peshkov

It’s simply hard to find a company that gives a mix of both strong cash flow and capital appreciation potential, yet, this is where we find ourselves with Energy Transfer LP (NYSE:ET). ET’s stock has rallied in recent months since hitting a near-term low of $9.50 in July. However, it remains cheap relative to levels prior to 2020. This article highlights why ET’s valuation remains undeservedly cheap and is set for potentially high rewarding returns, so let’s get started.

Why ET?

Energy Transfer LP (issues schedule K-1) engages in the transportation and storage of natural gas, crude oil, and refined products. As one of the largest energy infrastructure companies in the United States, ET has a diverse portfolio of assets that provide stable cash flows and strong growth potential.

It operates a network of pipelines and storage facilities that span across the country, providing it with exposure to various markets and commodities. This diversity helps to mitigate the impact of any individual market or commodity on the company’s overall performance.

Moreover, with the current U.S. administration in place, it’s become very difficult to get new permits to build large scale fossil fuel pipeline infrastructure. This is a hidden blessing for ET, as it reduces competition and makes its existing asset base more valuable.

ET is seeing strong growth, as it achieved record intrastate natural gas transportation volumes in the third quarter. Moreover, NGLs are seeing strong demand, as fractionation volumes also reached a new record in the same time period. These factors led to both adjusted EBITDA and distributable cash flow improving by 20% YoY to $3.1 billion and $1.6 billion, respectively.

NGL’s are very valuable in the energy value chain, as it comprises of various products including Ethane, Propane, and Butane, which are used for petrochemical feedstocks, heating, and cooking. Its end products include things that people use every day, including plastics, anti-freeze, detergent, barbeque tanks, and synthetic rubber for tires.

Importantly, management expects to reach its target leverage of 4 to 4.5x by the end of this year, putting it safely below the 5.0x level that’s generally deemed to be safe by ratings agencies. ET also maintains plenty of distribution flexibility, as it generated excess cash flow of $760 million after paying the distribution last quarter, and has $2.32 billion in total available capacity under its revolving credit facility.

Management has a stated goal of returning to its previous distribution level of $0.305 per quarter, or $1.22 per year. The distribution was raised every quarter this year, and currently sits at $0.265 per quarter, putting it on path to reach this goal, perhaps by the end of next year.

Looking forward, Energy Transfer is positioning itself as being more than just a traditional fossil fuels company, by pursuing a number of projects related to carbon capture and sequestration, and enhanced oil recovery for use in the food and beverage industries. It’s also ramping up its LNG capabilities with the Lake Charles project. Plus, management noted their expectation of strong NGL demand in the U.S. and overseas, and plans to meet that demand with projects underway during the recent conference call:

NGL demand both in the U.S. as well as from overseas customers continues to increase, and we have sufficient commitments to move forward with an ethane export expansion. Even though we expect to expand our ethane export capabilities at both our Marcus Hook and Nederland Terminals, these commitments provide us with the optionality to initially expand at either terminal.

Construction of Frac VIII continues to schedule, and we expect it to be in service in the third quarter of 2023, which will bring our total Mont Belvieu fractionation capacity to over 1.1 million barrels per day. Construction of our new 200 million cubic foot per day Grey Wolf processing plant in the Delaware Basin is underway.

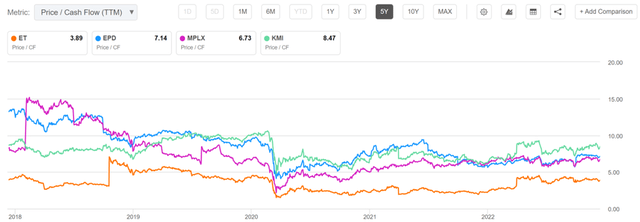

Lastly, ET remains undervalued from a price to cashflow perspective. At the current price of $11.91, ET trades at a price to cash flow of just 3.9x, which as seen below, trades substantially below that of natural gas focused midstream peers Enterprise Products Partners (EPD), MPLX (MPLX), and Kinder Morgan (KMI). Analysts have a consensus Strong Buy rating on ET, with an average price target of $16.31, which if realized, would equate to a price to cash flow of just 5.3x, still sitting well below that of its peers.

ET Price to Cash Flow (Seeking Alpha)

Investor Takeaway

Energy Transfer is a great option for investors looking for a large exposure to the natural gas midstream space. The company has strong fundamentals, with record transportation and fractionation volumes in the most recent quarter, along with a solid outlook for NGL demand in the U.S. and abroad.

In addition, ET remains highly undervalued from a price to cashflow perspective compared to its peers. All in all, ET looks to be an attractive option a combination of a high and growing distribution yield and strong capital appreciation potential.

Be the first to comment