JHVEPhoto

Introduction

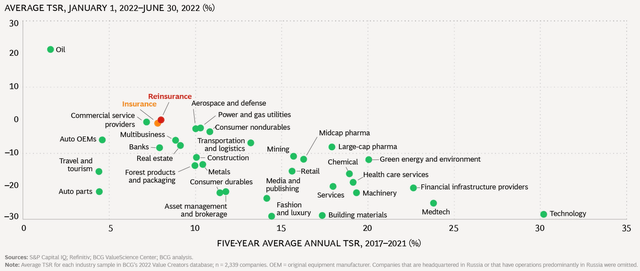

After oil stocks, reinsurance stocks have outperformed the S&P500 the most in H1 CY22. Reinsurance Group of America, Incorporated (NYSE:RGA) is a global life reinsurance specialist that is now poised to benefit from industry growth tailwinds in a post-pandemic world. The company’s niche positioning in an oligopolistic industry provides it with opportunities to gain market share. Additionally, the broad rate-hike-themed environment can also act as a favorable tailwind to the firm’s investment yields.

I anticipate a P/E multiple upgrade for the stock in the coming quarters as RGA proves a sustained rebound in its operating profitability. My valuation shows a 17% upside in the stock, which I deem to be quite healthy in the current bear market environment. The price and volume charts also seem to indicate that the outperformance of reinsurance and RGA over the S&P 500 will continue.

Industry Brief

We all know reinsurers insure insurers. But why? Can the insurers not insure themselves completely? The answer lies in a fundamental distinction between insurance and reinsurance business models:

- Insurers are typically B2C facing. So they generally have to cater to many customers, and an extensive on-the-ground sales and distribution workforce is usually a core success requirement. To fund these extensive operations, insurers need to free up capital.

- Reinsurers are typically B2B facing. They have relatively fewer customers to cater towards and large on-the-ground sales and distribution forces are usually not required to the same extent. This allows for specialization and spare capacity for greater risk-taking on their insurance books. This is precisely the value proposition reinsurers present to insurers to alleviate the latter’s capacity constraints and underwrite the more complicated risks, enabling them to run operations more smoothly.

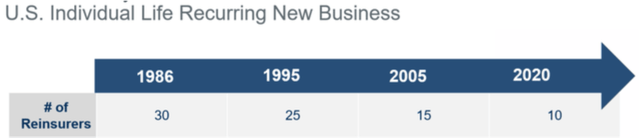

- Reinsurance as an industry is more consolidated and oligopolistic, thus granting greater scale advantages to incumbents. For example, over almost 35 years, the U.S. life reinsurance industry’s competitive intensity has changed from 30 reinsurers to 10:

US Individual Life Recurring New Business (Munich Re, Society of Actuaries)

Reinsurance currently looks very attractive because it has been a quiet outperformer in the U.S. stock markets for the first half of this year. In fact, a recent BCG report shows that reinsurance as a sector has outperformed every other sector except oil from a total shareholder returns (TSR) perspective:

Business Brief

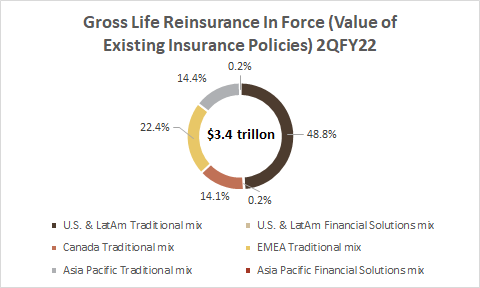

RGA is in the business of life reinsurance, with almost $3.4 trillion of value in existing reinsurance policies.

Gross Life Reinsurance in Force (Company Filings, Own Analysis)

The company has a long tenure, having been founded in 1973. It services insurance clients worldwide, with the majority of its business coming from the U.S. Regarding service lines, the company sells traditional life reinsurance solutions but also finance restructuring solutions to help its clients manage and design their portfolios specific to their unique exposure, duration, and risk needs.

Globally, RGA is the world’s second or third largest life reinsurer, typically behind Munich Re and Swiss Re (OTCPK:SSREY). Unlike the other two insurance giants, RGA is a life reinsurance specialist; it does not have meaningful business in other lines of reinsurance.

