cemagraphics/iStock via Getty Images

By James Bristow

War in Europe comes at a time when the global economy was just emerging from the COVID-19 pandemic. As the crosscurrents complicate the investing backdrop, Fundamental Equities investor James Bristow applies a stock-specific lens in assessing the risks and opportunities.

Volatility has ratcheted up across global stock markets in 2022. While much of the market’s attention has been focused on the Fed and its intentions for U.S. monetary policy, James Bristow, long-time portfolio manager of the BlackRock International Fund, has been eyeing up the dynamics that are shaping investment opportunities worldwide.

Here we capture some of his insights and investing inspirations.

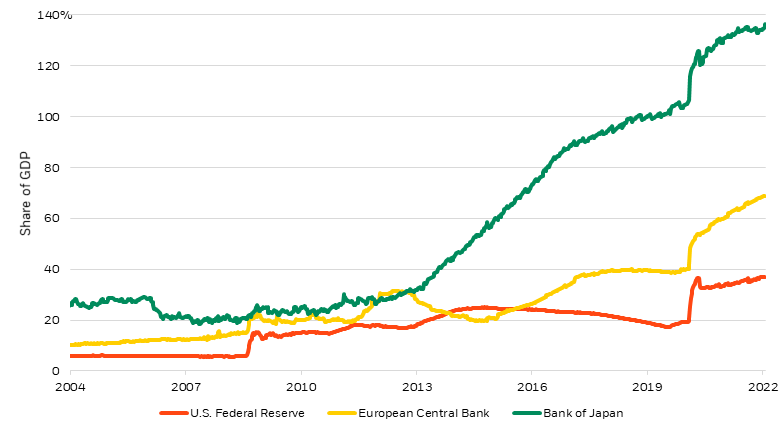

1. What stands out to you in terms of monetary policy globally?

There’s a lot of talk about the Fed’s balance sheet, but I think what people forget is that the size of the balance sheets relative to gross domestic product (GDP) is much higher in Japan and Europe. (See chart below.) So, essentially, rates have been even more suppressed in those markets. This means we’re likely to see more accommodative policy relative to the U.S., particularly in Europe where the war in Ukraine and higher energy prices exacerbate concerns about both inflation and an economic slowdown. This is making stocks, and risk assets generally, even more sensitive to changes in rate expectations, and it’s something we’re watching closely.

Central bank balance sheets

Central bank assets as a percent of nominal GDP forecast, 2003-2022

BlackRock Investment Institute, with data from Refinitiv Datastream as of March 15, 2022.

2. What is your outlook for company earnings outside the U.S.?

Interestingly, we saw a very similar speed of profit recovery across all markets following the 2020 margin declines brought on by COVID lockdowns. Yet there has still been a consistent shortfall versus the U.S. in terms of stock performance.

We see some important nuance to that. If you take Europe, for example, and sector-adjust it to the same sector weights as the U.S., the profit gap is actually very small. Hence, we see the issue as one of sector composition, rather than the broadly accepted view that companies outside the U.S. systematically underearn their U.S. counterparts.

This micro-level observation sits alongside some pressing macro considerations, such as the implications of war on global growth, and it reinforces for us the importance of applying in-depth company-level analysis when making investment decisions in international markets.

3. What is your view on emerging markets (EMs)?

We seek to invest where the greatest opportunity resides, be it in EMs directly or via indirect exposure through developed markets (DMs). At present, we are finding more immediate opportunities in DM stocks that we see benefiting from important secular trends and growth in EMs.

Part of the reason is related to profitability: In aggregate, we see lower profitability in EMs versus other markets. We also find the DM companies offer more consistent return profiles as well as greater visibility into their operations. That said, we are dipping our toes back into some direct EM investment and believe flexibility is critical, particularly given that even small change at the margin can be a powerful driver of returns in EMs.

4. Where are you sourcing investment opportunities?

I would identify three buckets that are inspiring a lot of our research and stock selection:

Follow the leaders. Innovation isn’t exclusive to the U.S. We know that pockets of strength exist around the world and that means the better alternative can be an international one. We’re looking for non-U.S. companies with a competitive edge on their U.S. counterparts and finding many of them in industries such as renewables, luxury goods and the semiconductor supply chain.

Mind the gaps. We’re exploring areas where U.S. companies are increasingly constrained from participating or competing. Often this is in China given ongoing U.S.-China trade tensions. We spend a lot of time thinking about whether there are non-U.S. alternatives that have an increasing or inbuilt advantage to growth above and beyond what’s available in the U.S. and whether we can capitalize on that.

Get in early. Some secular trends with significant growth potential remain in a more nascent stage in parts of the world. Case in point: Despite major advancements in digitalization since the pandemic, we’re still finding budding opportunities across e-commerce, online payments and education and training in Asia, South America and even Canada. Many of these types of businesses have been strong performers over several years, and this remains a fruitful area of investigation for us.

I think these big buckets of opportunity stand firm, despite the loud and ongoing debates around rates and inflation. Those debates will provide a lot of near-term volatility, but that’s exactly the kind of environment that we as active investors seek to manage, mitigate and exploit. Dispersion and volatility continue to provide great opportunities for stock pickers.

This post originally appeared on the iShares Market Insights.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment