DNY59

I’ve always had a limited attention span but assumed, magically, that once I was older, wiser and more mature, I’d finally be able to focus just like all the other grownups do. Man, what a disappointment! So it actually turns out that at age 52, I have a SHORTER attention span than I did at age 18! Probably must be because my brain is stuffed beyond capacity with wisdom, right?

Hear that sound? It’s the sound of thousands of eyes rolling.

I do have to say, I sometimes wonder what wisdom besides “don’t throw away rubber bands” I would impart to my younger self if I could travel back in time. Do you know where I think I’d start? I would share everything I needed to know, and (more importantly) nothing that I didn’t need to know, about how to become a stock market investor. My golly. If I’d had any clue back then (which I did not) I’d be filthy, rotten, stinking rich today instead of merely “comfortable.” But knowing the very limited gossamer-like threads of my attention span both then and now, I’d be concise as hell.

Ten Minutes To Learn Everything You Need to Become an Investor.

(1) What is a stock?

If you own stock, you own a piece of a business. If a company has 100 shares and you own 1 share then it means you own 1% of the entire business. That means you own 1% of all the company’s assets, earnings and future earnings for as long you own the stock, minus whatever liabilities the company has (like debt or obligations to pay employees or suppliers).

(2) What is a stockholder?

If you own 1% of a company and the company earns $100 per year, then you own $1 of the company’s earnings per year for every year that you own the stock. That $1 is called the “earnings per share.”

But you are about to ask a very smart question. Can you get your hands on that $1 of earnings?

Here is the reason (the only reason) why stock markets exist: “owning” money is not the same as “controlling” money. The stock market exists to make it possible for investors to basically “rent” out their capital to business managers. Stockholders give up control of their capital in exchange for a bet that the managers will use that capital, hopefully grow it, and then ultimately return it to the shareholders with extra profits to compensate the investors for taking the risk. When you buy stock in a company like Apple (AAPL), it is precisely BECAUSE you want to give up control over your capital and rent it out to Tim Cook (the CEO of Apple) and his team because you’re willing to bet that he can grow that capital faster and better than you can.

But like everything else in life, there are limits. As a business owner, you do get to vote on important matters – like who will be on the company’s board of directors (those are the folks who ultimately have control over the company). Day-to-day, the company’s managers are in charge of everything else – but they can be fired and replaced by the board of directors at any time, for any reason, or for no reason at all. And in turn, the board of directors can be fired and replaced by you and all the other shareholders.

(3) How do companies make so much money?

Let’s stick with our example of a company with 100 shareholders and $100 of earnings. What could the company decide to do with that $100 of earnings? Two things, basically. It could distribute all or some of those earnings to shareholders like you. That’s called a “dividend.” Or, the company could reinvest all or some of that $100 back into growing the business. Or the company could do a little of both by paying a dividend with some of that $100 and reinvesting the rest of that $100 back into the business.

For example, imagine a company like Starbucks (SBUX). Starbucks uses some earnings each year to open more restaurants that generate even more earnings in the future. Then Starbucks uses the income from those new restaurants (plus all the other restaurants it owns) to open even MORE restaurants that generate even MORE earnings. And so on. It is like a money virus.

And the whole time, Starbucks pays all the rest of its earnings out to shareholders as a cash dividend.

(4) How do stockholders like you make money?

Shareholders can make money in two ways. To see how, let’s step back and get a broader perspective.

The price for stock is usually some multiple of the company’s earnings per share. Stick with our example of a company with $1 of earnings per share. Some days, the stock price might trade at 15 times the earnings per share – which means the stock trades at about $15 per share. Other days, the multiple might be 14, or 16. This “multiple” changes constantly because when investors are feeling bullish, they’ll pay a higher multiple and when investors are feeling bearish, they’re only willing to pay a lower multiple. That’s why stock prices change all the time throughout the day.

What makes investors feel “bullish” or “bearish?” The answer is that many investors aren’t just thinking about the company’s $1 of earnings per share today. They’re thinking about how much the company MIGHT earn next year and the year after that, and the year after that, etc. And they’re thinking about how RISKY those earnings are. If there is a 50/50 change the company will earn $1, that’s not as valuable to a shareholder as a 100% chance that the company will earn $1. Investors can all have their own ideas about what those chances are, and ideas like that tend to be fickle.

