Editor’s note: Seeking Alpha is proud to welcome Luke Krogh as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Natal-is/iStock via Getty Images

Crocs Inc. (NASDAQ:CROX), the specialty-apparel manufacturers and retailer, has flirted with disaster in the past. Yet, in the last five years, Crocs has delivered industry-leading results, earning investors a 1,034.38% in total returns. Crocs not only has strong fundamentals, the company is growing quickly and profitably. Nonetheless, it is trading at a massive discount to the market that makes it a good buy opportunity. Since Rees joining Crocs in 2014, the company has built $8 billion in shareholder value, with his tenure as chief executive being its greatest period of economic performance. Crocs’ recent acquisition of HEYDUDE is likely to spur even greater shareholder value creation. The company has a strong, albeit divisive brand, thanks to the design of its clogs. Under Rees, clogs have become more relevant to millennials and Gen Z customers, driving revenue growth and greater profitability. With its Jibbitz charms, Crocs has been able to further monetize its customers and increase lifetime value. Digital sales have grown as a share of revenues and the company’s China push has reaped dividends in the last year.

Andrew Rees Has Been a Remarkable Capital Allocator

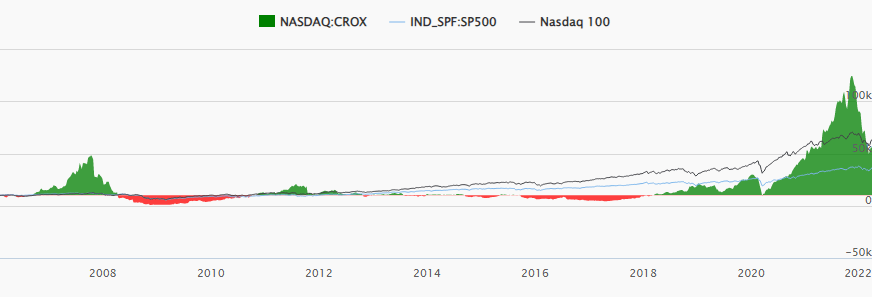

Since its initial public offering (IPO) in 2006, Crocs has given investors a total return of 454.68%, compared to 261.52% for the S&P 500, and 533.22% for the NASDAQ 100. Crocs, renowned for its colorful clogs made from a soft resin material, has had periods of extreme volatility, losing 98% of its value just 2 years after its IPO. Between 2014 and 2018, the company left shareholders in the red.

Source: Crocs Inc.

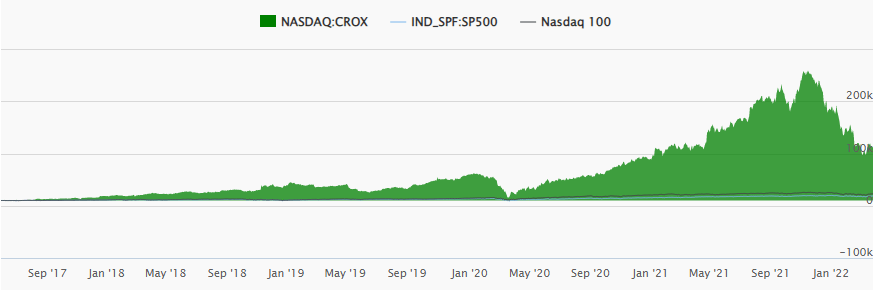

Yet, since chief executive officer Andrew Rees took over in June 2017, he has presided over a remarkable turnaround in the company’s fortunes. Since his assumption, Crocs has earned a total return of 1,034.38% compared to 88.29% for the S&P 500 and 129.79% for the NASDAQ 100.

Source: Crocs Inc.

When Rees joined Crocs in June 2014, Crocs was on its knees. Sales were floundering, expenses were soaring, and brand strength was low. Crocs had the telltale signs of a dying company whose core good has a low and declining product-market fit. That year, the company lost $19 million. Yet, Rees saw that the company possessed “an incredible brand with incredible passion, but with untapped potential”. Rees has scaled the brand, reduced the size of the company refocusing it on core lines, reduced expenses, made the company cool among millennials and Gen Z consumers under a mantra of “clog reverence and sandal awareness”, made the company profitable, and stuck to a clear, rational strategy. The company has returned a profit every year since he became CEO in 2017. 2021 was Rees’ best year in terms of numbers. Revenue rose 63% to $2.3 billion, the company’s operating margins were the best in the industry, and revenue rose for the fourth straight year, and hit double-digit growth for the third straight year.

Under Rees, revenue has gone from just over $1 billion in 2017 (where it had been for several years) to $2.3 billion in 2021, compounding at more than 18% per year. Net income has risen from $10.2 million in 2017 to nearly $726 million in 2021 at a compound annual growth rate (CAGR) of nearly 135%. Operating margins have risen from 2.21% in 2017 to 29.53% in 2021 for a 5-year operating margin of 10.51%. Return on invested capital (ROIC) has risen from a shareholder value-destroying -2.59% in 2017 to 90.26% in 2021. The company’s 5-year ROIC is 20.31%.

