Kevin Dietsch

Article Thesis

Palantir Technologies Inc. (NYSE:PLTR) reported its third-quarter earnings results on Monday morning. The company outperformed revenue expectations thanks to ongoing compelling commercial growth, but profitability was slightly worse than expected. Considerable execution uncertainties remain, but I believe that Palantir Technologies is a company providing significant long-term opportunities if things go right.

What Happened?

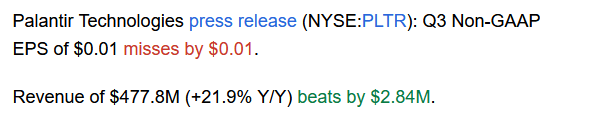

When Palantir Technologies reported its third-quarter results, the company beat revenue estimates but missed on the bottom line:

Seeking Alpha

The initial market reaction was negative, as shares traded down 2% at the time of writing, but investors can expect that shares will be volatile in the near term, thus this could change. Earnings per share were half as high as expected, but due to the low absolute number, it wouldn’t really have mattered all that much if the company had hit estimates, I believe. Revenue performance was slightly better than expected, despite headwinds such as currency. Let’s dive into the details.

Business Momentum Remains Solid, But Execution Is Key

Palantir Technologies has long been regarded as an extremely government-focused company. Many saw this as a key risk, as shifts in government strategy or spending could hurt Palantir. But over time, that has changed, as Palantir Technologies has been experiencing faster growth in its commercial business relative to the growth it generates in its government business.

Palantir Technologies helps companies optimize their supply chains, it helps mining and energy companies identify the best areas for exploration, it helps companies identify risks to their business models to make them more resilient, and so on. In short, Palantir is able to do a wide range of potentially very helpful tasks for all kinds of companies, which is why its offerings are in high demand.

During the third quarter, Palantir’s commercial revenue rose by a highly compelling 53% in the United States. Commercial revenue growth in overseas markets was hindered by adverse currency rate movements, as a strengthening U.S. dollar means that revenue generated in euro, yen, etc. is worth less once denominated in USD. The U.S. dollar will likely not strengthen forever, though, which is why this headwind will likely cease eventually, I believe.

Looking at Palantir’s commercial customer count growth, the performance has been excellent: the company added 66% to its customer count over the last year, mostly driven by additional commercial customers. Now investors might question how Palantir is able to grow its customer count by close to 70% while delivering revenue growth in the low 20s. There are several factors at play. First, the aforementioned forex rate headwind reduces revenue growth, all else equal.

More important, however, are two other factors. When Palantir adds a new customer, this is oftentimes for a smaller project to start the relationship and to see what works best for the customer. Once that has been done and the project is successful, the customer will be willing to work with PLTR on a larger project. Thus, new customers oftentimes come with below-average deal sizes at the beginning. But since Palantir’s customer retention is high, which means that customers must be happy with the outcomes PLTR delivers, there is a high likelihood that fast customer growth today will add to more meaningful revenue growth in the future, once the relationship is more established and customers do larger deals with Palantir.

On top of that, the lower revenue growth rate is also the result of how Palantir is able to recognize revenue under GAAP accounting rules. When Palantir closes a deal for a $10 million contract with a lifespan of 5 years, it usually can’t record $10 million in revenue in year one. Order intake, or closed deal value, is thus way higher than Palantir’s reported revenue. During the third quarter, Palantir closed contracts worth $1.3 billion, yet its reported GAAP revenue was only $480 million. The value of the deals Palantir has crafted is thus around 3x as high as what Palantir reported revenue-wise. I believe that the reported revenue number thus severely understates the underlying business performance of Palantir, i.e., its ability to forge deals with customers both on the government and commercial side. Since those deals will lead to revenue being recorded in the future, considerable revenue growth is already “locked in.”

