VioletaStoimenova

RLI Corp. (NYSE:RLI) continues to deliver strong premium growth, even in segments where insurable projects could have been expected to decline like construction and marine. Pricing drives the growth still. In terms of underwriting income, it has seen YoY decline because of the pretty large-scale damage coming in from Hurricane Ian. While it is a negative event this year, the Southeast US is also one of the less served markets in terms of insurers, and events like this should keep driving the E&S specialty businesses in those markets as hurricane damage is first and foremost in people’s minds. There’s not really any sign of macro-related slowdowns yet, but we do need to watch construction in case backlogs get low and new projects start to decline.

Q3 Breakdown

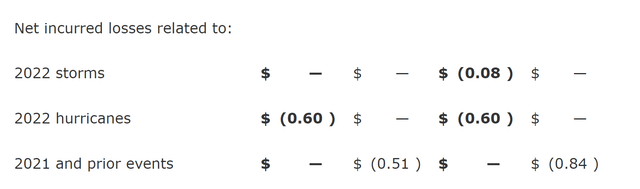

A big feature of the current quarter is Hurricane Ian damage, which made landfall in one of RLI’s major exposure areas, and also one of the higher risk areas in general. RLI specialises in covering niche risks, so South-eastern US remains one of their key markets in specialty insurance but also in property markets. Reserves grew substantially and weighed on overall underwriting profits.

Reserves (RLI PR Q3 2022)

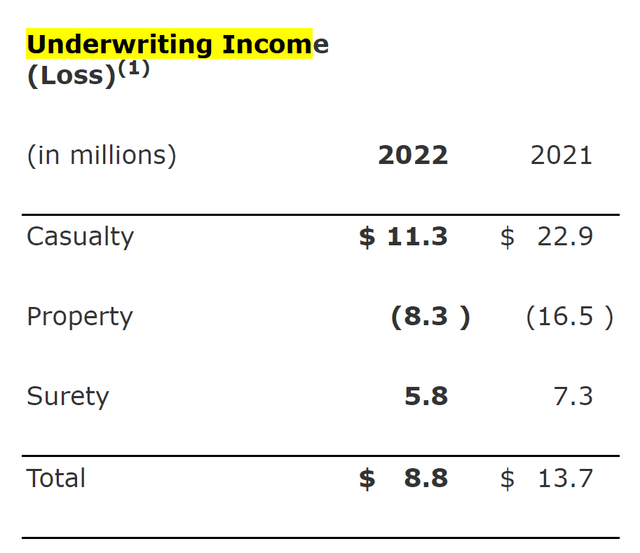

Underwriting income saw a decline from $13.7 million last year in Q3 to $8.8 million.

Underwriting Income (RLI PR Q3 2022)

The E&S segment within property still saw underwriting profit despite the pressure from hurricanes on that segment, and thanks to strength in markets like Hawaii, overall property premiums grew 40%.

Surety saw 12% premium growth as new projects still need to be insured for supply chain risks. We thought that the state of the property market might start putting pressure on this segment, but construction seems to be holding.

There are other construction facing businesses in casualty, which is up 3%, driven by strength in markets outside of the Northeast which are apparently the most competitive and are flat. The real declines are coming from the executive products and cyber risks that RLI has been scaling down for a couple of quarters now. Macro doesn’t seem to be the problem here yet.

Personal umbrella also appears to be growing at a healthy rate. Net premiums earned are still growing quickly at 15% YoY, and increases in fixed income yields are allowing for increased investment income this quarter by 19%. Maui Jim was also closed this quarter, and the investment produced a gain in excess of 10% of the company’s market cap, rocketing consolidated revenue by more than 3x. Drawing back this Maui Jim effects, operating earnings declined 10%.

Bottom Line

While hurricanes are not a one-off, exceptionally high reserves are. Moreover, periods of high damage usually spur more insurance purchases the next year, and these can be at higher rates even though the likelihood of a similarly devastating hurricane is lower. With RLI even producing underwriting income this year, claims shouldn’t be as aggressive in this segment for another year or two.

In other markets, RLI continues to grow premium and maintain discipline in tackling various markets. The Hawaiian property market is a market that RLI dominates, and marine and other specialty categories continue to be markets where capacity remains low and RLI is present. Marine grew by 25% in terms of premium growth and the team is being scaled up, with any macro effects on the goods and cargo markets not being noticed here, likely because of low insurance capacity in these markets, an open sea for RLI.

Thanks to its specialty and niche background, finding new fallow markets is something that they can consistently do. Pricing in insurance also remains positive, and things are trending in the right direction. While there isn’t sequential dividend growth, the annual levels will rise this year from last thanks to increases in past quarters in 2022, and RLI should remain a stalwart as far as dividends go. Still, RLI gets a D- on the valuation factor rating for good reasons. Earnings yields are really low, and while that implies growth that RLI is likely to produce, the multiple is at best fair.

Be the first to comment