Hirurg

A Quick Take On Sportradar Group AG

Sportradar Group AG (NASDAQ:SRAD) went public in September 2021, raising approximately $513 million in gross proceeds from an IPO that was priced at $27.00 per share.

The firm provides data on sporting events for betting operators and media firms.

Optimistic investors may wish to watchlist the stock for its upside potential, but for now, I’m on Hold for SRAD.

Sportradar Group Overview

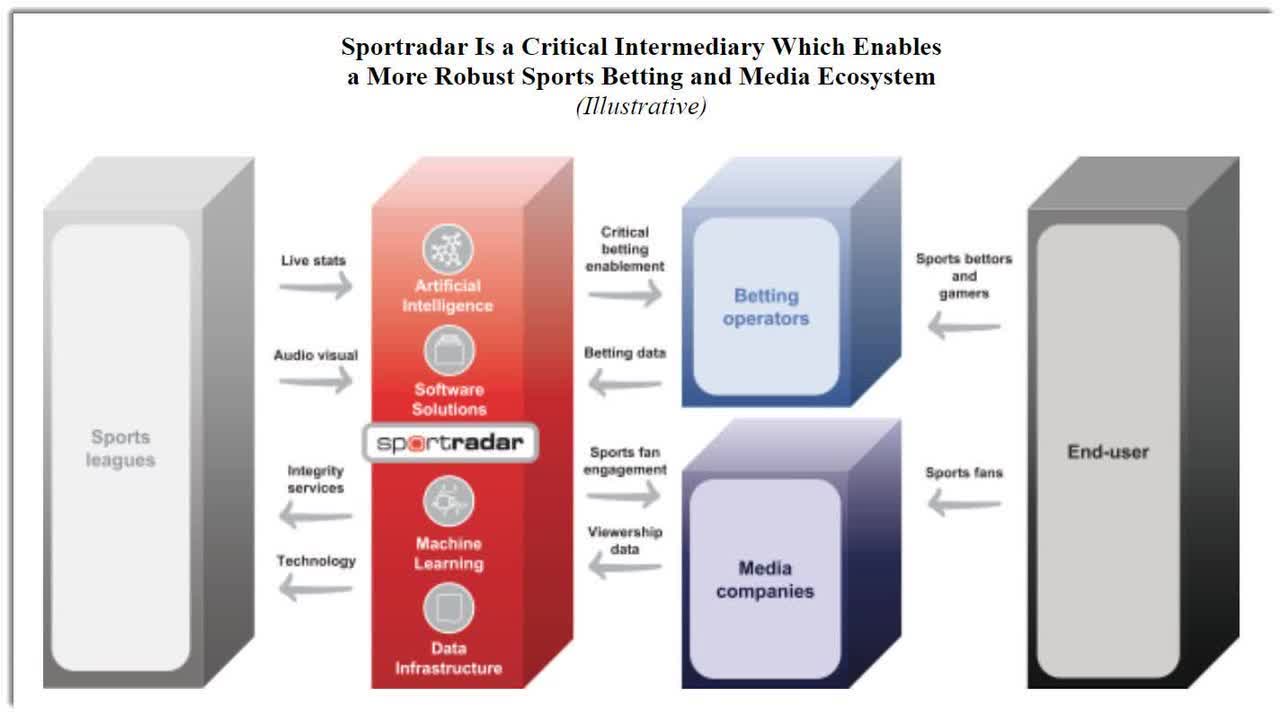

St. Gallen, Switzerland-based Sportradar was founded to create a platform to provide sports event data to betting operators and operate as an intermediary between the sports leagues, betting operators and media companies.

Management is headed by founder and CEO Carsten Koerl, who has been with the firm since inception and was previously in management positions at various software and gaming industry companies.

The firm seeks relationships with sports leagues, media companies and betting operators.

Below is a graphic showing the firm’s conception of its place in the sports ecosystem:

Sportradar Ecosystem (SEC EDGAR)

Sportradar Group’s Market & Competition

According to a 2021 market research report by Technavio, the global market for sports betting will reach $106 billion by the end of 2025.

This represents a forecast CAGR of 9.7% from 2021 to 2025.

The main drivers for this expected growth are a continued transition to digital entertainment by consumers and increased availability in some regions such as various U.S. states and Asia.

