designer491

(This article was co-produced with Hoya Capital Real Estate)

Introduction

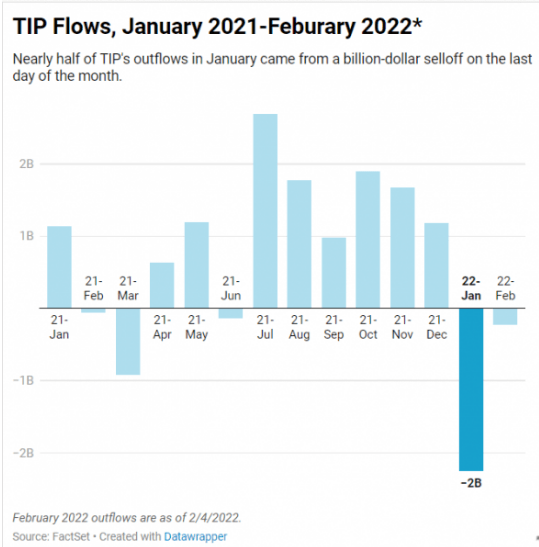

Even before investors understood the Fed got it wrong on inflation, inflows into TIPS funds were positive. I looked for but did not find more current flow data.

etf.com

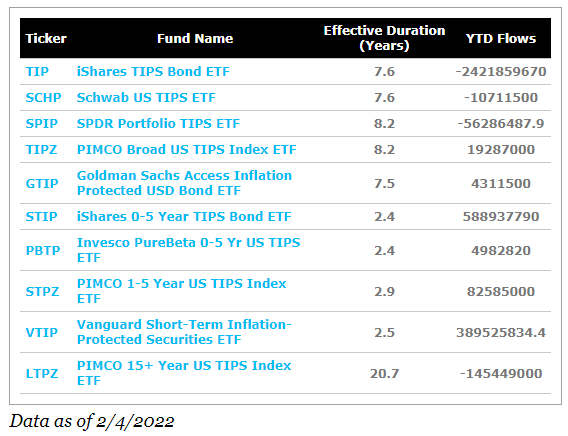

As you can see, there were differences in which TIPS ETFs investors preferred (short versus longer duration) at the start of 2022.

etf.com

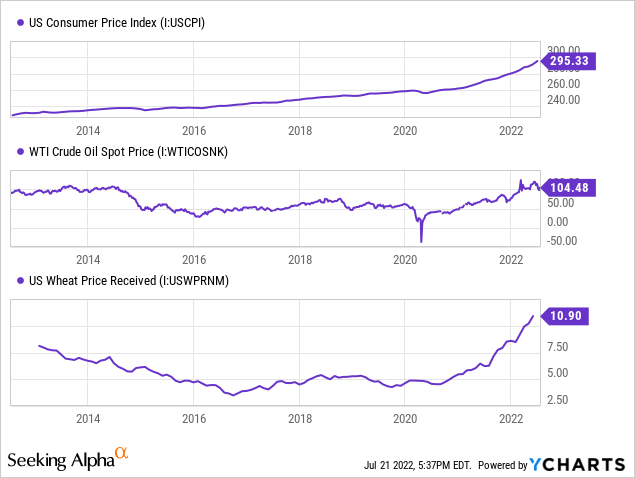

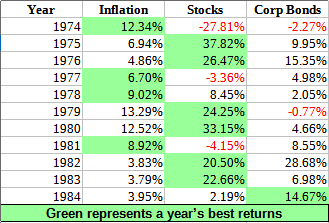

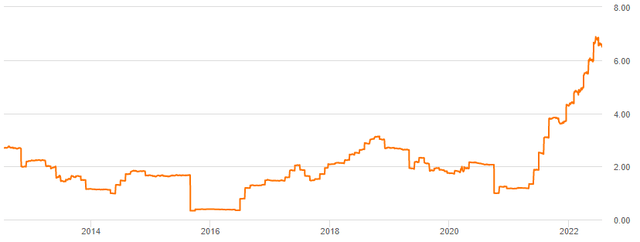

As if readers needed charts to remind them why inflation-protection ETFs might be a wise choice now, here are three.

This article will compare two TIPS ETFs that follow different strategies that investors can pick from: the FlexShares iBoxx 3-Year Target Duration TIPS Index Fund (NYSEARCA:TDTT), with its focus on short-durations TIPS, or the iShares TIPS Bond ETF (NYSEARCA:TIP), which covers the whole TIPS universe. At the article’s conclusion, I list other TIPS funds, with a link to a recent TIPS article I did.

Defining TIPS

While I imagine most readers know what TIPS are, I included this “just in case”.

Treasury inflation-protected securities, or TIPS, are a type of Treasury security issued by the U.S. government. TIPS are indexed to inflation in order to protect investors from a decline in the purchasing power of their money. As inflation rises, rather than their yield increasing, TIPS instead adjust in price (principal amount) in order to maintain their real value. The principal amount is protected since investors will never receive less than the originally invested principal.

Source: investopedia.com TIPS

FlexShares iBoxx 3-Year Target Duration TIPS Index Fund review

Seeking Alpha describes this ETF as:

The FlexShares iBoxx 3-Year Target Duration TIPS Index Fund is an exchange traded fund launched by Northern Trust Corporation. It invests in inflation protected public obligations of the U.S. treasury with an average modified adjusted duration of three years. The fund seeks to track the performance of the iBoxx 3-Year Target Duration TIPS Index. TDTT start in 2011.

Source: seekingalpha.com TDTT

TDTT has $1.8b in assets and sports a 6.5% Forward yield. The managers charge 18bps in fees. iBoxx provides this guidance to their Index, which is used by TDTT, the only ETF following this Index.

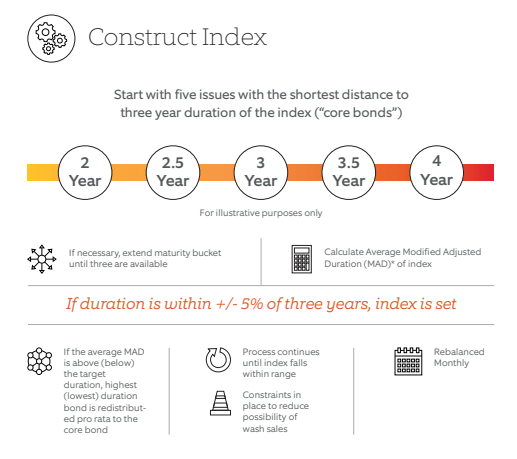

The iBoxx® 3-Year Target Duration TIPS Index measures the performance of Treasury Inflation Protected Securities as determined by Markit iBoxx’s proprietary index methodology. The iBoxx® index methodology targets a modified adjusted duration of 3.0 years and defines the eligible universe of TIPS as having no less than one year and no more than ten years until maturity as of the Index determination date. A proprietary regression calculation is then used to determine the modified adjusted duration of the TIPS and weight the TIPS in the Index at a modified adjusted duration level within a range of 3.0 years, plus or minus 5% within Index constraints. One cannot invest directly in an index.

Source: flexshares.com Index

FlexShares provides an Index construction process diagram.

flexshares.com

There must be $2b outstanding of any issue included, excluding the amounts not on the open market. I find it interesting they can manage to own 10-yr maturities and still keep the duration under 3 years. Readers can use this link for more on how the Index is built.

TDTT holdings review

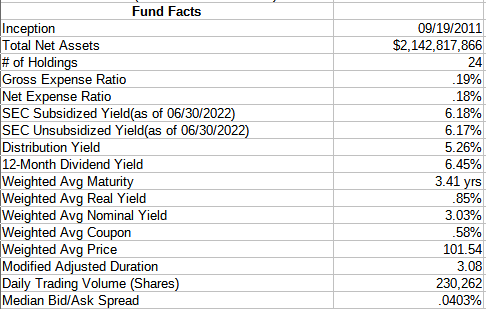

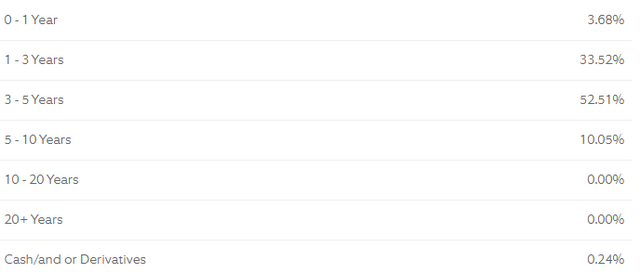

FlexShares provides these facts about TDTT:

flexshares.com; compiled by Author

The maturity schedule shows 37% coming due in the next three years, allowing for a decent turnover while rates might still be climbing, at least so over the next year.

