alacatr

Investment Thesis

Snap-on (NYSE:SNA) is continuing to steadily compound. The business reported impressive third quarter results. I think that the company is well positioned to capitalize on auto repair tailwinds in the near term. I think it can retain and grow its offerings in the long term.

The company’s organic revenue growth has started to speed up since I last covered it. It paired this outperformance with a solid 14.1% dividend hike. Overall, I maintain my view that this is a good defensive dividend growth stock.

Snap-on Third Quarter Results

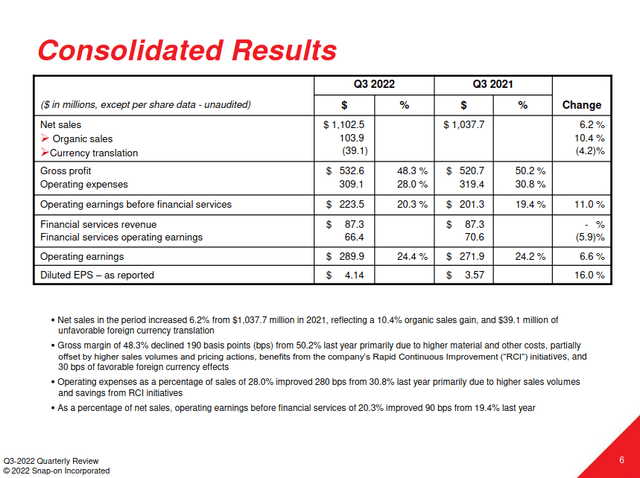

Snap-on reported strong continuing demand in its third quarter results. The company boosted its EPS by an impressive 16% since last year. Its key tools segment increased its organic sales by 7.4% year over year.

The company reported especially impressive results in North America. North American sales grew 11.2% since last year.

But Snap-on’s results were dragged down by weakness in Europe. Revenue from Europe was down 18% since last year. This offset the solid growth in North America and the rest of the world.

Part of this was due to unfavorable currency translation issues. FX headwinds have been a continuing issue for the company. The business reported an impressive 10.4% revenue growth rate in constant currency.

Snap-on Q3 2022 Quarterly Financial Review

Most of Snap-on’s metrics are moving in the right direction. The business increased its gross profit and reduced its expenses. Excluding its financing segment, it cut its operating expenses by 3.2% year over year. This is an impressive performance when inflation is so high.

I’m impressed by the company’s organic top line growth. This is because Snap-on has been struggling to grow its revenue for some time. From 2016 to 2020, it only grew its top line at a 1.2% CAGR. Then, it suddenly grew its revenues by 18% from 2020 to 2021. So it is a good sign that the business can beat those results. Lapping those tough comps with double digit organic growth is even more impressive.

What’s The Outlook?

I think that Snap-on has a solid outlook even as the broader environment deteriorates. In the near term, the company has a resilient revenue base. Automobiles are often a nondiscretionary expense, especially in most of the United States. The automotive repair industry is a basic necessity, regardless of the environment.

New car sales have dropped in recent years due to supply chain constraints. This has caused an increase in the average age of cars. In the current economic pullback, car repair is more important than ever. So even as the economy is pulling back, Snap-on is reporting a strong demand environment. Management is even increasing production.

But in the long term, there are still some risks. The auto industry is changing, especially with the increasing adoption of electric vehicles. EVs made up 5% of United States auto sales last year, up from 2% in 2019. These cars have different repair and maintenance needs than ICE cars. These trends could hurt Snap-on’s business.

I think that Snap-on can navigate these headwinds. Management seems to be aware of future trends. They regularly discuss electric vehicles and hybrids on their earnings calls. They’re also adding new products and offerings to capitalize on these trends.

