Douglas Rissing

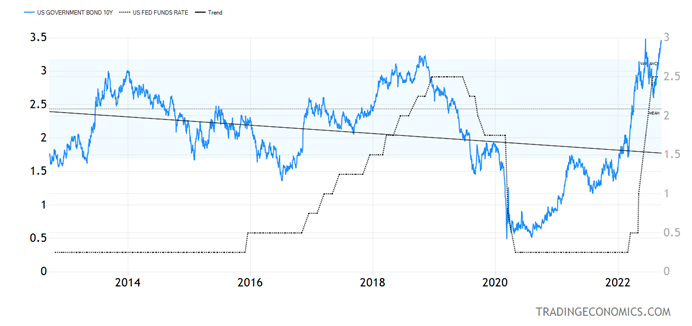

One has to wonder if the 400 (or more) PhD economists employed by the Federal Reserve have explained to the Fed Chairman how monetary policy works with a LAG. Those previous 75 basis point Fed funds rate hikes are not reflected in the economic data yet, and one more may be too much. It’s way too close to the election to make those many aggressive monetary policy moves.

Federal Express (FDX) just withdrew its EPS guidance and had one of its worst days on record on Friday as its business is slowing down dramatically. FedEx’s operational performance has a high correlation to global GDP growth, which had caused former Fed Chair Alan Greenspan to use it as an economic indicator. Maybe the present Fed Chairman should do the same.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

This week the Fed funds rate will likely rise above the prior Fed funds rate hiking cycle for the first time in 40 years or so, ever since Fed Chair Paul Volcker managed to tame inflation at the cost of two nasty back-to-back recessions. I am sure Jerome Powell can do the same, but the goal of the Fed should be to manage the inflation picture without causing extreme policy outcomes.

I am of the opinion that the Fed overly stimulated the economy in 2021 and now we are all paying the price for their past mistakes. To be fair, it is not only the Fed’s fault.

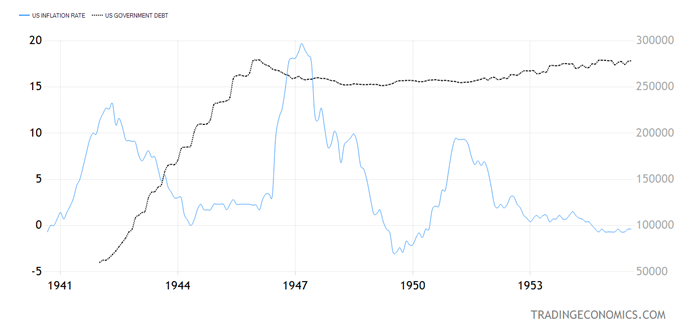

The Biden administration was aggressively handing out cash with the American Rescue Plan, and the Trump Administration fought the early stages of COVID with aggressive deficit spending on par with what the U.S. did in World War II. It is this extreme deficit spending, in combination with an extreme version of Quantitative Easing (QE), that caused the present inflation problem.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Right after World War II (chart above), when the U.S. economy normalized and government debt went up nearly five-fold in about five years, the inflation rate shot up close to 20%. Then they had supply chain challenges and bottlenecks as the whole economy was working to support the war effort, and now it had to switch back to more normal economic activity.

In the late 1940s, it took some time for inflation to normalize, and this time it will likely take some time, too, hopefully without Volcker-style nasty recession.

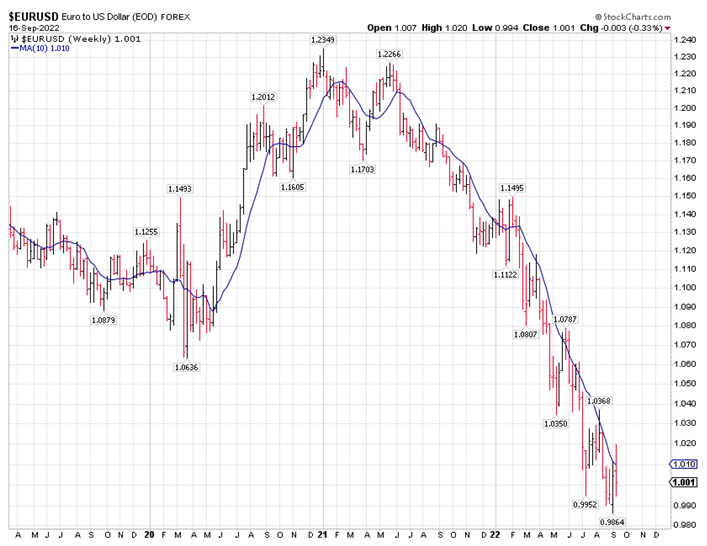

The Euro is Likely Not Done Falling

For the euro to bottom, we need the Fed to stop or cut back on its tightening cycle, and we need the war in Ukraine to end. The euro perked up as Ukraine delivered an impressive counteroffensive in the Kharkiv region – a currency market move which was misguided, in my view.

It would be great if the Ukrainians take their country back and the global economy becomes more normal again but judging by history, I don’t believe the Russians will give up. There could be some form of nasty response to this Ukrainian counteroffensive – I just have no idea what kind.

Going back to the invasion of Napoleon Bonaparte in 1812 or the invasion of Germany in 1941, when backed into a corner the Russians will keep on fighting. Ironically, they are the invaders now, but that still does not change the fact that they have backed themselves into a corner.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The European winter is coming, and I don’t think partial gains by Ukraine indicate any Russian normalizing of natural gas flows. On the contrary, they may completely shut off the gas. There is gas flowing to Ukraine from Russia and some of it transits to Germany.

That is one pipeline that is in danger of completely shutting off. If the Russians completely turn the gas off, I am not sure what will happen to the European economy, but it won’t be good. Plus, the first major country with an election cycle in Europe is Italy on September 25, and it looks like the right-wing coalition is about to win there, and they are not keen on maintaining Russian sanctions.

I don’t think the ECB can be as aggressive as the Fed in normalizing monetary policy, and with further deterioration in the EU economy the euro is likely to head to 90 cents.

Navellier & Associates Inc. does not own FedEx Corporation in managed accounts. Ivan Martchev does not own FedEx Corporation personally.

Disclosure: *Navellier may hold securities in one or more investment strategies offered to its clients.

Disclaimer: Please click here for important disclosures located in the “About” section of the Navellier & Associates profile that accompany this article.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment