Kevin Frayer/Getty Images News

Introduction

Nike (NYSE:NKE) is a leading athletic footwear and apparel brand with more than $45 billion in revenue. Despite ongoing challenges around the pandemic and supply chains, the company is making a steady comeback and should continue to benefit from increasing consumer awareness of health/fitness. In this article, I will discuss recent business updates and my opinion on the stock.

Business updates

Nike finished FY 3Q22 (ended February 2022) with revenue up 5% YoY (8% CC) led by 17% growth in Nike Direct. Wholesale returned to growth with revenue up 1%. Nike digital grew 22% driven by strong demand through the Nike app. Lastly, Nike-owned store sales grew 14% with much better traffic during the quarter. Regarding the latest Russia-Ukraine, revenue in both countries represent less than 1% of total company revenue.

As the brand continues to pivot towards a direct-to-consumer (DTC) model and full pricing strategy, gross margin saw a 1% expansion from 45.6% in FY 3Q21 to 46.6% in 3Q22. Further, management noted that over the past 4 years, the number of wholesale accounts has been reduced by >50% as Nike continues to invest in its own channels. This is evident in Foot Locker’s (FL) latest earnings call where management highlighted that Nike products will account for 60% of total inventory (vs. 70% in 2021 and 75% in 2020) in 2022.

Operating margin of 15% was slightly down from 16.2% last year, driven by normalized demand creation spend (8% of revenue in 3Q22 vs. 7% in 3Q21) and SG&A (32% of revenue in 3Q22 vs. 29% in 3Q21). Due to a higher effective tax rate (16.4% vs. 11.4% last year), net margin came in at 12.8% vs. 14% in 3Q21, which explains why EPS was down slightly from $0.9 to $0.87.

Supply Chains

On FY 2Q22 call, Nike mentioned that supply disruptions in Vietnam due to Covid had caused the company to cancel production of 130 million units, but weekly footwear and apparel production had returned to 80% of pre-closure volumes. As of FY 3Q22, all factories in Vietnam are operational with production back in line with pre-closure volumes.

While production has return to normal, transit time remains a problem. Per management, transit time are now 6 weeks longer than pre-pandemic levels and 2 weeks longer than 3Q21 as port congestions have not improved. Though Nike has been able to manage the impact by 4 weeks better than industry averages, in-transit inventory still represents around 65% of total inventory.

Greater China

Representing approximately 18% of total Nike brand revenue over the last 4 quarters, Greater China has been seeing year-over-year decline in revenue of -5% and -20% in 3Q22 and 2Q22. Although the region still delivered over $2 billion in revenue driven by CNY in 3Q22, Nike noted a 5% revenue decline in Nike-owned stores and a 19% decline in digital due to ongoing supply delays.

Aside from supply chain issues, the ongoing challenges around Omicron remains a problem as the Chinese governments takes a wholistic approach in containing the virus. This not only impacts Nike’s business as owned stores and retailers are forced to pause operation but also poses challenges from a logistical standpoint as inter-province and inter-city transportation have been greatly limited. Subsequently, e-commerce sales have slowed as goods cannot be delivered in time.

Further, China appears to be a much more competitive market for Western brands. For example, adidas (OTCQX:ADDYY) 2021 results show that sales in China (~21% of total revenue) only grew 6% YoY, significantly slower than North American and EMEA at 13% and 23%, respective. On 4Q21 earnings call, CEO acknowledged the following:

So on the China situation or the China market, there’s – the guidance we’ve given, we believe that, that growth will probably be more or less in line with the Western competitors in the market. We still think that the local Chinese competitors will grow at a higher rate than that.

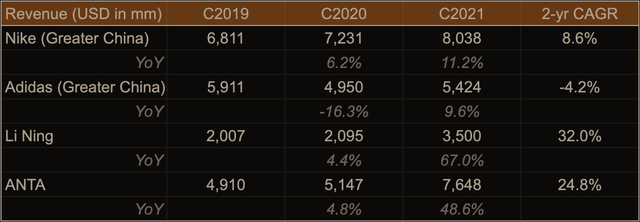

Digging further, we can see that domestic Chinese brands such as ANTA and Li Ning have actually been outgrowing their Western counterparts over the last 3 years. As a result, some of Nike’s slowdown in revenue growth in China could be attributed to competition and potentially the issues surrounding Xinjian Cotton which saw a number of Chinese celebrities cutting ties with the brand. Thought management remains optimistic about the Chinese market, this is something to watch going forward.

Digital

Nike’s investments in digital has been paying off relatively well. In FY 3Q22, digital revenue was up 22% (CC) and the Nike mobile app grew more than 50% to surpass nike.com. For the quarter, Nike digital increased 3% from last year to represent 26% of total Nike brand revenue.

Given valuable digital assets such as Nike mobile app, the SNKRS app, NTC (Nike Training Center) and NRC (Nike Run Club), Nike has a number of levers to pull when it comes to the marketing game. For example, Nike collaborated with EA Sports to give members who ran 5 miles in the Nike Run Club the ability to unlock rewards in the Madden NFL game.

Aside from owned digital channels, Nike is actively involved in the metaverse, with Nikeland on Roblox being a primary platform where a total of 6.7 million players from 224 countries have visited the virtual space since launch. Additionally, Nike has also acquired RTFKT Studios to launch the first Nike-branded NFT in Q3.

Outlook

For fiscal year 2022 (May 2022), Nike expects revenue to grow mid single digits from $44.5 billion in FY21 (+19% YoY) to roughly $46.8 billion. This represents a growth rate of almost 20% vs. FY19 and a 3-year CAGR of 6%. As supply chain issues alleviate going forward, management believes fiscal 2023 should be another year of solid growth.

Thoughts on the stock

Nike went from the $60 low in March 2020 to an all-time high of $178 in November 2021, driven by (1) a stronger public desire to stay healthy under Covid-19, (2) trend towards athleisure that benefited from WFH, and (3) the prospects of reopening across major markets which saw faster than expected recovery. After experiencing a brutal selloff of more than 30%, the stock has bounced back 18% from the low of $118 in mid-March when the Russia-Ukraine crisis took over news headlines.

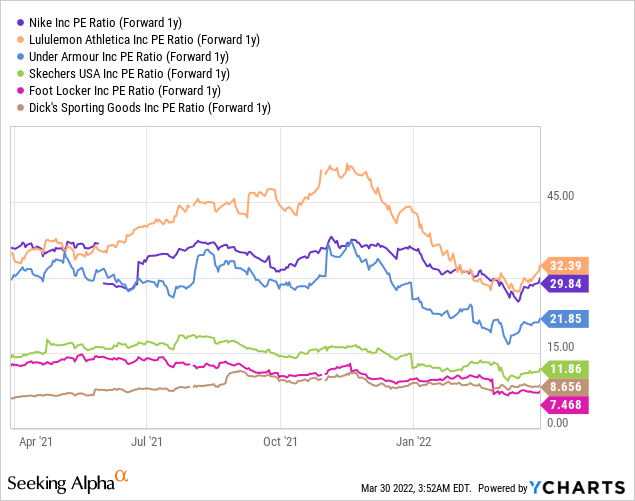

From a valuation standpoint, Nike currently trades at a forward P/E of ~30x, a premium relative to peers but deservedly so. Despite Greater China being a slower market, Nike remains a dominant player with an attractive brand in the global sportswear and athletic footwear market. As the company continues to build its DTC business by cutting out the middlemen for a higher gross margin and gradually recovers from impact of Covid and supply chain challenges, I believe the current valuation represents a fair price for a wonderful business.

Be the first to comment