Also, the fastest growing countries for sports betting in the APAC region will be China and Australia, with all countries in the region accounting for 39% of the market growth through 2025.

Major competitive or other industry participants include:

-

Genius Sports

-

Stats Perform

-

IMGArena

-

BetConstruct

Sportradar Group’s Recent Financial Performance

-

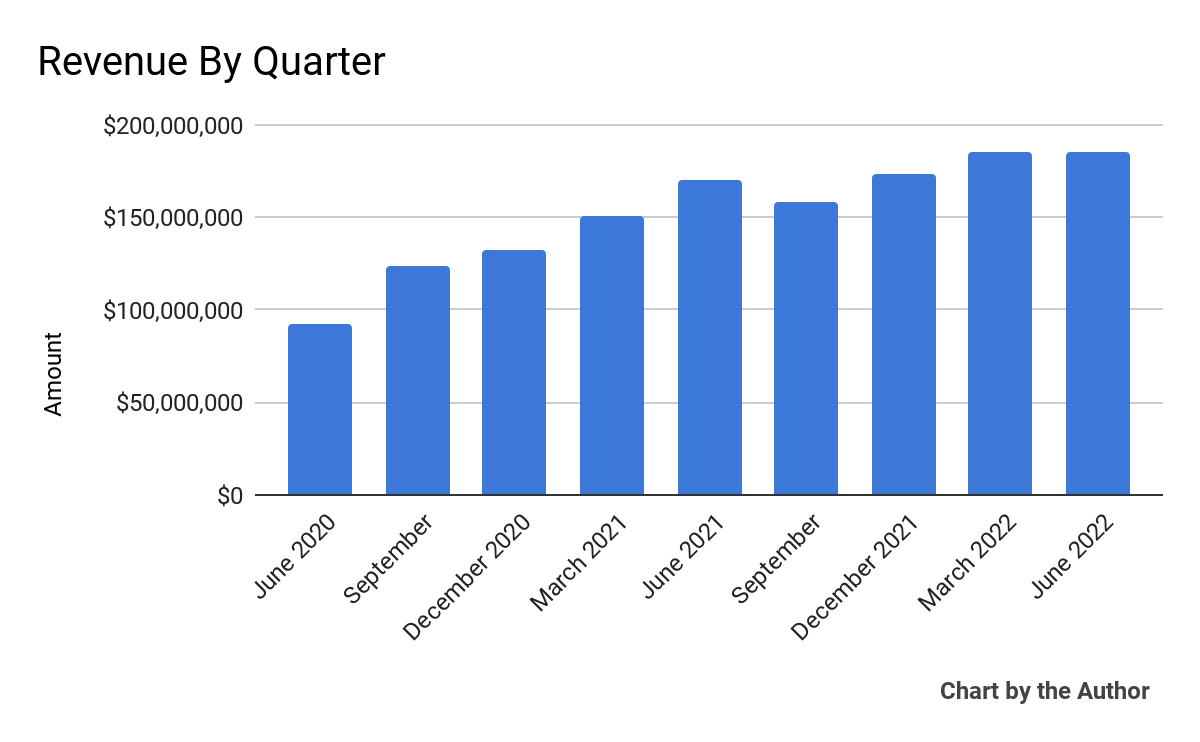

Total revenue by quarter has risen according to the following chart:

