felixmizioznikov

Introduction

I now own two real estate companies in my long-term dividend growth portfolio in a move to diversify, add more yield, and buy companies that I’ve liked for a long time. After writing an article titled “2 Dividend Stocks I’ll Be Buying With Both Hands”, I decided to buy one of the stocks I discussed in that article. I bought Extra Space Storage (EXR), which now pushes my real estate exposure to 6.6%. The other REIT I own is Public Storage (PSA), which I have owned since 2020. On a longer-term basis, I’m looking to push my REIT exposure to at least 15%. One of the stocks that could help me with that is Cube Storage (NYSE:CUBE). CUBE is the smaller peer of my current holdings with high exposure in dense areas. The company has a history of rapid and sustainable growth as it has maintained an increasingly healthy portfolio throughout the years. In this article, I’ll walk you through my thoughts as we discuss what I believe to be a long-term outperformed in the industry.

It also helps that macroeconomic woes could provide us with a fantastic buying opportunity.

So, let’s get to it!

Weakness Is Hitting The Market

Most of my readers know that I have a thing for self-storage real estate. While I usually invest in companies in industries with high entry barriers, I do love self-storage for several reasons.

First of all, I believe that self-storage benefits from long-term secular tailwinds like the decreasing size of the average home due to high costs. Moreover, people have so much stuff, which requires additional storage.

Moreover, self-storage assets are often located in perfect places close to populated areas. While that may sound extremely obvious (and it is), it comes with an additional benefit. Self-storage will increasingly provide last-mile and same-day delivery options as it’s basically a building full of mini-warehouses. So far, REITs haven’t focused on that, but I have little doubt that we’ll see more of that.

This is what Life Storage (LSI) did in 2018 when it announced its Warehouse Anywhere Last Mile Delivery Solution:

“Corporate and small business customers are an increasingly important segment for Life Storage. Leveraging Warehouse Anywhere to efficiently solve last mile delivery challenges is an exciting opportunity to develop deeper customer relationships,” commented Life Storage COO Ed Killeen. “Using our technology and a network of more than 10,000 Life Storage or partner facilities, our customers can forward deploy inventory at a local level to help meet their customers’ needs.”

Moreover, self-storage is an easy place to put a lot of money to work within a limited amount of time (bulk buying), especially compared to residential or retail real estate.

This was a huge benefit for self-storage REITs when large buyers were investing with both hands.

Unfortunately, higher rates have put an end to that. At least for the time being.

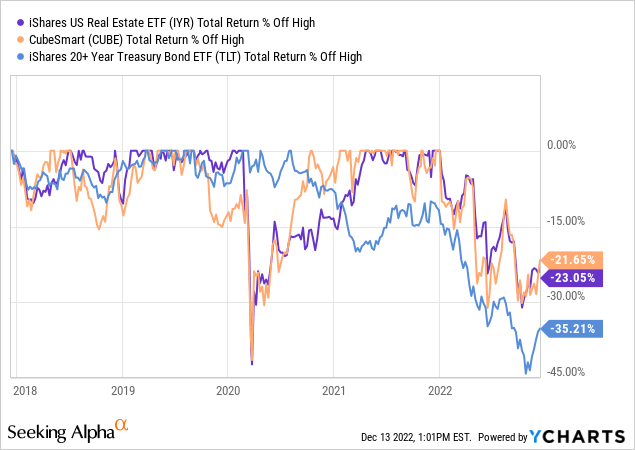

The good news is that this comes with new opportunities. Currently, real estate stocks are 23% below their 52-week high using the iShares US Real Estate ETF (IYR) as a proxy. CubeSmart shares are down 22%, outperforming the benchmark by slightly more than 100 basis points. Note that these numbers include dividends.

As the graph above shows a steep increase in rates is one of the reasons why investors have dumped stocks that do well with leverage. After all, that’s what real estate is built on.

But not only that, housing demand, in general, is weakening. Higher rates on top of high real estate prices are a toxic mix.

