Sundry Photography

At the point of its IPO, no rational person could ever have thought Palantir (NYSE:PLTR) would ever become a value stock. Yet after a year of relentless declines, that is exactly what it is now. The secretive Silicon Valley powerhouse, one of the most prominent names in AI and machine learning and a critical vendor to the U.S. government, was at one point one of the hottest trades on Wall Street. Now faced with decelerating revenue growth and a fidgety market that is turning its back on growth stocks, Palantir has been relegated to the penalty bucket.

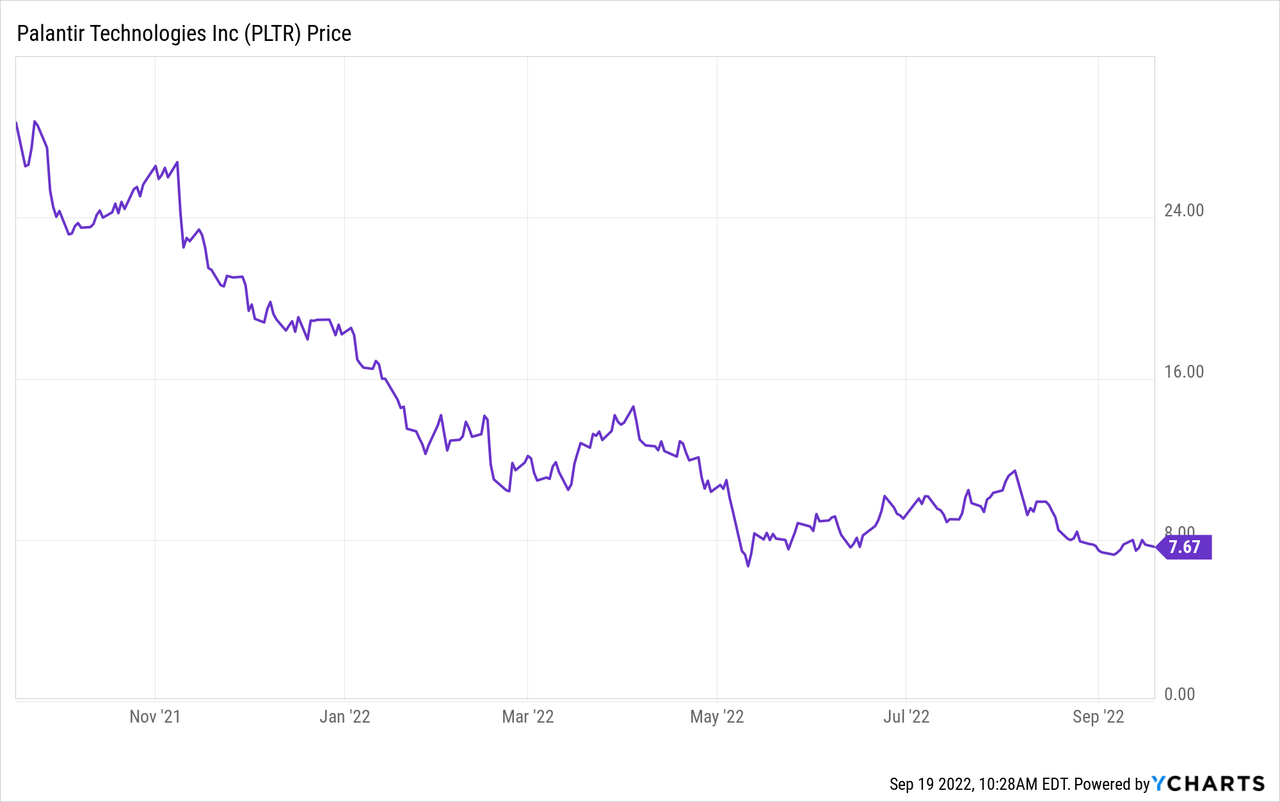

Year to date, the stock has lost 60% of its value. And though so far, each quarter has brought a slew of more or less bad news, I think Palantir has now reached its near-term bottom after the company cut guidance for the remainder of the year. With expectations reset lower, Palantir is well-equipped to take charge of its story and rebound from here.

I remain very bullish on Palantir: it’s one of the core holdings in my portfolio, and I’ve added on the way down. Palantir is undoubtedly subject to the volatility of the business cycle (especially as it currently relies on a number of key buyers, such as the U.S. government, with very irregular buying patterns), but when we take a step back, the company’s technology platform, brand, and customer reach are unparalleled in the industry.

Here’s a refresher on what I view to be the key bullish drivers for Palantir:

- Big data is a massive discipline that can be applied in nearly limitless ways. Palantir isn’t a software company that serves only one or a limited set of use cases. Data and inferences that can be made from data are prevalent in just about everything: which explains why Palantir is such a powerful tool for both public and private sector clients.

