Semiconductor Maker Advanced Micro Systems Reports Quarterly Earnings Justin Sullivan/Getty Images News

Even a mediocre company can deliver good numbers when the wind is on its back, but it takes a special business to outperform under challenging conditions. Advanced Micro Devices, Inc. (NASDAQ:AMD) is delivering very well and obliterating its main competitor, Intel (INTC).

For investors with a long-term horizon and the ability to hold through the short-term economic uncertainty, shares of AMD are trading at a more-than-reasonable valuation when considering the quality of the business and its growth opportunities.

Outstanding Execution

To provide some context to the data, it is worth noting that AMD’s biggest competitor – Intel – reported a 17% year-over-year decline in revenue for Q2. Intel reported that sales from Datacenter and AI Group declined 16% due to “continued adverse market conditions.”

On the other hand, the numbers from AMD confirm that the company is executing at a high level and gaining market share versus its main rival.

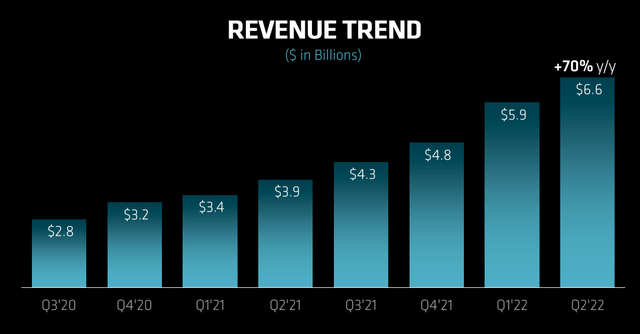

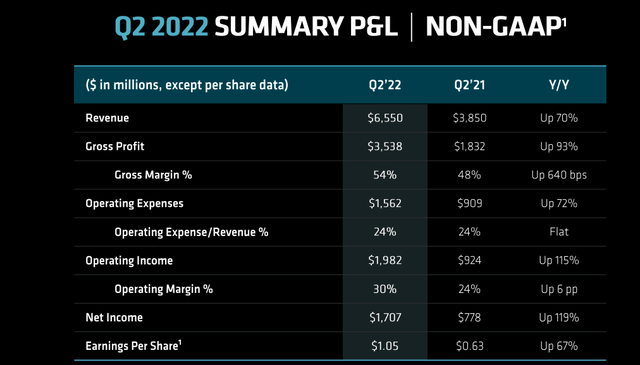

Revenue grew 70% year-over-year to a record $6.6 billion.

For the third quarter, AMD expects revenue of $6.7 billion, plus or minus $200 million. The guidance is a bit below the $6.82 billion forecasted on average by analysts at the time of the report.

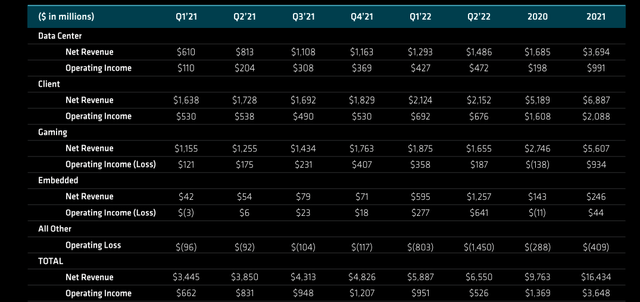

AMD had previously announced a new segment reporting format to begin in Q2. This is more relevant in terms of end markets and strategic initiatives.

- The Data Center segment includes server CPUs, data center GPUs, Pensando, and Xilinx data center products.

- The Client segment includes desktop and notebook PC processors and chipsets.

- The Gaming segment includes discrete graphics processors and semi-custom game console products.

- The Embedded segment includes AMD and Xilinx embedded products.

The company also published historical data based on this new format to make comparisons more informative.

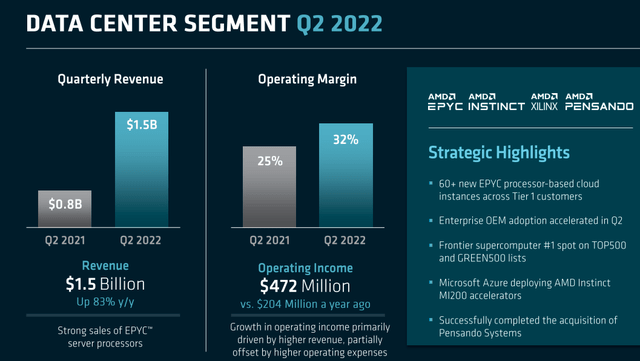

Demand in Data Center grew 83% year-over-year, with an operating margin of 32% of revenue.