The company’s profitability has allowed it to grow its cash from $172 million in 2017, to more than $213 million in 2021. The company’s free cash flow for 2021 stands at $510 million. The company also returned $1 billion in cash to its shareholders through share repurchases. The company’s recent purchase of casual footwear brand, HEYDUDE is another example of how it has deployed its cash to serve investors and improve the company’s competitive position.

In the next five years of his tenure, Rees believes that Crocs can grow revenue to more than $5 billion in 2026, at a 17% 5-year CAGR. He also believes that by 2026, non-GAAP operating margins will exceed 26% and annual free cash flows (FCF) will surpass $1 billion.

HEYDUDE

The aforementioned HEYDUDE purchase is an important one for Crocs. The deal was closed in February 2022 for $2.5 billion. The deal was funded with $2.05 billion in cash and $450 million in Crocs shares issued to HEYDUDE founder and CEO, Alessandro Rosano based on the average of the daily volume-weighted average price of Crocs stock for the 20 days immediately prior to the signing date. Crocs entered into a $2 billion Term Loan B Facility and borrowed $50 million under the Company’s existing Senior Revolving Credit Facility to fund the cash consideration. Crocs ended 2021 with a net leverage of <1x. Under the deleveraging terms of the HEYDUDE deal, share repurchases will be on hold until gross leverage is <2x, which Crocs expects to occur at the end of 2023.

The deal opens up various possibilities for Crocs. The combined company now has an addressable market of more than $160 billion. It is a bolt-on acquisition that aligns with its philosophy and fits into its portfolio. HEYDUDE fits into secular consumer trends, so that the scalability opportunities that come from being in the Crocs family (global presence, marketing expertise, wholesale relationships, etc.) will lead to the brand delivering even greater profitability than it had before. Crocs believes it can turn HEYDUDE into a $1 billion brand by 2024.

Financially, HEYDUDE helps Crocs grow revenues, fatten its operating margins and profitability, and increase FCF. Consequently, the company’s increased leverage should not be a worry for management or investors. The risks of interim leveraging are outweighed by the derisking that comes with diversifying from a single brand to a multi-brand strategy.

Growing Digital Sales

Digital sales are becoming an ever-more important source of revenue for Crocs. In 2017, digital sales accounted for 14.6% of revenues. The company had 13 company-operated eCommerce sites worldwide. In 2021, through its 14 company-operated eCommerce sites, Crocs earned 37% of its revenue. In 2020, digital sales, due to the pandemic, made up 42% of the company’s revenues. In the year prior, digital sales were 31% of revenue.

At a time when investors worry about the Retail Apocalypse, Crocs has already diversified its revenue to reflect what is less an apocalypse than a transformation of the retail sector.

Gaining Market Share in Sandals

Sandals have always been a focus of Crocs’ business and are, according to its 2021 10-K filing, a “natural extension” of its brand. According to the company’s 2021 Investor Presentation, the sandal market is worth $30 billion. The market is fragmented, with no clear leader. Although its clogs are the company’s most well-known product, sandals are an important revenue driver.

The company’s research shows that consumers tend to consider buying clogs and sandals under the same category. In other words, if Crocs cannot win a customer over to its clogs, it may still win that customer over with its sandals. As for its clogs buyers, they may now also choose to buy its sandals as well.

Crocs believes that the sandals market has the potential to quadruple in the next five years. The company also launched a line of socks last year, to make its relationships with its customers stickier.

Sandals play a different role to clogs. Crocs is geared toward making its clogs more relevant to its customers. During the Q3 investor presentation in 2021, Crocs’ chief marketing officer, Heidi Cooley, described the brand as still battling against a perception as being, “one of the most polarizing shoes in the industry”. This is a battle that the company will fight for some time. Sandals exist to drive awareness about the company’s clogs. Crocs is working to make its customers more aware of its sandals and achieve the same kind of brand awareness that its clogs have. If the company can convert existing customers into sandals buyers and provide more gateways to becoming sandals buyers, Crocs believes it will be able to make sandals an even more important, year-long source of revenue, given that the occasions in which sandals are worn are not driven by trends.

Increasing Personalization

Jibbitz, or charms in the form of letters, numbers, figures and images, that can be clipped onto a pair of Crocs to personalize them and provide an outlet for self-expression. Jibbitz retail for about $3.99 and can be clipped on and off, allowing customers to have different looks on different days. The company has developed partnerships, such as with the Star Wars franchise, to enhance the opportunities for customization.

