Patryk_Kosmider/iStock Editorial via Getty Images

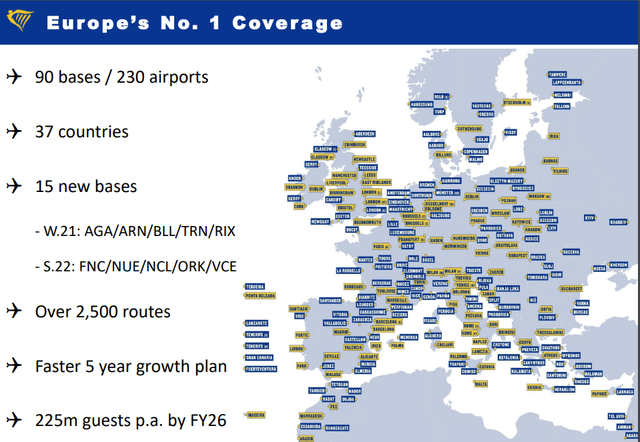

Ryanair Holdings plc (NASDAQ:RYAAY, OTCPK:RYAOF) is the holding company for Ryanair Limited the European low-fares operator. The company (RYAAY, OTCPK:RYAOF) also provides various ancillary services such as marketing of car hire and accommodation services, travel insurance, F&B and many others. Looking at Ryanair’s latest investor presentation, it had a principal fleet of approximately 560 aircraft and offered approximately 2,500 routes per day serving approximately 230 airports. Ryanair Holdings was incorporated in 1985 and it is headquartered in Swords (Ireland).

Aside from the Ryanair brand, the company also operates with the following carriers:

Ryanair other brands

Why are we positive?

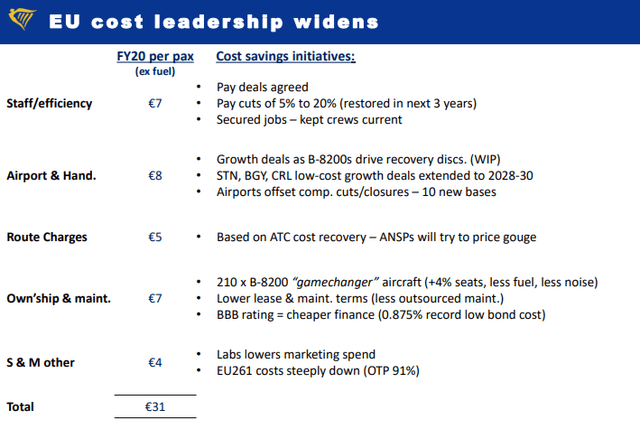

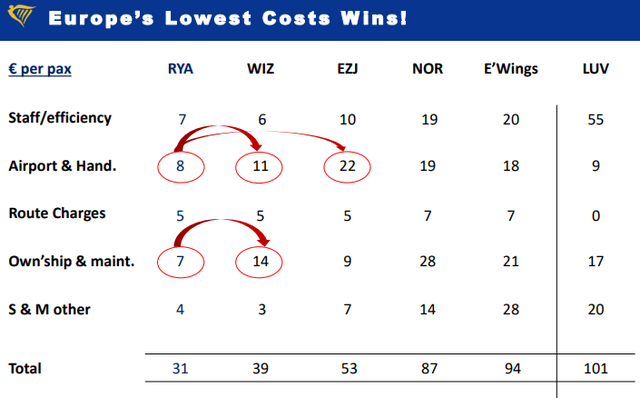

Ryanair’s Gamechanger strategy equals more seats, less fuel, and other costs, incremental capacity at airports, and lower tariffs that lead to more traffic and more profit in a positive circle. Ryanair is the clear leader in low-cost fares.

Following our article on easyJet (OTCPK: EJTTF, OTCQX:ESYJY), we are positive about the summer recovery of 2022 even if excess capacity in the coming months could weigh on profitability.

March figures were affected by around 2,000 flights cancelled as a result of the Russian invasion of Ukraine, yet Ryanair recorded 2.5 million more passengers than the previous month. In March 2022, Ryanair carried 11.2 million passengers with an average LF of 87% operating more than 67,800 flights.

Latest news

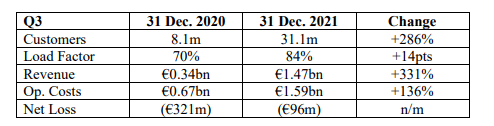

Ryanair Holdings on April 4 announced that: “it expects to report a pre-exceptional FY22 (yr. ended 31 Mar. 2022) net loss of between -€350m and -€400m (previously guided range of -€250m to -€450m). The Ryanair Group’s full-year traffic recovered strongly to over 97m (27.5m in FY21, but below pre-Covid traffic of 149m)”. Looking at the numbers, revenues more than quadrupled to €1.47 billion over the period and air traffic increased in a similar proportion, considering the end of 2020 was marked by very severe restrictions on international travel due to Covid-19.

Ryanair main fin ratio

Ryanair’s balance sheet is one of the strongest within the sector. Year-end net debt dropped to €1.5bn and since the last update, the Irish company’s fuel hedging will cover almost 80%.

Conclusion, valuation and risks

Airlines’ accounts are struggling to turn a profit, and market players still remain some of the most weakened companies by the pandemic. The Irish company still managed to reduce its net loss to €96 million, even if the Omicron variant weighed on Christmas air traffic. After the latest update, Ryanair implicitly reiterated its estimate of 100 million passengers for this financial year.

The next catalyst is on May 16 with the FY22 results. Currently, the company trades at a forecast ’23 EBITDA of 7x versus a historical five-year average of 8x. Aside from the multiple valuations, we value the Irish operator with a DCF model with the main inputs as follows:

- WACC set at 10%;

- Long-term growth rate at 2.5%;

- Long-term operating profit margin at 15%.

Based on the above parameters, we see potential upside in the company with a target price of €20 per share. The key risks to our target price include cost inflation (especially staff costs), air travel demand, new M&A, new variants, and higher competition, especially Wizz Air.

Previous coverage in the travel and leisure industry:

easyJet: Short Turbulences, Long Upside

Be the first to comment