imaginima

A combination of a share price decline, together with strong financial results, have quickly corrected what we previously saw as an overvaluation in the shares of Teradyne (NASDAQ:TER). In other words, we believe the company has now caught on with its valuation, and it is now trading at a valuation that is easier to justify.

2021 was a very strong year for Teradyne, with sales growing 19% and non-GAAP earnings per share up 29%. The company continues to be well positioned in two attractive and growing markets, Semiconductor Testing and Industrial Automation. Industrial Automation in particular is firing on all cylinders, and we believe it to be the crown-jewel of Teradyne’s business portfolio.

Financials

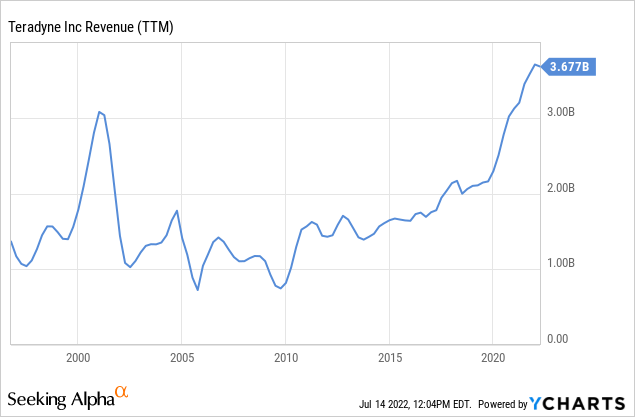

Revenue has been setting records recently, and it is impressive how much it has grown in the last ten years. However, it is important to remember that semiconductor testing equipment is mostly needed when companies are expanding production, and can therefore experience significant downturns when the industry contracts. We don’t expect a repeat of what happened to Teradyne in the 2001 recession, but it is a good reminder that the industry is cyclical. There are some arguments as to why the semiconductor industry has become less cyclical, such as the fact that applications where semiconductors are used has expanded. In any case, just remember this is an industry that used to be very cyclical and that it remains to be seen if that cyclicality has been tamed completely.

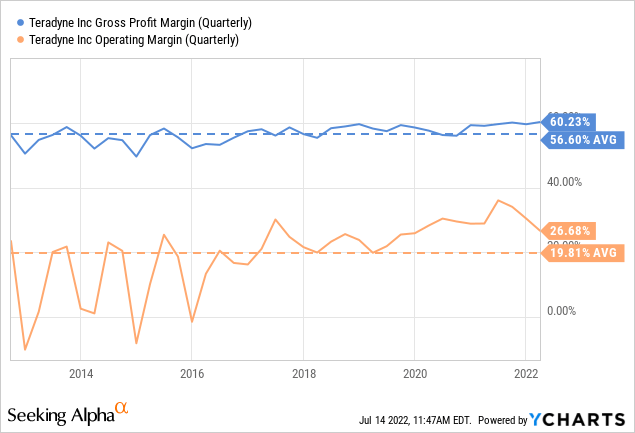

At least the last five years Teradyne’s operating margins have been a lot more stable than they used to be. For instance, in the period between 2012 and 2016 notice how many times its operating margin went below 0%. In contrast, the last 5 years the company has been able to maintain very healthy operating margins with much less cyclicality.

Growth

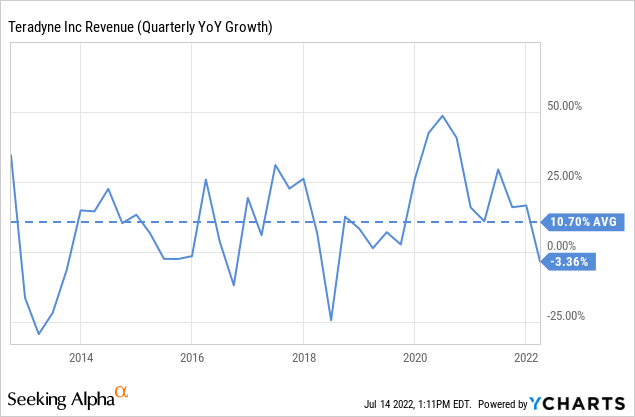

While Teradyne’s markets experience a lot of up and down swings, the general trend does seem to be that of higher average revenues.