The global life reinsurance industry has grown at a paltry 4% CAGR over the last 34 years. However, more recently, new structural drivers for the industry have helped the industry clock in growth rates in the high single digits to low teens. RGA is now well-positioned to capture industry-wide growth opportunities as it emerges out of the pandemic shocks.

Why is RGA a Good Play?

I think RGA is a good buy due to three key opinions I hold:

- RGA will grow faster than the industry as it captures a premium share of demand tailwinds

- Strong operating momentum will continue as the world moves past the pandemic

- Interest rate hikes can boost investment income

Let’s explore each view in depth:

RGA will grow faster than the industry as it captures a premium share of demand tailwinds

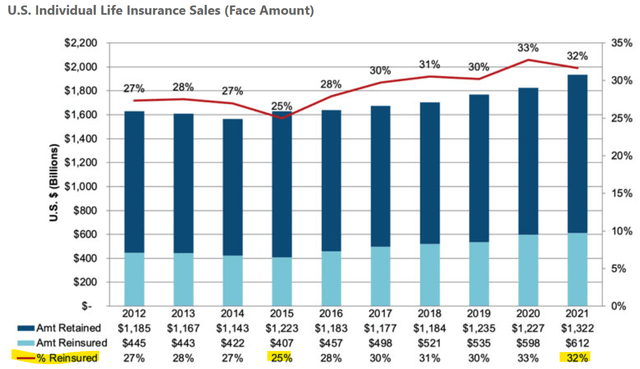

The life reinsurance industry has been seeing a steady uptick in reinsurance coverage rates over the past few years in both the U.S….

US Individual Life Reinsurance Penetration (Society of Actuaries)

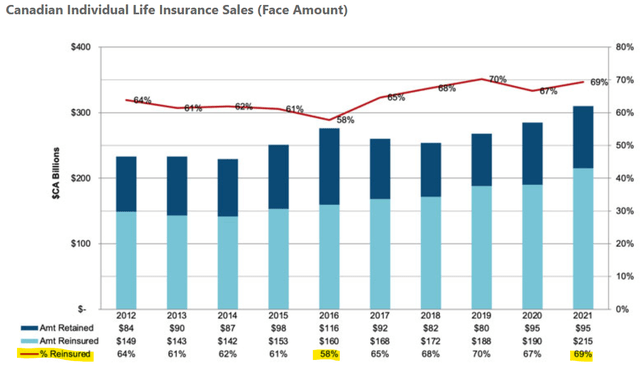

… and in Canada:

Canada Individual Life Reinsurance Penetration (Society of Actuaries)

RGA’s management commentary suggests a structural increase in life reinsurance demand now compared to two years ago, before the pandemic. In the company’s Q1 FY22 earnings call, CEO Anna Manning noted that she expects increased reinsurance demand and penetration driven by accelerated digital underwriting efforts and increased awareness of RGA’s expertise.

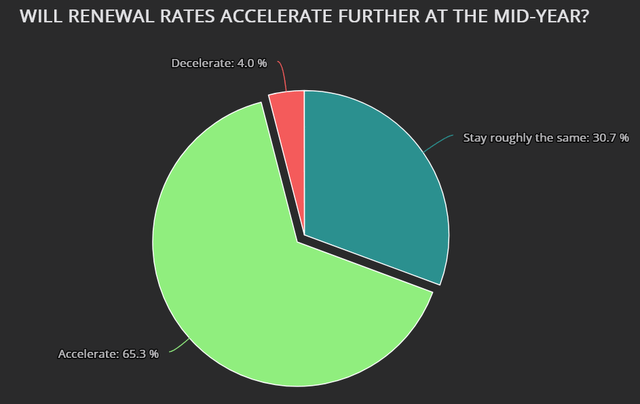

More recently, a reinsurance industry survey of hundreds of industry participants held by Artemis had only 4% of respondents expect a deceleration in reinsurance renewal rates for the mid-year 2022:

Reinsurance Renewal Rates Survey (Artemis BM)

