chaofann/iStock via Getty Images

Intro & Thesis

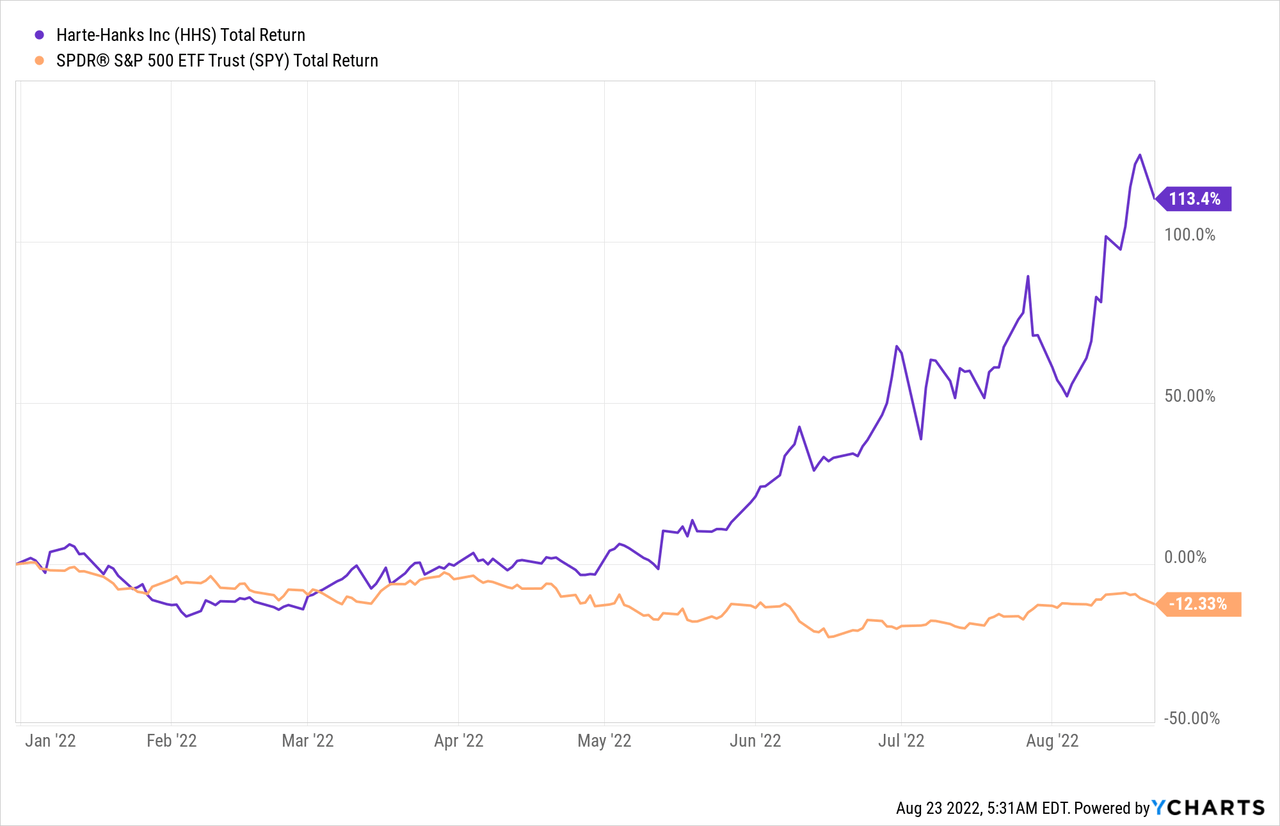

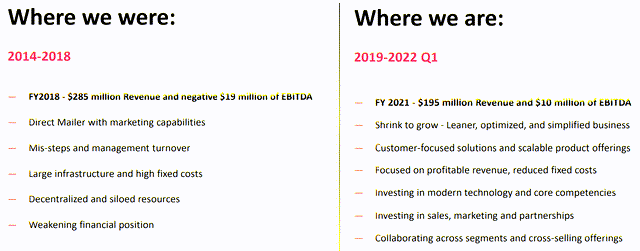

A little over a month ago, I initiated coverage of a small-cap marketing and customer experience company Harte Hanks, Inc. (NASDAQ:HHS) and gave the stock a Strong Buy rating based on its high-quality fundamental profile, growth prospects, and low valuation. In just one month, my thesis has held up quite well, even compared to the July rally in the broader stock market:

Seeking Alpha, my article on HHS [July 14]![Seeking Alpha, my article on HHS [July 14]](https://static.seekingalpha.com/uploads/2022/8/23/49513514-16612464105869834.png)

Since the publication of that article, the company has managed to report and hold an earnings call for analysts and investors. For this reason, I have decided to once again focus my attention and yours on HHS.

Based on my updated analysis, I conclude that HHS, which has risen >50% in just 2 weeks, could face mean-reversion effects in the days ahead – especially if the S&P 500 (SPY) continues to correct below its 200-day moving average. However, if you bought HHS with the desire to hold the stock for the long term, you definitely have nothing to worry about – the valuation is still quite low, the turnaround is progressing, and the key fundamentals have only improved in Q2 2022. Therefore, I reiterate my buy recommendation, although I lower it from “Strong buy” given the high probability of a technical correction on the horizon.

