John Penney

Etsy (NASDAQ:ETSY) stock has been severely punished over the past year and a half due to an unfavourable narrative surrounding the company. For a long time Etsy was perceived simply as a pandemic play, however the company has demonstrated incredible resilience and has come out from the COVID crisis stronger. Down more than 63% from all time high, I believe that Etsy is in a better position now than ever and a positive risk-reward play for the long term.

Etsy is an online e-commerce completely devoted to unique or hand-crafted goods. This is a very important distinction as it differentiates the company from the other Amazons (AMZN) of the world as Etsy, like the products sold on its platform, is somewhat unique. The company generates revenue in two ways: Marketplace Revenue, which Etsy earns through fees charged to sellers for listing items or processing orders and payments; and Services Revenue, which are optional services that the company offers to sellers such as advertising, shipping labels and other. It’s a relatively easy to understand business, which primarily benefits when the number of transactions on the platform improves, as well as the total value of the money spent on the platform by buyers (Gross Merchandise Sales, or “GMS”).

Despite generating all of its growth pretty much organically, over the last few years Etsy also pulled the trigger on a couple of acquisitions that managed to improve the business moat. In 2019 Etsy completed the acquisition of Reverb for $275 million, an online marketplace focused specifically on new, used as well as vintage musical instruments. In 2021 the company actually acquired two other platforms devoted to e-commerce: Elo7, the so-called “Etsy of Brazil,” for $217 million and Depop for about $1 billion, an online e-commerce based in the US focused on second-hand clothes where over 90% of its 30 million users are under 26 years old.

I am a happy shareholder of Etsy despite the massive stock price decline. The company is operating very well and has recently posted its Q2 2022 results which were also positive. I am going to show my thesis on Etsy and why I believe it is a very promising long-term play.

Etsy is now stronger thanks to the pandemic

Etsy has released its latest earnings report on July 27. The market reacted positively, with the stock rallying in the following weeks to a high of about $120. In recent days however the stock lost some ground and is now down about 10% from that point. Could this be an opportunity to scoop up some shares on a discount? Let’s dive deep on the company’s results.

Etsy posted revenue of $585 million, up 10.6% y/y and beating consensus by about $29 million. On the bottom-line Etsy also posted a net income of $73.1 million, down from $98.3 million posted in the same period a year ago. The picture is even better on a Free Cash Flow basis as the company reported about $123 million of FCF for the quarter. Quite a rosy picture overall.

Even more impressively, the company managed to grow revenue about 10% while the GMS growth YoY was actually marginally down (-0.4%). This means that while the overall value of everything sold on Etsy stayed basically the same, the company managed to generate higher revenue. The main reason why Etsy was able to do so is because the company in April 2022 raised the transaction fee charged on the platform from 5% to 6.5%. At the time this decision actually sparked some protests among sellers: few of them halted any sale on the platform for a week to protest against the fee increase. Nevertheless, Etsy’s performance suggests that it managed to exercise some pricing power while also retaining its sellers.