- Growth at scale. Despite being at a ~$2 billion annual revenue scale, Palantir continues to deliver mid-20s y/y revenue growth. Few companies are able to achieve this kind of growth at scale, and it’s a testament to the wide applicability of Palantir’s products and the humongous clientele it has drawn (in particular, the U.S. Army). Prior to the recent government spending slowdown, Palantir had forecasted >30% y/y growth through 2025 (which may still be feasible when macro conditions turn around).

- Stepping up go-to-market momentum. Palantir is chasing growth across a wide variety of channels. The company has stepped up its sales hiring this year, a nod at the broad market opportunity it has and the need for more territory coverage. Palantir also has deepened relationships with ISVs (integrated service vendors) that can resell Palantir’s products without its involvement and offer additional coverage that Palantir’s direct sales force can’t handle.

- One foot in the public sector, one foot in private. Palantir made its name on being a large federal government contractor, but its products are just as compelling to an enterprise segment that is growing ever more obsessed with the value of big data. Most software companies start off as primarily dealing with enterprise buyers, and then hopefully getting FedRAMP certification to sell into public sector clients later. Palantir did the reverse: but now, its momentum with Fortune 100 companies is continuing to grow, and customer adds are continuing to trend at an impressive pace.

- Free cash flow. Though not yet profitable from a GAAP standpoint, Palantir continues to exceed internal expectations for free cash flow, which means the business is self-financing (a departure from many other rapid-growth software companies that continue to need to raise capital to finance their losses).

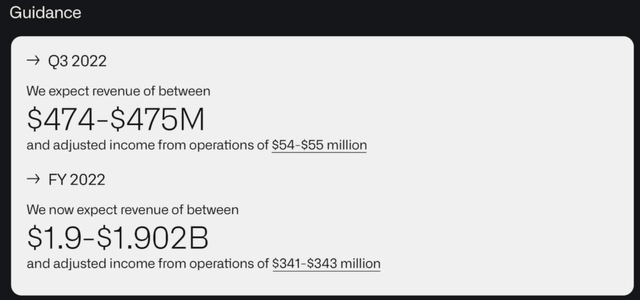

Alongside its latest quarter, Palantir did admittedly cut its guidance outlook. It’s expecting $474-475 million of revenue in Q3, representing a continued slowdown to 21% y/y growth. It is also expecting $1.900-1.902 billion in revenue for FY22, which is 23% y/y growth – versus a prior expectation that the company would continue growing at a >30% y/y pace through at least 2025.

Palantir outlook (Palantir Q2 earnings deck)

While this is obviously a disappointing turn in messaging driven by uncertainty over the pace and timing of U.S. government purchases, I do think this pessimism is already well reflected in Palantir’s stock price. At current share prices just shy of $8, Palantir trades at a market cap of $15.93 billion. After we net off the $2.46 billion of cash on Palantir’s most recent balance sheet, the company’s resulting enterprise value is $13.47 billion.

This puts Palantir’s valuation multiple at 7.2x EV/FY22 revenue. And if we look ahead to FY23, where Wall Street consensus is expecting $2.37 billion in revenue (+25% y/y; data from Yahoo Finance), Palantir’s multiple flexes down to just 5.8x EV/FY23 revenue. Recall that at one point, Palantir had traded north of >20x revenues. This is quite a bargain multiple for a mid-20s grower with an established track record for pro forma profitability and FCF.

The bottom line here: for most of its life as a public company, Palantir stock has traded on momentum alone. Now, we can rely on fundamentals and value to guide its rebound. A <6x FY23 revenue multiple is quite an opportune time to jump into this stock. Ignore short-term noise here and buy for the long term.

Q2 download

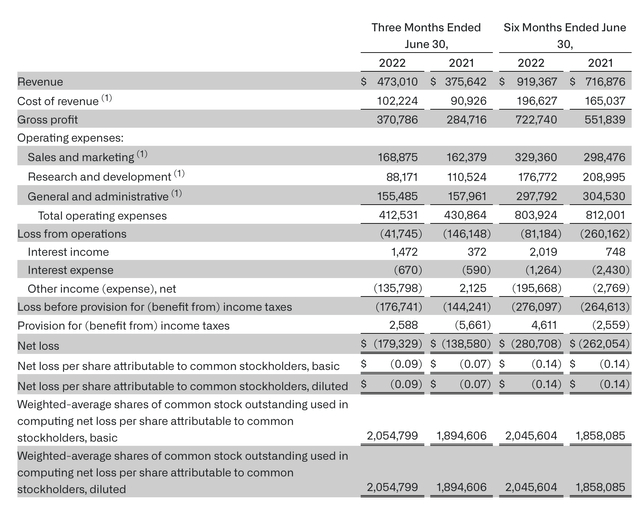

In spite of deal-timing noise in the government sector, there were still positive highlights to call out in Palantir’s second quarter. The Q2 earnings summary is shown below:

Palantir Q2 results (Palantir Q2 earnings deck)

Palantir’s revenue grew 26% y/y in the quarter to $473.0 million, only slightly edging out over Wall Street’s expectations of $471.7 million (also at 26% y/y). Growth decelerated five points relative to 31% y/y in Q1.

