peepo/E+ via Getty Images

Article Thesis

Microsoft (NASDAQ:MSFT) and Apple (NASDAQ:AAPL) are the two biggest publicly-traded companies by market capitalization. Both are tech companies, but there are some important differences. In this article, we’ll take a look at which of these two companies is the better pick today.

Apple Has Shown A Stronger Performance

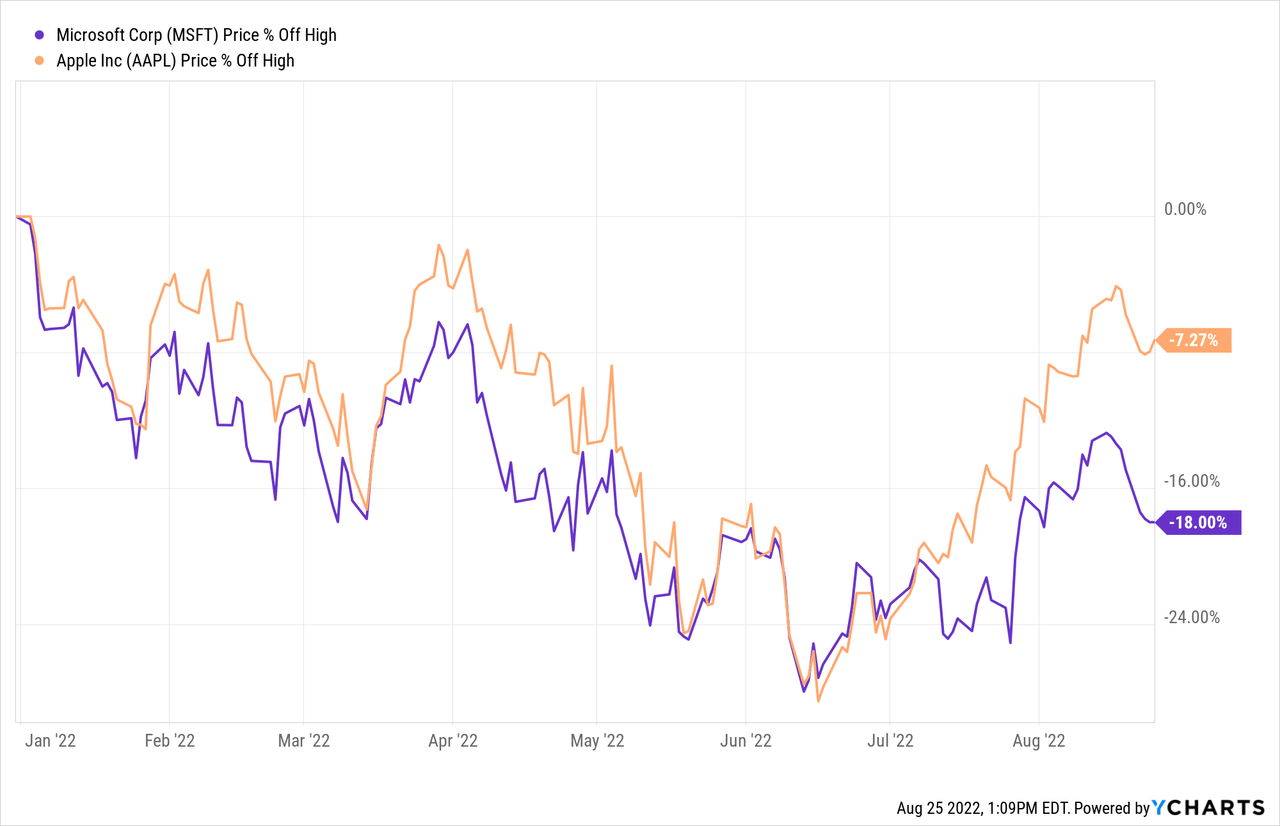

At $2.1 trillion and $2.7 trillion, respectively, Microsoft and Apple are the two largest companies in terms of market capitalization, not including Saudi-Aramco (ARMCO), which is mostly owned and controlled by KSA. Both companies trade off their all-time highs, but the performance over the last year shows some noteworthy differences:

Apple is currently trading just 7% below its 2022 high, whereas Microsoft is trading 18% below its high. Up to July 2022, the two companies moved very much in line with each other – both were down around 23% at the half-year mark. But since then, Apple has risen a lot more than Microsoft. This is good news for Apple’s current shareholders, of course, but it brings up the question of whether that makes sense. Due to Microsoft’s stronger recent results (more on that later), I do believe that Apple’s larger price jump is not justified. From a timing perspective, buying a stock closer to its lows is also a better idea compared to buying a stock that is trading close to its highs.

