sefa ozel

Introduction To The Series: Ranking Recession Readiness

Let’s imagine a scenario where due to the Ukraine war, geopolitical tensions between Europe and Russia, and continued supply chain troubles continue to cause huge inflationary pressures, so much so that the Fed loses control of inflation, and rates are hiked up to record levels. In turn, this triggers a spiral in spending, a deep recession is triggered, debts go into distress, and businesses slash spending with the biggest layoffs since peak COVID.

Yep, we’re talking about a deep and damaging economic downturn. Maybe even a depression.

With a very real potential recession certainly on the horizon (and some pundits arguing we’re already there), I decided to take the opportunity to consider the 100 largest firms on the U.S. stock market and see if there was a way to calculate the preparedness of a firm facing a prolonged and deep-impacting economic downturn.

What I came up with was a way to calculate the relative preparedness of any group of firms to a downturn based on their balance sheet and several other metrics easily accessible on Seeking Alpha.

I do this in order to help investors prepare for a potential downturn and avoid investing in firms likely to suffer the worst through a recession.

I will be writing a series of articles on what I consider are the most (and least) prepared firms for a recession, and discuss each firm in detail with respect to the learnings from business leaders during the 2008 Great Recession.

This piece will run through in full detail my theory and calculations, and subsequent articles will address individual firms in detail, but refer back to this piece for methodology.

In this introductory piece, I will break down in detail the preparedness of Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL), a firm I consider well insulated against a recession, and look at some more detailed qualitative points that help answer the question: “Is Alphabet Prepared For A Recession?”

First, Some Research – Consider The Great Recession of 2008

In February 2017, researchers Xavier Giroud (MIT) and Holger M. Mueller (NYU Stern) published a piece in The Quarterly Journal of Economics, titled “Firm Leverage, Consumer Demand, and Employment Losses During the Great Recession.”

The piece looked at firms’ balance sheets and how susceptible they were to layoffs and closures through the recession.

In short, the research confirmed that

… establishments of more highly levered firms experienced significantly larger employment losses in response to declines in local consumer demand. These results are not driven by firms being less productive, having expanded too much prior to the Great Recession, or being generally more Prepared to fluctuations in either aggregate employment or house prices. Likewise, at the county level, we find that counties with more highly levered firms experienced significantly larger declines in employment in response to local consumer demand shocks.

I also conducted some basic research looking for advice from business leaders who were at the helm of companies throughout the recession, and how they weathered the storm.

The common themes of advice were:

-

Manage debt and deleverage before a recession hits. Further, get a line of credit beforehand when approvals are easier

-

Maintain a stockpile of cash in order to maintain the business as cash flow shrinks

-

Minimize accounts receivable, as customer’s finances may not be as firm through a recession

-

Minimize inventory levels to keep cost of holding stock down

-

Reduce overheads as much as possible but avoid layoffs, given hiring and training is expensive. Don’t survive a recession, just to be not able to afford to grow and recover.

-

Invest in CAPEX during a recession, as the opportunity cost of capital is lower and will improve efficiency.

Taking the above into consideration, we’re going to delve into the top 100 US firms and calculate their preparedness to a prolonged and deep recession, in a series called “Taking the above into consideration, we’re going to delve into the top 100 U.S. firms and calculate their preparedness to a prolonged and deep recession, in a series called “Too Big To Downsize.”

(Data & prices correct as of pre-market 13th July 2022)

(The Top 100 U.S. Firms referred to can be found on this Seeking Alpha screener)

Want to skip the articles and dive right into the data? You can download my data and calculations here and see how the Top 100 U.S. Firms compare on Recession Preparedness

The Preparedness Calculation

The metrics we’re considering are focused on 3 key areas that came from the research and advice:

Debt management, cash stockpiling and liquidity.

The metrics that we’ll be using to calculate recession preparedness are:

- Debt to Equity (Debt)

- ST Debt / Long Term Debt (Debt)

- Cash/Debt (Cash)

- Quick Ratio (Liquidity)

- Covered Ratio (Liquidity)

- FCF Margin (Cash)

- Debt to FCF (Debt)

- Current Ratio (Liquidity).

We measure these metrics in a peer analysis style against the other 99 companies that make up the top 100 U.S. firms, using percentile ranks.

Each of these metrics are assigned a weight to balance their importance in preparing a firm to face a recession. In my opinion, the most important factors are a firm’s debt levels, cash level, quick ratio (in the event a firm needs to downsize), cash flow and current debt serviceability (covered ratio).

You’ll note the Debt to FCF metric is weighted at 0%, as this is a metric I think is important to report and note, but I don’t feel it adds much weight to my calculations.

|

Metric (Calculation) |

Weight |

|

Debt to Equity (scored as a negative percentile rank) Minimum score -1, maximum score 0 |

30% |

|

ST Debt / Long Term Debt (scored as a negative percentile rank) Minimum score -1, maximum score 0 |

5% |

|

Cash/Debt (Scored as percentile rank) Minimum score 0, maximum score 1 |

20% |

|

Quick Ratio (Scored as a ratio of percentile rank / 50%) Minimum score -1, maximum score 1 |

15% |

|

Covered Ratio (Scored as a ratio of percentile rank / 50%) Minimum score -1, maximum score 1 |

10% |

|

FCF Margin (Scored as a ratio of percentile rank / 50%) Minimum score -1, maximum score 1 |

15% |

|

Debt to FCF (scored as a negative percentile rank) Minimum score 0, maximum score 1 |

0% |

|

Current Ratio (Scored as a ratio of percentile rank / 50%) Minimum score -1, maximum score 1 |

5% |

|

100% |

For clarity, the calculation “Scored as a ratio of percentile rank / 50%” is to help us identify which firms have a metric above or below the midpoint amongst its peers. For all metrics, a positive score where possible is desirable, and for debt ratio metrics, a 0 is the best possible score.

These scores then give us a weighted “Preparedness Score” with a maximum of 65%.

We then divide each firm’s score by 65% to calculate its preparedness relative to its peers in the Top 100 U.S. Firms list. A positive number means a firm is better prepared to face a recession, while a lower or negative number indicates that a firm is likely to be more sensitive to a recession.

It’s important to remember that these are relative scores and not absolute scores. So the question being asked of the data is; “How prepared is firm XYZ for a recession, compared to the rest of the top 100 US stocks?”

How Prepared Are The Top 100 Stocks For A Recession?

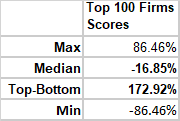

Looking at the top 100 firms, and running each one through this simple algorithm, we get an interesting look at overall preparedness for a recession.

Author

There is a weak positive correlation between market capitalization and preparedness scores (~25%), but a huge gap exists between the most prepared firms for a recession and the least prepared firms, suggesting that a downturn could have a significant impact on firms relative to each other.

So let’s start by looking at the data for internet powerhouse, Alphabet.

Alphabet’s Base Financial Health

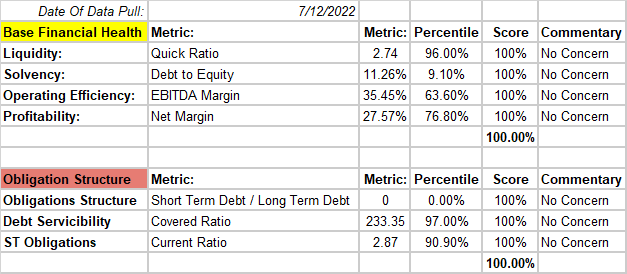

Let’s start with a brief look at Alphabet’s base financial health, and how the firm looks in a “normal” economic situation.

Looking at Alphabet’s base financial health and obligations structure, Alphabet earns perfect scores with no concerns across any of its operating metrics for a basic assessment of its health.

Author

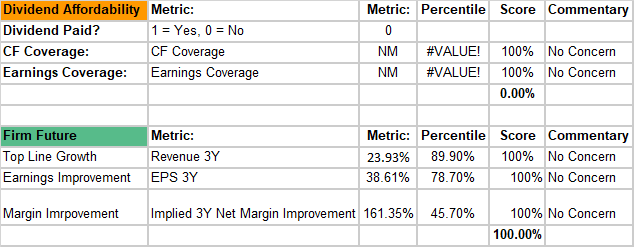

Next is dividends and financial outlooks, again, perfect score for outlook, and Alphabet doesn’t pay a dividend so nothing to worry about here.

Author

So with this perfect picture of financial health, let’s now look more closely at GOOG’s recession preparedness.

Assessing Alphabet’s Recession Preparedness

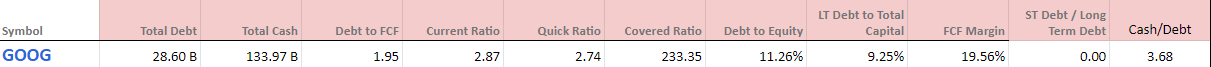

First off, let’s look at the critical balance sheet items already discussed.

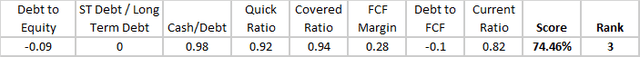

Author

Eyeballing the data, everything here looks pretty good. There’s a large debt on the balance sheet, but Alphabet is a massive firm, and this only represents ~11% of it’s equity so the debt level is very manageable, which is confirmed by the covered ratio of 233.