Why Do I Think So?

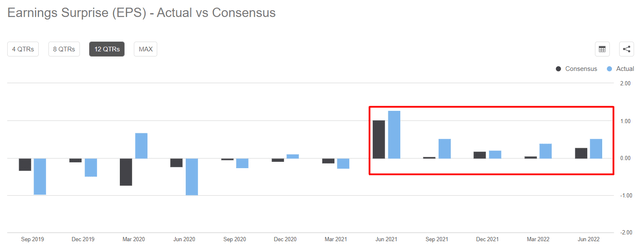

For small-cap companies like HHS (market cap = $121 million), my observation is that fundamental changes within the company are more clearly reflected in stock prices. Either you grow and improve your business qualitatively (your stock starts to rise), or you lose – investors look at your capitalization and poor results and do not believe management’s promises to fix everything when they fail, as is often the case with large technology companies, for example. That’s why the extraordinary growth in HHS stock over the past year fits in with the company beating analysts’ forecasts quarter after quarter:

Seeking Alpha, HHS, author’s notes

In the last reporting quarter (Q2 2022), Harte Hanks again managed to exceed analysts’ expectations and deliver an EPS surprise of 89%. Revenue growth broke a number of positive surprises and was actually 1.5% lower than expected by the Street. However, as we all know very well, revenue is only the first key element of the income statement, but far from the last. Investors are interested in the profit and how the company copes with the tasks set for the turnaround – I talked about this in my last article.

The business structure of the company is as follows:

- The Marketing Services segment delivers strategic planning, data strategy, performance analytics, creative development and execution, technology enablement, marketing automation, and database management;

- The Customer Care segment operates teleservice workstations in the United States, Asia, and Europe to provide advanced contact center solutions such as speech, voice and video chat, integrated voice response, analytics, social cloud monitoring, and web self-service;

- The Fulfillment & Logistics Services segment includes printing, lettershop, advanced mail optimization (including commingling services), logistics and transportation optimization, and monitoring and tracking to support traditional and specialty mailings.

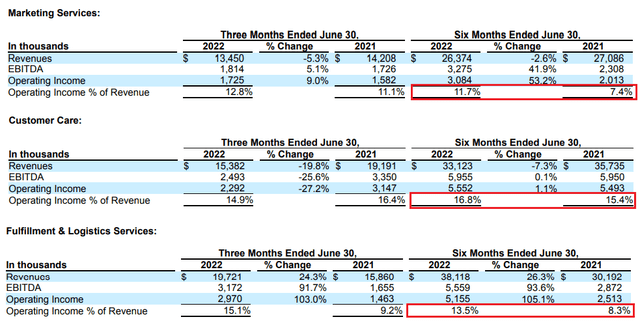

Thus, despite the decline in sales in 2 of 3 segments, the company was able to increase its EBITDA growth to an impressive level by (its standards):

HHS’s recent 10-Q, author’s notes

Let us now turn to the company’s recent earnings call to understand what management expects in Q3/Q4 2022 and perhaps 2023.

As you may see, the above-mentioned decrease in total revenues is due to a sharp decline in the Customer Care segment, which is due to the expected discontinuation of projects related to COVID. However, according to the CEO, this segment is expected to return to higher demand from existing and new customers in Q3 2022 as the company onboards agents to support the premiere of House of the Dragon. As the margins of this segment have improved on a half-year basis (due to cost optimizations), I expect that we will see revenue growth as well as EBITDA and EPS growth (at roughly the same margin level) in Q3 2022 due to new demand.

As for the Fulfillment & Logistics business, the company has exceeded its own margin expectations – EBITDA of sales is 13.5% in 2H 2022, significantly better than in 2H 2021. The consolidation of operations into the Kansas City and Boston facilities, which I mentioned in the last article, is bearing fruit – Harte Hanks has a rapidly growing customer base and order book, while the major competitors in this industry are suffering from the size of their operations. Margins for this HHS segment will most likely stop increasing – or even decrease slightly – due to the impact of consolidation, but we will most likely see a positive change again in Q3 2022 due to the new volume.

The Marketing Services segment is currently facing temporary difficulties – as expected, customers’ advertising budgets began to shrink due to uncertainty about the impending recession. However, HHS management remains optimistic, talking about a new partnership with a regional bank signed in Q2 2022.

In addition, the company plans to complete the repurchase of preferred shares from Wipro (WIT) in Q3 2022 – this is a little tailwind for common shareholders for Q4, in my opinion.

… we reached an agreement with Wipro at the end of the quarter, in which we will acquire all of the outstanding preferred shares for a onetime cash payment of $9.9 million and 100,000 common stock shares. Please note that under GAAP at closing, this transaction will result in adjustments to our earnings per share but not our net income. This is likely to close during the third quarter.