As the Yardi Matrix writes in its November self-storage report:

[…] as inflation persists and a recession is increasingly likely, households are cutting expenditures on non-essential items such as storage. To prepare for the more difficult economic landscape, operators are reducing street rates to maintain high levels of occupancy and looking for ways to cut costs to further protect themselves from a recession.

These headwinds are reasons why we get to buy some high-quality stocks at great prices.

What Makes CUBE So Powerful

As I already mentioned, I am increasingly investing in REITs. However, I’m looking for a great mix between yield and growth. As much as I like a good yield, given my expected investment horizon, I rather not invest in slow-growing stocks whose biggest benefit is their yield.

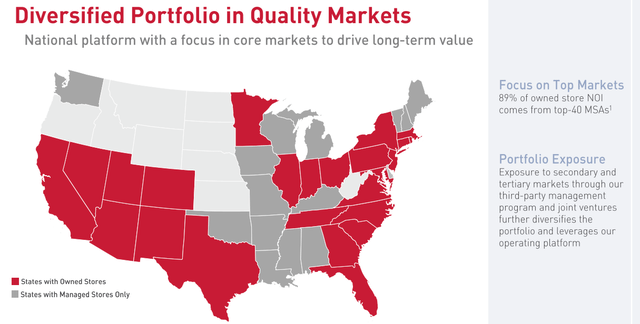

CUBE is a self-administered and self-managed real estate company focused on self-storage assets in the United States. The company started the year with 607 self-storage properties in 24 states and D.C.

The company’s storage assets are usually leased on a month-to-month basis. Both residential and commercial customers use affordable storage options for various reasons. This includes large-item storage in some of the company’s outside storage areas.

Roughly 84% of storage facilities include climate-controlled cubes.

The company’s largest markets are New York and Florida, where 19% and 15% of total revenues were generated in 2021, respectively. In New York, the company is the market leader. In the Bronx and Queens, CUBE generates close to 5% of total revenues (each).

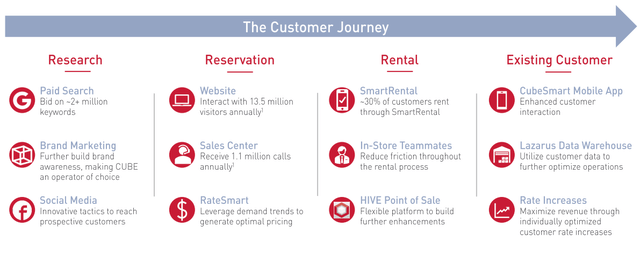

While self-storage is still a low-entry barrier business, operators are increasingly using added customer value to stand out. CubeSmart is no different. Like its peers, the company uses advanced marketing tools to reach customers and easy reservation and rental methods to get them to sign up. This includes increasing online booking options, the use of smartphone apps, and the efficient use of in-store employees.

In the case of CubeSmart, these measures are needed as the company lags behind its competitors when it comes to customer service. The company came in last on the Forbes rating scale.

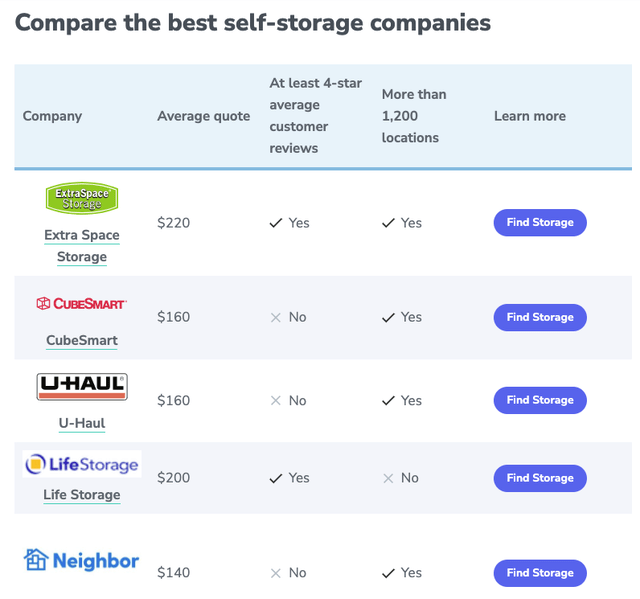

Another source, Move.org, confirmed this. The company did not score high on customer reviews, but it was the pricing leader.