Free cash flow margins are strong, and the firm’s total cash balance covers the current outstanding debt 3 times over.

Let’s now apply relative scores to Alphabet’s numbers, then add weightings and see how the firm stands up.

We can see that the perfect financial health has helped Alphabet prepare its balance sheet for a recession, with a really strong score of 74.46% ranking it the third most prepared firm in the top 100.

Overall, from this view, it looks like Alphabet is well positioned to ride out any recession better than the vast majority of firms we’ve compared it to, which I suspect is thanks to superior balance sheet management.

But this is just a glancing view at the firm’s balance sheet, so to really understand how prepared Alphabet is for a recession, we need to dive a little deeper and search for both qualitative and quantitative measures not available to us in the above data.

A Deeper Dive Into Alphabet’s Preparedness

If we go back to the key themes of advice from 2008 veterans, we’ve certainly covered advice themes 1 & 2 (debt & cash management).

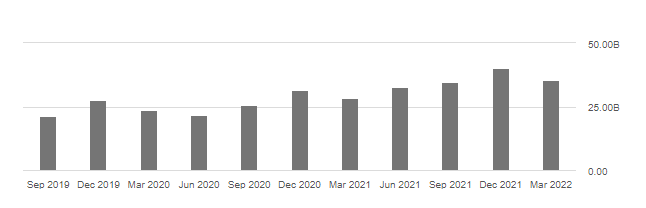

Next is looking at accounts receivable, and on a quarterly basis, Total Receivables appear to be growing, which represents a risk to the firm, though at $35.6B, this represents only 20% of total current assets and only 9% of total assets. Still a large chunk, but by no means critical.

A recession would put a portion of this current asset at risk, though Alphabet will be in a position to offer flexible terms to its customers to ensure the accounts are paid up as best as possible.

GOOG Total Accounts Receivable (Seeking Alpha)

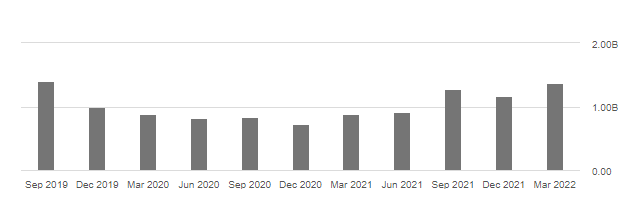

As for inventory, Alphabet already does an excellent job of minimizing inventory carried, with only $1.36B in inventory held currently (0.7% of total current assets).

GOOG Inventory (Seeking Alpha)

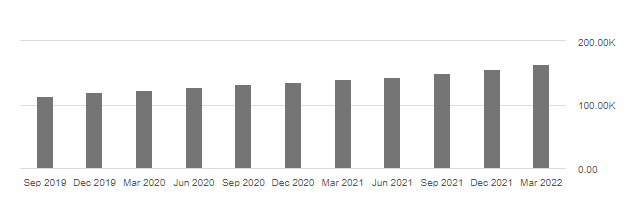

As for reducing overheads, Alphabet has been steadily growing its team, with the most recent report showing 163,906 employees at the firm.

It’s hard to say how Alphabet might cut its overheads going into a recession, but if we use revenue per employee or profit per employee as a guide to if layoffs are likely, the firm is generating ~$1.65m in revenue per employee, and $454,766 in profit per employee.

With these figures, it would take a phenomenal impact on the business in order to consider shaving the headcount given how efficiently the business can generate revenues and profit from its workforce.

GOOG Total Employees (Seeking Alpha)

The last piece of advice is probably the most difficult one to forecast and measure ahead of time, which is increasing the firm’s investment in CAPEX while the opportunity cost is lower.

Alphabet is arguably one of the most innovative companies in the world, in terms of size of investment in innovation R&D, the impact of its work and its founders have made it very clear that they have no intention of the firm becoming a “conventional company.”

I would expect that in a downturn, a firm like Alphabet would fully understand how to find new opportunities out of a recession, and be prepared to invest capital to do just that.

Closing Remarks

With a perfect score for base financial health, a 74% preparedness score relative to its peers, and great qualitative points, Alphabet is well insulated to face a recession.

Its largest risk is its accounts receivable, with $35B at risk of customers not able to repay their liabilities to Alphabet.

While I don’t intend to offer any kind of specific pricing recommendation for Alphabet based on its preparedness for a recession, I would certainly give the firm a Buy rating for investors looking for a safe harbor during a downturn, relative to the Top 100 U.S. Firms.

I hope you enjoyed this introductory piece to the series, I certainly look forward to releasing more of them in the coming days.

If you have any questions or would like to see any particular Top 100 US Firms assessed for their recession preparedness, please leave a comment and let me know (I always do my best to monitor and respond to genuine comments!).

Be the first to comment