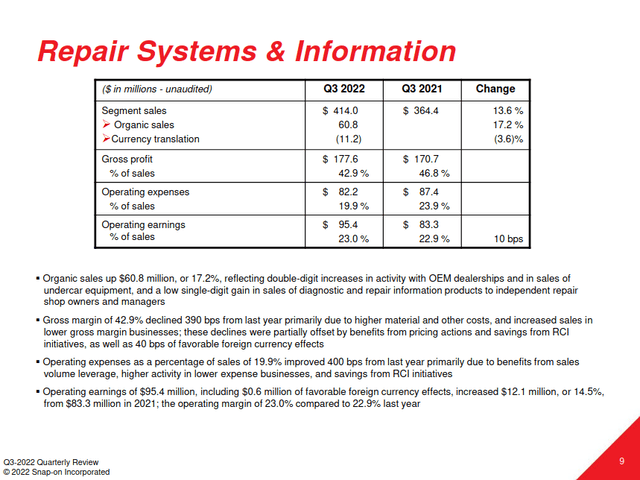

Snap-on Q3 2022 Quarterly Financial Review

The company’s repair systems and information segment is a good example of this. The segment grew its organic sales by a solid 17.2% in the quarter. This was driven by strong sales of undercar equipment. This equipment is becoming more and more important as cars become more complex. Management provided more details about it on their earnings call.

Collision repair is a star in this era. I think it’s driven by the idea that collision, the cars now has that neural network of sensors. So every time — if you just dent bumper, it’s thousands of dollars of repair, because you’ve got to recalibrate everything and so on.

So collision shops got to upgrade to take advantage of that to actually be able to effectively, not only restore shape but put things back into operating performance. But also, the other businesses we’re selling via the other products like lifts, just basic lifts, which you would think would be the most vanilla of products in the situation are selling quite well.

So I think it’s on collisions shops, as the situation, but also repair shops in general are seeing the future, and they are pumped about this. Like I said, I think even the dealerships are starting to get over the idea, they don’t have cars to sell and are turning to repair.

The auto industry is changing, but I think that Snap-on is well positioned to adapt. I think that this is important when assessing it as a long term dividend growth stock. It’s important to make sure the company is positioning itself for the long term.

Still A Solid Valuation

I still believe that Snap-on is trading at a reasonable valuation. The business has a forward P/E of 13.3 times and a forward EV/EBITDA of 9.4 times. Over the last twelve months, the business has generated a 14% ROIC. These are strong metrics. I think that this valuation is justified by the company’s fundamentals.

The company has a solid balance sheet. It has $760 million in cash on hand, supported by an $800 million undrawn line of credit. This is offset by only $1.2 billion in debt. This gives Snap-on a healthy debt to EBITDA of 0.9 times. Most of the company’s debt has extremely low interest rates, at a weighted average rate of 3.47%. This is below the current two year Treasury yield (US2Y). 75% of this debt isn’t even due until 2048.

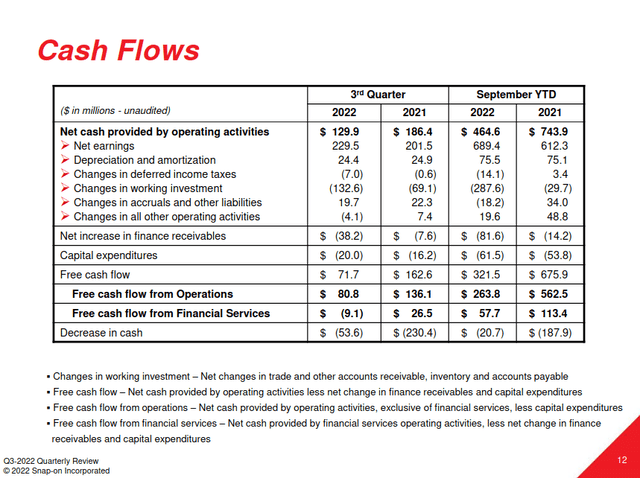

Snap-on Q3 2022 Quarterly Financial Review

I will point out that the business has been experiencing some cash flow headwinds. In the last quarter, the company converted only 49% of its net income into free cash flow. In the last twelve months, Snap-on has generated FCF equal to only 68% of its net income. This is down from its five year average conversion rate of 107%. Management attributes this to increases in the company’s receivables and inventory. Both of these are signs of high demand, but I would keep an eye on this in future quarters.

The company is still generating strong shareholder returns. Even with these free cash flow headwinds, its dividend is well covered. The business demonstrated this with another strong 14.1% dividend hike. Even after these payouts, the business has the cash to continue buying back its shares. It reduced its shares outstanding by almost 2% since the start of 2021.

Final Verdict

I still believe that this is an unambitious investment. Snap-on is unlikely to report very high growth in the long term. But I like the business’s financial profile. I think that it is well positioned for the current environment. I still believe that this is a good buy for a defensive dividend growth portfolio.

Be the first to comment