From an underlying business growth perspective, Q3 looked pretty good, I believe. Palantir’s commercial business is growing at a compelling rate, the company is adding new customers at a massive pace, and the total contract value that Palantir closed is way higher than PLTR’s reported revenue, suggesting that there’s “hidden” business growth that is not yet recorded in GAAP numbers.

Underlying business growth is important, but other things are important as well. Margins and dilution are two of the key items when it comes to Palantir Technologies. Some investors believe that Palantir will always be a low-margin business, with stated reasons such as a lot of customization being needed for each customer. But Palantir is actually able to grow its margins pretty fast. Over the last year, Palantir’s operating margin expanded by a massive 1,000 base points, for example. Palantir is still reporting a negative operating margin, but the massive improvement over the last year suggests that there is a lot of operating leverage at work.

While many other tech companies, including big names such as Meta Platforms (META), Alphabet (GOOG)(GOOGL), and Amazon (AMZN), saw their margins decline over the last year, Palantir’s margins improved massively. When that trend remains in place, Palantir will undoubtedly become profitable in the not-too-distant future, even on a GAAP basis, while the company is already profitable on a non-GAAP/adjusted basis today. The company also raised its outlook for this year’s expected operating income, which suggests that cost controls are in place and that the company isn’t facing the same profitability issues many other tech companies face. Sure, Palantir is not ultra-profitable yet, but its profits will be higher than the company expected earlier this year, which can’t be said about the profitability performance of many other companies.

Operating cash flow, and also free cash flow, has been positive for quite some time. That’s great, as it means there is very little risk of bankruptcy, relative to other “growthy” names with hefty cash burn rates. On top of that, cash being piled up on the balance sheet gives Palantir Technologies some optionality when it comes to M&A and/or shareholder returns in the future. As of the end of the third quarter, Palantir’s cash position totaled $2.4 billion, excluding restricted cash, which is equal to around 15% of Palantir’s market capitalization — a pretty sizeable cash hoard, much larger, on a relative basis, compared to the likes of Apple (AAPL) and Microsoft (MSFT).

It should be noted that cash flow has benefitted from Palantir’s share-based compensation (SBC). While SBC is not unusual for tech companies, and especially not for smaller, “growthy” tech companies, there has been a lot of focus on Palantir’s share issuance to employees and management in the past. That still is going on, but on a much-reduced rate. Over the last year, Palantir’s share count increased by 5.5%, from 1.964 billion to 2.073 billion. It would be best, of course, if there was no dilution at all, but I do not believe that dilution of around 5% is an overly large problem for a company that is growing its customer count and revenue at a way higher rate. If Palantir was a no-growth company, 5% annual share count dilution would be a major issue for sure. But since business growth is many times higher than Palantir’s share count growth, there is not too much reason to worry about dilution here, I believe.

It is also worth noting that Palantir’s diluted share count has actually declined over the last year, from 2.34 billion to 2.14 billion shares, which should ease concerns further. Share-based compensation expenses have also declined year over year for both the third quarter alone and for the year-to-date period, which also suggests that dilution is not the huge issue some investors believe it is. True, there is some dilution, but that holds true for almost every tech company. SBC is declining in absolute terms, the basic share count is rising only slightly, and the diluted share count is shrinking — that doesn’t look like a stock-breaking issue to me.

Takeaway

I believe that Palantir’s performance in Q3 was compelling. Massive contract value being closed bodes well for the future, as does PLTR’s customer growth rate. Forex rates are a bit of a headwind, but Palantir nevertheless is delivering compelling business growth. Margins keep expanding quickly, which should lead to GAAP profits in the not-too-distant future. With dilution coming down considerably, it does not look like the major issue some have made it out to be any longer.

Palantir is currently trading at around 9x this year’s revenue, and at around 7x this year’s revenue when we adjust for its large cash position. For a company with 20%+ revenue growth and massive business growth potential, that does not look like a very high valuation, I believe. True, there are some uncertainties about profitability in the long run, but the trends are positive, and I believe that Palantir could be a very profitable long-term holding at the current valuation.

Be the first to comment