish negative RSI divergence, but then this past June’s low occurred with bullish positive momentum divergence. The RSI indicator (top) can help spot momentum changes that take place before price inflects.

Also on the chart is support around that June low, but that is considerably below the current price. Resistance might be seen just above $3 care of a downtrend line off the 2021 peak. Moreover, a negatively-sloped long-term 200-day moving average suggests that the bears are indeed in control.

I also added the ‘volume-by-price’ indicator (left) which helps illustrate where key supply is. The $2 to $2.80 area has seen significant action over the last three years, so that suggests support just below where NYMT settled Thursday. Overall, the technical picture is mixed, but I think I would prefer to wait for a pullback toward $2.50 with a stop under $2.24 before getting long. A breakout move above resistance near $3.10 could help send shares back into the mid-$4s.

NYMT Technicals: Wait For A Good Risk/Reward Opportunity

The Bottom Line

NYMT’s big dividend is attractive and may be sustainable. Unfortunately, negative earnings last year and this year is a fundamental negative feature, but that could reverse in the coming years. I would wait for the stock to pull back into the mid-$2s before getting long, but if the stock breaks out above $3.10, it can be played for momentum.

Be the first to comment