Example: if a stock trades at 15 times earnings most of the time and I start to think that the earnings per share will certainly be $2 next year, I’d probably be willing to buy the stock for $30 per share, right? Well, if I see that stock trading at $15, it looks like a bargain and I’m going to pig out on as many shares as I can. If enough other investors are convinced (like I am) that the company will earn $2 per share next year, then the stock price is going to rip higher to $30 today, even if the company’s earnings per share today are still coming in at just $1 per share.

Here’s the key point to take away from all this. Stock prices today reflect expectations of the future and odds of those expectations coming to fruition, decided upon by thousands or even millions of investors at any given moment of every single day while stock market is open.

But not let’s get back to the question – the only relevant question – which is how do YOU as the shareholder get paid? Simple. You buy the stock today for $15 per share while the company’s earnings per share are $1, then the company grows the business and the earnings per share rise to $2, you keep holding the stock and then one day in the future, the earnings per share rise to $3, and then $5, and then $10. And guess what? Over the very long-term, the stock price will probably rise along with the earnings per share.

Now picture yourself many years after you bought the stock. If the stock trades at 15 times the earnings per share like it did when you bought the stock but the earnings per share are $10, your stock that you bought for $15 is now worth $150 and you just got paid ten times your original investment. That’s one way to get paid, but that’s only part of the story. Remember that the company might also pay you cash dividends every year while you wait.

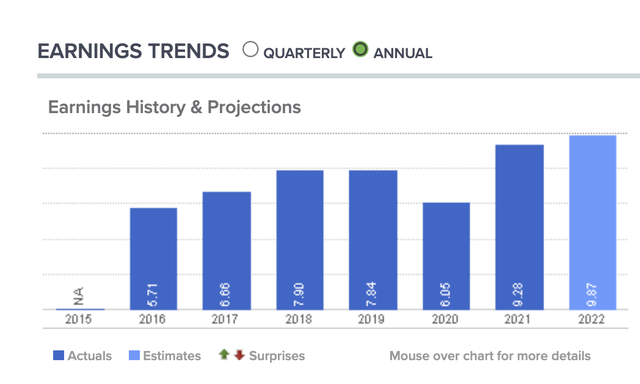

Let’s look at a real world example. Here are McDonald’s (MCD) earnings per share since 2016 according to CNBC.com:

McDonald’s Earnings (CNBC.Com)

And here is the stock price over the same time period.

McDonald’s Stock Price (CNBC.com)

See the pattern? McDonald’s uses earnings to reinvest in the business and grow more earnings, over and over again. When earnings per share rise at least as much as investors expected, stock prices tend to follow. Does it work like that day-to-day? No way. The stock market is complete chaos over the short-term. But over the long-term, yeah, there’s a very close relationship between stock prices and earnings growth.

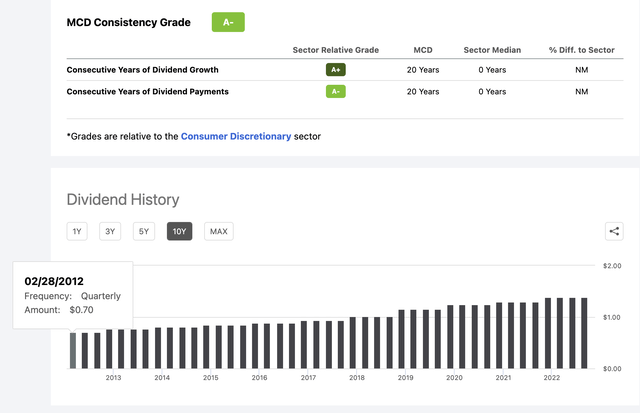

But rising stock prices is only part of the story. Dividends can rise, too. For example, ten years ago McDonald’s paid a dividend of $.70 per share once every three months. But the company’s earnings kept growing and growing and today, McDonald’s pays a dividend of $1.38 per quarter. For shareholders, it’s like getting a raise at work.

McDonald’s dividend history (SeekingAlpha.com)

Now comes the really fun part…..

(5) How do I create a nuclear chain reaction WITH MONEY?