With that said, service quality is NOT bad. If anything, CubeSmart is rapidly expanding, which means customer service can always be improved to the next level. It would have been an issue if the company weren’t a leader in anything. That’s clearly not the case as affordable prices are a big driver of growth.

Bank of America (BAC) like CUBE going into 2023. As reported by Seeking Alpha:

[…] with a high quality portfolio and a large exposure to NYC, screened the best of its peers on 2023 earnings growth and has an attractive valuation with the lowest 2023 PEG and PEGY ratio. “We view NYC’s market as a key catalyst for continued growth given its high density, unique demographics, and strong demand tailwinds.”

What I like about these comments (among other things) is that even NYC is a fast-growing market. Usually, the focus is on areas benefiting from the migration from blue to red states after the pandemic. However, self-storage is much stronger. NYC home prices are high, demographics are favorable, and self-storage is a much-needed service for a lot of households. As I said at the start of this article, I do not expect that to change.

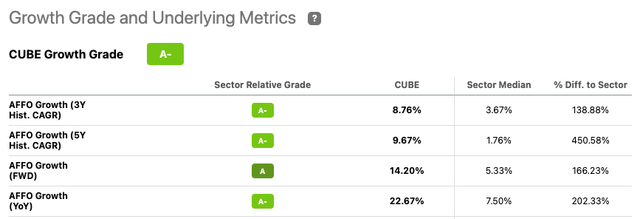

Using Seeking Alpha’s numbers, we see that the company is indeed growing fast. Over the past three years, adjusted funds from operations have grown by 8.8% per year. That beats the real estate sector median by a wide margin.

Over the past five years, that number rises to 9.7%. This, too, outperform the sector media – by an even wider margin.

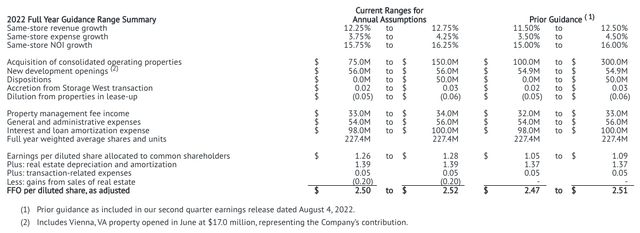

In its most recent quarter (3Q22), the company proved its strength. Total same-store net operating income rose by 15.4%. This was driven by 12.2% higher revenues and 4.3% higher operating expenses. That’s not only a good result because of strong revenue growth, but also because the company managed to handle costs quite well in a very inflationary environment.

The company was quite upbeat as it raised its full-year outlook.

“We continue to see solid demand across the portfolio as we returned to more normalized seasonal trends during the quarter,” commented President and Chief Executive Officer Christopher P. Marr. “We are in an outstanding position as our focus shifts to 2023. With another year of positive cash flow growth and a strong balance sheet, we’re well-positioned to perform in any economic climate and capitalize on all growth opportunities that present themselves.”

The company now sees at least 15.75% comparable net operating income growth. That’s up from 15.00%.

Full-year AFFO is expected to be in the $2.50 to $2.52 range.

This implies a 17.2x AFFO valuation, using the midrange of that estimate. This valuation is less than 2 points above the sector median. It’s not deep value, but it’s hard to make the case that this is overvalued.

With that said, let’s dive into the dividend, which is also a big part of the valuation.

The CUBE Dividend

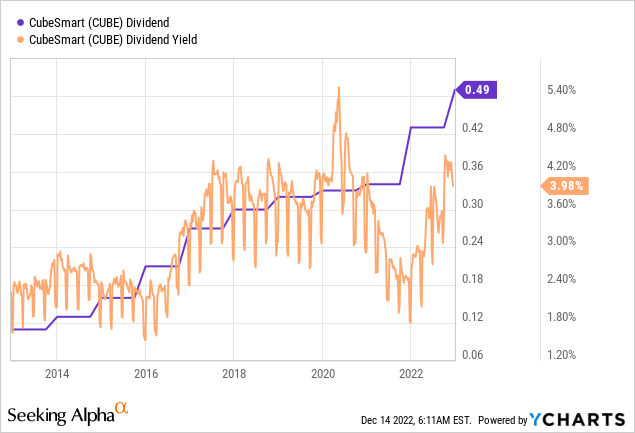

The dividend yield is truly one of CUBE’s biggest strengths. The company yields 4.5%, which is based on a $0.49 per share per quarter dividend. The sector median yield is 4.6%. Bear in mind, these yields are almost equal, yet the median sector peer is not able to grow as fast as CUBE.

