Wirestock

Business is on the ballot. There’s much uncertainty about how the government will look when new members of Congress are sworn in next January.

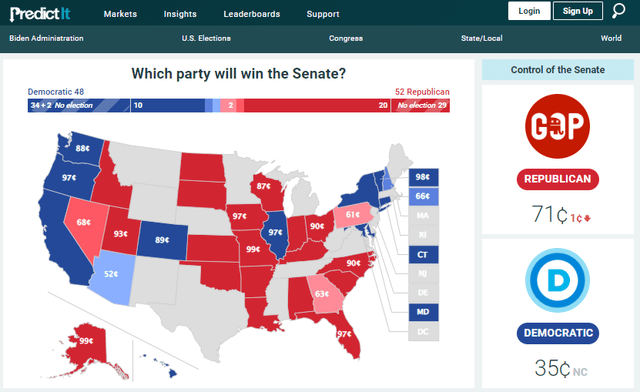

Tuesday night’s mid-term elections will determine how fiscal policy might go over the next two years before the next general election. According to betting market data from PredictiIt.com, there’s about a 70% chance that the Republicans retake both houses of Congress while there’s a less than 10% implied probability that the Democrats retain total control that started in January 2021 – known as the blue wave.

Traders Lean Toward The GOP Taking The Senate

Predictit

Much ink has been spilled about how bullish a split government is for stocks. More broadly, the S&P 500 tends to do very well in the months following U.S. mid terms. But let’s dive in further. One niche will likely move big if an unexpected outcome takes place after Tuesday evening. Another scenario, as we saw in 2020, is that the Georgia Senate race could result in a runoff that would delay a definitive outcome for several more weeks.

According to iShares, as part of its investment objective, ICLN seeks to track an index that applies the following business involvement screens: Controversial weapons, small arms, military contracting, tobacco, thermal coal, oil sands, shale energy, and arctic oil and gas exploration. The business involvement screens are based on revenue or percentage of revenue thresholds for certain categories and categorical exclusions for others.

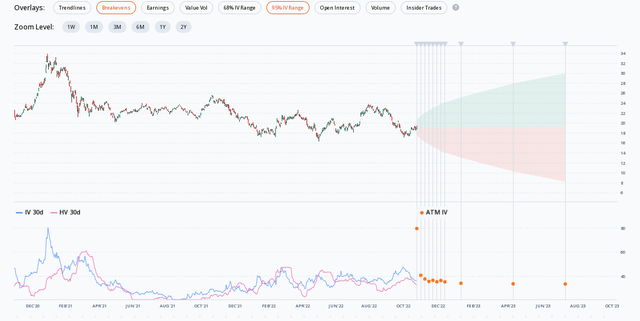

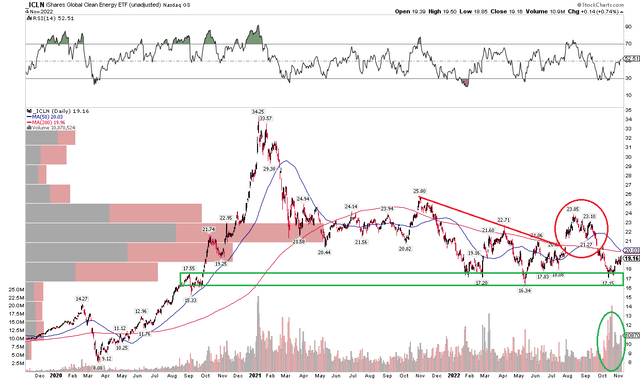

The iShares Global Clean Energy ETF (NASDAQ:ICLN) has seen big volume recently (as shown in the technical chart below). I get the sense a big move might be on the horizon. I also like to look at the options market to see if there are signals that a single event could result in a big share price swing.

The Options Angle

According to Option Research & Technology Services (ORATS), ICLN has implied volatility readings that are off the highs, but I see that implied volatility did not spike until after the 2020 elections due to the runoff in Georgia that year.