Two simple steps. Step one: use your dividends to buy more shares of stock, which means you get more dividends in the future that you use to buy even more shares. Step two: do this continuously for 20 or 30 years.

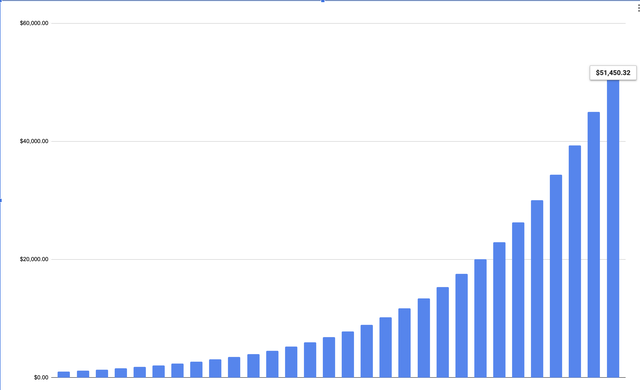

Example: Imagine you start with $1,000 and you buy 10 shares of stock that cost $100 apiece. The stock pays a dividend of $4 per share and every year, the company raises dividends by 10% every year. You are going to use all your dividends to buy more shares over time, but the stock price is going to keep getting more expensive each year as the company keeps growing the dividend which makes the stock more and more valuable. How much will you have at the end of thirty years? Here is chart that shows you the exact answer:

The power of compounding (Google Finance)

The answer is that in thirty years your $1,000 investment would equal $51,450.32!

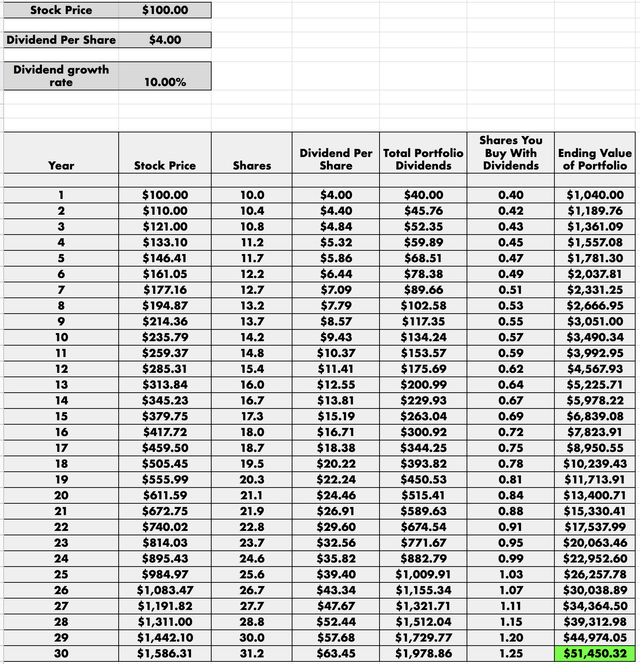

Do you want to see the math behind how this works? Here it is.

Exponential Stock Price Growth (Google Finance)

Do you see how you can grow your wealth exponentially if you just keep using your dividends to buy more and more shares? And maybe you noticed that the longer you play the compounding game, the higher your returns? In this example, you see that it took twenty years to grow your net worth by $12,000 but only ten years to grow your net worth by $50,000. Time is absolutely THE MOST critical component of using the power of compounding to grow your wealth and most of the action happens towards the end. This is why you have such a massive advantage as a stock market investor. You’re young. Use those extra years you have to hypercharge the power of compounding to your financial advantage.

(6) How about a real world example?

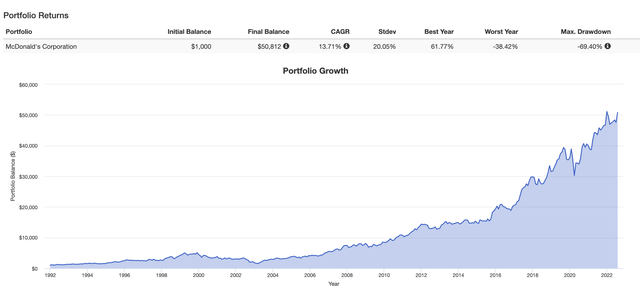

Here’s a real world example of what a $1,000 investment in McDonald’s would look like if you bought the stock 30 years ago and reinvested dividends the whole time. According to Portfoliovisualizer.com, your $1,000 investment in 1992 would be worth $50,812 today. Multiplying your net worth by 50 times is pretty fun.