CUBE scores high on dividend growth. Over the past ten years, the average annual dividend growth rate was 18.3%. This beats the sector median by 15 percentage points.

Please note that the dividend yield has not been updated in the YCharts chart below.

The payout ratio is 78% based on 2022E FFO, which obviously means that the company’s dividend growth will grow along with AFFO in the years ahead.

These are the most recent hikes:

- December 2022: +14.0%

- November 2021: +26.5%

- December 2020: +3.0%

- December 2021: +3.1%

I expect dividend growth to slow in 2023 and maybe 2024 – depending on the housing market. Prices have peaked and demand growth will come down.

However, on top of a decent valuation, the company has a healthy balance sheet to weather the storm.

Balance Sheet Strength

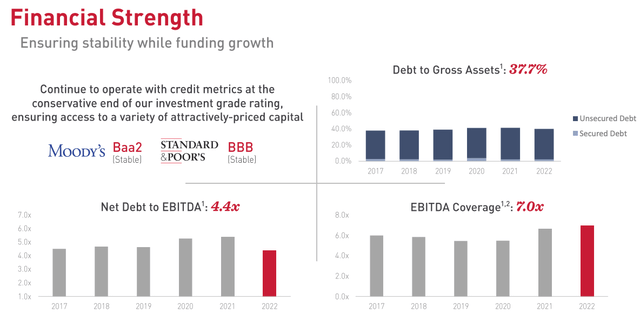

The company has a BBB-rated balance sheet, a net debt ratio of 4.4x, which is rather low, and an (EBITDA) interest coverage of 7.0x. Most of its debt is unsecured with a debt to gross-assets ratio of less than 40%.

Moreover, in light of the surge in rates, the company not only has a reasonable leverage ratio, but it also has no major maturities until 2025 when $300 million in unsecured debt is due. It also has $664 million remaining liquidity from its revolving credit facility.

Takeaway

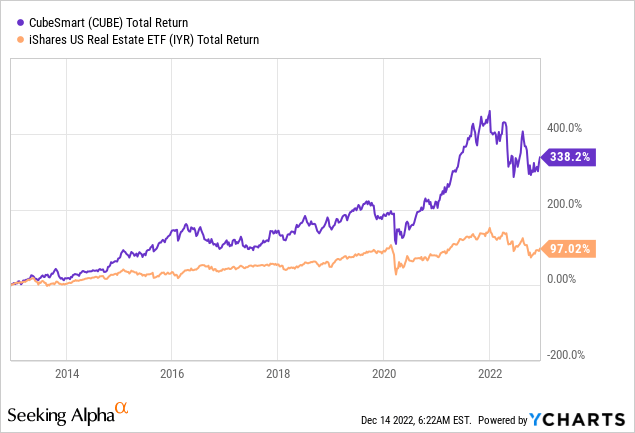

I am increasing my REIT exposure. In this article, I explained why I like CUBE. The company operates in an outperforming industry, it has a healthy balance sheet, pricing power, and the ability to quickly expand its footprint in profitable markets.

Moreover, the company offers a very decent high-yield dividend and above-average dividend growth, resulting in long-term share price outperformance, which I expect to continue.

Right now, the valuation is attractive as the market has punished real estate stocks. Higher rates and pressure on housing are not doing these stocks any favors.

However, in light of these risks, I have no worries that CUBE will emerge as a winner as soon as the Fed takes its foot off the brake.

So, going into 2023, I will be looking to deploy some cash in CUBE as part of my efforts to diversify into REITs.

(Dis)agree? Let me know in the comments!

Be the first to comment