9 Quarter Total Revenue (Seeking Alpha)

-

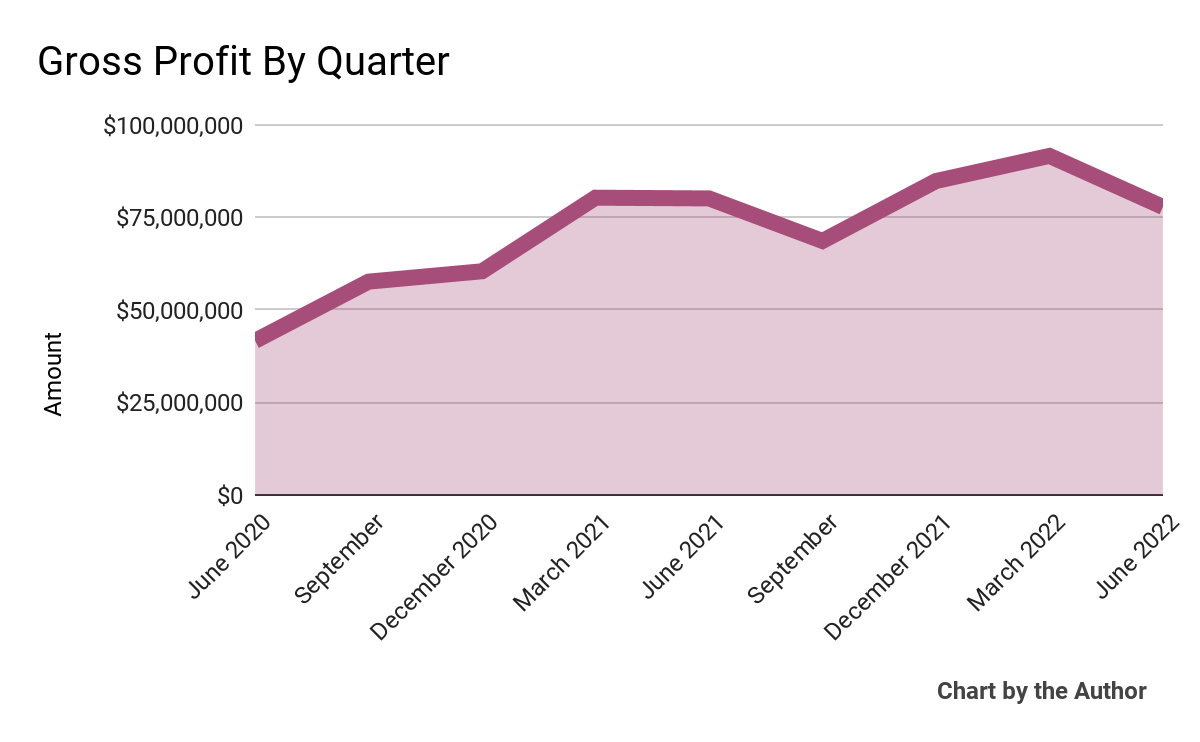

Gross profit by quarter has produced the following trajectory:

