Wolterk/iStock Editorial via Getty Images

Few industries have taken the beating that the restaurant industry has over the past two years, seemingly caught in a tornado, with new headwinds thrown at these companies from each direction. It began with traffic declines (COVID-19) and was followed up by higher commodity costs and an exodus of workers from the industry. Now, restaurants must try and navigate the difficulties of holding the line on margins while still offering value to a weaker consumer. Fortunately, Papa John’s (NASDAQ:PZZA) has held its ground and has actually thrived among the storm, putting up another blowout quarter in Q1. Given its positioning as a trade-down option in a recessionary environment and its strong unit growth rates, I see it as a solid buy-the-dip candidate.

Papa John’s Menu (Company Website)

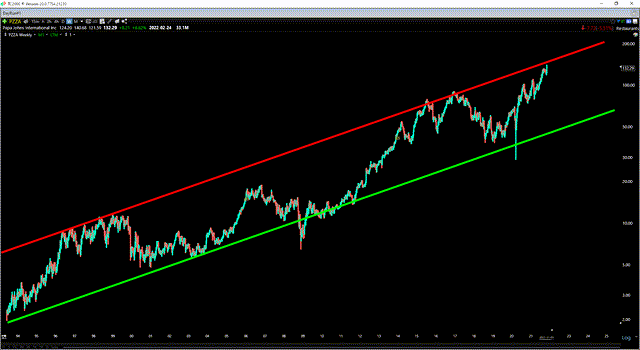

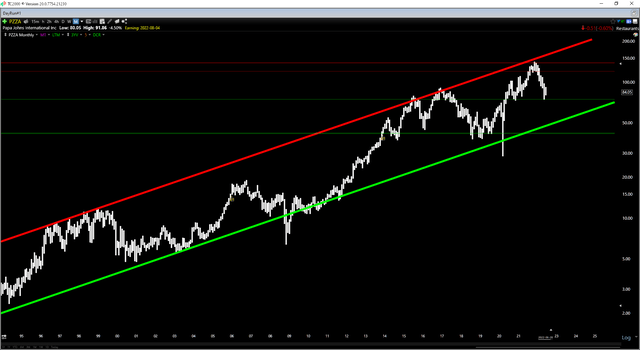

Just over six months ago, I wrote on Papa John’s, noting that the stock was trading well above its historical multiples, making it a case of growth at an unreasonable price. In fact, the stock was trading at 36x forward earnings and hugging the upper portion of its long-term channel. Since then, the stock has plunged 36%, massively underperforming the S&P 500 (SPY). In this update, we’ll look at whether this pullback has built enough of a margin of safety into the stock and, if not, where the low-risk buy zone lies. Let’s take a closer look below:

PZZA Weekly Chart – November 2021 Article (TC2000.com, Seeking Alpha Premium)

Q1 Results

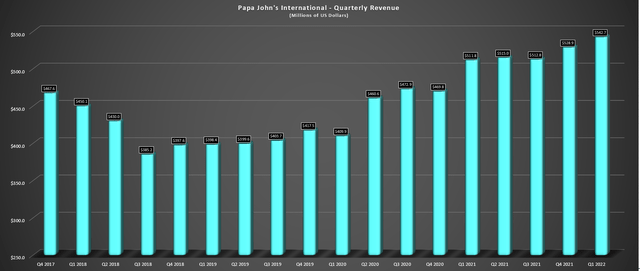

Papa John’s released its Q1 results last month, reporting quarterly revenue of $542.7 million, a 6% improvement from the year-ago period. Meanwhile, global system-wide sales improved to $1.3 billion, up just shy of 6.0%, and comp sales came in at 0.8% (International) and 1.9% (North America). While these numbers might look like they’re on the weak side, the company was lapping 20%+ comps from the year-ago period, and after adjusting for this, the sales performance was phenomenal. In fact, the company exited Q1 with a two-year stacked comp sales growth rate of 28.1% (North America) and 24.0% (International), placing it among the upper ranks of the industry from a sales standpoint.

Papa John’s – Quarterly Revenue (Company Filings, Author’s Chart)

It is important to note that the solid sales performance was helped by a 7% increase in menu prices in its company-owned stores (10% of the system) to offset inflation, with dairy prices continuing to rise at a torrid pace. However, the strong sales were also helped by continued menu innovation and a favorable mix of premium options with higher tickets, such as its Q1 launch of New York Style Crust. This new menu item offers an option for those wanting larger slices and a thinner, stretched crust, with the New York Style Crust shown below. However, the company continues to see solid momentum from previous offers, including its Epic Stuffed Crust, launched last year.

These strong results prompted Papa John’s to raise its development outlook, increasing its FY2022 outlook to 280-320 new units vs. 260-300 previously. Meanwhile, it bumped up its multi-year outlook to 8% unit growth annually from 2023-2025, giving the company one of the highest unit growth rates among its peers, assuming it can deliver on these results. So, despite the tough environment, the company is not resting on its laurels and is pushing ahead aggressively with its development plans.