With options cheap on ICLN right now, it could be worth a shot to go long a December or January straddle. Options traders have priced in a 95% chance that ICLN will be between $13 and $25 by January 23, 2023 (after the new Congress takes control).

ICLN: Tame Implied Volatility As Was Seen 2 Years Ago

ORATS

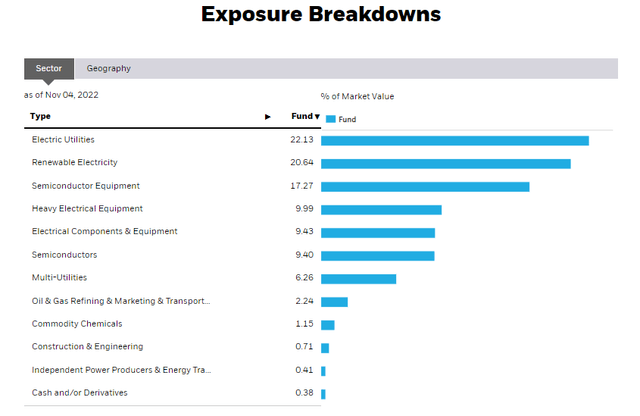

What Do You Own With ICLN?

It’s an international ETF with companies from a variety of sectors and industries represented. Some defensive utilities are in the fund while more aggressive semiconductor/chip-related stocks add to the beta. Enphase (ENPH) and First Solar (FSLR) are two of the top holdings on the aggressive side, while Consolidated Edison (ED) and Iberdrola SA (OTCPK:IBDSF) are lower beta.

ICLN: Sector Exposure Shows A Healthy Mix

iShares

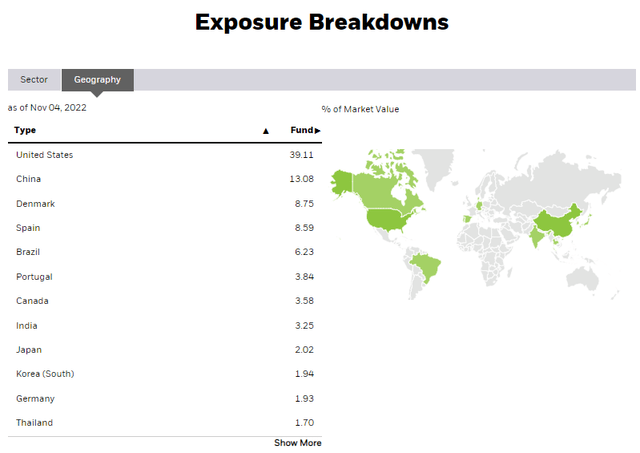

If the U.S. dollar is indeed topping out, expect ICLN to outperform due to its more than 60% ex-US exposure. Moreover, recent bullish price action out of China is a tailwind should that momentum keep up.

ICLN: Significant Foreign Exposure

iShares

The Technical Take

ICLN has a fascinating chart right now. As mentioned earlier, there’s a big volume spike ongoing. Perhaps institutional investors are positioning themselves ahead of the election. It’s critical, however, that the ETF holds the key $16 to $18 range – if that area is breached, then I see downside risks to the $14 to $15 area (pre-COVID high).

There’s also an island reversal in the $21 to $24 range from August and September. That’s when some bullish news hit the tape regarding the Inflation Reduction Act. Moreover, there’s big “volume-by-price” there, so the bulls might have a tough slog getting above $24.

Combining the technical and options pictures, I think buying an at-the-money straddle with a January expiration while selling upside $24 calls and selling downside $16 puts could be a reasonable play.

Long-term investors, meanwhile, should wait for a breakout above $24 before going long. It’s also not cheap with a P/E of 26.8, per iShares.

ICLN: Bearish Overhead Supply In The Low $20s

Stockcharts.com

The Bottom Line

I see chances of a near-term volatility spike in ICLN following the election. Options are historically cheap. Long-term investors should wait for a breakout before getting long. Value investors, however, might want to avoid ICLN due to its high valuation right now.

Be the first to comment