Sundry Photography

Still growing sales and winning customers despite a challenging macro

There’s little doubt that Cloudflare (NYSE:NET) remains a high-growth company now the pandemic is over. The cloud services provider grew revenue by 50%/52% in 2020/21 and has continued its monstrous growth thus in 2022 with a top-line growth of 54%/54%/47% in Q1/Q2/Q3.

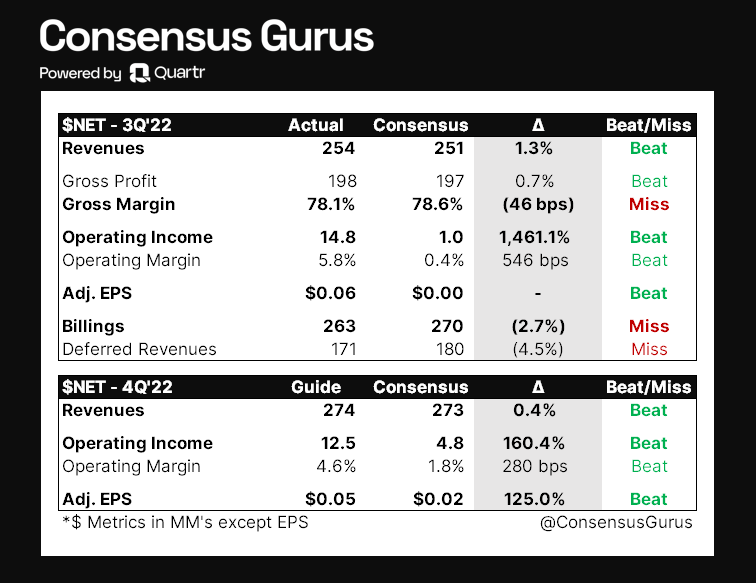

In 3Q22, revenue of $254 million grew 47% YoY and was 1.3% above consensus, while gross margin of 78% remained above the 75-77% target and showed resiliency in a highly inflationary environment. For reference, Amazon (AMZN) saw a lower AWS EBIT margin in Q3, driven partially by higher electricity costs (analysis here).

ConsensusGuru

Despite a difficult macro, Cloudflare’s Q3 DBNR (dollar-based net retention) was a still respectable 124% (flat YoY) vs. 126% in Q2. The company added almost 4.2k customers and reached 156k total paying customers in the quarter. Large customers (>$100k/year) increased 51% YoY to ~1.9k and accounted for 61% of revenue. Customers paying over $500k/year grew 88% YoY, while those paying >$1M/year grew 63% YoY. At Q3, Cloudflare reached $1 billion in annualized revenue.

For 4Q22, Cloudflare guided for revenue of $274 million (+42% YoY/in line with consensus), adj. operating margin of 4.6% (above 1.8% consensus), and adj. EPS of $0.05 vs. $0.02 consensus.

But why isn’t the stock working?

Everything seems to be going well at Cloudflare. Top-line growth remains strong as expected, customers are spending, and profitability seems okay on an adjusted basis. Management is still confident about growing Cloudflare into a $5-billion-dollar business as penetration for the company’s product portfolio is currently just below 1%. So what exactly is the market missing?

Underneath the surface lies a list of reasons driven by both macro and micro factors. First, the market no longer has an appetite for companies that cannot make money regardless of how fast sales can grow. In the first nine months of 2022, Cloudflare reported a GAAP operating loss of $151 million (-22% EBIT margin). The adjusted operating income of ~$19 million (2.7% adj. EBIT margin) was mostly a result of adding back the $155 million in stock-based comp and other shenanigans like amortizations and acquisition-related expenses.

While this may be something worth celebrating back in the go-go years when money was free and investors felt silly for not chasing growth, markets are likely no longer convinced that Cloudflare is a profitable business based on “adjusted” metrics. In other words, to say that Cloudflare is a profitable enterprise is equal to saying my cholesterol would’ve been better if I subtract the ice cream I ate and add back the exercise I didn’t do yesterday.

The second reason is valuation. When a non-profitable growth name like Cloudflare is trading at a double-digit price-to-sales ratios (12.5x prior to Q3 earnings), future results will have to exceed expectations just to keep the stock from falling. When the bottom line is also virtually non-existent, investors have little ground to find any valuation support for the stock. Despite beating Street estimates on both Q3 earnings and Q4 guidance, Cloudflare could not sustain its lofty valuation. This is a bad omen for other unprofitable yet highly valued names like Snowflake (SNOW), Datadog (DDOG), Shopify (SHOP) (analysis here), and CrowdStrike (CRWD) (here).

| Company | 2022 Rev | 2023 Rev | 2022 Growth | 2023 Growth | Market cap | 2023 P/S | 2023 P/S/G |

| RBLX | 2,821 | 3,190 | 47% | 13% | 24,217 | 7.6x | 0.58x |

| TTD | 1,566 | 1,981 | 33% | 27% | 22,582 | 11.4x | 0.43x |

| SHOP | 5,519 | 6,649 | 19% | 20% | 40,476 | 6.1x | 0.30x |

| NET | 958 | 1,316 | 48% | 37% | 13,455 | 10.2x | 0.27x |

| SNOW | 2,045 | 3,078 | 68% | 51% | 42,339 | 13.8x | 0.27x |

| DDOG | 1,583 | 2,214 | 58% | 40% | 22,271 | 10.1x | 0.25x |

| CRWD | 2,111 | 2,994 | 54% | 42% | 29,770 | 9.9x | 0.24x |

| BILL | 796 | 1,149 | 92% | 44% | 11,234 | 9.8x | 0.22x |

| MDB | 1,143 | 1,507 | 31% | 32% | 9,989 | 6.6x | 0.21x |

| MNDY | 488 | 668 | 63% | 37% | 3,651 | 5.5x | 0.15x |

| BIGC | 274 | 328 | 27% | 20% | 679 | 2.1x | 0.10x |

| AFRM | 1,492 | 1,966 | 86% | 32% | 4,676 | 2.4x | 0.07x |

| Average | 52% | 33% | 7.9x | 0.26x |

Source: company data, consensus estimates, table by author

Conclusion

Barring any surprises such as an acquisition, I think the only scenario where stocks like Cloudflare could work is a Fed pivot. This is of course unlikely to happen any time soon, given Chairman Powell has made it clear that the Fed will do everything in its power to bring inflation down to 2%. For now, markets are unlikely to find Cloudflare’s P/S ratio helpful considering growth is likely to slow down while losses may continue to mount despite management believes the business to be profitable by adding back the highly dilutive stock-based compensation. As a result, I see more downside for shares as investors increasingly focus on conventional profitability metrics. While the stock is already down 69% YTD, the risk/reward profile remains negative in this environment.

Be the first to comment