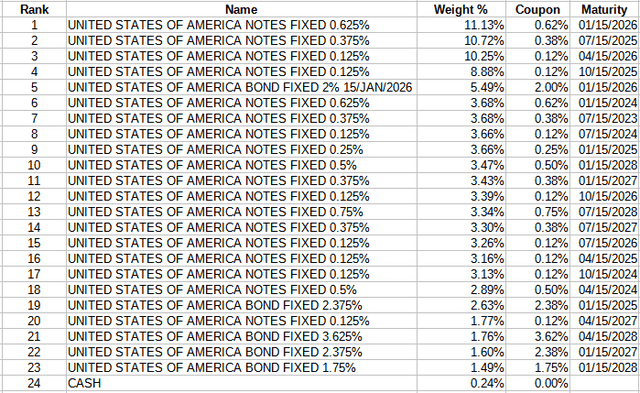

This is a complete holdings list for TDTT.

flexshares.com; compiled by Author

One bond matures in 2023 (3.68%) and four in 2024 (13.37%).

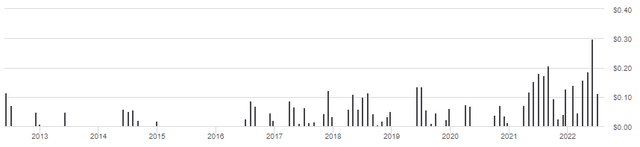

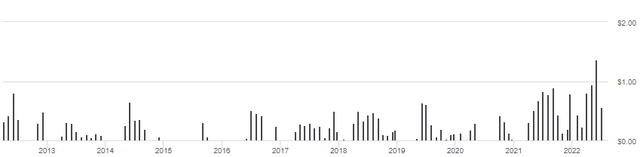

TDTT distribution review

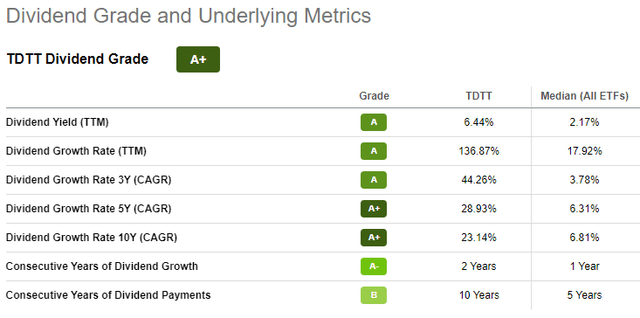

Investors needing a consistent payout stream should look elsewhere. No monthly payouts are common when inflation is low. Until the current inflation spike, TDTT had a yield below 2%.

I suspect Seeking Alpha’s “A+” dividend rating was heavily influenced by the current yield and recent rise from prior levels.

seekingalpha.com TDTT DVD scorecard

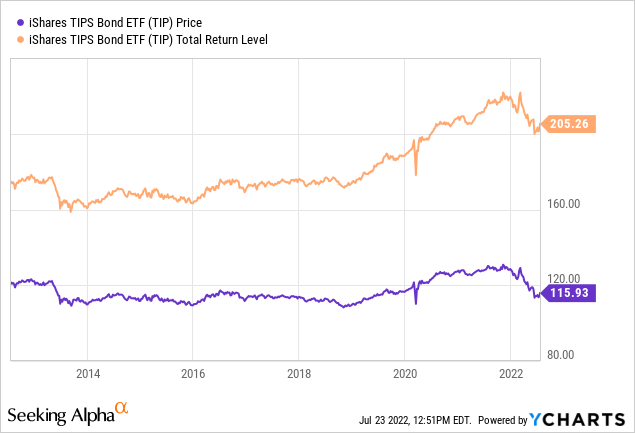

iShares TIPS Bond ETF review

Seeking Alpha describes this ETF as:

iShares TIPS Bond ETF is managed by BlackRock Fund Advisors. It primarily invests in U.S. dollar denominated, fixed-rate, investment grade inflation-protected public obligations of the U.S. Treasury that have at least one year remaining to maturity. The fund seeks to replicate the performance of the Bloomberg Barclays U.S. Treasury Inflation Protected Securities Index (Series-L). The ETF started on December 4, 2003.

