Andres Victorero

Apollo Commercial Real Estate Finance, Inc (NYSE:ARI) is primarily involved in commercial mortgage loans. It is a real estate investment trust (REIT) headquartered in New York, United States. ARI is involved in the strategic acquisition, management, and financing of commercial mortgage loans and subordinate loans worldwide. My thesis is primarily based on ARI’s strong dividend yield and recent financial performance. However, the recent interest rate hikes, the recessionary pressure, and the high Debt/Equity ratio are serious causes of concern for ARI. Therefore, I assign a hold rating to ARI.

12.60% Dividend Yield

Nasdaq

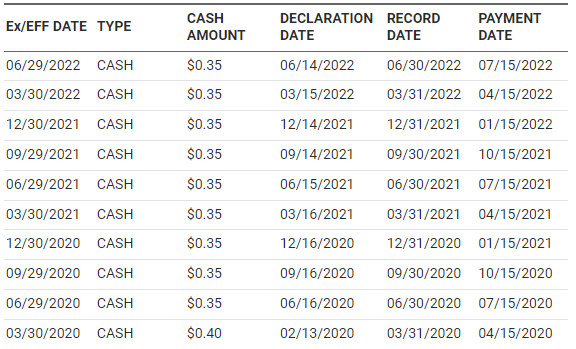

ARI has been consistent with the dividend payment in the last three years. Apart from the decline in the June quarter of 2020 from $0.40 to $0.35, ARI has been paying a steady quarterly dividend of $0.35. At the current share price of $11.10, the annualized dividend yield stands at 12.6%, with an annual dividend payout of $1.40. The dividend yield seems very attractive, given its steady history. I believe the dividend payout could increase in the future quarters given the increased loan base of the company and better diversification, providing scope for achieving the pre-covid dividend payout levels.

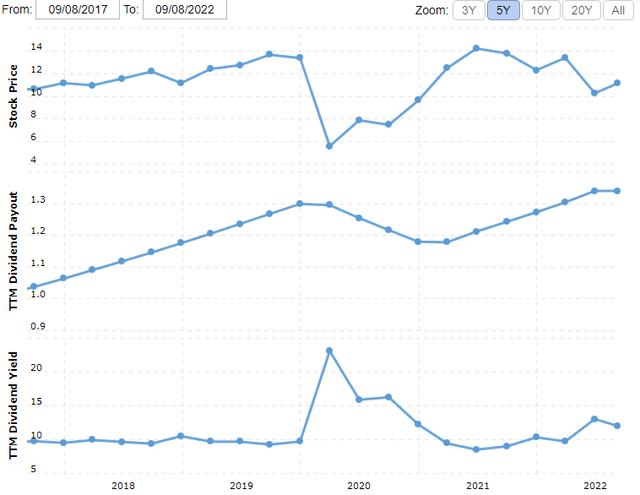

Let’s look at the stock price to dividend yield comparison. We will realize that the company has consistently had a dividend yield above 10% over the last five years, even with the drastic price flections during covid-19 and during the recovery phase after that. This makes the stock really attractive for investors looking for a solid dividend yield with a consistent return over time. However, the price fluctuations, especially after the covid-19 pandemic, raise a question about the price stability of the stock, which is a cause of concern that I believe cannot be ignored, and with the economy in recession, we can witness even greater price fluctuations.

Financial Analysis

ARI posted Q2 2022 results, beating the market EPS estimates by 9.37% and revenue estimates by 25%. The improved performance was primarily due to an increase in the interest income from commercial mortgage loans. I believe the gain from forward currency also helped in improving the company’s net income. Even though the company beat the market expectation, the performance on Y-o-Y hasn’t seen much improvement.

