Michael Vi/iStock Editorial via Getty Images

Investment Thesis

Companies such as Palantir (NYSE:PLTR) rarely draw to my attention due to high retail investors involvement as it almost certainly indicates high volatility and unpredictability of stock behavior. However, if any company with positive operating cash flow, strong and growing client base and no apparent business deterioration falls by more than 70%, I have no other option as to value it as that is the way how bargains can be identified. Although Palantir faces some apparent issues such as miss of the recent earnings results, lower revisions to its future guidance and continuing shares diluting practices, its business model remains robust and customer growth quite impressive. Discounted FCF model indicates the stock currently trades at least twice lower than its fair value, so we hold buy view on it.

Company at Glance

Palantir does not need any introduction as it has been one of the hottest stocks since its IPO in 2020. However, as it is my first write-up on SA on this stock I am still going to start with its intro, so all enlightened ones can skip this section and move on to the next one.

Palantir Technologies Inc. is a public American software company that specializes in big data analytics and AI. The company provides a cutting-edge software platform which enables users to identify patterns hidden deep within datasets, ranging from signals intelligence sources to reports from confidential informants.

Its story is quite intriguing one. The company was founded in 2003 by its current CEO Alex Karp and co-founder Peter Theil, and initially it was five men show that was offering software solutions for defense and intelligence agencies such as the NSA, the FBI and the CIA. Its technology allegedly even helped to locate Osama Bin Laden. Since its inception the business model has changed and in 2021 only 58% of its revenue were derived from government enterprises with the rest coming from the commercial sector. They have total 227 clients out of which 184 are commercial with the client count growth of 86% YoY. Its revenue is quite diversified geographically with 57% coming from the US and the rest from abroad.

Palantir offers three software platforms: Gotham, Foundry, and Apollo. Gotham and Foundry enable institutions to transform massive amounts of information into an integrated data asset that reflects their operations. Gotham is used by defence and intelligence agencies while Foundry is designed mainly for commercial use and deployed by various industries, such as, financial services, healthcare, telecoms, transportation etc. Apollo is a cloud-agnostic, single control layer that coordinates ongoing delivery of new features, security updates, and platform configurations.

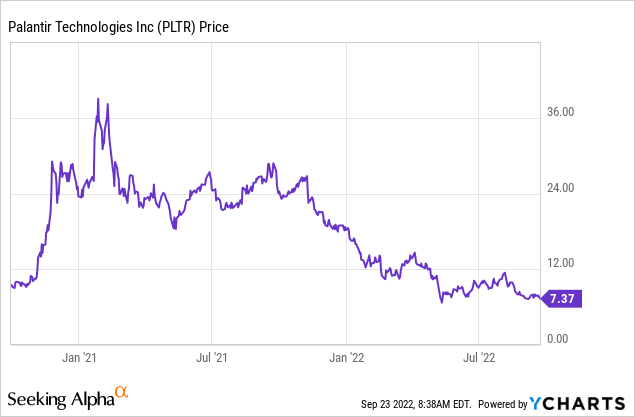

The company generates USD 1.7 billion in revenue annually and at a current stock price of $8 it is valued at USD 16 billion. It went public in September 2020 at a $9.50 per share with the stock price tripling by the end of 2020. It reached its all-time high of $39 at the end of January 2021 and then we saw its dramatic fall that eroded 60% of its value within a year. It was and is a classic meme stock with high retail trader’s involvement and with only 32% owned by institutions.

Although the company has generated outstanding gross margin of 78% and has been in a fast-growing stage for several years the company is still being in negative earnings reporting stage.

Is Negative Earnings a Problem?

First thing to bear in mind is that earnings is an accounting measure which doesn’t tell us much about underlying business. It is reported purely for accounting purposes and more often than not is used by firms as a tax treatment to carry negative income for following years and in such way offset income tax expense.

When we need to make a decision on whether negative earnings are a problem or not, we need to answer on the following questions. At which stage of business cycle the company is? Is this core business profitable? What are growth prospects and competition?