Source: seekingalpha.com TIP

TIP has $31b in assets and shows a Forward yield of 6.6%. BlackRock imposes 19bps in fees. The Index comes with this description.

The Bloomberg Barclays US Treasury Inflation-Linked Bond Index (Series-L) measures the performance of the US Treasury Inflation Protected Securities market. Federal Reserve holdings of US TIPS are not index eligible and are excluded from the face amount outstanding of each bond in the index. The US TIPS Index is a subset and the largest component of the Global Inflation-Linked Bond Index (Series-L). US TIPS are not eligible for other Bloomberg Barclays nominal Treasury or broad-based aggregate bond indices. The Index was launched in March 1997.

Source: data.bloomberglp.com Index

Some Methodology rules are:

- Securities must be rated investment grade (TIPS easily meet that).

- USD 500mn minimum par amount outstanding (not adjusted for inflation indexation) outside the Federal Reserve SOMA account.

- At least 1 year until final maturity with a fixed-rate coupon.

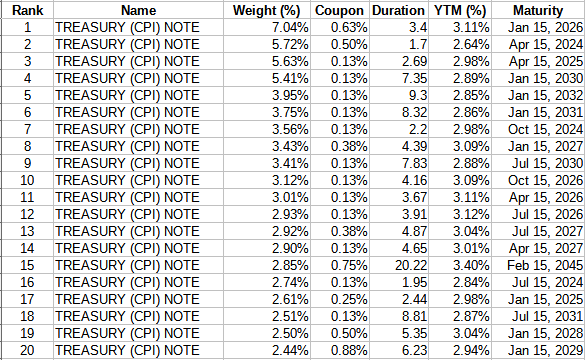

TIP holdings review

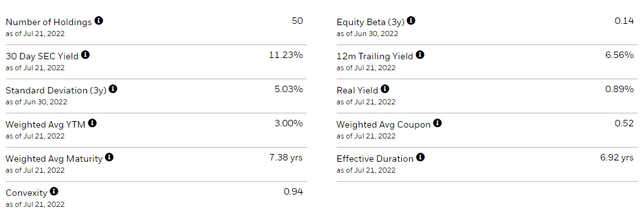

iShares provides the following portfolio characteristics.

The Top 20 holdings are:

ishares.com; compiled by Author

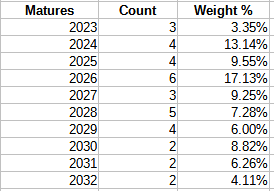

The Top 10 are 45% of the portfolio; the Top 20 are 72%. I calculated the maturity allocations as:

iShares.com; compiled by Author

While TIP has more bonds maturing over the next three years than TDTT, the percentage of the portfolio is less at 26%. TIP has one bond maturing in every year between 2040 and 2052, with the exception of 2051 which has three. Currently, years 2033-2039 have no bonds maturing.

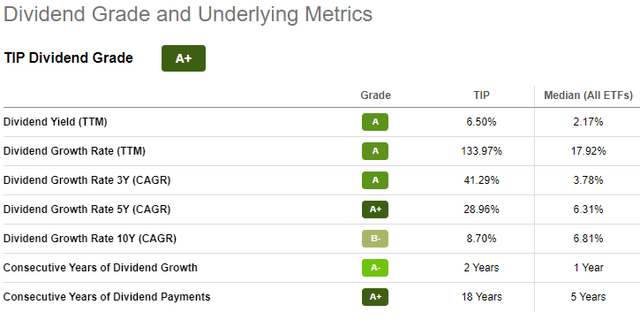

TIP distribution review

TIP’s payout pattern closely mirrors that of TDTT. Notice, despite rising inflation, the last payout was under 50% of the prior one, the same as TDTT. Owning longer-date TIPS doesn’t seem to add much, if any, to the yield investors earn.