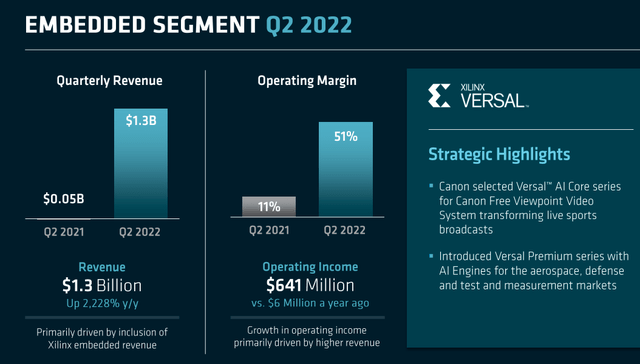

The embedded segment is remarkably profitable, with an operating margin above 50% of revenue.

Management expects the Data Center and Embedded businesses to get to over 50% of the company’s revenue in the future, versus a contribution in the low 40s now.

This trend should be quite favorable to AMD, as it should have a positive impact on both revenue growth and profit margins going forward.

Looking at non-GAAP numbers to leave aside the impact of the acquisitions, Advanced Micro Devices is a widely profitable business at the operating level and at the net income level.

The Details

CEO Lisa Su said in the conference call that a quarter ago they were expecting the PC business to be down in the “high single digits” during Q3, and now they expect that business to be down “in the mid-teens.”

This is arguably the main factor that explains why Q3 guidance is a bit soft versus Wall Street expectations.

Management was asked during the conference call if they think that excess inventories from competitors could put additional pressure on the PC business versus current guidance, and Lisa Su answered that she believes that they are already making conservative assumptions for the PC business (emphasis supplied):

In the current guidance for the full year and the second half, what we’re saying is that we continue to see strong demand in the Data Center, in our Embedded business, as well as in the Console business. And we are being more conservative in our PC outlook. Our PC outlook now at mid-teens would kind of put the market at somewhere around, let’s call it, 290 million to 300 million units. So I do think we’ve appropriately derisked the PC business.

As it relates to inventory, as we look at the current situation, given some of the COVID lockdowns and things in the second quarter. I think there was a bit of buildup in PC inventory, and we’ve taken that into account in the second half. We think the AMD portion of that is modest. And as a result, it will rebalance itself in the second half of the year.

AMD management sounds confident in its chances of delivering above expectations in other areas during the second half of the year. This could arguably compensate for any additional weakness in PCs beyond current expectations:

So overall, I think we feel very good about the second half. And again, with the portfolio that we have, one of the things that has been important is we were still supply constrained in several of the areas. Certainly, on the Embedded side, we were supply constrained in the second quarter. And even on the Server side, we were tight in the second quarter. We have additional supply that’s coming online, especially as we get towards the end of the year. That will help us really meet more of the demand from customers. So we feel pretty good about all of those puts and takes.

The analysts in the conference call had lots of questions about the Data Center segment, especially after seeing the weak numbers from Intel in this business.

Mark Lipacis, from Jefferies, had some very specific questions about the market share gains that AMD made versus Intel during the quarter. The analyst was calculating that AMD gained a record 6.6% versus Intel last quarter, reaching a market share level in the mid-20s for AMD.

The analyst wanted to know if that math made sense or if maybe he was missing something due to larger contributions from the acquisitions.

Lisa Su clarified that the math was “in the right zip code” and that there was no outsized contribution from the Xilinx and Pensando acquisitions:

I think your math is in the zip code from our point of view. And we’re pleased that we’re gaining share. I think that was our expectation was that as the product portfolio expands, as we increase supply, as we ramp more instances across the customer set that we would see share gains. And we will continue to focus on that going forward.

It is very good news to see AMD focused on Artificial Intelligence, as this is a massive opportunity that could allow the company to widely exceed market expectations over the years ahead.

AMD is well behind Nvidia (NVDA) at this point in AI, but the opportunities are huge and there should be enough room for multiple players to do well in this market:

Our largest opportunity is in AI, and we’ve already started executing new hardware and software roadmaps to capture the significant opportunity we see to drive pervasive AI across cloud, edge and endpoints.

Reasonable Valuation

AMD stock is currently trading at around 20.5 times earnings estimates for 2023. This is a significant premium versus other semiconductor names in the market, but it is not excessive at all for such a high-quality business with far-above average growth prospects.