According to Crocs, not only do Jibbitz drive overall consumer engagement, they also result in buyers having an average lifetime value that is twice that of those Crocs customers who do not buy Jibbitz. Estimates are that Crocs will be able to double its Jibbitz business and grow market share through providing outlets for self-expression.

Jibbitz sound superficial on the face of it, but these simple tools are driving market share and are high margin.

Capturing the Opportunity in the Asia Pacific

China is the world’s second largest footwear market, with 27% of the world market, with China accounting for 20% of global sales in 2020. The entire Asia Pacific is a key area for Crocs with Crocs believing that within the next 5 years, the region, more specifically, China, will account for 25% of the company’s revenues by 2026. Crocs aims to penetrate the digital market there, grow sales, brand awareness and relevance through an “always on” marketing playbook and open new stores in major cities and key outlet centers. Relevance is strengthened by the brand’s local-for-local products, marketing, and collaboration.

Peer Competitors

Clogs is the predominant market leader in the clogs segment and in the sandals market, which is six times greater than the clogs market, competition is highly fragmented. This allows for growth without real fear of peer-competitor. In product terms, the company does not have a single peer-competitor of renown. No other major company makes clogs and sandals. Both markets are thus different from, say, athletic footwear, which have clear leaders such as Nike (NKE) and Adidas against whom Crocs would have to battle.

However, clogs can be seen as part of the casual footwear market, which is highly competitive. In this market, the company competes with brands such as Nike, Adidas, Deckers Outdoor Corporation (DECK), Skechers USA Inc. (SKX), Steve Madden, Ltd. (SHOO), Wolverine World Wide, Inc. (WWW) and V.F. Corporation (VFC). The company’s retail stores compete with footwear retailers such as Genesco, Inc. (GCO), Macy’s (M), Dillard’s (DDS), DICK’S Sporting Goods Inc. (DKS), The Finish Line, Inc. (FINL), and Foot Locker, Inc. (FL).

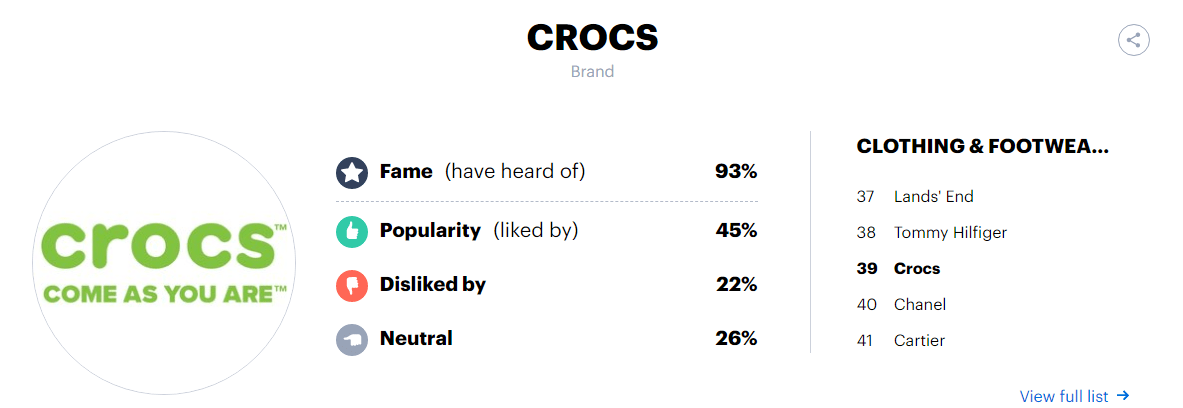

The casual footwear market is defined by brand awareness, functionality, design, quality, pricing, customer service, and marketing and distribution. As we have said above, the company has become more of a lifestyle brand and improved designs and used Jibbitz to personalize its shoes, but the brand still suffers from some stigma. The stigma around Crocs is both a strength and a weakness. It’s a strength because it means buyers are highly loyal and committed to their brand, and it’s a weakness because it makes it harder to win the next customer, compared to peers.

According to YouGov America, although the brand is widely known, with 93% of clothing & footwear buyers being aware of it, just 45% of buyers actually like the brand. In comparison, Adidas, the most popular footwear brand, has a popularity of 63%.

Source: YouGov America

In addition, the company’s peers are bigger and better resourced than Crocs, with broader product lines, a bigger market presence, and more long-run relationships with suppliers and distributors, and more powerful brands. This puts Crocs at a competitive disadvantage to its peers.