New York Style Crust (Company Website)

Following quarter-end, the company launched its new Epic Pepperoni Stuffed Crust, with pepperoni and cheese stuffed into its crust. The company noted that the reception to date is promising, and this is yet another premium option that could help drive a slightly higher ticket and keep Papa’s top of mind among pizza options to help it maintain and potentially gain market share. The other benefit of this is that these limited-time offers continue to grow the loyalty base, with 150,000 members added thus far from Epic Pepperoni Stuffed Crust, which was available exclusively to loyalty members. The company’s loyalty program now sits at nearly 25 million members, which is impressive for a company of its size.

While everything was rosy on the sales side, it is worth noting that the company did have its challenges, as has the pizza category, with a lower than anticipated availability of drivers and staffing challenges. The good news is that Papa John’s leaned into third-party delivery well ahead of its peers, unlike Domino’s Pizza (DPZ), which helped pick up the slack in a tough period for staffing, exacerbated by Omicron. Obviously, these delivery-as-a-service transactions carry slightly lower margins than regular delivery (Papa’s own drivers). Still, if the company cannot fill the orders due to staffing challenges, it’s better to have incremental sales at slightly lower margins than miss the sales completely as customers are forced to order elsewhere in busy periods.

Industry-Wide Headwinds

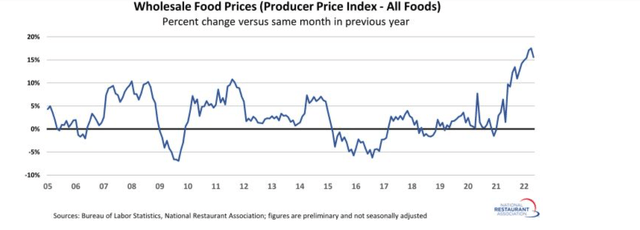

While Papa John’s has continued to navigate the staffing issue well and its Papa Call (centralized order-taking, customer service center) has freed up team members to focus on making/delivering pizza, it hasn’t been immune to cost increases. Some items seeing the most inflation have been flour, butter, and eggs, with milk and cheese also up 23% and 17% year-over-year in May. The good news is that Papa John’s is an iconic brand with pricing power that should have no issue passing on these costs. The negative news is that Papa John’s did report a slight hit to transactions, potentially making further price hikes over the short run more difficult.

Wholesale Food Prices (National Restaurant Association, BLS)

This is not a company-specific problem, and other names in the restaurant industry have the same issues and are forced to take prices to protect or at least blunt the impact of rising food/labor costs on margins. The silver lining is that Papa John’s has a relatively low ticket compared to casual dining and other options,; it could benefit from a trade-down effect as consumers see their discretionary budgets shrink due to food/gas inflation. So, while all restaurant brands are struggling in the current environment to balance attention to margins with ensuring they don’t erode visit frequency, the pizza category and quick-service are much better positioned if this pressure on consumers persists.

Finally, it’s worth noting that, at least for now, Papa John’s is not seeing a clear migration into the value segment of its menu. This is evidenced by encouraging results for premium products (New York Style Crust, Epic Pepperoni Stuffed Crust) that are priced above its average pizza and are seeing high demand. So, while it may see a slight hit from a sales standpoint from its lower-income consumers if inflationary pressures worsen, this could be partially offset by the continued solid results from its premium menu innovations helping to bump average checks higher across the system.

Earnings Trend

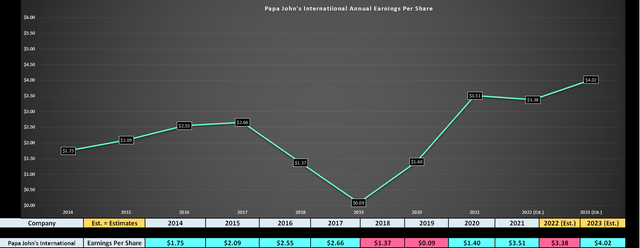

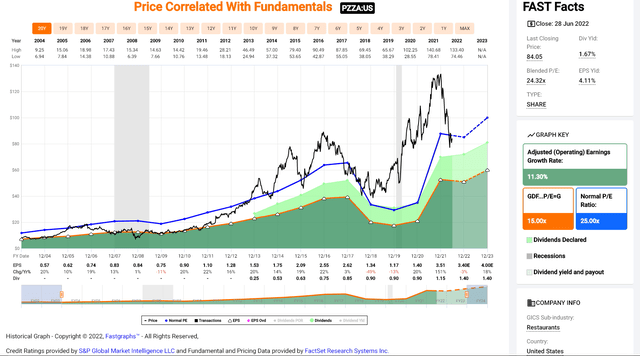

Looking at Papa John’s earnings trend below, we can see that the company had a rough couple of years in the latter portion of the decade due to the racist remark heard around the world. However, despite the slowdown, it’s still managed to grow at a ~10.5% compound annual EPS growth rate (FY2014 –> FY2021). Some investors might be discouraged by the fact that annual EPS is expected to dip this year vs. FY2021 ($3.38 vs. $3.51), but I don’t see this as an issue. In fact, after a year of ~150% annual EPS growth, maintaining 90% of earnings power or better is an impressive feat, especially given the industry-wide headwinds.