TIP’s dividend grades also benefited from the recent elevation in its yield.

seekingalpha.com TIP DVD scorecard

Portfolio strategy

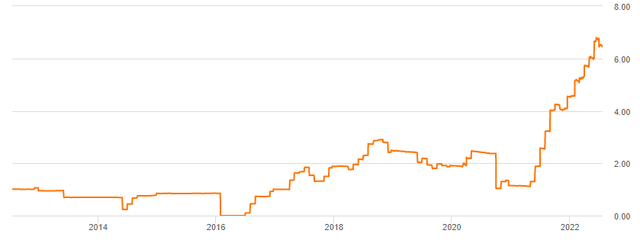

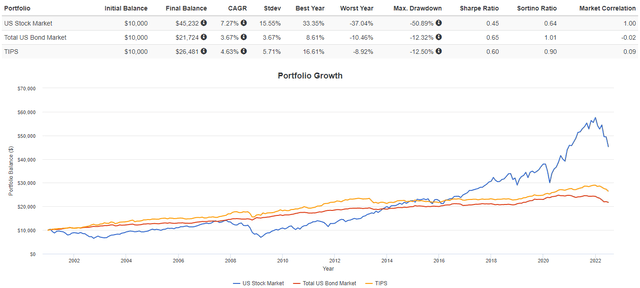

From the next chart, adding TIPS to a portfolio allocation appears to be a good substitute for US bonds and a means of reducing a portfolio’s standard deviation.

Looking at what data Portfolio Visualizer had when inflation last reached today’s levels, stocks were the best performer in 6 of 11 years, inflation in 4, with bonds only coming in first once, thus using funds focused on “beating inflation” might not be the best strategy.

PortfolioVisualizer.com; compiled by Author

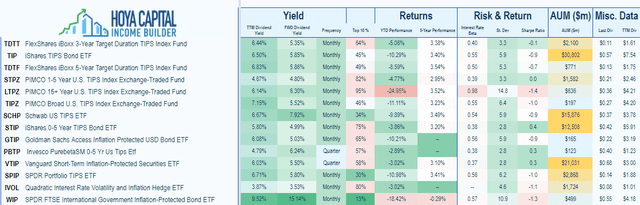

Below is a long list of TIPS funds investors can use to start their due diligence with. Like TDTT, some focus a segment of the TIPS market. Most show similar results over the last five years, with none showing positive results for 2022, seeming to indicate TIPS are designed to protect against inflation, not an increase in interest rates, as their name implies.

The SPDR FTSE International Government Inflation-Protected Bond ETF (WIP), provides exposure to the non-US TIPS, but my last review was not favorable. FlexShares also has an ETF, the iBoxx 5-Year Target Duration TIPS Index Fund (TDTF), which invests with a duration goal between TDTT and TIP.

Final thought

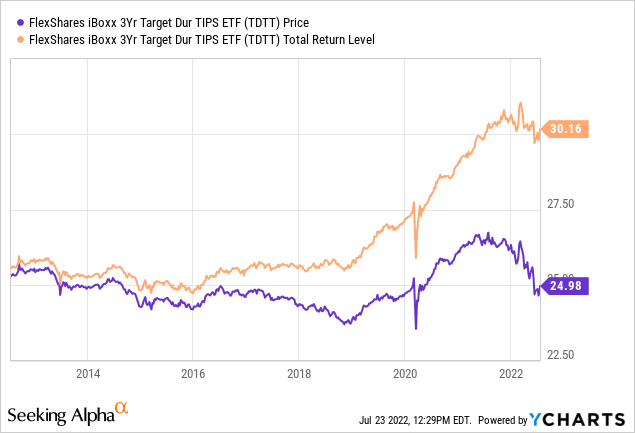

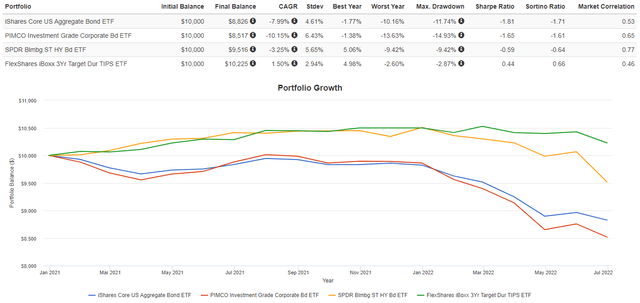

As the next chart shows, TIPS funds can do better than other bond funds when both inflation and interest rates are climbing. The real difference starts to show after the Fed started in early 2022.

While I would not be prone to replacing any equity allocation into TIPS, they should comfortably fit into one’s fixed income allocation. Here, other readers have reported a suggested weighting between 5-10% of a total portfolio. Readers might want to check out my STPZ: PIMCO’s Only TIPS ETF With Positive 1-Yr Return article, which also compares short and long duration TIPS ETFs.

Be the first to comment