For instance, over the last ten years revenue growth turned negative multiple times, but the average quarterly growth rate is more than 10%.

The Crown-Jewel: Industrial Automation

Industrial Automation is quickly becoming one of the most important businesses for Teradyne. This business grew 34% from 2020 with their Universal Robots and Mobile Industrial Robots product lines growing 41% and 42%, respectively.

Teradyne continues to expand the range of applications they serve. One exceptional example is their expansion into “cobotic” welding applications where the company finished the year with sales of more than triple the 2020 level, reaching nearly $20 million.

Teradyne expects Industrial Automation to grow nearly 40% per year through 2024 given their strong position and the tailwinds from global shortages of labor, increasing labor costs, re-shoring of supply chains, and worker safety concerns.

Balance Sheet

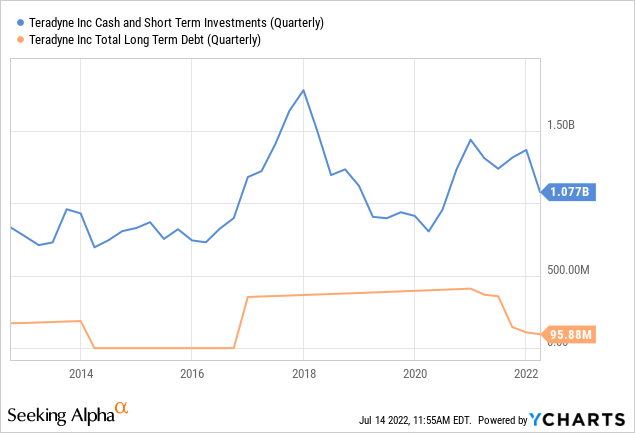

Teradyne’s balance sheet remains quite strong with over a billion in cash and short-term investments, and with only ~$95 million in long-term debt.

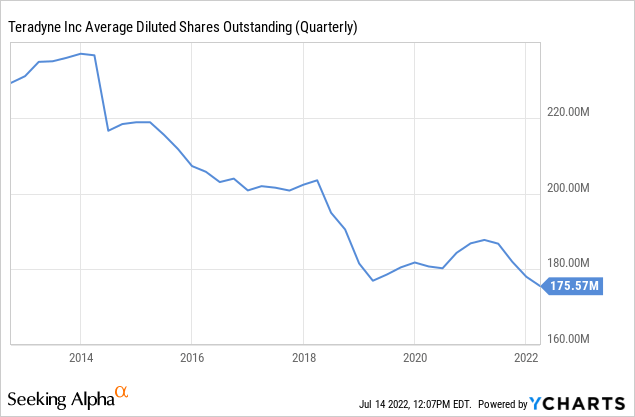

What is remarkable is that the company has managed to retain such a strong balance sheet despite spending very significant amounts of capital buying back shares. The company has bought back about a quarter of its shares in the last ten years.

Dividend & Buybacks

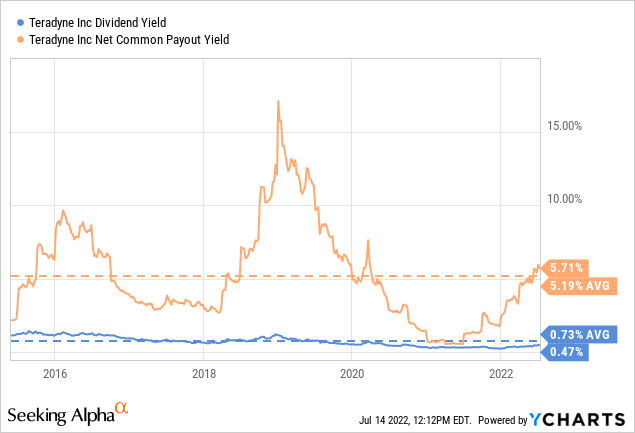

While the dividend is relatively modest, and yields less than half a percent at current prices, the net common payout yield is very significant given how aggressive Teradyne is with share repurchases. The net common payout yield currently stands at ~5.71%, which we view as an attractive yield. It appears that the company is particularly active in buying back shares when they are trading at lower valuation levels.