9 Quarter Gross Profit (Seeking Alpha)

-

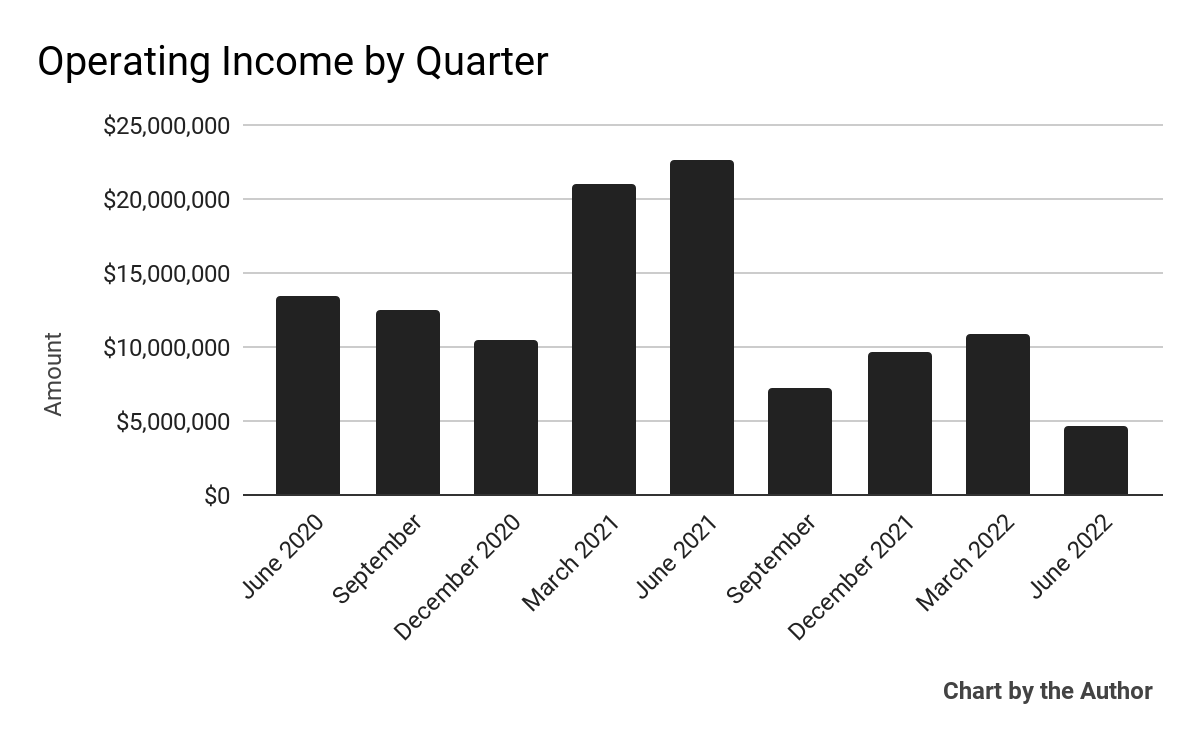

Operating income by quarter has dropped in recent quarters:

9 Quarter Operating Income (Seeking Alpha)

(All data in above charts is GAAP)

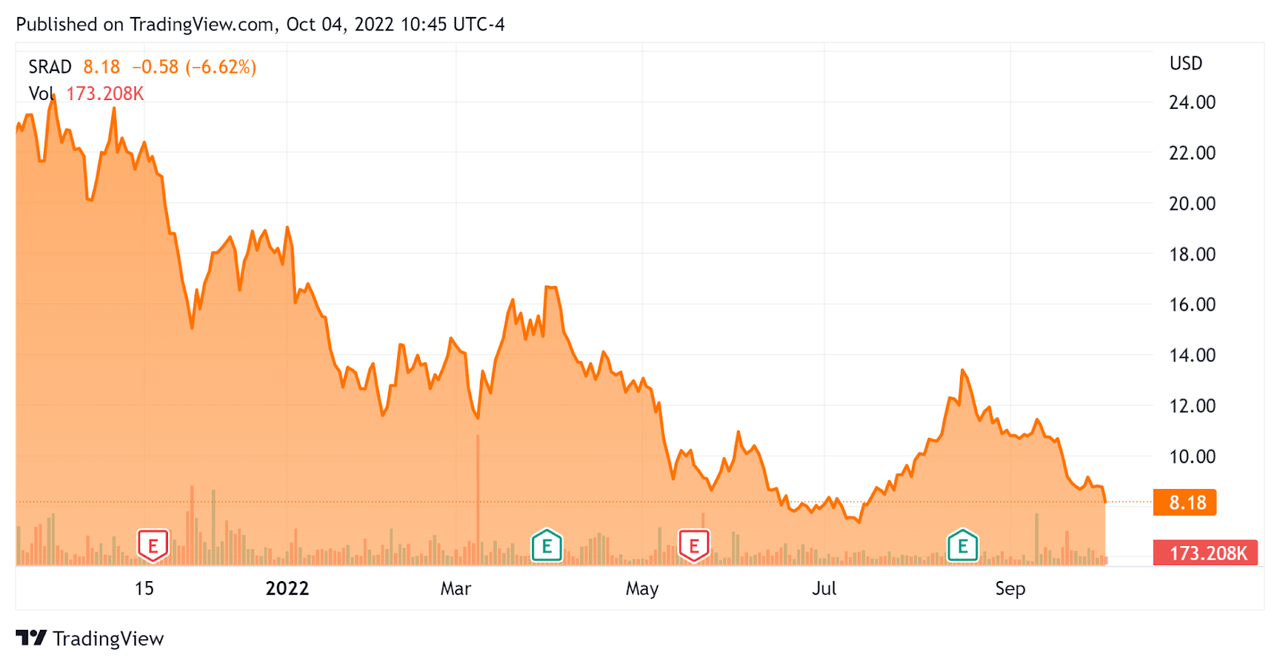

Since its IPO, SRAD’s stock price has fallen 63.8% vs. the U.S. S&P 500 index’ drop of around 12.2%, as the chart below indicates:

Stock Price Since IPO (Seeking Alpha)