The elimination of the preferred stock dividend accrual and the earnings attributable to preferred shareholders will be offset by a onetime accounting charge based on the fair value of the common shares. We funded the cash portion of the repurchase consideration with a combination of cash and cash equivalents on hand and an additional $5 million borrowing under our credit facility.

Source: HHS’s earnings call

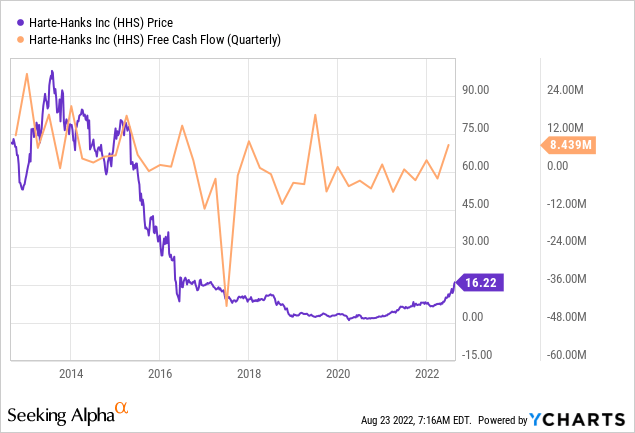

According to YCharts, Harte Hanks generated nearly $8.5 million in free cash flow in 2Q2022, which is comparable only to the pre-crisis periods in which the company operated.

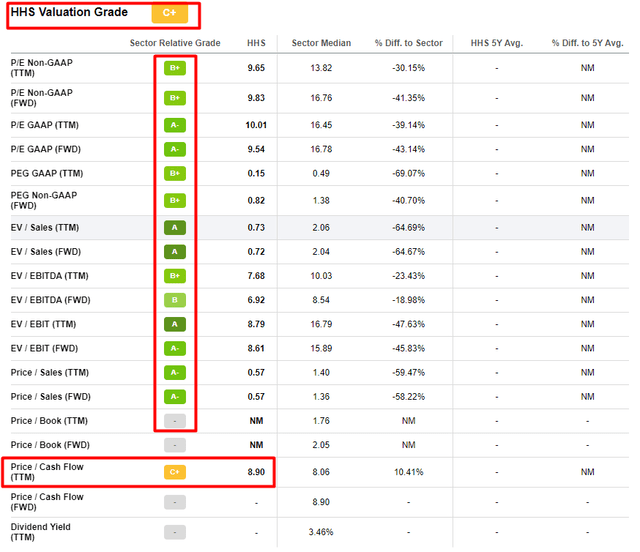

I believe that HHS will continue to grow operationally and provide great value to its investors in the future. Therefore, TTM FCF values should not be used as the sole benchmark for valuing a company as they are blind to the prospects. Why do I mention this? Because Seeking Alpha’s Quant rating system shows that HHS’s “Valuation” grade is “C+” while its price-to-cash flow ratio (TTM) is the only valuation factor of this quality in the sample. The other ratios are much better:

Seeking Alpha, HHS, Valuation, author’s notes

Takeaway

I may be wrong about the quality of the company’s turnaround. So far, recessionary sentiment has not significantly affected the company’s customers and their business relationships with HHS. However, as we saw in Q3 2022, there are signs of a slowdown in the Marketing Services segment, and if that continues, the consequences could hit the company’s shareholders hard. And given the company’s small capitalization and overall growth year-to-date, that it could be very painful.

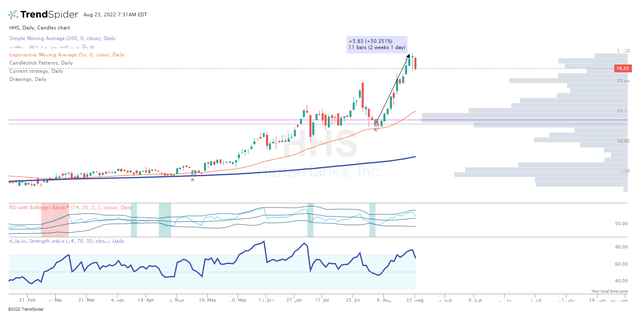

The reason for downgrading my recent Strong Buy rating is that the stock seems overbought.

In the last 2 weeks, the HHS has managed to rise 50% from its local low (note that this move occurred on the chart after the hammer candle, the reversal pattern of Japanese candlesticks). Yesterday, the quotes fell by almost 6%, forming a new reversal pattern – The Bearish Engulfing Pattern.

This pattern coincides with the fact that the HHS has pulled its 200-day moving average very high, with the weekly RSI at ~74, which is a lot.

Therefore, I expect HHS to fall 10-15% in the short term. However, for long-term investors, this will be an opportunity to buy cheaper before the next rally.

Happy investing and stay healthy!

Final note: Hey, on September 27, we’ll be launching a marketplace service at Seeking Alpha called Beyond the Wall Investing, where we will be tracking and analyzing the latest bank reports to identify hidden opportunities early! All early subscribers will receive a special lifetime legacy price offer. So follow and stay tuned!

Be the first to comment