HJBC

Amazon (NASDAQ:AMZN) is undergoing a shift in market sentiment. Okay, that could challenge being the understatement of the year. With the stock down nearly 50% and the Fed’s hawkish stance last week (despite better inflation readings), things don’t appear all that bright in the short to medium term. With Amazon far away from paying dividends, is there anything that could cushion our blows? Enter Covered Calls.

To explain Covered Calls using an elevator pitch, when using covered calls, you are agreeing to:

- sell shares (at least 100) in a stock that you own already

- sell at a future date you pick

- sell at a price you pick

- get paid a premium for doing so

Not bad. This is where Amazon’s recent stock split comes in very handy for retail investors. I mean, how many of us would have had 100 shares of Amazon at the current pre-split level of $1,740? Not many. But the number of retail investors owning 100 shares of Amazon at the post-split price of $87 will be significantly higher.

Covered calls tend to work better when executed on green days in down-trending markets. We are obviously in a choppy but still down-trending market. So, the trick is essentially to sell the covered call on a day the stock in question is in green as the strike price will be closer, netting a higher premium.

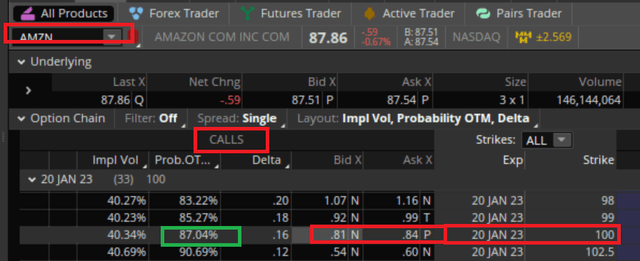

AMZN Jan. 2023 Covered Call (Think or Swim)

Although Amazon closed down on Friday, I am picking the chain above for illustration. The key items to note (highlighted in green and red boxes) are:

- We are selling a covered call on Amazon.

- Strike Price: $100.

- Expiration Date: January 20th, 2023 (Amazon is expected to report earnings on January 31st, 2023 according to Seeking Alpha. So, earnings-related volatility should not impact this trade much).

- Premium: About 80 cents per share. That means for each 100 shares of Amazon you are selling a covered call on, you get $80 in return.

Let us look at the returns and possible scenarios.

- If Amazon remains flat or below $100: The premium of about 80 cents per share represents a return of ~1% on the underlying share price of $87. Before you scoff at it, keep in mind this return is for less than a month, and repeating this over 12 months will net a nice annualized return.

- If Amazon goes above $100: The covered call writer will be forced to give up the shares in this case. This may not be too bad considering that Amazon is currently trading at $87 and selling at $100 represents a 15% return in a month. Adding the 1% for the premium, that’s a 16% return. The total return in this scenario is $100 + $0.80 – $87 = $13.80 per share, or a healthy 16%.

- What if Amazon blasts off?: This is the only flip side of using covered calls. If the underlying stock shoots through your strike price, you will be forced to sell at the strike price, denying yourself any future upside potential. However, the market predicts with an 87% probability that Amazon will be below $100 by January 20th, 2023 as shown by the green box in the image above. In addition, since I am using a monthly chain here (option expires in about a month from now), short-term technical indicators are of paramount importance. As shown in the chart below, Amazon is still heavily in downtrend. With no earnings report before expiration, a nearly 15% move within one month seems unlikely given this downtrend.

- Just in case you get called away (meaning, forced to sell 100 shares at $100), you can always sell a cash-secured put to put yourself in a position to acquire Amazon at a lower strike price.

Fundamental Outlook

There is no doubt that things look bleak for the stock in the short term, but from a long-term fundamental perspective, Amazon is far from a finished story.

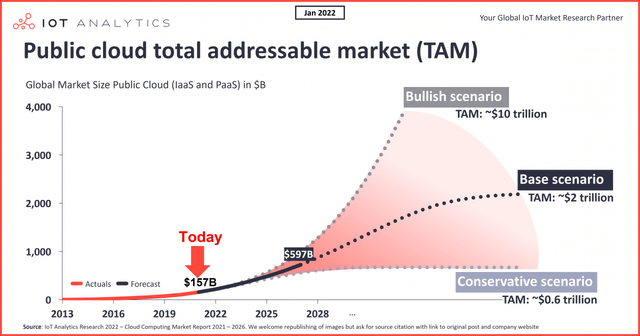

- An AWS spin-off always remains an enticing possibility, with valuations for the stand-alone company ranging from $600 Billion to more than a Trillion. AWS is still growing at more than 30%, despite headlines about “slowing” growth. The growth rate slowing down and competition catching up (or at least taking some share) are both offset by the fact that even the base-scenario Total Addressable Market (“TAM”) is still 10 folds away.

- Advertising is getting bigger by the day as covered in this article and is setting up nicely for further growth a cord-cutting is still a trend and there are not too many powerful online mediums to advertise outside of the mega caps.

- Despite recent troubles, analysts still have a median price target of $135, which represents a hefty 55% return from here. No wonder, Amazon is repeatedly making it into 2023 short-lists for a turn-around as covered here and here on Seeking Alpha.

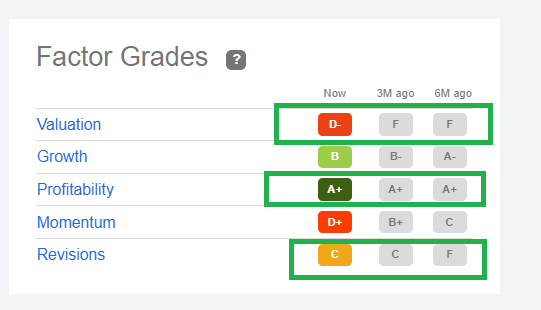

- Lastly, Seeking Alpha’s quant ratings show that Amazon is going in the right direction in the three key factors shown below: valuation, profitability, and revisions. Valuation has always been a problem with Amazon (partly due to their inclination to invest profits into the next growth avenue). Recent earnings revisions have also been a problem, with people getting more pessimistic. Both these factors are now turning a corner as highlighted below. Growth and Profitability remain strong, while momentum is clearly down, which makes your covered calls less risky.

AMZN Quant (seekingalpha.com)

Conclusion

There are no free meals in the world of investing. However, selling covered calls comes closest with pretty much no downside. You can have your cake and eat it too, although this applies even more to dividend-paying stocks. However, using the strategy above, you just created your own dividend from Amazon, a non-dividend-paying stock. If you dearly want to hold onto your shares, picking a farther strike price and settling for a lower premium is your best bet. If you don’t mind risking some, if not all, your shares getting called away, a closer strike price gets you a higher premium, which cushions your short-term blows further.

Be the first to comment