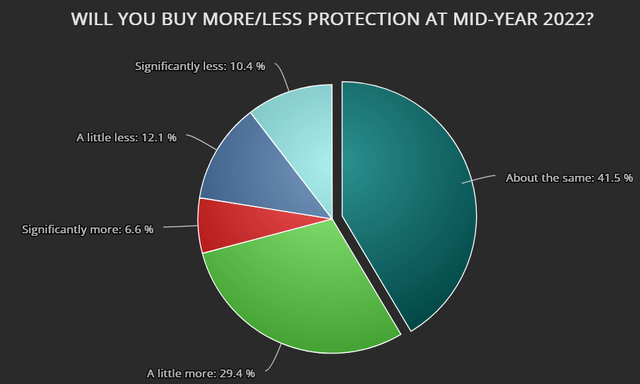

Additionally, 77.5% of survey respondents indicated that they would maintain or increase the amount of reinsurance protection they would buy:

Reinsurance Protection Spends Survey (Artemis BM)

In the Q2 FY22 earnings call, Manning highlighted two more long-term growth opportunities. First, insurance clients are leaning towards more capital-light models, thus offloading more risk to reinsurers. Second, there is increased demand for longevity-related pension risk transfers, wherein corporates are looking to reduce the risks of having to pay out pensions for longer as people live longer. Reinsurers are beneficiaries here as they will gladly take on this risk for a fee.

RGA’s management also called out a strong uptick in activity in the company’s US facultative business line. This is a less competitive subsegment of the market, with higher entry barriers implying a competitive advantage that grants RGA access to relatively exclusive growth opportunities.

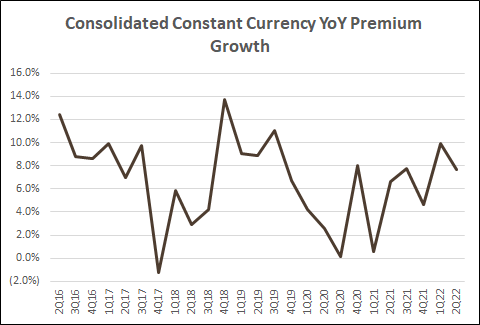

In the Q2 FY22 earnings call, CFO Todd Cory Larson reiterated that mid to high single-digit premiums growth continues to be achievable. As of Q2 FY22, the company has clocked in an overall premiums growth of 7.7% YoY in constant currency terms:

Consolidated Constant Currency YoY Premium Growth (Company Filings, Own Analysis)

Given the many fresh growth drivers giving confidence in increased demand in a post-pandemic world, I believe YoY premiums growth going forward has a good chance to be at a low double-digit percentage. Altogether, these factors feed into my view that RGA will ride the best of the industry’s growth drivers, with good opportunities to capture relative market share.

Strong earnings momentum will continue as the world moves past the pandemic

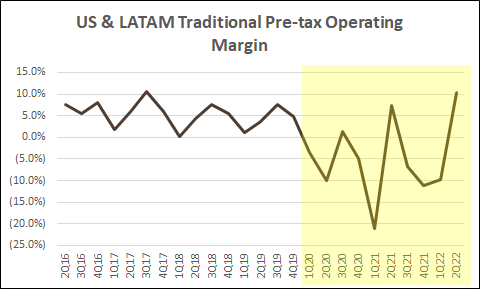

RGA has shown a profitability rebound in its major lines of business. In Q2 FY22, the U.S. & LATAM traditional reinsurance business made up more than 50% of the company’s net premiums and almost 75% of the company’s pre-tax operating income. For this geography, there has been a strong rebound in operating margins since the pandemic quarter, with a 10.3% print last quarter. This is the highest it’s been over the last five years:

US & LATAM Traditional Pre-Tax Operating Margin (Company Filings, Own Analysis)

The high performance in this segment was driven by much lower policy claims than historical norms, suggesting early signs of the company’s stronger operating discipline.

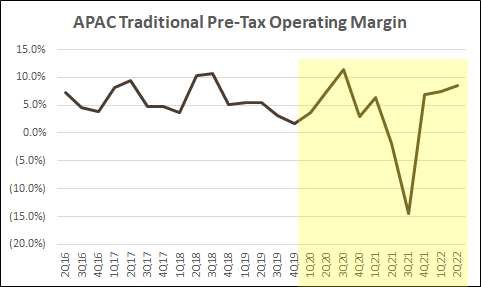

In Q2 FY22, the APAC Traditional reinsurance business made up almost 20% of the company’s net premiums and almost 23% of the company’s pre-tax operating income. Here too, after a steep decline due to higher payouts resulting from the pandemic, pre-tax operating margins have normalized to pre-pandemic levels with an 8.5% print last quarter:

APAC Traditional Pre-Tax Operating Margin (Company Filings, Own Analysis)

Management attributed this performance to favorable underwriting and new product initiatives activities that boosted profitability.

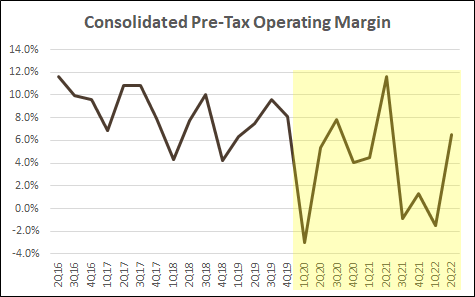

Overall, RGA’s consolidated pre-tax operating margins jumped firmly back into positive territory from -1.5% in Q1 FY22 to 6.5% in Q2 FY22:

Consolidated Pre-Tax Operating Margin (Company Filings, Own Analysis)

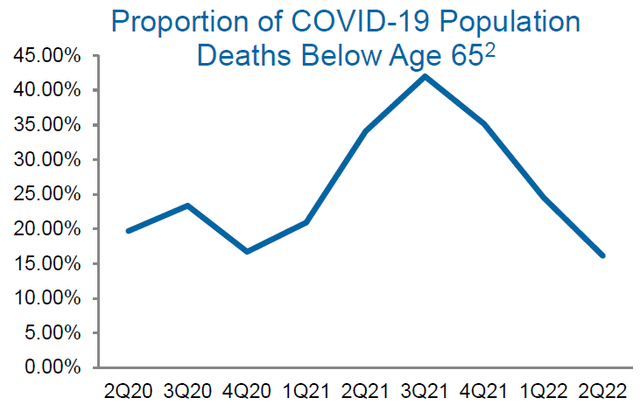

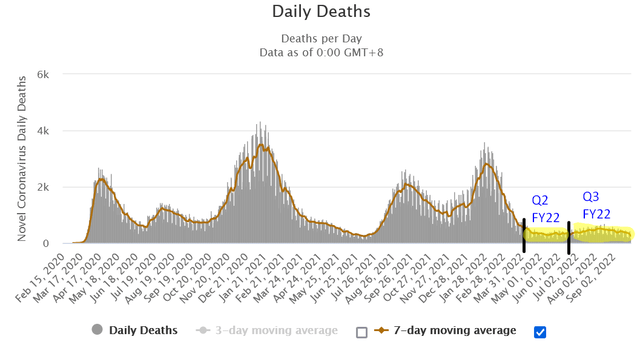

Note that in all these margin results, around 3Q FY21, pre-tax operating margins took a nosedive back into negative territory. This coincides with increasing COVID-19 mortality rates in the U.S., as they are the leading indicators of operating margin performance in these times:

US COVID-19 Mortality for ages below 65 (Company Q2 FY22 Earnings Presentation, CDC)

The good news is that COVID deaths have been trending down. Even more recently, COVID death count data for Q3 FY22 suggests similar death levels as was seen in Q2 FY22:

This suggests sustenance of pre-tax operating margins in healthy positive territory and reduced chances of yet another sharp reversal. Thus, I believe the setup is in place for RGA to continue its earnings rebound in the quarters ahead.