McDonald’s Portfolio Growth (Portfoliovisualizer.com)

Does this happen every time you buy a stock? Sometimes it does. Other times, the company could go bankrupt and you lose your entire investment. That’s why you always want to DIVERSIFY your investments.

(7) What is diversification and why does it matter?

Diversification means “don’t own stock in just one company or just one industry.” Own stock in at least 20, 50 or even more companies that operate in different parts of the world and in different lines of business. Do that and the whole investing equation tips unfairly in your favor.

Unfairly?

Yes. Here is why. If a company goes bankrupt, the maximum amount you can lose is 100%, but there is no maximum to how much you can EARN if a company does well. Think about it. If you buy ten stocks and just one jumps up by 1,001%, all the other nine can go bankrupt and you’ll STILL make money. Thanks to limited downside and unlimited upside, investing is one game where you can have a really lousy batting average and do quite well if you get it right (or get lucky) just once or twice. And how do you increase your chances of getting it right (or getting lucky) once or twice? Easy. Buy a lot of companies. After all, even a blindfolded drunkard on a pogo stick can probably at least wing the target as long as he’s firing with a shotgun.

Say, did you know that you can instantly create a diversified portfolio with the click of a button? You don’t even have to pick out which individual stocks to buy, either!

(8) What is an “index fund?”

Imagine someone buys 500 stocks in 500 different companies, puts those 500 shares into a basket, and then sells 100 shares of that basket to 100 different investors. If you buy one share of that basket, you indirectly own a fraction of a share of each of the 500 companies in that basket. That means you are diversified. If one or two out of 500 companies go bankrupt, so what? The gains on the other 498 companies will probably more than offset those losses.

What are some popular index funds? The Vanguard S&P 500 Index Fund (VOO) is a good example. There are many, many others like it.

There are just three boxes to check before you buy an index funds. First, you want funds that are super diversified and own every type of company. VOO owns 500 different companies in every industry in America. Second, the fees for the fund should be very low. VOO only charges .03% per year which is low. Third, the fund is “passive” – which means the fund just buys and holds stocks for the long run. You can tell if a fund is “passive” by looking at the “turnover ratio” – which shows what percent of the portfolio the fund buys and sells each year. For VOO, the turnover ratio is 2.3% which is low. If an index fund does not check all three of these boxes, it’s not a fund that I personally would ever invest in – but that’s just me and other investors may disagree.

(9) Why should I plan my retirement years before I even start working?

A wise man named Yogi Berra once said “if you don’t know where you are going, you won’t get there.” I’ll tell you where you’re going. One day, you’ll get to a point where your portfolio pays you enough dividends each year that you can live off portfolio income for the rest of your life without having to dip into your principal. Very shortly thereafter, a day will come when your portfolio dividends are $1 per year more than you need to spend. This day may come and go without you realizing it, but it will technically be the most important day of your entire financial life.

Why? Because that will be the day when the entire investment game will become rigged in your favor. How? The game will be rigged because you shall win if the stock market rises (when it does, your portfolio will be worth more), yet you shall also win if the stock market crashes (because that is when your portfolio income will grow fastest). Check out this example.

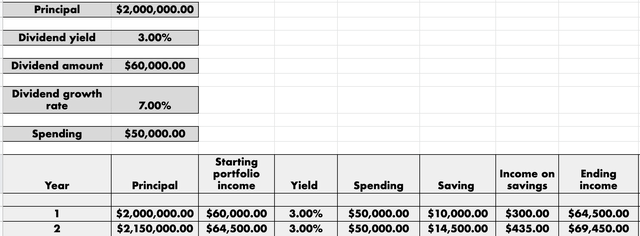

Imagine that after decades of spending less than you earn and investing the savings, your portfolio is now worth $2,000,000. The dividends are $60,000 per year, so the “dividend yield” on your portfolio is 3% (that’s $60,000 divided by $2,000,000). Assume that you need $50,000 to live on, so you can save $10,000 in year one and use that money to buy more shares. Finally, assume that all the companies you own raise their dividends by 7% per year on average. What does your retirement look like?

