adaask

Both STORE Capital (NYSE:STOR) and Spirit Realty Capital (NYSE:SRC) are investment grade triple net lease REITs. While STOR has the better track record, SRC pays out a higher dividend yield. In this article, we will compare them side by side and offer our take on which one is a better buy.

STORE Capital Vs. Spirit Realty Capital – Balance Sheet

As was already stated, both boast investment grade credit ratings. STOR has a BBB (positive outlook) credit rating from S&P, whereas SRC has a BBB (stable outlook) from S&P, giving STOR the slightest of edges when it comes to credit rating.

When we look at STOR’s specifics, we find that it has very little debt maturing in 2022 or 2023, which is very fortunate given that interest rates are elevated at the moment. Moreover, its unencumbered assets debt to EBITDA is 4.6x which is considered to be fairly conservative. It also covers its interest expense easily with a 5.7x coverage ratio and its unencumbered assets to unsecured debt ratio is 3.1x, which is also quite conservative.

Meanwhile, SRC’s balance sheet looks quite strong as well. Its overall adjusted debt to annualized adjusted EBITDAre is 5.2x, which is lower than STOR’s 5.7x and its fixed charge coverage ratio is 5.8x, well above STOR’s 3.6x ratio.

STOR has a slightly more positive credit rating situation whereas some of SRC’s credit metrics are stronger. Overall, we consider this area to be a tie between them.

STOR Vs. SRC – Investment Portfolio

STOR leases properties to over 570 tenants spread across over 120 industries. STOR’s focus is on non-investment grade tenants in order to secure better lease terms and instead focuses on property-level profitability as it realizes that the true value of the real estate is found in the location and actual utility of the property itself and not the tenant. STOR is investing in real estate, not its tenant, and therefore believes it can optimize its risk-reward by focusing on the property level metrics rather than just the tenant. This approach held up quite well in the face of massive headwinds during the COVID-19 lockdowns, so we have confidence that it will continue to serve STOR well in a more traditional recessionary environment.

SRC also has a very well diversified portfolio of over 2,000 properties and it places a much higher focus on industrial properties than STOR does with about 20% of its total rental exposure coming from industrial properties. Its approach also performed very well during COVID-19 as it lost only 0.06% of its rent during that period and its occupancy remained above 99% throughout the COVID-19 lockdown period.

Overall, we are going to call this a tie as well as each takes a unique approach. We believe that overall, SRC’s approach is likely a bit more conservative, but STOR’s generates more attractive leasing spreads and enables them to generate stronger profitability.

STORE Capital Vs. Spirit Realty – Dividend Safety

Both REITs’ dividends appear to be quite safe for the foreseeable future. SRC’s AFFO dividend payout ratio for 2022 is expected to be 72.5% and STOR’s is expected to be 70.2%. STOR has a slightly better projected growth rate in the coming years than SRC has (3.4% AFFO/share CAGR vs. 2.8% AFFO/share CAGR), so – when combined with its slightly lower current payout ratio – we give it a very slight edge here. However, the advantage is very slight, especially when considering that SRC’s tenant quality is a bit higher than STOR’s.