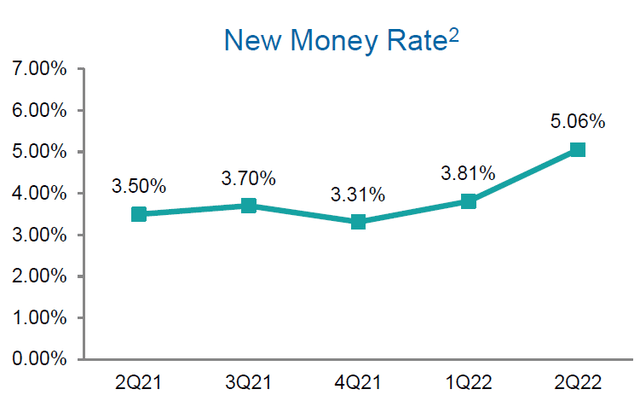

Interest rate hikes can boost investment income

RGA’s business benefits from higher interest rates. Already, the company has seen a steady uptick in new money rates, which refers to rates that are more immediately responsive to interest rate changes in the economy:

New Money Rate (Company Q2 FY22 Earnings Presentation)

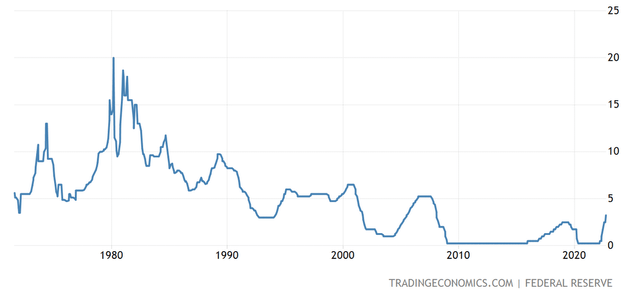

In September 2022, the Fed raised interest rates by 75bps to the 3.00% – 3.25% range to counter inflation. The chart below shows the Federal Funds Rate over time. Notice that during the high inflation period of the 1970s, interest rates hiked rapidly up to 20% and came down more gradually. This gives us a directional indication that sustained, higher interest rates can emerge.

Fed Funds Rate (Trading Economics, Federal Reserve)

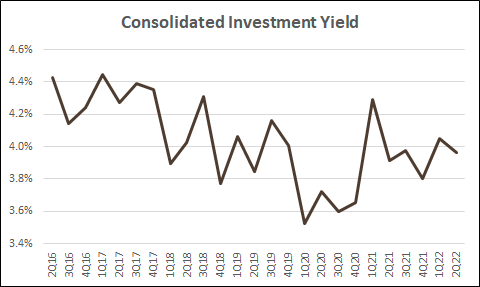

The market consensus view is that further interest rate hikes are on the cards to 4% or even 4.5% within the next year. Ultimately, if interest rates remain elevated and inflation is brought under control, RGA can benefit from a higher nominal spread above inflation. This is likely to push its investment yields higher, possibly to 6-year highs towards 5.0%:

Consolidated Investment Yield (Company Filings, Own Analysis)

Thus, if this upside scenario to interest rates plays out, RGA may benefit from higher investment yields and hence income.

Valuation

Looking at the historical trading multiples range, RGA is currently trading at a 1-year forward P/E of 8.9x, which corresponds to a 12.5% discount from its long-term average of 10.1x:

Reinsurance Group of America PE (Capital IQ)

Considering the aforementioned business driver tailwinds, I believe RGA is due for a valuation multiple upgrade. I anticipate that if the next quarter’s results show sustained pre-tax operating profitability, the stock would elevate to a higher multiple. Therefore, I am assuming RGA deserves a 10% premium above its long-term average price. This corresponds to a multiple of 11.2x.

Combining this with FY23 consensus EPS forecasts of $13.19, the implied valuation I get is $147.12, which is 16.9% higher than the current share price of $125.81. Given the overall bearish market conditions currently, I think this upside is very attractive.