Retirement Plan (Google Finance)

By the end of year one, you’ve added $300 of dividend income to your portfolio because you saved and invested $10,000 and got a 3% dividend yield on your savings. In addition, your original $60,000 of portfolio income grows by 7%, thanks to the dividend increases your portfolio companies announced during the year. That leaves you with a combined total of $64,500 of dividend income by the end of the year.

By the end of year two, you’ve kept your spending at $50,000 and so your savings have risen to $14,500. Those savings bring in an additional $435 of new dividend income because you invest $14,500 at a 3% dividend yield. Plus, your portfolio of companies also raised their dividends by 7%, so by the end of year two, your portfolio dividend income has risen to $69,450. So far, so good.

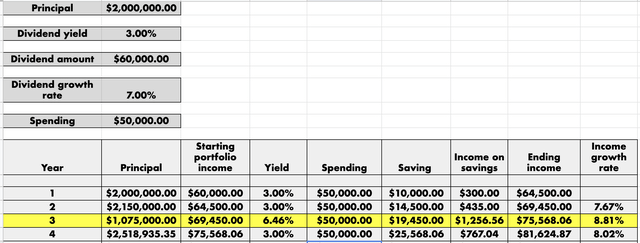

But in year 3 the stock market CRASHES by 50% taking your portfolio principal down with it!

Retirement Plan (Google Finance)

Most investors would panic to see their $2,000,000 portfolio crash to $1,075,000, but not you. Most investors would be tempted to sell their stocks because they are terrified that the stock market might drop even further! But not you. Why don’t you panic? The reason why is because even if the market crashes, your dividends are still $69,450 per year.

Here is where most investors get confused. Dividends are independent of stock prices. Dividends are a piece of a company’s earnings and a company’s earnings don’t drop simply because the stock price drops. Some companies even keep a cushion of cash handy so they can keep paying dividends even IF their earnings drop temporarily.

Now let’s talk about the “dividend yield” again. If a company’s stock price is $100 per share and the company pays $4 of dividends per share, the “dividend yield” is 4%, but if the company’s stock price falls to $50 per share but the company keeps paying $4 per share in dividends, then the dividend yield jumps to 8%.

Back to the example. In year 3 you’re still earning more than you spend and you are able to save $19,450 that you invest into more shares. Since stock prices are 50% lower but dividend payments have not changed, you earn a higher dividend yield on your $19,450 of savings! You can see this clearly if you compare the dividend income on your savings in year 2 ($435) with the dividend income on your savings in year 3 ($1,256). The price of your portfolio might be temporarily lower, but your portfolio dividend income growth is $821 faster than the year before! Unlike most investors, you are not tempted to sell your portfolio when stock prices are dropping. You are desperate to BUY more shares so you can pig out on higher dividend yields and grow your portfolio income faster.

Throughout US history, bear markets never last forever. They usually last longer than most people want and are over before most people realize it. Year 4 in our example and your portfolio has recovered (and then some – remember that you bought a lot more shares when stock prices were low during year 3). And your portfolio dividend income just keeps chugging along higher and higher at an exponential rate. The market goes up, the market goes down, and either way you come out ahead. No, life isn’t fair.

So here is a financial goal you can set for yourself on the very first day you start to save and invest for your future. Get to a point where you get paid at least $1 more while you sleep than you spend while you are awake.

Here’s a little tip to help you along your path. Don’t even look at the value of your portfolio. Instead, only pay attention to the amount of dividend income that your portfolio pays you each year. Make yourself a free copy and then refer back to the spreadsheet to remind you of why stock market crashes help you to reach retirement faster and can also help you during retirement.

(10) Any other tips?

I have seen a lot of people who are smarter than you (and definitely smarter than me) endure various types of personal financial catastrophes. You can avoid or mitigate financial catastrophe by paying heed to four simple rules.

- Don’t develop fancier tastes and spending habits just because you are earning more money.

- If an investment opportunity seems too good to be true, it either isn’t true, or it isn’t good, or most likely BOTH.

- Get comfortable saying “no” when friends ask you for money.

- Pick a romantic partner who shares (or at least complements) your long-term financial vision and values.

Be the first to comment