STOR Vs. SRC – Track Record

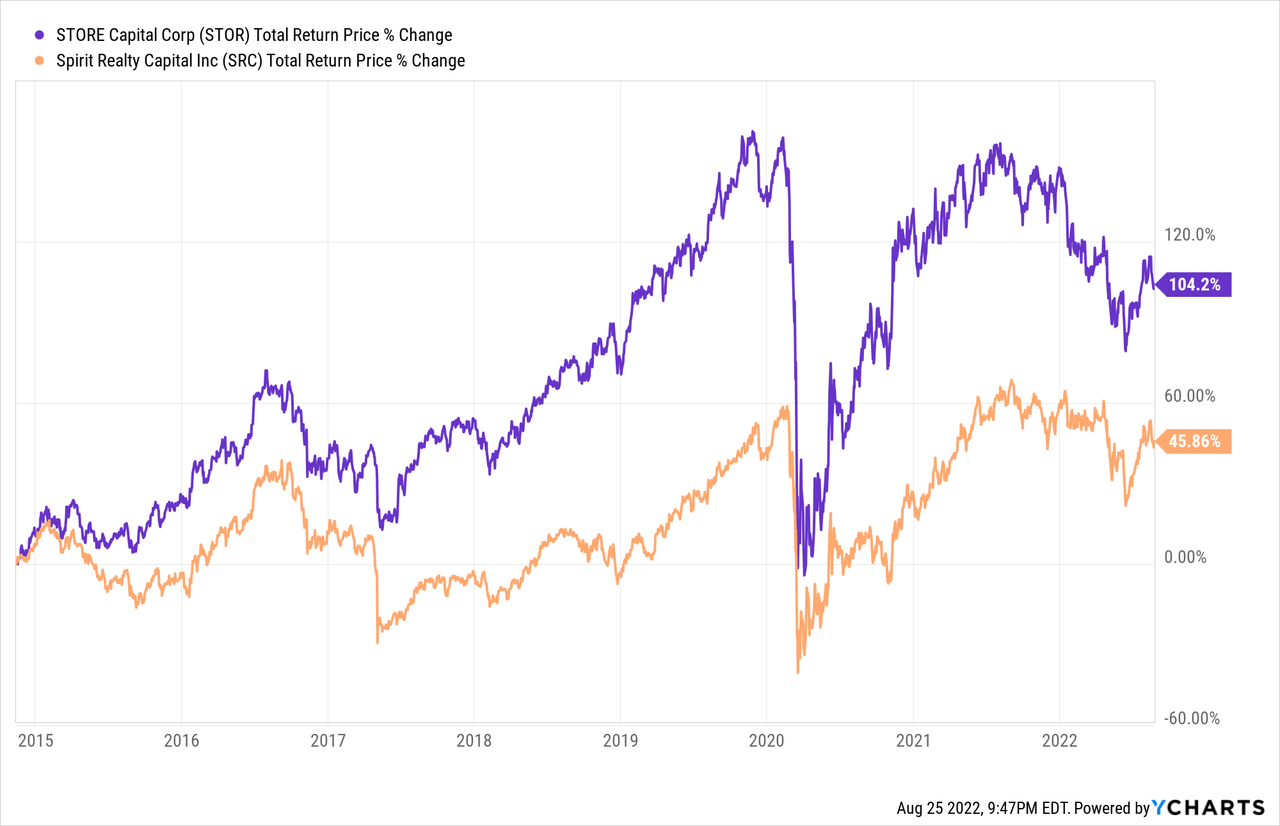

While STOR’s track record is vastly superior to SRC’s, it is a bit misleading given that SRC was a REIT in transition during the first several years of that comparison period:

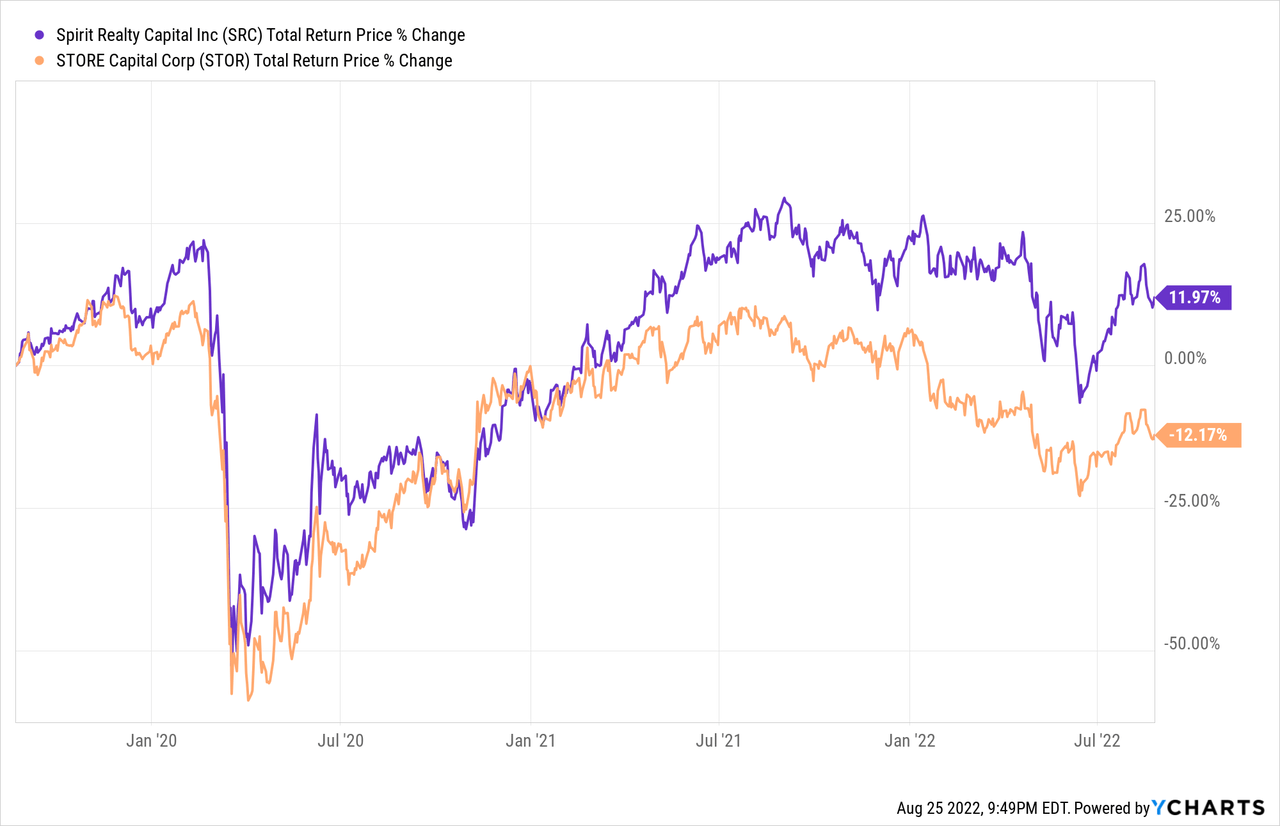

Over the past three years, SRC has actually outperformed STOR:

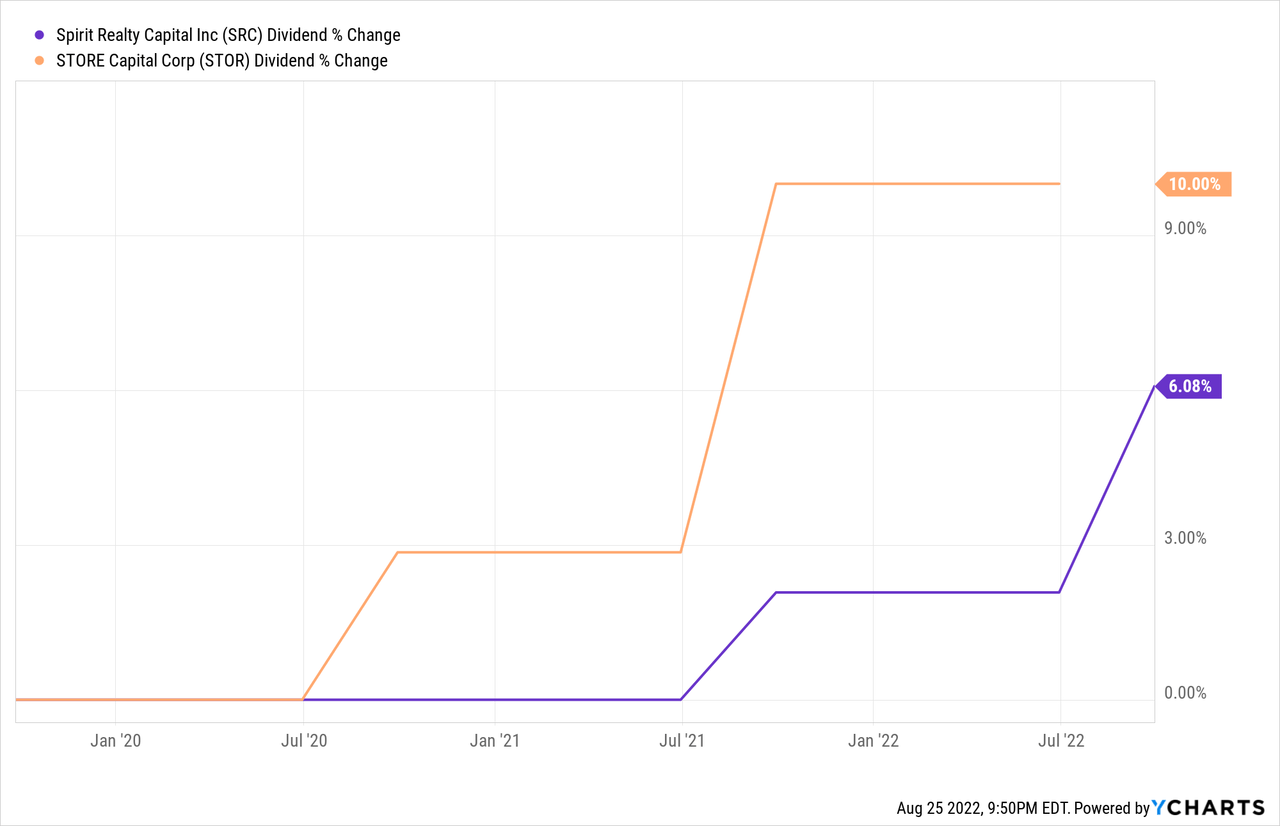

That said, STOR has outperformed SRC in terms of dividend per share growth over that span:

And has also significantly outperformed SRC in AFFO per share growth over that period of time. As a result, we can conclude that on a fundamental level, STOR has outperformed SRC over time, but SRC’s stronger recent total return performance is largely a function of the market starting to wake up to SRC’s successful transition to being a pure play triple net lease REIT that proved itself during the COVID-19 lockdowns. As a result, we give STOR the edge in the area of track record.

STOR Vs. SRC – Stock Valuation

Here is a side-by-side comparison of SRC and STOR on several valuation metrics

| Valuation Metric | SRC | STOR |

| P/AFFO | 11.88x | 12.28x |

| P/AFFO (3 Year Average) | 13.63x | 15.56x |

| Dividend Yield | 6.08% | 5.79% |

| Dividend Yield (3 Year Average) | 6.11% | 4.94% |

| P/NAV | 0.93x | 0.95x |

| P/NAV (3 Year Average) | 1.02x | 1.16x |

At first glance, SRC seems to be clearly cheaper thanks to its lower P/AFFO ratio, high dividend yield, and lower P/NAV ratio. However, the differences in each of these metrics are quite small. Furthermore, STOR trades at a much larger discount to its recent historical averages than SRC does. Overall, we rate this comparison as a draw, as SRC is a bit cheaper, but STOR also has a stronger track record and slightly better growth outlook, so it does deserve to trade at a slight premium to SRC.

Investor Takeaway

Overall, this is a very close matchup. STOR appears more likely to enjoy a credit rating upgrade in the near term than SRC, but both have strong balance sheet metrics, with SRC besting STOR in some areas. In terms of dividend safety and growth potential, STOR slightly edges out SRC, but SRC’s portfolio is probably slightly more defensively positioned thanks to its greater emphasis on investment grade tenants and more substantial exposure to industrial real estate.

When it comes to track record, STOR is the clear winner when it comes to fundamentals, but SRC has greatly improved its performance in recent years as it has completed its transition into a pureplay triple net lease REIT. Valuation is once again extremely close, with SRC being slightly cheaper, but STOR is trading at a wider discount to its historical multiples. At the end of the day, we give a slight edge to STOR as its fundamental performance has been stronger for longer and its growth outlook is also better while its valuation is essentially identical to SRC’s. We rate both REITs as Strong Buys.

Be the first to comment