Joe Raedle/Getty Images News

Pretty it wasn’t, as the retail space continues to face a challenging 2022. But at least on the key headline numbers, Macy’s (NYSE:M) delivered a solid Q2 beat on revenues of $5.6 billion that was $100 million better than consensus, and on adjusted EPS of $1.00 that topped expectations by 12 cents.

The New York-based department store chain seems to be doing what it can to (1) manage its inventory well, (2) mitigate the impact of inevitable merchandise discounting activity, and (3) keep demand afloat ahead of what will likely be a rough patch in consumer discretionary spending. But because of Macy’s hit-and-miss Q2 results and full-year outlook amid a challenging environment, I find it hard to be enthusiastic about Macy’s stock – despite valuations that, as usual, continue to look pretty discounted.

On the Q2 numbers and outlook

Macy’s topline is perhaps what encourages me the most about the retailer’s recent results. Once upon a time, some (myself included) feared for Macy’s secular growth prospects in the face of several headwinds: A decisive shift in consumer spending habits to e-commerce, a change in consumer preference toward athleisure (particularly impactful in the women’s department), and the “death of the mall” phenomenon. The COVID-19 crisis could have been the nail in the coffin.

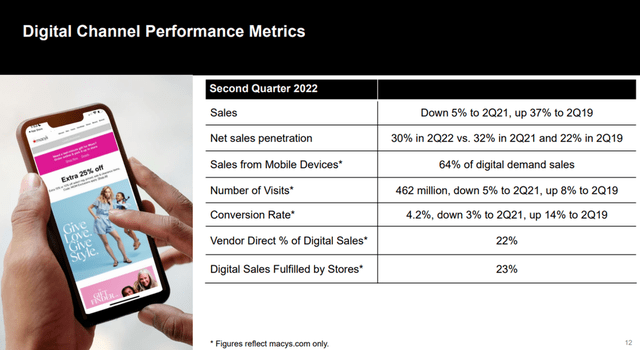

But in Q2, Macy’s delivered two-year annualized sales growth of 25% to effectively return to a pre-COVID growth trajectory that, while not exhilarating, at least puts worst-case scenario concerns at ease. Some key markets like San Francisco, Washington, D.C., and Orlando even witnessed positive sales growth in Q2 of 2022 on top of very tough 2021 comps. And since Q2 2019, before the pandemic shutdowns, Macy’s digital channel has climbed 37% while the conversion rate has risen by a healthy 14% (see table below).

Macy’s digital channel performance metrics, 2Q22 vs. 2019 (Company’s Q2 earnings slides)

This is where most of the good news ends, in my view. Further down the P&L, Macy’s gross margin is under pressure. While the deterioration across the entire Spring season does not look too bad (a 50-bp YOY decline to 39.2%), the trend toward the back end of the period worries me.

As Macy’s continues to right-size its inventory and slash prices where needed, I have little conviction that the worst of the margin compression has been left behind. In fact, loss of profitability seems to be at the core of the management team’s decision to cut its full-year EPS guidance by a sizable 64 cents to $4.10 at the mid-point of the range. The possible spillover effect into next year has yet to be estimated.

To make matters worse, a potential recession (or, at least, economic growth deceleration) could hurt Macy’s in the back half of the year and early in 2023 exactly when the retailer could use macroeconomic support the most. The management team seems well aware of the problem and has cited macro-level headwinds as yet another reason to be cautious about the company’s performance in the next couple of quarters, at least.

Meanwhile, Macy’s continues to spend a good amount on opex and capex. In Q2, SG&A as a percentage of revenues climbed sharply YOY by 180 bps, as previously open positions have been filled at a higher hourly wage. Capex for the year, at nearly $400 million, more than offset about $300 million in cash produced from operations, as Macy’s continues to invest in the supply chain and technology infrastructure.

On the stock

In summary, Macy’s comps and total sales have been holding up well lately, which is the silver lining in a quarter that has been otherwise quite messy, in my view. Aged inventory is an issue yet to be fully resolved, while discretionary spending could hit a bump in the road. As a result, profitability might keep on trending lower, while Macy’s continues to spend lavishly to support operations.