Microsoft And Apple: Growth And Recent Performance

The two companies do not only differ when it comes to recent share price movements, however. There are also other differences, such as the recent growth momentum and when it comes to the expected growth over the next couple of years.

During the most recent quarter, Apple was able to grow its revenue by 1.9%. That’s better than a sales decline, of course, but far from great. Growing revenue by a little less than 2% while inflation is running at a rate of 8% or so, means that revenues actually declined by around 6% in real terms. Contrast this with Microsoft’s revenue growth rate during the most recent quarter, which came in at 12.4% – that’s easily positive even after accounting for inflation.

Not only was Microsoft’s sales growth rate a lot better, but MSFT also led AAPL when it comes to growing profits. Apple actually saw its operating profit drop by 4% year over year, or by $1 billion in absolute terms, during the most recent quarter. Microsoft, on the other hand, saw its operating profits rise by 8% year over year. That can be attributed to MSFT’s better sales performance, but its margins also play a role. Thanks to very high gross margins, a larger portion of Microsoft’s revenue contributed to profits relative to Apple. This will remain true in the future, too, I believe, which is why I believe that Microsoft’s margin expansion potential is larger. Adding one more dollar in revenue comes with lower proportional costs for Microsoft relative to Apple, as Apple has to produce costly hardware, whereas that is not the case for the majority of Microsoft’s business units.

When it comes to the growth potential for the two companies going forward, Microsoft also looks like the stronger pick to me. Apple generates most of its revenue by selling phones, tablets, etc. That’s a large market, and Apple holds a strong position in it. But the global smartphone market is not a fast-growing market, and Apple can’t capture a lot of additional market share, as many global consumers can’t or won’t buy a phone costing around $1000. Thus Apple will in all likelihood continue to generate hefty revenues and profits with its hardware franchise, but growing those revenues is a difficult task. This is partially offset by Apple’s better growth rate in the services business, but that business is too small to have an overly large impact on Apple’s expected sales. It’s thus not too surprising to see that analysts are expecting Apple to grow its revenue by just 4% to 5% over the next three years.