Papa John’s Earnings Trend (YCharts.com, FactSet, Author’s Chart)

In fact, if we look at FY2023 estimates, the drop in annual EPS in FY2022 is just an aberration in the long-term trend, with annual EPS expected to jump to $4.02 in FY2023. This would maintain the company’s near 10% compound annual EPS growth rate, and there could be a further upside if the company continues its aggressive share repurchases. Unfortunately, the company was far too early with its purchases in Q1, buying back 300,000 shares (0.1% of float) at $108.76 per share. However, with prices below $90.00 and $369 million available on its share buyback program, it would be nice to see the company be more aggressive now that its valuation is more reasonable. Let’s take a closer look below:

Valuation

Looking at the chart below, Papa John’s has historically traded at ~25x earnings, and the stock currently trades at ~25.2x FY2022 earnings estimates after its recent decline. This suggests that the stock is not yet undervalued but has at least seen its valuation back off from its lofty Q4 levels. I would argue that this earnings multiple of 25 is conservative, especially given Papa John’s industry-leading growth rates among QSR and pizza category peers. Based on FY2023 annual EPS estimates of $4.02 and an earnings multiple of 25, I see a fair value for Papa John’s of $100.50, translating to an 18% upside from current levels.

PZZA Historical Earnings Multiple (FASTGraphs.com)

While this might point to a decent upside for investors, I prefer to buy at a minimum 30% discount to fair value when buying mid-cap growth stocks to ensure an adequate margin of safety. After applying this discount, Papa John’s would need to dip to $70.35 or lower to move into a low-risk buy zone from a valuation standpoint. So, while I think the stock is reasonably valued here, I believe patience is the best course of action, and I would not be surprised to see the stock trade back down to 19x FY2023 earnings estimates ($76.40).

Technical Picture

Moving over to the technical picture, we can see that PZZA has retreated to the middle of its multi-decade channel after this correction, following a visit with its channel top in Q4 2021. This has led to an improvement in the reward/risk ratio. However, as we’ve seen from previous tests of the upper channel line, these upside extensions often lead to overshoots to the downside, with PZZA dropping into the bottom-fourth of its channel before finding a sustainable bottom. This time could be different than 2000/2018, but things rarely change in the market, given that human emotion doesn’t change. So, panic selling often follows panic buying, with those that overpaid for a stock dragged out in disgust at much lower levels.

PZZA – Monthly Chart (TC2000.com)

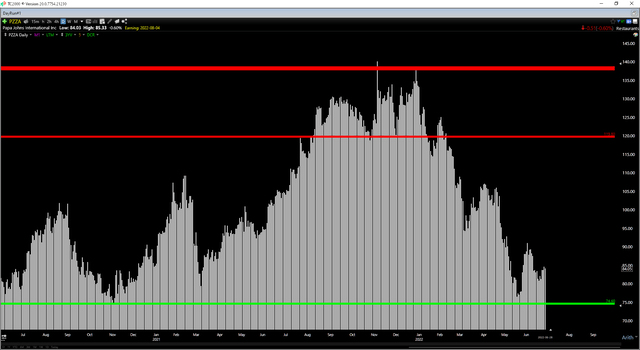

Zooming in on the technical picture, we can see that PZZA has an upper support area at $74.60, with a new resistance level at $119.80. Based on the stock currently trading at $85.30, this translates to a reward/risk ratio of 3.22 to 1.0, which is a decent reward/risk profile. However, in cyclical bear markets for the S&P-500, which exhibit increased volatility, I prefer to buy at support or on shake-outs below support. So, while PZZA’s pullback has undoubtedly worn off the overbought readings in Q4 2021, I still don’t see a buying opportunity. If the stock were to dip below $72.00 though (4% below support), I believe this would offer a low-risk area to start a position in the stock.

Summary

While the rest of the industry had a tough Q1, Papa John’s came out of the gates strong, lapping near-insurmountable comps with positive figures and enjoying high double-digit two-year stacked same-store sales. However, while the valuation has improved and the stock has shed its overbought status, it is more than 13% above its next support level, and support levels are often tested in turbulent markets. So, while I see PZZA as a decent buy-the-dip candidate, the more interesting level to initiate a long position is at $72.00 or lower.

Be the first to comment