Valuation

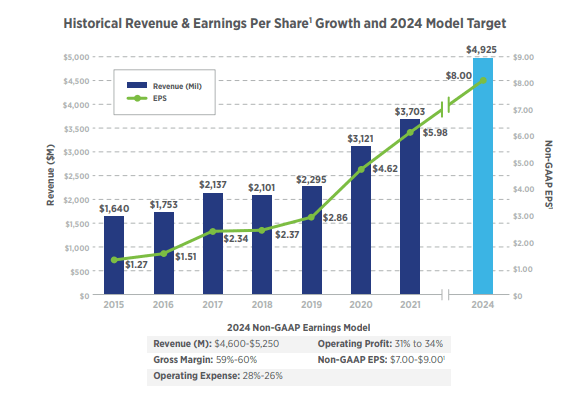

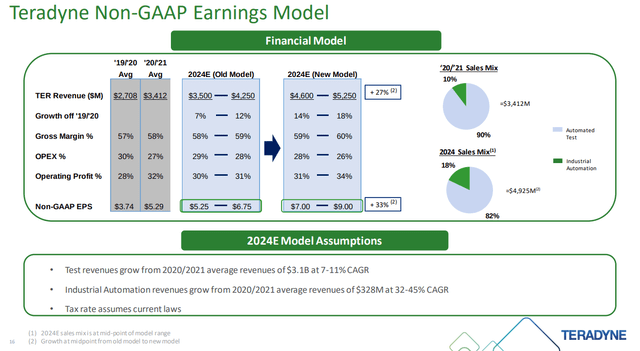

Teradyne has put forward what they call the 2024 Non-GAAP Earnings Model, which calls for Non-GAAP EPS for FY24 between $7.00 and $9.00. That gives a P/E of between 13x and 10x using the current share price, which we view as very attractive. The question then becomes whether the company can deliver these earnings.

Teradyne Annual Report

The model assumes test revenues to grow from 2020/2021 at a CAGR of 7-11%, and industrial automation to grow from 2020/2021 at a CAGR of 32-45%. These appear as reasonable assumptions and we have no reason to doubt management can deliver them if the global economy cooperates. One interesting corollary from these assumptions is that industrial automation is expected to grow from ~10% of the business to ~18% in 2024.

Teradyne Investor Presentation

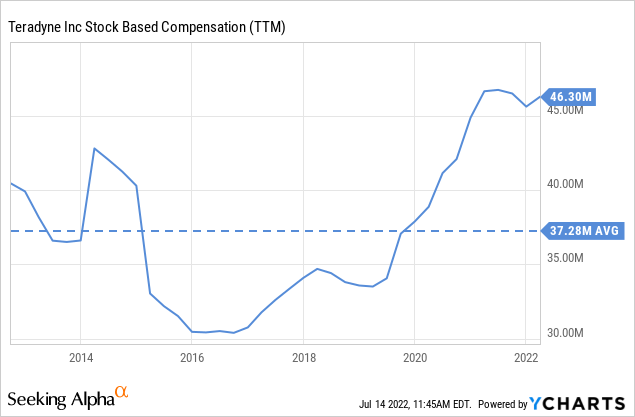

While the 2024 model is based on Non-GAAP earnings, we have to say that Teradyne appears one of the few technology companies we have analyzed to be responsible with its stock-based compensation. At less than 5% its operating profit, stock-based compensation is not as significant a factor as it is with other technology companies.

Risks

The main risk we see with an investment in Teradyne is the historical cyclicality of the industry in which it operates. However, there are reasons to believe that cyclicality has moderated as semiconductors are used in a wider range of applications. The company is also benefiting from the stability and growth of its industrial automation segment.

Conclusion

We believe that the combination of a lower share price and strong financial results have quickly improved Teradyne’s valuation. Based on the company’s 2024 Earnings Model, shares are currently trading between 10x and 13x the earnings the company estimates it can deliver by fiscal year 2024. We view these as attractive multiples, especially given the improved business mix with industrial automation becoming a more important part of the business and bringing significant growth.

Be the first to comment