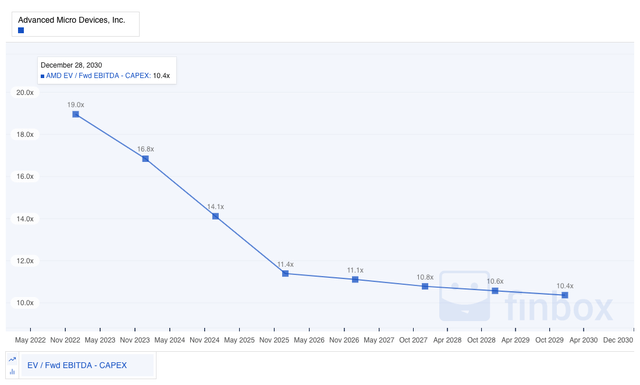

To provide a dynamic perspective, the chart below shows the evolution of the Enterprise Value / EBITDA – Capex ratio to have a proxy for free cash flow generation. If AMD meets growth estimates, the ratio is declining from 19 at the end of this year to 11.4 in December of 2025.

In the paragraph above, the phrase “If AMD meets growth estimates” is crucial. Stock prices reflect market expectations, and valuations are often – not always – roughly in line with current expectations.

The key to finding superior opportunities is investing in companies that can consistently exceed growth expectations over the long term. If the fundamentals outperform expectations, the stock price will typically tend to rise to reflect those improved expectations going forward.

In the short term, there is some downside risk to earnings due to macroeconomic headwinds. The global economy is under huge uncertainty, and there is always a lot of cyclicality in semiconductors.

Over the long term, however, AMD has an impeccable track record of widely exceeding expectations by making the right strategic decisions to expand into the most promising sectors and executing the strategy at a high level.

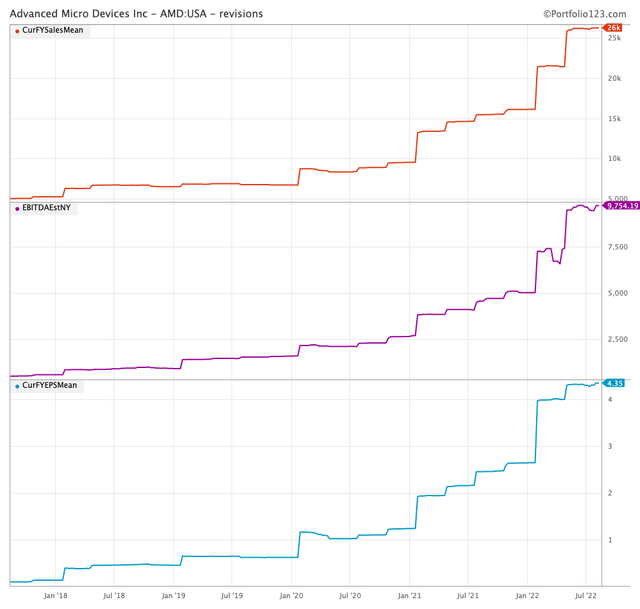

The chart below shows how revenue, EBITDA, and earnings per share estimates for the year 2022 have evolved over the past five years. To be clear, we are not looking at revenue or earnings growth, we are looking at how revenue and earnings estimates for the current year have moved over time.

In August of 2017, Wall Street was expecting AMD to make $5.04 billion in revenue during the year 2022. Now they are estimating $26.25 billion in sales for that same year. Earnings per share estimates have jumped from $0.1 to $4.35 USD.

When looking at this data, it is easy to see how a static valuation can be so limited and shortsighted. If the company can deliver multiple times the current estimate of revenue and earnings, then the stock is far more undervalued than what the valuation ratios are currently indicating.

In the case of AMD, there is some uncertainty about financial performance in the months ahead due to macro factors. Longer term, however, the company has proven to have an exceptional ability to execute at a high level and widely outperform market forecasts.

The Bottom Line

This is not an easy time to invest in semiconductor stocks. Economic risk, industry cyclicality, and geopolitical tensions with China over Taiwan create considerable uncertainty around the sector.

On the other hand, if you have a long-term time horizon, meaning at least 3 years and ideally much more, this short-term uncertainty can be a key source of a long-term opportunity. Economic headwinds come and go, and great companies can remain great for decades if they have the right management team.

Under the leadership of Lisa Su, AMD has one of the best management teams in the sector, as reflected in both qualitative factors and financial performance.

From current price levels, AMD is positioned for attractive returns under conservative assumptions. If the company can continue outperforming expectations going forward, then the upside potential could remarkable.

Be the first to comment