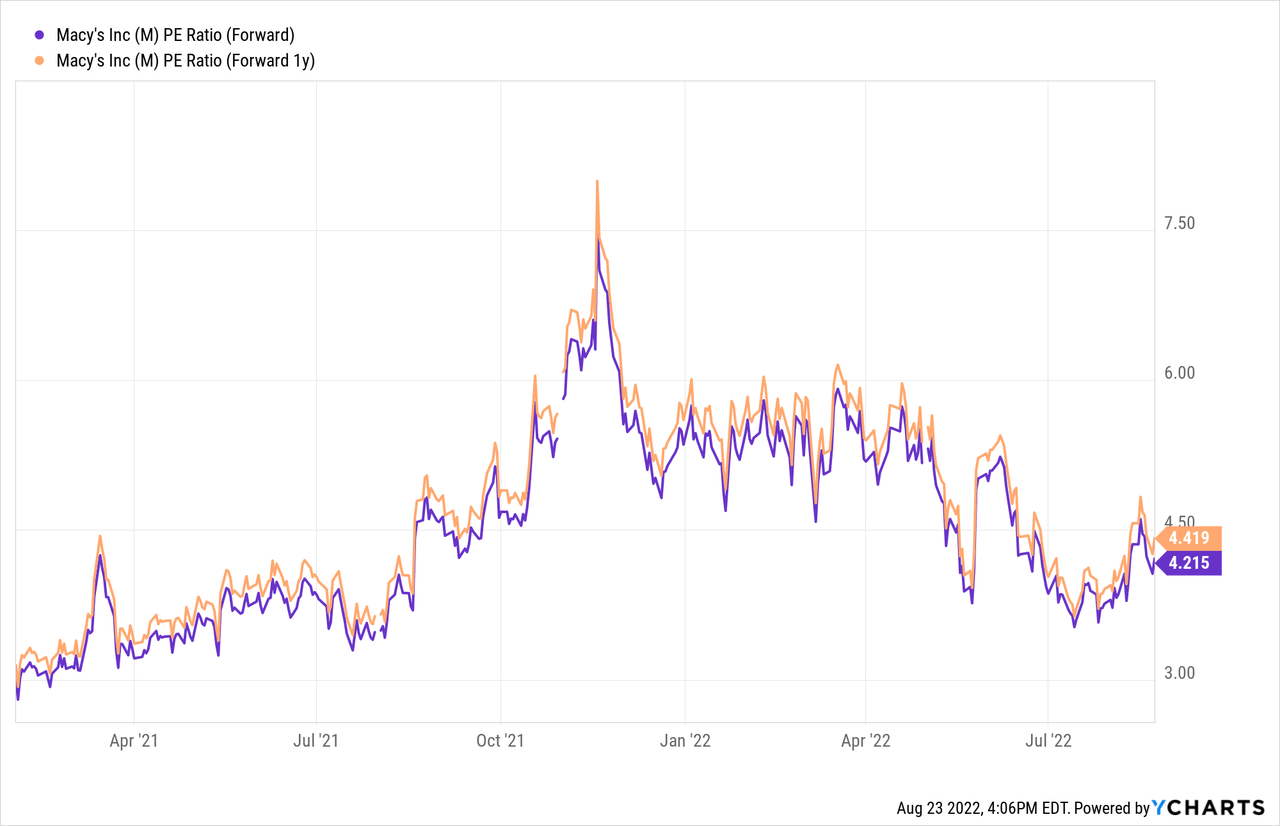

Yes, the stock is cheap, at a next-year P/E of only about 4.2 times. But as the chart above depicts, valuations for this high-risk, high-reward retail name have consistently been discounted, hardly ever climbing above the mid-single digits, probably for a very good reason. It’s not a surprise, therefore, that Macy’s stock has been so unpredictable in the past five years:

- Sky-high annualized volatility of 57%

- Best-year returns at 136% (2021)

- Worst-year returns at -38% (2019)

- Cumulative gains over the period of only 1% vs. the S&P 500’s 87%

I’m a fan of fairly predictable financial and operational performance, leading to compelling risk-adjusted returns on the stock. This is not, at all, how I would characterize Macy’s shares historically or how I would expect them to behave in the foreseeable future. Due to unpredictability, I stay away from M at the moment, maintaining a hold rating on the stock.

Be the first to comment