The main driver here is a push-out in U.S. government deals, which the company has now completely stripped out of its FY22 forecast. The company’s chief legal and business affairs officer, Ryan Taylor, commented as follows on the Q2 earnings call:

While the timing of large contracts in government can be frustrating, the underlying requirements and needs are enduring. It’s worth noting that our revised guidance excludes any new major U.S. government awards.

At the same time, we have seen the opportunity presented by this environment before. As organizations around the world face more pressure and experience more pain, there will be a slowdown in the rate of spending and lengthening of sales cycles, but it will also reveal gaps in enterprises operations. Gaps our software can solve.

In the short term, this means less revenue now. But on longer time horizons, it accelerates our business. The global financial crisis, ISIS attacks in Europe, the COVID pandemic, through each upheaval, we emerged substantially stronger by investing in our customers ahead of revenue and delivering results in days, not months.”

Government-source revenue decelerated to 13% y/y growth in Q2, down from 16% y/y growth in Q1 and 26% y/y growth in Q4.

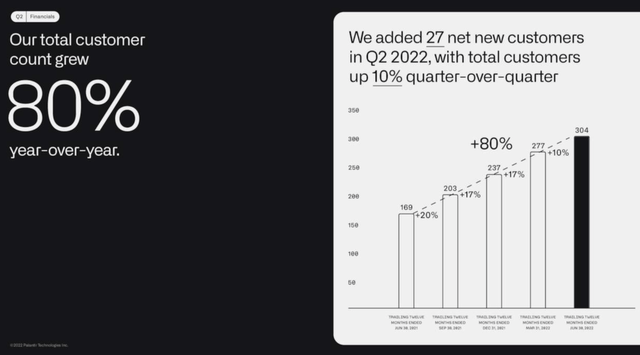

Irrespective of this, however, Palantir continues to march forward in adding new customers, particularly in enterprise. Total customers grew 10% sequentially to 304 (+80% y/y) in Q2:

Palantir customer growth (Palantir Q2 earnings deck)

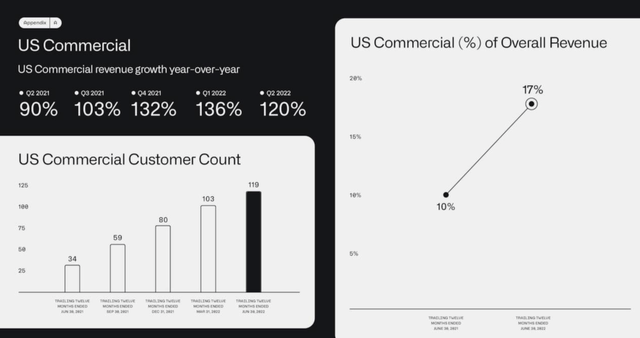

And while U.S. government revenue certainly did decelerate, U.S. commercial revenue barely did. U.S. commercial revenue grew 120% y/y in the quarter and ballooned to a 17% contribution of total revenues, while the company added 16 net-new commercial clients to end the quarter at 119.

Palantir commercial segment results (Palantir Q2 earnings deck)

Shyam Shankar, the company’s COO, also noted that Palantir has observed many of its clients returning to Palantir after experimenting with competitors’ software: yet another reflection of the fact that Palantir remains best-of-breed in its space. Per Shankar’s remarks on the Q2 earnings call:

We are seeing former customers, particularly those in the U.S., including some of the world’s largest transportation, banking and retail enterprises return to our platforms in increasing numbers after periods of experimentation with other platforms and approaches. These customers, they’re not returning to our software platforms merely because of the expansion of our sales operations, which does continue, they are often returning because they have tried other options, and those options have failed to deliver needed results.”

On the profitability front, Palantir still managed to deliver $108 million of adjusted operating income at a 23% margin, down eight points relative to 31% in the year-ago quarter due to expense inflation. Adjusted FCF of $61 million, however, still grew at 26% y/y and matched last year’s 13% FCF margin.

Key takeaways

It’s way too premature to give up on Palantir. This best-in-class software vendor remains the gold standard for both public and private entities in AI and machine learning, serving an endless array of use cases. Don’t miss the opportunity to pick up this stock cheaply.

Be the first to comment