Natalia Kopyltsova/iStock via Getty Images

Novo Nordisk (NVO) reported Q2 and H1 FY22 results on 3rd August 2022. Excluding the effects of a strong US Dollar in 2022, results included a 14% year-over-year growth in Operating Profit, where continued stellar performance of their GLP-1 (e.g. Ozempic, Rybelsus) and weight loss (Wegovy) products – at 45% and 84% year-over-year, respectively – offset pricing related declines in their traditional insulin products – at -8% year-over-year. Full-year guidance for sales and operating profit was raised at the mid-point to 14% and 13%, respectively. Aided by buybacks, EPS growth likely will be higher.

Yet, the stock (US ADR) dropped 12.7% on the news, and as of Friday 12th August was down 7.4% since the start of August. Disappointment mainly stemmed not from results, but from expectations. They are sky high for Novo Nordisk, thanks to the opportunity presented to extend the diabetes market with GLP-1s and commercialize a weight-loss treatment that is embraced by patients, medical practitioners, insurers, and governments alike as obesity becomes a recognized ‘medical condition’.

This piece aims to unravel the opportunities and risks Novo Nordisk faces with its Obesity Care unit with reference to recent business results and what it means for shareholders.

Quick recap of the Novo Nordisk investment case

First, a recap of the Novo Nordisk investment case.

- Secular tailwinds: Diabetes, a chronic illness associated with age, weight, and high blood pressure, is fueled by modern lifestyles. The number of diabetic people is expected to grow by 46% by 2040.

- Dominant position: Since commercialization, the insulin market has been largely dominated by two players: Novo Nordisk and Eli Lilly (LLY). With Sanofi (SNY), these firms supply c.90% of insulin in the US.

- Barriers to entry: Dominance, scale, and focus creates a moat, from research to distribution.

- Optionality: A deep understanding of diabetes extends to risk factors like obesity and cardiovascular disease.

- Recurring revenue: Chronic illnesses require constant treatments and medication. Pharmaceuticals tend to avoid the worst effects of a recession.

- Industry-leading margins, returns, and balance sheet: See Figure 1.

| Fields | Novo Nordisk | Eli Lilly | GlaxoSmithKline (GSK) | Sanofi | Bristol Myers Squibb (BMY) |

| Market Capitalization | 182,258.3M | 307,087.0M | 69,156.0M | 104,412.8M | 159,204.6M |

| Sales | 21,538.1M | 28,318.4M | 46,133.0M | 44,588.0M | 46,385.0M |

| Operating margins | 42.1% | 28.9% | 23.4% | 21.9% | 21.2% |

| 5-year Sales CAGR | 4.6% | 9.1% | 3.1% | 0.6% | 22.2%* |

| Net Debt-EBITDA | 0.1x | 1.3x | 1.9x | 1.1x | 1.4x |

| Quick Ratio | 0.7x | 0.8x | 0.5x | 0.9x | 1.4x |

| Return on Capital (ROC) | 57.8% | 28.7% | 16.2% | 9.2% | 11.4% |

| Return on Equity (ROE) | 71.2% | 74.5% | 24.2% | 9.5% | 19.0% |

Figure 1: Selected metrics of Novo Nordisk and peers (08/22/2022). *BMY sales CAGR influenced by acquisition of Celgene, which had sales of 15.3B USD at time of acquisition.

Two innovations have reinvigorated Novo Nordisk’s pipeline and shareholder optimism: GLP-1s and Obesity Care.

First, GLP-1s. Though not the focus of this writeup, Glucagon-like Peptide 1s (GLP-1s) effectively extend the treatment lifetime of diabetes patients by aiding insulin secretion to those whose pancreas can still produce insulin. Along with patch pumps, these contribute to the majority of diabetes care growth – which roughly totals c.5% annually.

Second, Obesity Care – which is the focus of this writeup. Serendipitously, GLP-1 products markedly enhance weight loss. Thus, these products have since been repurposed. Its efficacy amid a global obesity pandemic and rising healthcare costs are believed to have created a platform from which weight loss drugs can become a mainstream medical course of action.

Together, these innovations help Novo Nordisk offset declines in basal insulin pricing – driven by market and government forces. For example, the US government plans to market generic basal insulin at 30 USD per vial; the average price is estimated at nearly 100 USD.