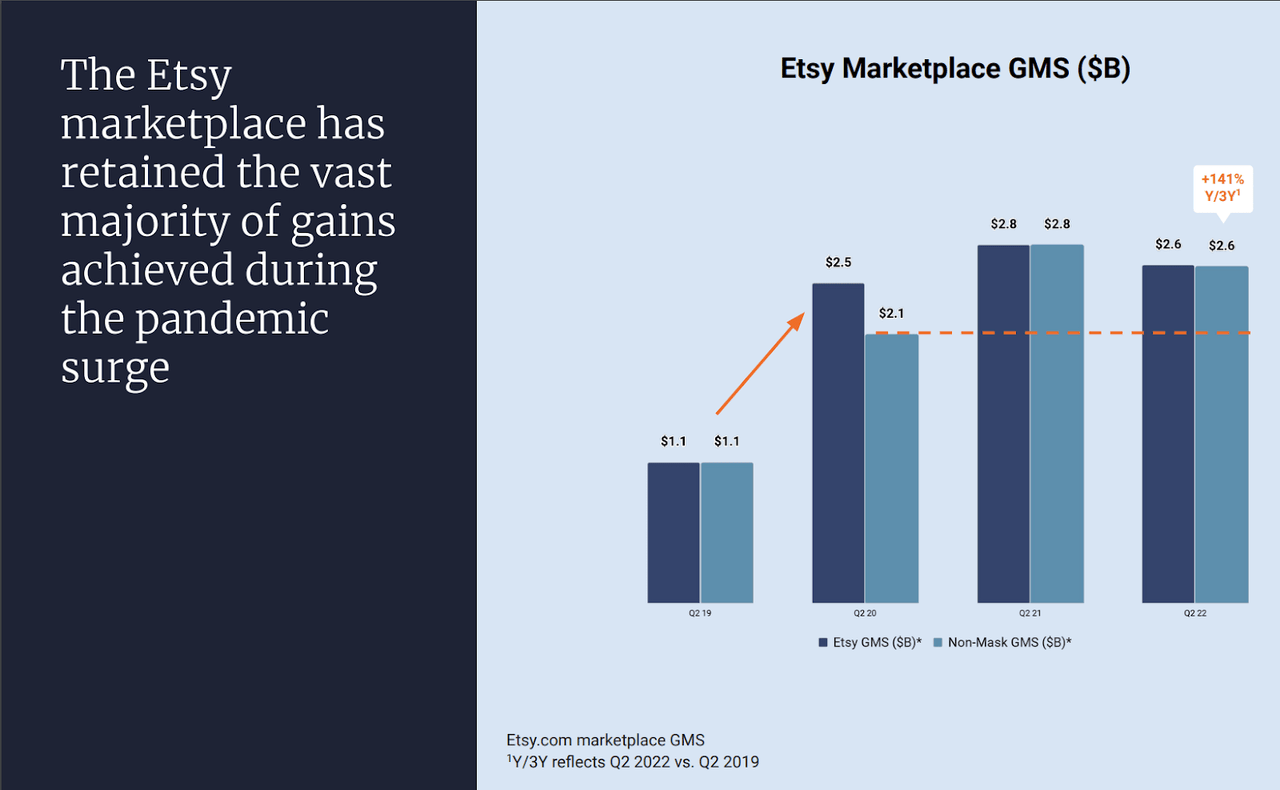

The pandemic has also proven to be a resilient boon for Etsy’s overall performance. The general narrative surrounding Etsy when the lockdowns were starting to be imposed was that it was a pure pandemic play that was destined to deflate once the people stopped purchasing masks. In reality Etsy has proven that it was able to retain almost all the customers that were acquired during the COVID crises in 2020, even those that inevitably visited Etsy for the first time simply to buy a mask. The following graph shows the difference between Etsy’s total GMS and Non-Mask GMS in 2020, and how the difference between the two reduced pretty much to zero already in 2021. Moreover, the churn of customers during the past couple of years has been overall negligible. This is an astounding result that speaks volume on how Etsy is actually improving its business moat by retaining a large portion of the buyers that manages to attract on the platform, boosting its network effect.

Etsy 2Q 2022 Earnings Report

All this good news is clearly reflected in the numbers. From 2019 to 2021 Etsy has experienced a jump in every possible metric, indicating a high quality business that is exercising operating leverage: full year Gross Margin improved from 66.88% to 71.90%, Operating Margin from 10.85% to 20% (almost double!), and Net Income Margin from 11.72% to 21.92%. Etsy’s free cash flow is also very impressive, standing at over $600 million both in 2020 and 2021. For a company that is currently trading at $13.71 billion market cap that makes it for a Price to FY2021 FCF of about 23 which seems quite reasonable.

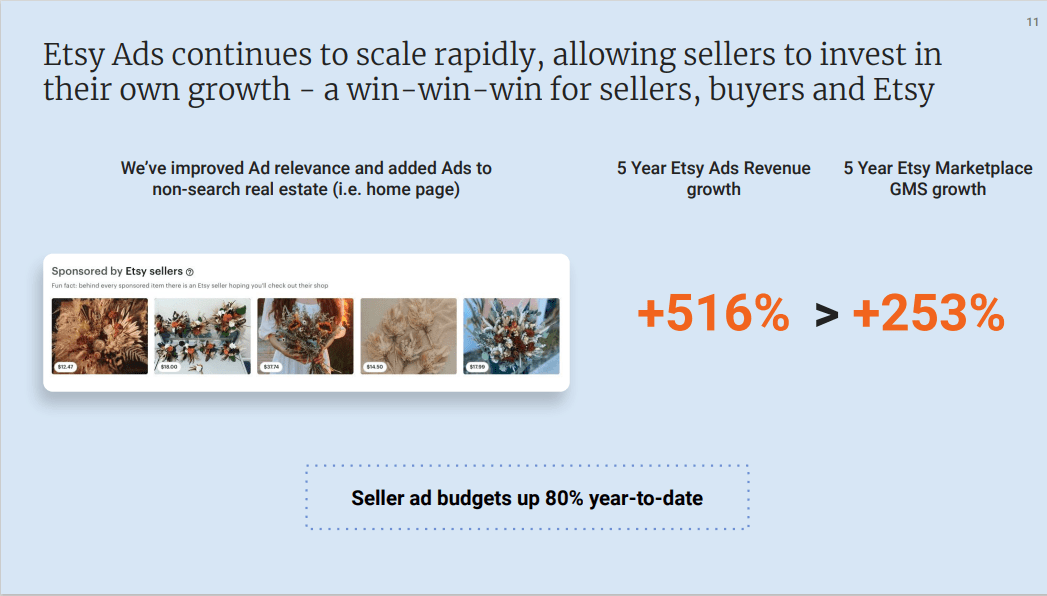

Etsy’s story however is not limited to transaction fees. Over the past few years Etsy has rolled out an increasingly meaningful advertising business that is only destined to grow. With more and more buyers coming on the platform to purchase unique products, the competition among sellers to achieve visibility will also proportionally increase. Management has noted that Etsy Ads is scaling very rapidly, having increased 516% in the past 5 years. This is an incredibly positive achievement as ads revenue is generally high margin and is a testimony of network effect in play: more buyers coming leads to more sellers coming, which in turn also brings in even more buyers. And with those there will be the need from sellers to invest some money into advertising in order to gain visibility on the platform.

Etsy 2Q 2022 Earnings Report

Temporary headwinds and potential risks

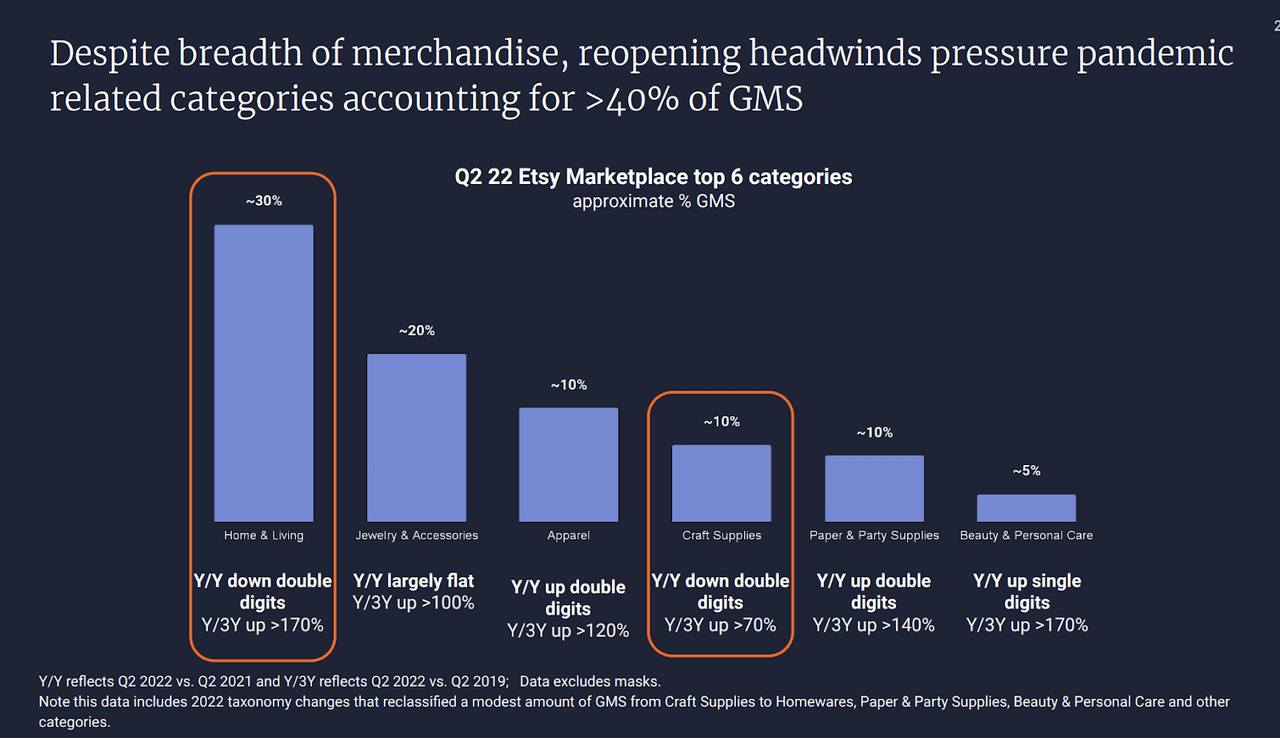

Despite the revenue increase, the drop in GMS might spook some investors. Coming out from the COVID-induced economy, Etsy is still experiencing some headwinds as highlighted in the latest presentation for the Q2 2022 Earnings Report. As shown in the graph below, management provided a breakdown of the item categories sold to highlight how 2 of the top 4 categories (Home & Living and Craft Supplies) representing more than 40% of GMS have experienced a double digits drop in overall sales compared to the same quarter last year. The reason is quickly explained as these two categories were generally on fire during the lockdowns, with many people stuck at home and mainly focused on finding new hobbies (craft supplies) or renovating their home (home & living). Needless to say that these are temporary headwinds destined to normalize and that will only serve as easier comps to beat next year.

Etsy 2Q 2022 Earnings Report

Another potential risk for the company’s long term strategy is the possibility that it won’t be able to hike the transaction fees charged to sellers without suffering more severe consequences. As mentioned before, the price increase imposed in April only sparked limited protests that did not have any material impact on the business. However, this might be an indication that the company is quickly approaching a limit to how much it can charge to sellers without experiencing meaningful churn. In my opinion however Etsy has proven that it is able to generate revenue by innovating and opening new lines of revenue such as Etsy Ads, as well as by completing acquisitions that can only expand the company’s reach and network effect.

I believe the strongest headwind at the moment is related to consumer sentiment, as the portion of consumer’s budget that will be devoted to discretionary spending could be impacted in the short term: with inflation so high at the moment, many consumers will probably tune back any unnecessary spending for the time being. If that will be the case for Etsy as well, GMS might stall or even marginally decline until inflation will be back on track. Even worse if the economy slips into a recession that could have even a more severe impact. That is a risk that cannot be ignored but that unfortunately cannot be controlled by Etsy’s management as it strictly relates to macro trends of the economy in general. Luckily Etsy is navigating this difficult environment from a position of strength: it is an asset light business generating high amounts of free cash flow, already exercising operating leverage and has carved out for itself an absolute leadership position in the hand-crafted retail market. If the worst will materialize in terms of recession and a collapse in discretionary spending, Etsy will be able to simply tune back operating expenses and still generate positive operating cash flow, thanks to the business being very asset light.

Guidance and my personal take

For the 3Q 2022 management is guiding for a GMS between $2.8 and $3.0 billion, and revenue between $540 and $575 million (9.5% increase at the midpoint of guidance). Etsy will still experience headwinds such as normalizing consumer behaviour coming out from the COVID pandemic, currency fluctuations and a potential drag on consumer’s sentiment.

Nevertheless, as explained I believe the company will be able to deliver long-term business growth regardless of the short-term economic conditions thanks to its position of strength and leadership. The stock is currently trading at a clear historical discount compared to Etsy last 5 year average: Trailing P/E of 26.32, about 55% discount; Trailing P/S of 5.83, about 41% discount; Trailing P/FCF of 24.67, about 31% of discount. Thanks to the relative discount the company seems well positioned for delivering long-term business growth which in turn should also be reflected in the stock price all things considered. I will personally take advantage of any drop in price for adding to my position until I reach my personal allocation target in my portfolio.

Be the first to comment