Technical Analysis

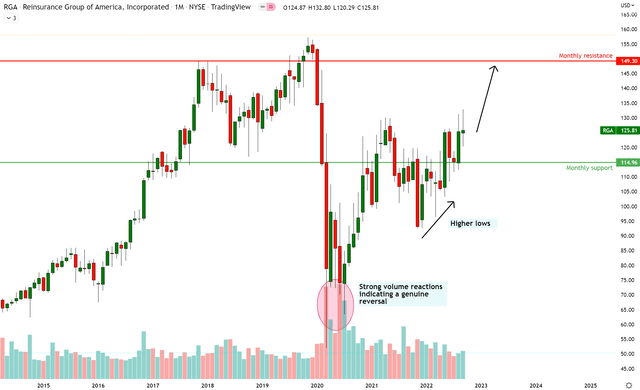

RGA Technical Analysis (TradingView, Own Analysis)

RGA is holding above monthly support at $114.96. Importantly, the overall origin of this current price swing is accompanied by a sharp reversal and higher volumes in early 2020, indicating a genuine reversal. I believe the price is headed towards monthly resistance at $149.30.

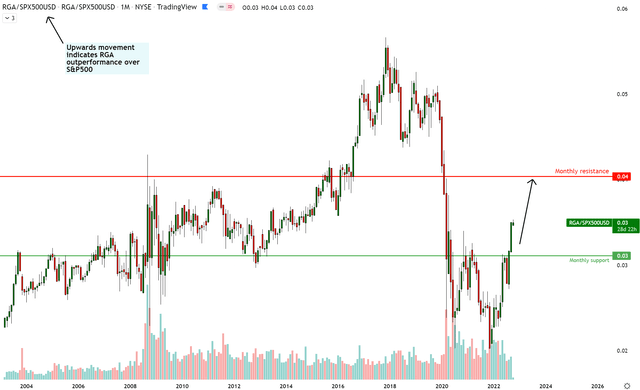

As usual, I measure my performance based more on alpha over the S&P 500. To do this, I assess the relative attractiveness of RGA by analyzing the RGA/S&P 500 ratio spread:

RGA vs S&P500 Technical Analysis (TradingView, Own Analysis)

The price action shows an emerging uptrend on the monthly RGA vs. S&P 500 chart. I anticipate price to make its way towards the next key area of monthly sell liquidity over the next few months and quarters. I will exit my positions and book the alpha if the price of this ratio spread hits the monthly resistance. Depending on how the price action evolves, I may exit my positions in RGA sooner before it reaches the monthly resistance as well. In any case, I will keep you updated.

Key Risks and Monitorable Items

COVID mortality is clearly a key monitorable statistic since the company is yet to sustain its pre-tax operating margins back into profitable territory for multiple quarters. Based on the CDC data discussed earlier, Q3 FY22 statistics seem promising as they did not report an upwards spike in COVID deaths.

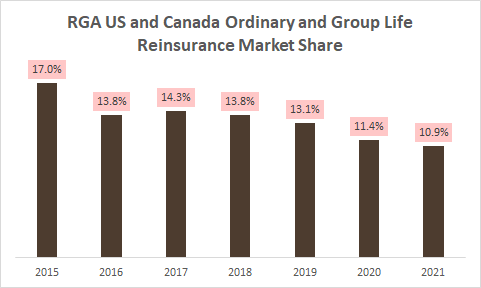

Another monitorable item is RGA’s market share. According to the Society of Actuaries’ Life Reinsurance surveys, RGA’s market share has been declining over the years in the US and Canada:

RGA’s Market Share (Society of Actuaries Surveys, Own Analysis)

These market share erosions for RGA have benefited Munich Re and Canada Life, which have gained market share. On the other hand, the RGA company management’s commentary is upbeat and, in some cases, suggests a relative gain in share. It remains to be seen whether this narrative holds true. Hence, I will be tracking relative market shares very closely as well to constantly assess if the above industry-growth part of my thesis is playing out.

Summary and Positioning

I think Reinsurance Group of America is a great way to play the quiet, overlooked, and undervalued reinsurance sector in this bear market. The stock has been consolidating for multiple months now with sideways action. Due to this, I think strong upward moves are likely to be more imminent. Hence, it may not be prudent to accumulate this position slowly over a long time, lest you miss the meat of the move. Call options structuring may be a good idea here if that’s a tool you use in your decision-making. If my thesis plays out, I look forward to seeing this stock add to my portfolio’s alpha over the S&P 500.

Be the first to comment