If we are talking about a startup or any company that is at the fast-growing stage, then naturally we expect the company reporting negative earnings and generating negative cash flow because at this stage all available cash is reinvested for future growth. As an example, if we look at Amazon (NASDAQ:AMZN) in the couple of years following its listing, it was reporting operating cash loss of USD 138 million on USD 314 million of revenue in a quarter basis.

Can we compare Palantir to Amazon in its early years? Surely not as the former, being founded two decades ago, has already passed the stage when it is seen as a start-up, but it is still worth to keep this fact in mind when we look at companies with negative earnings.

Talking about growth prospects, the enterprise data management sector in which Palantir is operating, is expected to grow at a double digit CAGR for the next decade (14% according to Grand View Research) and TAM by revenue in 2030 is forecasted to be approx. USD 265 billion.

Infamous Stock Based Compensation

When you read about Palantir it is almost inevitably that you come across their SBC practice and how devastating it has been over the years for its shareholders. Despite Palantir’s revenues growing substantially, its per share growth has been negative as a result of dilution impact of the SBC scheme.

Talking about SBC practices in general, it is not uncommon for high growth software companies to attract staff with these kinds of schemes. Highly experienced and skilled staff is the most important asset of such companies and paying them with the SBC creates twofold positive impact for the company growth. First, it provides incentives to staff to maintain high standard of their work and be willing to contribute as their compensation directly depends on the company profits. Second, it frees up some cash for its owners to be able to invest in the growing business.

SBC is not a cash flow item and when estimating operating cash flow it is added back, so if we do that adjustment to Palantir’s statement we will see that they are already generating positive CF.

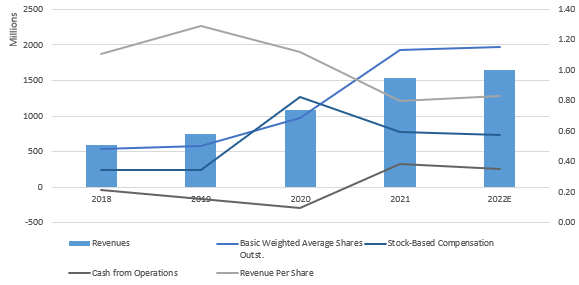

Company annual fillings, author’s presentation

What is important from investors standpoint is to see SBC trend downward as company matures. In case of Palantir we can see that SBC has only started to decline from 2021. If this trend continues it will give relieve to current and potential shareholders.

Financials

Palantir generates USD 1.7 billion annually and its average revenue growth for the last three years has been around 38%. Its revenues in the first two quarters of this year rose on average 28% year-over-year and management expects annual revenue growth of approx. 23% in 2022. The commercial segment delivered 46% of growth with the government enterprises more tepid (but still in two digits) +13%. Its customer count grew 80% year over year with total number of clients at 304 in Q2. In its quarterly reports Palantir shows its gross margins adjusted to the SBC, which has been in the region of 81-83% for the last year. However, even removing this adjustment their GM has still been quite impressive 78% vs industry average of 71%.

In the H1-2022 Palantir reported net loss of USD 280 million on USD 919 million in revenue and its EPS declined somewhat to EPS -0.09 vs EPS -0.05 in Q1-22 and EPS -0.07 in YoY. The main driver of such deterioration has been an increase in other expenses (investments in marketable securities), so it had nothing to do with the core business of the firm.

If we adjust Net Loss for SBC and other loss, two items irrelevant to the main business of the firm, then its cash flow would be positive USD 210 million in H2-2022. This equals to operating margin of 23%.

The question is whether we should adjust numbers to SBC or not. In a way SBC is a way of financing and should be segregated when making a decision of one’s business strength. However, if an investor tries to estimate what the business is worth, it is really down to this person to decide how treat this item. In a way it is a staff compensation, so it directly relates to operating expenses and, hence, might easily be included as operating expense. This adjustment would of course bring the cash flow balance deep into negative territory to approx. average USD 140 million loss a quarter.

Palantir doesn’t have any outstanding debt and has roughly USD 2.4 billion in liquidity that at a running quarter loss should allow it to stay afloat for at least four years without the need for external financing.