ARI reported interest income from commercial mortgage loans of $99.38 million, a 20% increase from $82.4 million in Q2 2021. I believe the increased loan portfolio with a better loan spread resulted in this increase. The income from subordinate loans stood at $14.5 million, a 54% decline from $31.7 million in the same quarter last year. According to my research, the shift of focus towards commercial mortgage loans was the primary reason behind this decline. The company has been expanding its commercial mortgage loan base, and it is the primary focus for the company in the coming years. The interest expenses stood at $56.5 million, a 43% increase from $39.7 million in the year’s corresponding quarter. This increase was primarily due to a general increase in loan interest rates. ARI posted total net revenue of $76 million, compared to $75.8 million in the same quarter last year. The net revenue remained flat primarily due to an exponential increase in interest expenses. I believe the interest expenses will remain higher than usual even in the coming quarters, given the increased interest rates to tackle the inflation in the US economy. The total operating expenses stood at $29.9 million, a massive 60% increase from $18.6 million in Q2 2021. The increase in the operating expenses related to the real estate owned by the company was the primary factor behind this increase. ARI reported a net income of $70.9 million, a 5% increase from $67.7 million in the same quarter the previous year. The dilute EPS was reported at $0.44, a $0.02 increase from Q2 2021 EPS of $0.42.

Stuart Rothstein, Chief Executive Officer and President ARI, commented,

The rapidly evolving economic climate had a significant effect on the real estate capital markets during the second quarter. Despite the environment, ARI’s results demonstrated we continued to effectively deploy capital and earn our common stock dividend. I am encouraged that our resilient and diversified loan portfolio can generate solid returns in uncertain markets.

The increased commercial mortgage loan base is a positive for the company, but the company needs to address the increased interest expenses. The increasing interest expense is putting pressure on the company’s profit margin. I believe the company’s profit margins might remain stressed throughout FY22 due to the interest expense pressure. ARI has not provided any guidance for FY22 but I estimate the FY22 EPS to be in the range of $1.35-$1.40 on the basis on the company’s performance in the FY22 so far.

Is ARI worth buying?

ARI has a trailing twelve-month P/E of 7.8x and a forward FY22 P/E of 8.2x with FY22 EPS estimates of $1.35. The company is trading at a lower P/E multiple compared to the industry standard of 9.9x. Also, the company has a book value of $16.17, giving us the share price/book value P/B ratio of 0.68x against the industry standard of 1.15x. Generally, the P/B ratio below 1x is considered good for REITs. However, the company has a total debt obligation of $6.8 billion and is overleveraged in terms of its Debt/Equity ratio of 3.08 compared to the industry standard of 0.65x. Therefore, even with the discount in the P/E and P/B ratio, I would advise investors not to take any buying positions in the stock due to its high Debt/Equity ratio.

Main cause of concern

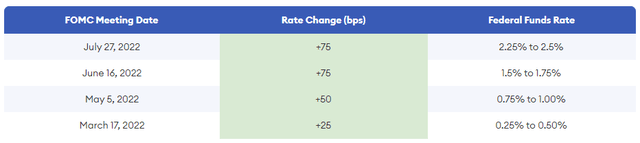

Recessionary fears amid increased borrowing rates

The commercial mortgage loan space is witnessing a slowdown amid the ongoing recession in the US economy. A recession could impact the company’s loan quality, resulting in increased NPAs. The company also has debt obligations of over $6 billion, the majority of which are secured debt arrangements. This could create a situation of overleverage for the company if the economic environment further deteriorates. The increased cost of borrowing is also a major concern for the company as it has seen an increase in the borrowing rate in the past six months. The increased cost of borrowing during the slowdown in the economy is a big negative for the company. The company has managed to control the impact of increased borrowing rate by improving the spread on the loans, but this is a risk that needs to be addressed by the management.

Bottom Line

ARI has a strong dividend yield of 12.60%, but the current financial performance of the company and its high debt obligation are a cause of concern for the company. The recession could be a major factor that could cause serious damage to the company’s future growth, and I believe the investors must remain cautious about this risk. I recommend investors hold the stock for now due to the 12.60% dividend yield, but taking any fresh positions in the stock is not advisable.

Be the first to comment