Valuation And Other Metrics For Sportradar Group

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

3.51 |

|

Revenue Growth Rate |

30.7% |

|

Net Income Margin |

4.1% |

|

GAAP EBITDA % |

27.9% |

|

Market Capitalization |

$2,620,000,000 |

|

Enterprise Value |

$2,330,000,000 |

|

Operating Cash Flow |

$156,210,000 |

|

Earnings Per Share (Fully Diluted) |

$0.13 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Genius Sports (GENI); shown below is a comparison of their primary valuation metrics:

|

Metric |

Genius Sports |

Sportradar Group |

Variance |

|

Enterprise Value / Sales |

1.90 |

3.51 |

84.7% |

|

Revenue Growth Rate |

57.3% |

30.7% |

-46.5% |

|

Net Income Margin |

-54.2% |

4.1% |

–% |

|

Operating Cash Flow |

-$38,940,000 |

$156,210,000 |

–% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

SRAD’s most recent GAAP Rule of 40 calculation was 58.6% as of Q2 2022, so the firm has performed extremely well in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

30.7% |

|

GAAP EBITDA % |

27.9% |

|

Total |

58.6% |

(Source – Seeking Alpha)

Commentary On Sportradar Group

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted paying down a significant amount of its debt load while retaining a high free cash flow conversion rate.

Notably, its managed betting services revenue grew by 65% year-over-year, with management stating the firm is now ‘one of the top five bookmakers in the world, including DraftKings and FanDuel as a comparison.’

The company also announced a joint venture with Ringier to bring immersive experiences for Africa-based sports betting enthusiasts.

As to its financial results, Q2 revenue rose 23% year-over-year, with subscription revenue accounting for approximately 70% of its total revenue.

The company’s net dollar retention rate was 115% for the quarter, indicating solid product/market fit and good sales & marketing efficiency.

SRAD’s Rule of 40 results have been quite impressive.

However, the company produced its lowest operating income for the last 9 quarters as the company continues to grow headcount, likely at higher compensation rates due to inflation.

For the balance sheet, the firm finished the quarter with cash and equivalents of $749.7 million and long-term debt of $449.7 million.

Over the trailing twelve months, free cash flow was an impressive $150.6 million.

Looking ahead, management raised its full year 2022 revenue guidance to 25.5% growth at the midpoint of the range versus 21.5% previously.

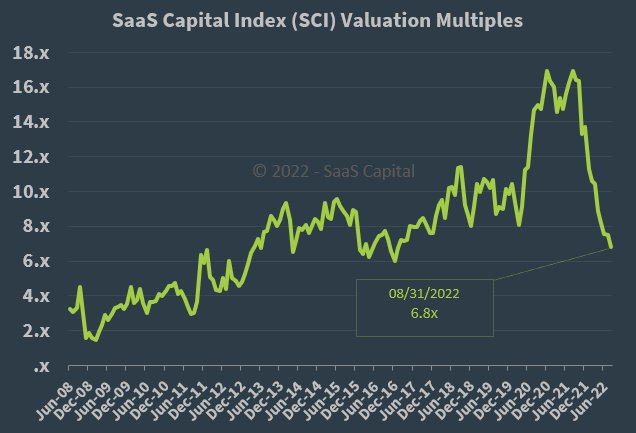

Regarding valuation, the market is valuing SRAD at an EV/Sales multiple of around 3.5x.

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 6.8x on August 31, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, SRAD is currently valued by the market at a significant discount to the broader SaaS Capital Index, at least as of August 31, 2022.

The primary risk to the company’s outlook is an increasingly likely macroeconomic slowdown or recession, which may slow consumer betting activity and reduce its revenue growth trajectory, although management believes the company is recession-resilient.

A potential upside catalyst to the stock could include a ‘short and shallow’ recession in the U.S., which represents a large and fast-growing market for SRAD.

SRAD appears to be performing relatively well as the pandemic wanes in many parts of the world and is positioning itself for further growth.

However, the stock has performed poorly despite management raising forward revenue guidance substantially.

A recent downgrade from BofA to underperform due to Europe headwinds may weigh on the stock until management can prove the company’s ability to grow EBITDA despite those challenges.

Optimistic investors may wish to watchlist the stock for its upside potential, but for now, I’m on Hold for SRAD.

Be the first to comment