Risks to the Thesis

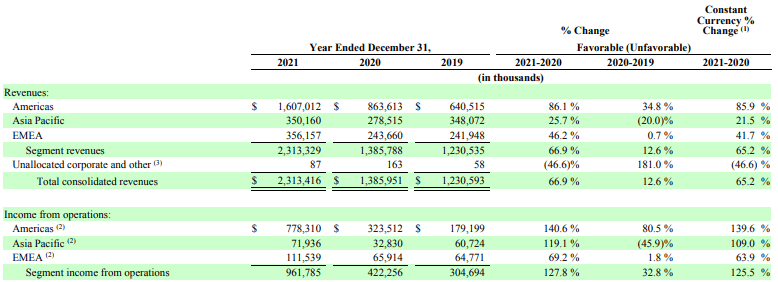

Firstly, although the Asia Pacific, or more specifically, China, is seen as a key pillar of the company’s long-term growth strategy, its performance there falls short of rivals. In 2017, revenues from the Asia Pacific accounted for 36.1% of Crocs’ revenues, declining to 15.13% in 2021. This is because, despite the company’s overall revenues growing substantially under Rees, revenue from the Asia Pacific has barely moved, nudging along from nearly $370 million in 2017 to just over $350 million in 2021. 2021 saw an upturn, as revenue from the region had been declining since prior to Rees appointment, falling to $278 million in 2020. Since the 2020 nadir, the company has grown digital penetration and brand strength.

Crocs’ income from the region grew at a more exceptional rate, growing by over 18% between 2019 and 2021, from more than $60.7 million to nearly $72 million.

Source: 2021 20-K

Rees is likely correct in estimating that China will be the company’s fastest growing region in the next five years. However, the question is whether Crocs is growing fast enough. Crocs’ plan for growth, focused on digital sales, leveraging social media communication, partnerships, and more retail stores, makes sense. However, the brand is lagging its peers. Rees himself noted that peers typically have 20% of sales deriving from China. Nike, for instance, has overseen seven consecutive years of double-digit growth in China. Just 5% of Crocs’ retail stores are in China, and only 5% of the company’s revenue comes from China.

China has been a pillar of the company’s strategy for the last six or seven years, so this focus on China is not new. However, that in itself is worrying. The Chinese footwear market is becoming more competitive, which will put limits on how much Crocs can grow and make it harder to gain brand visibility.

Failure to sufficiently grow in China will harm the company’s long-term growth strategy and make the company less attractive compared to its peers.

Secondly, Crocs’ growth is further hampered by the fact that peers are increasingly focused on combining comfort with fashion. Crocs still retains a certain stigma, even though it has made its clogs more attractive and increased the number of types of clogs available. Adidas, for instance, is committed to doubling its digital sales in the next five years and shifting more sales to its direct-to-consumer channels.

Crocs is transitioning into more of a lifestyle brand, in the belief that this will result in more frequent purchases, greater brand awareness as celebrities and influences work with the company, while leaning in on its divisiveness to spur conversation. As discussed earlier, Crocs still has work to do to win over more customers.

Finally, supply chain issues continue to affect the footwear industry. In 2021, 56% of Crocs’ production was in Vietnam, with its largest and second-largest third-party manufacturers having over 30% of their operations in both Vietnam and China. According to its 2021 10-K, the company believes that any concentration risk is “mitigated by the fact that the manufacturing capabilities required to produce our footwear are broadly available”. However, this does not free the company from supply-side disruptions. Covid-19, combined with China’s Zero Covid strategy, mean that there are still significant risks of factories shutting down, exacerbating its supply problems. In the long run, the company could adjust to profound supply chain issues, but in the short run, the company is vulnerable to outbreaks of Covid-19 leading to factory closures.

Valuation

The best investments are those in which the margin of safety is so great that a precise valuation is not required. The more precise a valuation needs to be, the bigger the risk that an investor has no margin of safety. Crocs’ valuation is sufficiently abysmal that a crude relative valuation is enough to show the size of the opportunity. Crocs is trading at a price/earnings (P/E) ratio of 6.65. In comparison, the S&P 500 is trading at a PE multiple of 25.92. Crocs’ PE multiple is some 466% lower than its 5-year PE multiple of 37.68. Indeed, Crocs is trading at its cheapest P/E multiple in over a decade.

Yet, this is a company that expects to grow revenue by more than 47% CAGR this year, improve its already best-in-class adjusted operating margins from around 22% to around 26% and improve adjusted earnings per share (EPS) by 5.67% CAGR year-over-year.

The market seems to have concluded that in a post-pandemic world, demand for Crocs’ products will decline sharply, despite the company showing strong results since Rees assumed office in 2017.

Conclusion

You either love Crocs’ clogs or you hate them. Under CEO Rees’ leadership, the number of people who love Crocs has risen. Improved product-market fit has driven improved financial results and total returns to shareholders. Crocs’ brand awareness and relevance are better than ever, the company’s growth and profitability have improved vastly, and the company’s acquisition of HEYDUDE promises to make Crocs an even better firm. Yet, Crocs is trading at a significant discount to the market. For the quality of company that Crocs is, and the massive growth runway ahead of it, Crocs has one of the best margins of safety I have seen this year.

Be the first to comment