Explaining the hype for Obesity Care

Opportunities: Secular Tailwinds and under penetration

The obvious opportunity within Obesity Care is its secular growth. Overweight adults in the US and globally are expected to increase from 108M to 128M and 650M to 1,000M by 2030, respectively. That is a CAGR of 2.1% and 29.3%, respectively, and indicates a few things.

First, growth. If Novo Nordisk can keep pace with the market, then it will grow at a remarkable scale and pace.

Second, under penetration. The rest of the world is far behind the US in terms of obesity trends. Novo Nordisk touts ‘The Rule of Halves’ when discussing unmet needs within diabetes care. Similar campaigns to boost awareness will be required for Obesity Care. The hope is studies like SELECT* – due to be completed by September 2023 – catalyze evidence that obesity is first, treatable, and second, worth treating due to its downstream health implications.

*The SELECT study is seen as crucial for widespread adoption, by scientifically linking weight loss drugs to cardiovascular disease prevention among obese patients. Analyst expectations were high that the SELECT study would be halted early because Novo Nordisk’s products conclusively prove its efficacy. Reiterating that its results will be available in September 2023 puts end to such speculation. This may explain the sharp fall on Q2 2022 results.

“[The objective of the SELECT study is to] Demonstrate that semaglutide [a.k.a. GLP-1s / Ozempic / Wegovy] 2.4mg lowers the incidence of MACE [major adverse cardiovascular events] vs [a] placebo.” (Novo Nordisk Q2 2022 results)

Opportunities: Widespread support

The less obvious opportunity is related to under penetration, where weight loss drugs play an increasing role in managing the obesity pandemic. The Lancet views this as a pandemic. Though exercise and healthy eating are optimal mediations, more is likely required. To this end, gaining support from the public, insurers, and ultimately the state are required.

Should people seek fast, convenient solutions (which are safe) then public support for weight loss drugs is likely. If states seek to reduce healthcare expenditure – where obese people directly cost the state 1,861 USD more than a healthy person – then government support is likely. Going deeper, all stakeholders will undertake a cost-benefit analysis.

For the public, the benefits are apparent. Costs include side-effects like nausea, constipation, and thyroid cancer, as well as financial costs – c.1,430 USD – if prescribed privately or without insurance. Nonetheless, appetite (pun intended) for weight loss drugs is broadly strong. Traditional weight loss drugs offered c.5% weight reduction; Wegovy touts c.15%. A big leap.

Twitter everyman Elon Musk vocalizes support for weight-loss drugs.

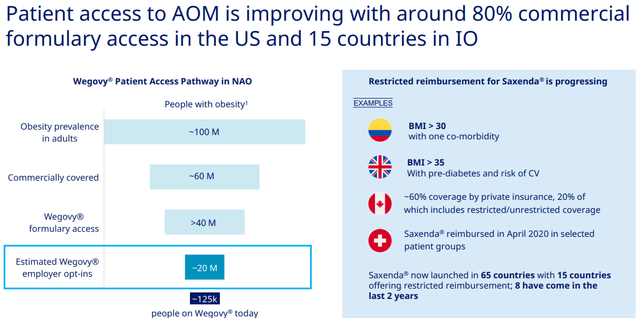

For the state, approval by the FDA in June 2021 allows insurers to include weight-loss drugs. In countries like the US, insurers ultimately determine the economic rationale. In countries with a public healthcare model, it is governments. Initial rollout will likely be limited to high GDP-per-capita countries (Figure 2). Novo Nordisk sees Obesity Care sales more than tripling by 2025.

Figure 2: Slide indicating penetration of Obesity Care products. (Novo Nordisk Q1 2022 Investor Presentation)

Threats: Supply Chain problems persist

Another negative from the Q2 2022 release – and possible explanation for its sharp drop – is that Novo Nordisk is still navigating supply chain disruptions. This was first announced in November 2021 and management indicated stabilization by the start of H2 2022. This has been delayed to the end of H2 2022. Frankly, this is not the worst problem to have, since it is largely a consequence of better-than-expected demand outstripping supply. Yet, Mr. Market has priced NVO to levels where everything ought to go right, and any slight setback can have outsized impacts on its valuation.