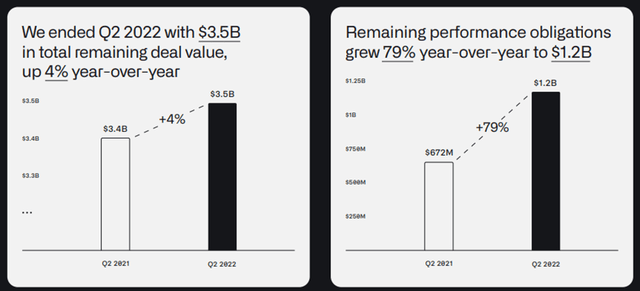

With regards to total remaining deal value and remaining performance obligations, both have increased quite substantially on a year-over-year basis but haven’t changed much since the previous quarter.

Palantir’s Q2-2022 Business Update

Valuation

When valuing companies with negative earnings we are quite limited in terms of valuation methods because certain techniques, such as, EBITDA multiple or dividend growth models are not possible to implement. In this case a detailed discounted cash flow model is probably only option that is left here.

My revenue growth projections for this year are in line with the company, at 23%, which would bring its top line to USD 1.9 billion in 2022. Revenue projections for the next seven years out are at CAGR 13% in line with the market. This is a very conservative forecast for Palantir and you would not find many analysts predicting such low numbers, but I prefer to be as conservative as possible to leave a room for upside surprises. I use current margins and assumption of no debt.

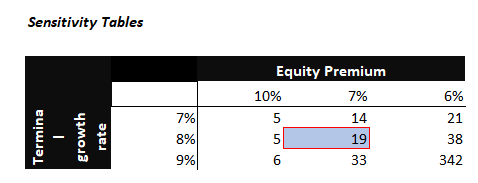

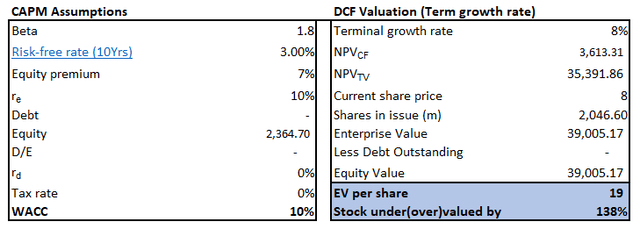

When valuing companies with negative earnings most of the value estimation comes from its terminal value. The most important assumption we have to make in determining terminal value is the terminal growth rate and to predict it for Palantir is close to impossible. I will present a sensitivity table below so investors can have a target price estimation that is more relevant to their required equity premium and their assumption of future growth rate. I use terminal growth rate of 8%. The current equity risk premium is 6% (I use 7% in my model to remain on a conservative side) and due to relatively high beta the discounting rate comes to 10%.

The results are presented below and as you see the target price comes to $19 a share. This is twice more than the current market price and as you’ve seen it is based on highly conservative assumptions.

Below is the sensitivity table for equity risk premium and terminal growth rate projections that normally varies the most among investors due to differences in risk aversion and expectations for future growth.

Author’s Calculation

If, for instance, you expect the company to grow at 9%, which not unlikely considering its growth in the previous years, then the target price can easily be in $30 area.

Risks

The main risk Palantir is facing is strong competition in data analytics segment. There are currently 375 listed software companies that specialise in the system and application field with many having a focus on data analytics in US alone. If we count all unlisted ones the number would come to several tens thousands. Plus, all medium and large corporates (the main segment Palantir is focused now on) have invested heavily in internal IT functions of big data analytics and we might see strong competition rising from this end as well.

Conclusion

Palantir operates in a highly competitive and rapidly growing industry. In our world the effectiveness and competitiveness of every large organization in every industry depends on its software and data, willingly or otherwise. The demand for the services that are offered by companies such as Palantir is growing exponentially and there is no doubt about it. Palantir’s excessive valuation last year has been a big distractor for investors. However, as it has lost more than 70% of its value since its peak in 2021, it’s definitely worth a revisit and my valuation based on conservative assumptions indicates that it is worth at least twice than it currently trades at.

Be the first to comment