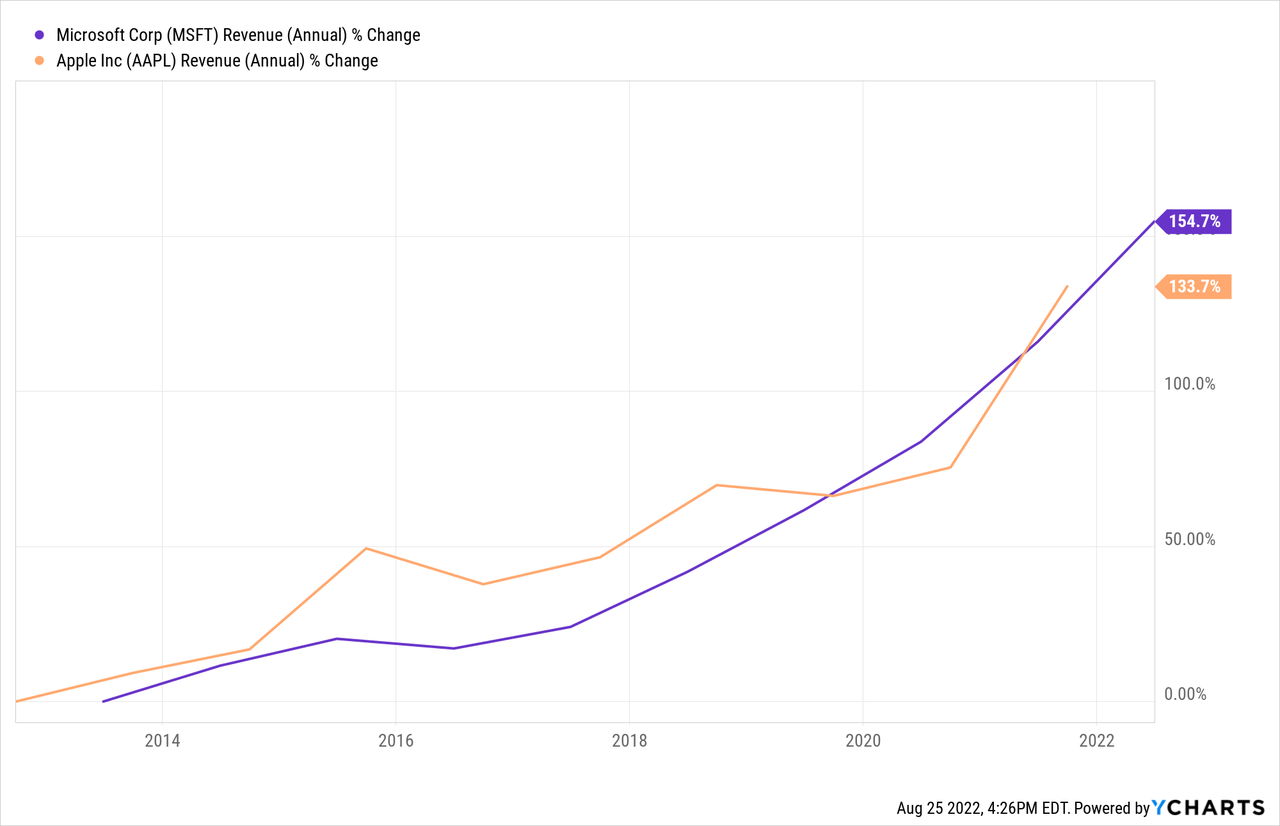

That pales in comparison relative to Microsoft’s expected growth over the same time frame, as analysts are forecasting that MSFT will add 14% a year to its top line over the same time frame – that makes for a growth rate that is 3x as high as that of Apple. This can be explained by Microsoft’s exposure to faster-growing markets, such as cloud computing. That market is not as mature as the tablet or smartphone market, and is forecasted to grow at a high-teens rate according to some forecasts. Higher gross margins, exposure to faster-growing markets, and M&A deals such as the pending takeover of Activision Blizzard (ATVI) should allow Microsoft to grow its revenue and its earnings per share faster, relative to Apple.

That doesn’t make Apple a bad company, of course, but it’s an advantage for Microsoft. Microsoft also has a stronger balance sheet, with a net cash position equal to 3% of its market capitalization, versus 2% for Apple. That could allow Microsoft to be more aggressive with share repurchases going forward, which would naturally boost its earnings per share growth further.

Resilience And Inflation Impact

Microsoft also seems advantaged when we look at some macro issues. An economic slowdown due to rising rates and costly energy has spooked the market over the last couple of months. Microsoft seems to be less exposed to that theme relative to Apple. During a recession, consumers might decide against a phone upgrade, deciding instead to keep their older phones for a little longer. Economic troubles could thus hurt Apple’s sales potential. On the other side, Microsoft’s fee-based model makes it very resilient versus recessions. Neither consumers nor businesses will stop using their Windows operating system or their Microsoft Office products during a recession, meaning those revenues are very secure in all kinds of economic environments.

Not only has Microsoft grown faster over the last decade (which is due to the aforementioned positioning in faster-growing markets), but Microsoft’s revenues also grew more smoothly over time. No matter what the macro environment looked like, Microsoft continually added to its top line, whereas there was a more pronounced cyclicality in Apple’s revenue. That’s not too surprising, as hardware businesses are just more cyclical than software businesses in general. Microsoft being a software business also is advantageous when it comes to inflation – rising energy costs, rising transportation costs, rising costs for all kinds of input materials and commodities do not impact MSFT a lot, whereas a hardware producer like Apple is more exposed to these themes. That being said, Apple is not in too much trouble, as its strong brand and pricing power allow it to fare better than many other hardware producers in an inflationary environment – just not as good as software king Microsoft.

Surprisingly, The Better Company Is Cheaper

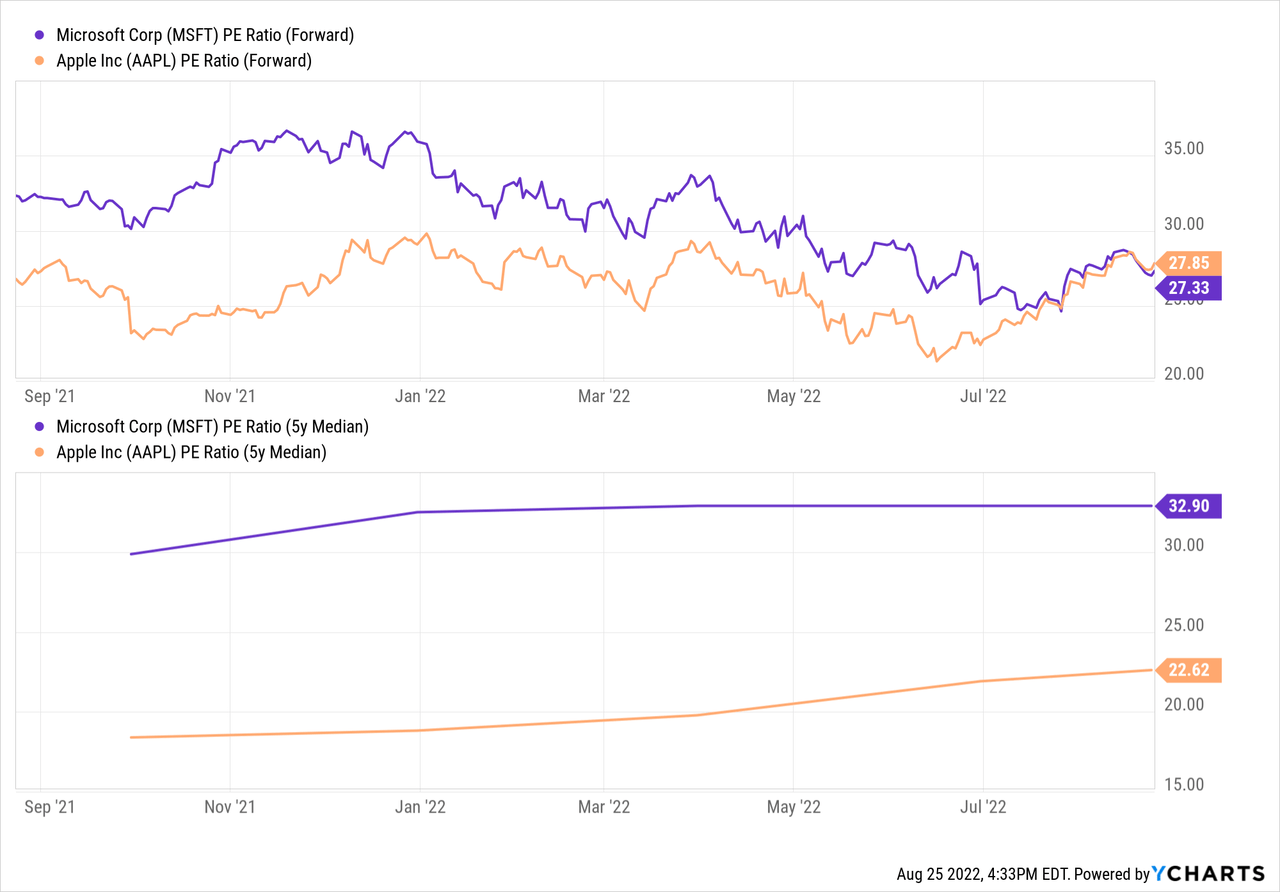

Apple is a good company, I believe. But Microsoft is a better one – it’s growing faster, has a larger net cash position relative to its market capitalization, has a more resilient business model, higher gross margins, a better credit rating, and so on. That does not automatically make Microsoft a better investment, as valuations have to be considered as well. Somewhat surprisingly, at least to me, Microsoft actually is the cheaper among these two today – that was not the case in the past:

Today, Microsoft trades at a (pretty small) discount versus Apple, as the forward earnings multiples stand at 27 and 28, respectively. But when we look at historical valuation ranges, the discrepancy looks much more pronounced. Over the last year, MSFT almost always traded at a higher earnings multiple than Apple. That also was the case over the last five years, as MSFT’s 5-year median earnings multiple is 33, versus 23 for Apple. That means that Microsoft is currently trading at a 20% discount versus the historical norm, whereas Apple is historically expensive, trading at a 20% premium. Naturally, buying is more attractive when one gets the opportunity to buy shares at a historically low valuation. The fact that Microsoft, the higher-quality, higher-growth company, is trading at a lower valuation in absolute terms, is just gravy.

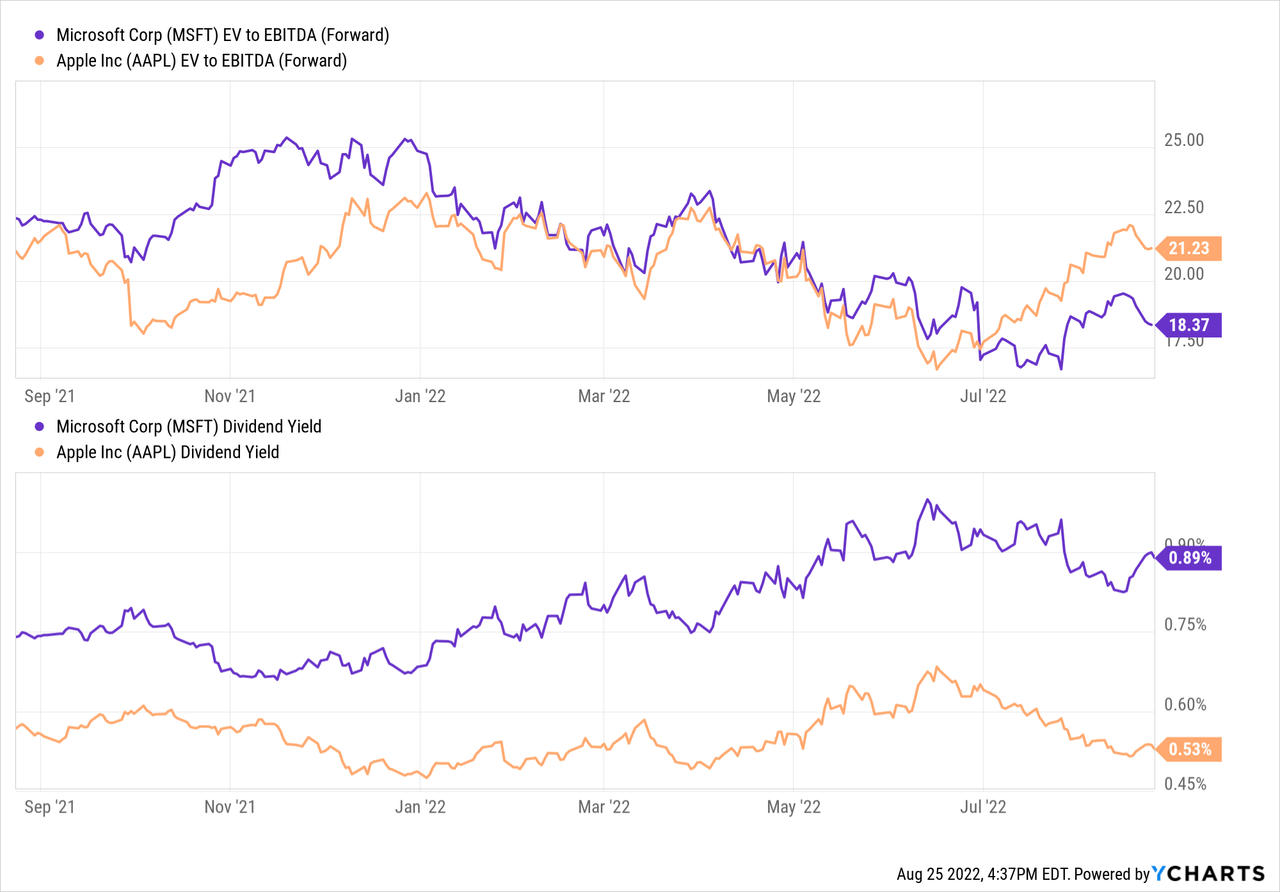

The earnings multiple is not an outlier, as the following charts show:

Microsoft also is cheaper in terms of enterprise value versus EBITDA, and Microsoft offers a higher dividend yield. Overall, Microsoft thus looks like the better pick at current prices.

Takeaway

Both Apple and Microsoft have $2+ trillion market capitalizations and thus a heavy weighting in the broad market. When investors want to go with one of the giants, I do believe that Microsoft is the better choice right here. It is growing faster, less exposed to recessions, trades at a lower valuation, offers a higher dividend yield, and so on. MSFT also trades at a discount relative to its own valuation in the past, suggesting a good time to buy – the contrary is true for Apple, which looks historically expensive today.

Be the first to comment