Threats: Competition

A reason for sanguinity is Novo Nordisk largely competes in an uncontested field, for now – boasting a market share of 84%. Yet, this market share, if anything, is a sign of under penetration; Novo Nordisk needs competition if it wishes to expand Obesity Care to become meaningful, financially. Eli Lilly is beginning to compete, following FDA approval of Tirzepatide in May 2022 and boasting higher efficacy than Wegovy. Fortunately, this category is big enough for multiple players. As this new generation of weight loss drugs matures, competition deserves greater focus.

Threats: Pricing and penetration

For now, aside from access, adoption of Wegovy et al. is hindered most by its cost. High costs may generate problems, new and old. First, expansion of Obesity Care is, even by Novo Nordisk standards, unprecedented. A segment that has the potential to be as big as its Diabetes Care unit requires a monumental effort. This can hit snags – indicated by supply chain issues. Constrained supply will further elevate prices, where uptake in emerging market will be reduced the most. Companies like Embecta (EMBC) are banking on novel diabetes treatments and delivery methods lagging in emerging markets. A longer-term risk is government involvement. Unlike insulin, weight loss drugs are not essential to patients’ lives. This may prevent action, for now, but given desperation to reduce healthcare costs, it is worth considering.

How important is Obesity Care, really?

It is important to reflect that Obesity Care, despite the hype, is only 4.5% of sales as of Q2 2022. Figure 1 shows Novo Nordisk has seen slower past growth than Eli Lilly, in terms of sales – but also stock appreciation. Excitement is future-looking, a result of Novo Nordisk’s first-mover advantage and assuredness of their ability to continually lead diabetes research – quite a feat, given its founding in 1923.

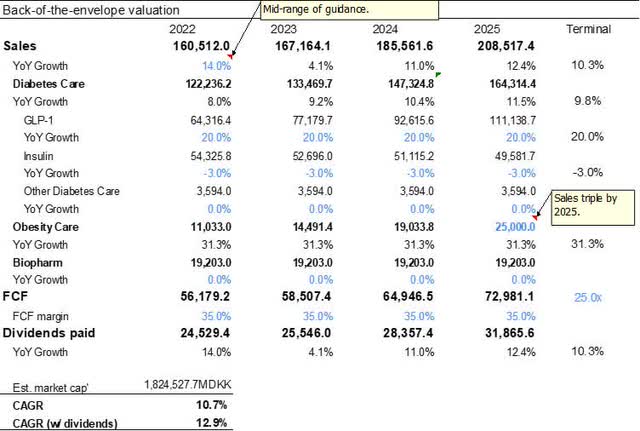

At their 2021 Capital Markets Day, management stated its ambition to increase Obesity Care sales to 25B DKK by 2025. This would imply a c.31.3% CAGR. Sentiment and speculation may suggest this is conservative – materially depending on the outcome of the SELECT study. Looking out to 2025, were trends of other units to persist (GLP-1 UP, Insulin DOWN, Biopharma FLAT), Obesity Care could conceivably be c.12.0% of sales (Figure 3). Rather inconsequential but, taking a trend out to 2030, this conceivably exceeds 25.0% of sales. More consequential.

With a 25.0x exit multiple (possibly quite an ask), this could yield low double-digit returns despite its current valuation.

Novo Nordisk forecasts, 2022E-2025E. (Author)

So, would all this suggest that Obesity Care is overhyped? Possibly, depending on one’s confidence in management, execution, and ultimately how much is paid.

Concluding remarks – and discussing why Novo Nordisk may have held up so well YTD

Finally, a word about performance during economic downturns and times of inflation. Pharmaceuticals, as a broad basket, tend to hold up well over such periods. NVO has so far reflected this, being down -2.2% versus -10.4% YTD, however NVO may buck the trend due to its historically high valuation. Therefore additional caution is advisable, mirroring comments made recently by Leon Laake.

Concerning Obesity Care, which was the primary focus of this piece, the hype is arguably warranted. Extensions of supply chain disruptions would be negative catalysts; positive outcomes of SELECT and other studies would be positive catalysts. On balance, its quality coupled with an attractive market which may be as consolidated as insulin has been suggests Novo Nordisk has the hallmarks necessary to be successful at a significant turning point in its 98-year history.

Be the first to comment